New here? Read up on our past Crypto issues to get the most from this post.

June 16, 2022 | ± 5 minutes

CONTENTS:

Today, we’re taking a closer look at GMX – perhaps the best Defi/Yield farming protocol to use in a bear market. And with its unique mechanics and tokenomics, this might be just what we need during the Crypto cold season.

Let’s go!

Table of Contents

Surviving the Crypto winter

While crypto can certainly go lower, it does seem like we are in yet another bear market.

It can be easy to lose motivation to invest in crypto during those times. However, there are many ways in which you can still do that. One of those ways (arguably the best one) is through yield farming on GMX.

GMX

GMX is a project and Defi opportunity on the Avalanche and Arbitrum chains that provides a great opportunity for farming during a bear market. That’s when it naturally works best. But how is that possible?

It’s essentially thanks to $GLP, the platforms’ liquidity provider token. More on that a bit further down, bear with us. (sorry)

$GMX is an interesting project – it’s a decentralized exchange with low swap fees, and its trades have zero price impact.

You can trade multiple cryptocurrencies on the GMX platform, and the trading fees earned then go to liquidity providers, aka the farmers we aim to be.

The value of the GMX is not in the token itself but in being a liquidity provider. The yield farming process allows you to earn interest on applicable crypto assets. Currently, there is $150M+ worth of assets staked on the platform.

I first heard about GMX from the well-known Youtuber and yield-farmer Taiki Maida through his private&paid Discord group.

GMX is one of his favorite farming projects, particularly during bear markets. While I can’t share his paid Discord information, he has some useful public videos on the topic from January, February, and May that might be of help if you want to hear more.

Understanding how fees are generated

One thing I like about GMX is that it’s easy to understand how the fees are actually generated.

For many Defi & farming protocols, you don’t always understand how the yield is generated, and if I’m looking to invest my money in a project, I definitely want to understand it. It’s usually a red flag if it’s unclear how the platform generates revenue.

Understanding revenue generation isn’t the only important thing to know in finding a project to yield farm with – here’s a super useful checklist with more tips.

To quote GMX:

“Trading is supported by a unique multi-asset pool that earns liquidity providers fees from market making, swap fees, and leverage trading.”

The more trades that happen, the more fees get generated.

Now, here’s why GMX is unique – it actually has better yield times during poor crypto sentiment, unlike most Defi platforms. And 2022 has been fairly bearish for crypto, which means GMX has been doing well for its yield farmers.

The difference between $GMX and $GLP

GMX has two tokens. Kind of.

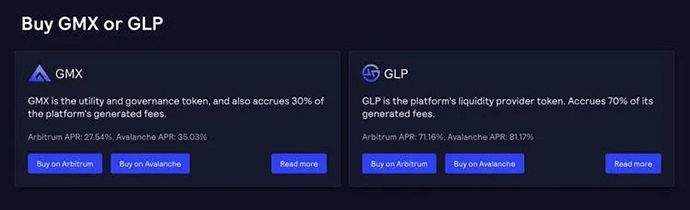

Its primary token, the token that is indicative of the project itself, is $GMX.

If you want to invest in the project and believe the value of GMX will go up, then you want to invest in $GMX.

However, my fellow yield farmers will be more interested in $GLP.

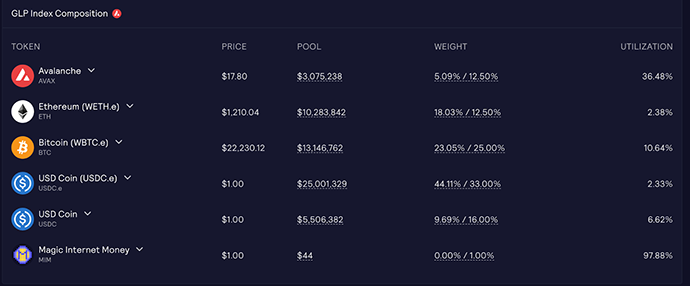

The value of $GLP is determined by this basket of tokens, not by project GMX itself. $GLP is an Index that is composed of $AVAX, $ETH, $BTC, $USDC, and $MIM with various weight allocations.

When you buy $GLP, you are buying into each and all of these projects. If you’re bullish on these tokens and want some diversification, you’re bullish on $GLP.

As far as cryptocurrency goes, the index is fairly safe when compared. In the basket, we have the two most popular cryptocurrencies $BTC and $ETH. We also have $AVAX, a token representing the Avalanche chain with clear value and utility. Finally, we have two stable coins pegged to the US dollar.

Because of the diversification and relative safety, it’s one of the most stable tokens you can have. The value won’t drop as much as other altcoins during a bear market, but it also won’t go up as much during a bull market.

In other words, if you’re farming, you’re not buying into the GMX project with your initial investment. Instead, you are buying into cryptocurrency market conditions in the form of this index.

Note that the rewards are paid in $AVAX and $GMX, so your yield does give you some exposure to the project itself (and additional exposure to $AVAX).

The roadmap

When a project has a solid product roadmap and executes it, the value of its token often goes ups.

In the case of GMX, a good roadmap influences $GMX price, but not $GLP due to how it’s calculated.

However, $GLP farmers will still want to pay some attention as the roadmap and decisions of the team can directly influence how lucrative farming is.

For example, if GMX decides to reduce trading fees, there will be fewer fees for yield farmers, resulting in a lower APR.

Here is GMX’s Roadmap.

The community

Community isn’t that important for a project such as $GMX, compared to other projects we have written about, such as Defi Kingdoms. That said, the better community a project has, the better for the project.

GMX’s discord has about 4,800 members. It’s not a huge community, but it’s decent enough for this type of project.

Conclusion

GMX is currently one of the best Defi farming protocols and will continue to be one of the best, while crypto sentiment remains fairly poor.

If you still want some exposure to crypto and want to participate in Defi & yield farming, then GMX is certainly one of the best options available.

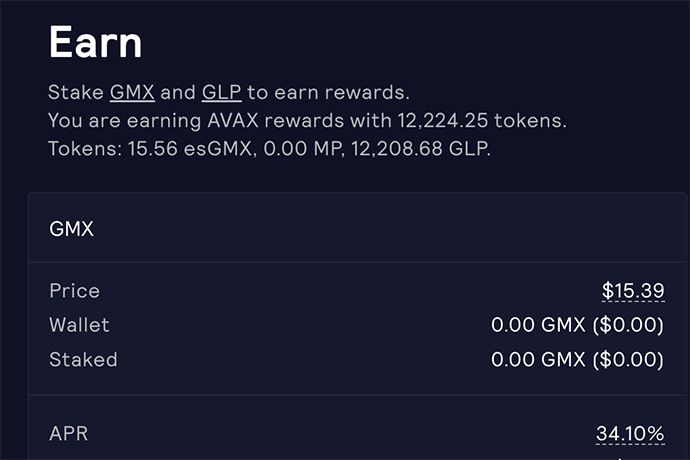

Its APR is currently ~34% and usually ranges from 20%-45%.

Better yet, it’s easy to understand where the returns come from regarding trading fees.

Again, remember that GMX is best during bear-ish markets and has limited upside in bull markets. And because of this, as soon as we transition into a bull market, you’ll want to consider rotating into other altcoins to maximize your upside.

See what Colin is working on and follow him on Twitter at @seo_colinlma

Last but not least, our Podcast

In this episode, Horacio spoke with Brian Harstine, CEO of Acquire and Andrew Hill from Frost Brown Todd, one of the leading experts in blockchain and cryptocurrency law in the country. Brian and Andrew talk about the advantages of blockchain, legal issues in the space, and more:

That’s it for this week’s Crypto Insider. Did you find it useful?

If you have any questions or would like to discuss anything about this issue (or about crypto/NFTs in general), feel free to respond to any email. We read everything, as always.

Thanks,

Colin