Welcome to Alternative Assets.

Today we have another announcement: We’re officially adding farmland to our repertoire.

Starting this month, our new analyst Brian will be covering farmland investing opportunities across FarmTogether, AcreTrader, and other platforms.

We’re excited to start diving deeper into this underrated & under-discussed asset class.

Let’s go

Table of Contents

Why invest in farmland?

“Buy land. They ain’t making any more of the stuff.”– Will Rogers

Wise words from an American legend.

Farmland is pretty much the opposite of NFTs. There’s an actual finite supply of the stuff, it has true physical utility, and human beings quite literally need it to live.

Still, that doesn’t mean every farm is a good investment. Far from it! You should check for red flags when investing in collectibles or NFTs, and farmland is no different.

But how do you go about doing that? What should you be looking for when investing in land? What do you need to watch out for? What metrics should you prioritize?

Our goal with this issue is to give you a framework for investing in farmland. Let’s journey down this ole country road by looking at the history of farmland as an asset class

The first question for investing in any asset class needs to be: What are the historical returns? Past performance is no guarantee for future results, but history is still a damn useful guide.

Fortunately, investing in farmland has a history as rich as volcanic Hawaiian soil.

Strong returns, low volatility

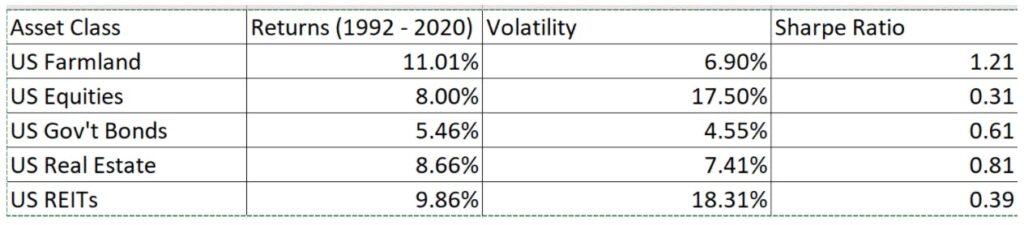

Since 1992, farmland had higher returns and lower volatility than four traditional asset classes. Farmland also has the highest Sharpe Ratio of the bunch.

The Sharpe Ratio was developed Nobel Prize winner William F. Sharpe, who developed the capital asset pricing model (CAPM).

His famous Sharpe Ratio is a measure of an investment’s performance as a function of its volatility/risk. A higher Sharpe Ratio indicates you are getting a great return given the amount of risk involved.

I think of it as the “sleep like a baby” number. A high Sharpe Ratio means consistently good returns with less gut-wrenching ups & downs of high volatility.

In addition to its strong historical returns, farmland also has several other promising characteristics:

- Inflation hedge. The price of farmland should stay at least consistent with inflation over an extended period.

- Demographics. The world’s population ain’t getting any smaller. More food will be required to feed everyone, and the demand for well-run farms will keep growing.

Downsides of farmland investing

Like with most investments, there are risks involved. Here are some of the cons:

Climate change

Farmland is particularly susceptible to changing weather patterns.

The United Nations Convention to Combat Desertification (UNCCD) estimates that more than half of agricultural land is affected by soil degradation, and that 12 million hectares of farmable land is lost to drought and desertification annually.

To put that in perspective, remember the 2019 Australian bushfires? (The ones which happened right before covid?) Those were the second-largest wildfires of the 21st century, burning 17 million hectares.

To be clear, this decreasing supply is good for land and crop prices as noted above. This is partly why Bill Gates has been scooping up farmland like crazy. Still, it poses a huge long-term risk.

Natural resource consumption

Some crops take far more water to grow than others. How much water a particular crop requires and the availability of nearby water sources are very important considerations.

Almonds, for example, are notoriously thirsty crops. It takes an astonishing 1.1 gallons of water to grow a single almond! No wonder there are so many almond farms for sale these days.

In addition, certain crops can deplete the soil of nutrients over time, requiring crop rotation or the use of increasing amounts of fertilizer (which can have their own environmental impact).

Liquidity

Unlike other assets, an investment in farmland is considered to be illiquid.

This isn’t like flipping domains, websites or sneakers. Farmland doesn’t lend itself well to quick profits. You should plan to be invested for an extended time period — conservatively at least 5-10 years.

Characteristics of farmland

Not all farmland is created equal. Here are some of the characteristics that will impact your investment.

Crop type

There are two main types of crops:

- Permanent crops (fruits, nuts, and other items that regrow from the same tree each year)

- Annual row crops (cotton, soybean, corn, etc)

While each crop market has its own characteristics, in general, permanent crops have higher risk & higher rewards. They can take up to 5 years to begin producing, but once they get going, cash yields are typically higher than annuals. The increased risk comes from the potential of crop loss during the long maturity period.

Location

Some regions are more conducive to growing certain crops than others. Bordeaux produces world-class wines, California and Mexico pump out the world’s best avocados, etc.

Differences in farmland quality can even be found within the same geographic region. Soil composition and micro-climates can make one area far more hospitable to growing than another. Plus, as noted above, climate (and climate change) can have a material impact on farmland.

As part of our investment analysis, we’ll focus on those opportunities that present the best growing environment.

Water rights

Water is the lifeblood of every farm, so understanding water rights is critical.

Does the water come from a well located on the property (groundwater)? Or does it come from a nearby surface source? If sourced externally, how much does the farm pay for water each year?

Does the farm currently hold a good water rights contract, or does one need to be obtained from scratch? Water rights vary from state to state. It’s sort of like getting a liquor license — thanks to government bureaucracy, it’s often far easier to keep or transfer water rights than get a new permit.

Livestock

There aren’t many investment opportunities in the livestock space. Livestock producers typically contract individual farmers to raise their livestock.

The farmers themselves are more like caretakers. They’re paid based on how efficiently they can raise the livestock, reduce mortality rates, and produce clean, healthy meat.

Access to infrastructure

How close and accessible are methods of transportation? Most crops require some form of processing or refinement. What sort of processing capacity does the local region have?

Similar to mining, it’s cheaper to extract resources from the ground when there are means to get it straight onto the market.

Capital investments required

Some farmland investment opportunities are turn-key. The investor is buying the land and renting it back to the current tenant. All development of the farm has already occurred and the investment acts more like a transfer of ownership.

For other opportunities, the investment is in undeveloped land that will require additional time and dollars spent on infrastructure and growing crops (especially permanent crops).

Growth prospects

It’s easy to think of farming as a single industry, but much like with geography, there is a lot of differentiation among the various crop markets. Any investment analysis should look at the growth prospects of the specific crop, both domestic and international.

How to invest in farmland

We are living in the golden age of farmland investment opportunities. There are three main avenues that make it easier than ever to become a proud farmland owner.

Fractional platforms

The big three platforms are AcreTrader, FarmTogether, and FarmFundr. (There are others as well, including FarmFolio, but they have fewer deals available.)

Think of these as the Otis/Rally/Collectable of the farmland investing world. These companies drop an investment opportunity and leave it open until it’s fully funded by investors.

Unlike the Reg A offerings from Rally, Collectable and Otis, offerings on these platforms are for accredited investors only. In addition, they require a high minimum investment — generally $10,000 — and there are no secondary markets to help with liquidity.

For more info, check out our past issue on fractional farmland platforms.

REITS

There are two main REITs that provide exposure to farmland: Farmland Partners (ticker FPI) and Gladstone Land Corporation (LAND).

These options do away with some of the disadvantages of the fractional platforms, namely illiquidity and high investment minimums. REITs trade frequently on major stock exchanges and shares can be bought for under $100.

REITs generate their revenue through the leasing of land back to farmers. An investment in these is similar to investing in the S&P 500 index. You’ll probably match the historical returns of farmland, but there’s little room for outperformance.

Startups

Startup investing platforms like AgFunder and WeFunder offer exposure to early-stage companies in the agricultural space. Instead of direct farmland exposure, investing in these startups provides “picks and shovels” exposure to the sector.

As with any early stage company investment, you’re placing a proxy bet on the team, traction, market, and future opportunity. Risks can be very high and financial information can be quite limited.

Investment evaluation criteria

Some additional ways to assess farmland investments:

Nature of the lease

The fractional platforms and REITs typically buy the land and lease it back to a farmer who does the dirty work.

You need to understand if there’s a current tenant, or if management needs to identify a tenant and negotiate the lease. Continuing operations with the current tenant means less risk, as the tenant is familiar with the land and there is no potential for downtime during the cutover.

In addition, it’s worth considering the nature of the lease agreement. Is it rent only, or does it allow management/owners to share profit from the crop sales? Profit sharing means greater returns, but also exposes the investor to greater risk through crop failure and commodity price swings.

Loan to value ratio

As part of the transaction, is any debt being assumed or issued? If so, what’s the loan to value ratio (LVR)?

This measures the debt associated with property divided by the total value of the land. Lower levels of debt are preferable and allows management/tenants to conserve cash for operating needs.

The LVR should be provided by the fractional platforms. If not, you’ll need to sift through the docs. (Don’t worry — we’ll do this for you.)

Historical price appreciation

A large component of the projected investment return is the eventual sale of the land.

The cost per acre at time of investment can be compared to current sale prices and projected growth to determine if the land is accurately valued.

Timing & cash flow

Different investments offer different income distribution calendars.

Some platforms pay the investor immediately, in quarterly/annual payments. Others may have low (or even no) income upfront as the farm is developed and trees grow to maturity.

If the eventual sale of the farmland comprises a large percentage of the return projections, this will cause the majority of income to backloaded.

If this is the case, inflation and opportunity cost need to be considered.

Liquidity

We touched on this earlier, but fractional platforms don’t currently offer secondary markets for trading (though these may be rolled out in the future).

In the offering sheet, they’ll usually project when they plan to sell. But remember, you’ll typically hold a farmland investment for 10 years until a potential sale.

Be prepared to hold for the long term. It’s almost never a quick flip situation.

Management fees

Platform management fees typically range from .75% to 1.35%.

All else being equal, a lower fee is obviously better. Though over time, fees shouldn’t drastically impact returns.

Management fees are more than what you would pay for an index fund, but less than the “2 and 20” fees common with hedge funds.

Our upcoming farmland coverage

If you think this asset class is right for you, follow the Farmland topic.

Farmland offers compelling returns, low volatility, and is an area of the market untouched by most new alternative investors.

Part of this is because farming isn’t sexy. That’s never going to change. But part of it is also because there’s a distinct lack of coverage on new farmland opportunities. It’s time to change that.

Over the coming weeks, we’ll bring the best farmland investment opportunities to your attention, just like we’ve done with over a dozen other alternative asset classes.

Each opportunity will be analyzed through a framework incorporating the criteria and characteristics noted above with a final verdict delivered Roman gladiator style – thumbs up ????or thumbs down ????

The focus of our coverage will center around the main fractional platforms, with occasional recommendations from the startup space.