Hello and welcome to Alts Cafe

Coming at you a day later than usual due to the long weekend.

Wyatt

Table of Contents

Macro View

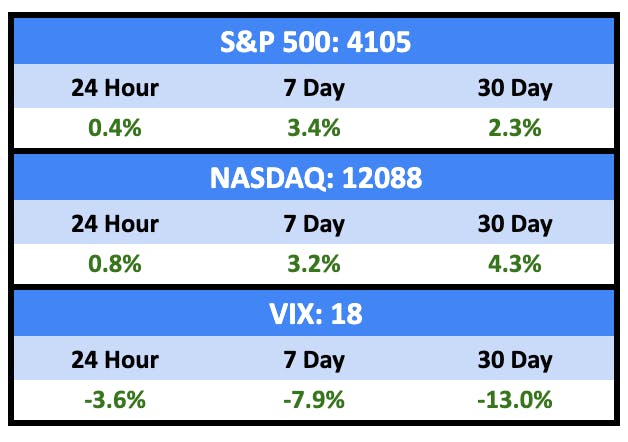

It’s a big week for equities earnings as JPMorgan Chase, Wells Fargo and Citigroup all report quarterly results. We’ve also got the U.S. consumer price index and producer price index to look forward to.

Bullish News

- Over the past 2½ years, immigration into the US labor market has increased by 4 million workers, and the working age immigrant population is now back at its pre-pandemic trend. High immigration is helpful for the Fed as it tries to cool down the labor market and slow down inflation.

Bearish News

- American manufacturing activity fell to the lowest it’s been since March 2020.

- All the money Americans stashed away during Covid will be gone by June.

- For banks outside the top 100, credit card delinquency rates are near all time highs.

- Credit markets have got exceptionally tight.

- Related, the share of U.S. households reporting it is harder to obtain credit than one year ago hit a new high in the New York Fed’s consumer survey, which is around 10 years old.

- Confirming what everyone sort of knew, US unemployment is hitting differently for skilled vs unskilled workers. The former are doing great, while the latter are getting laid off. (more on this in tomorrow’s WC)

- The Fed is making noise about sending rates even higher.

What are we doing?

ALTS 1 fund news:

Our Q1 report is out this week.

Real Estate

Bullish News

- Dolce & Gabbana is getting into real estate with residential projects in the US and Spain and a hospitality project in the Maldives. I don’t know why.

- China’s new home sales rose sharply in March, as a slew of support policies boosted a pickup in demand across the board.

Bearish News

- Blackstone’s REIT only fulfilled 15% of redemptions in March, holding onto $3.8B worth of requested capital.

- The European Central Bank has called for a clampdown on commercial property funds.

- Manhattan residential real estate sales plunged by 38% in the first quarter of this year while the average sales price dropped 5%.

- Apartment sales are off 74% year over year, the biggest decline in 14 years.

- 44% of millennials, and 39% of all Americans, say they’ve skipped meals to make housing payments.

How to invest in real estate right now:

I’m still out of the real estate market [no change].

Crypto & NFTs

Here’s what you need to know:

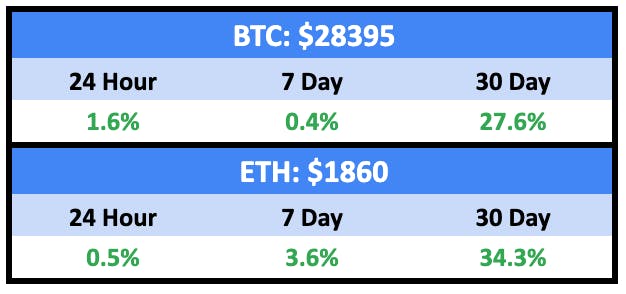

Bitcoin and Ether continue their march upward.

And degens are getting greedier.

Meanwhile, NFTs are flat over the last week and have really lagged behind crypto since mid-March.

Bullish News

- Bitcoin was by far the best performing major asset class in Q1.

- ETH crossed $1900 for the first time since August 2022.

- Dogecoin rose as much as 31% after Twitter users noticed their home buttons changed into the dog meme. This is just f*cking stupid.

- Dogecoin plummeted 15% as a few people came to their senses.

- The tokenized securities market could reach $4 trillion by 2030.

Bearish News

- Bitcoin liquidity is at a ten month low. People ain’t selling.

- The US Treasury Department says the growing use of cryptocurrency to pay for goods and services is a threat to government attempts to limit money laundering, and argues that most DeFi protocols should be regulated as financial institutions. Next they’ll ban photocopiers to limit copyright infringement.

- The American SEC delivered a Wells Notice to Coinbase. “The Wells notice informs Coinbase that SEC staff have made a preliminary determination to recommend an enforcement action against the firm for violations of federal Exchange and Securities Act violations.”

- The American CFTC charged Binance with “Wilful Evasion of Federal Law and Operating an Illegal Digital Asset Derivatives Exchange.” A choice quote: “Binance’s compliance efforts have been a sham and Binance deliberately chose – over and over – to place profits over following the law.”

How to invest in Crypto & NFTs right now:

Crypto continues to looks strong particularly relative to NFTs.

Startups

Pitchbook dropped its Q1 venture report, and it makes for ugly reading. Some highlights (lowlights):

Just $5.8 billion in exit value was generated in Q1, a figure that’s only 2.2% of the quarterly high from the past two years and the lowest quarterly value since the global financial crisis.

It gets worse.

Dealmaking didn’t fare much better. Deal value fell more than 60% from its peak in Q4 2021. Last quarter’s $37 billion total also includes Stripe’s $6.5 billion round, which wasn’t even raised for the company’s growth.

No surprise that VCs are struggling to raise new funds.

Just $11.7 billion was raised in Q1, setting the year on a path toward the lowest annual total since 2017.

Finally, reinforcing what everyone already knew:

VC-backed companies needing to raise capital are going to be looking at a formidable market. Investor caution has led to high benchmarks for raising, and even companies that have continued along their growth path won’t be able to raise at the multiples they’d hoped for, leading to smaller valuation step-ups and increased dilution relative to rounds of the past.

Be careful out there, kids.

Bullish News

Bearish News

- VC funding for climate tech startups has slowed to its lowest pace in nearly three years.

- Saudi Arabia’s sovereign wealth fund announced ties to several high profile VC funds including Andreessen Horowitz and other high profile names.

- Online grocery delivery company Boxed declared Chapter 11 bankruptcy.

- More and more startups are turning to crowdfunding, but it’s getting tougher to raise there as well.

- Q1 continued to be awful for IPOs.

- Proptech funding is down 77% year over year.

How to invest in startups right now:

I’m looking deeply into where the AI market will be at the end of 2023 and beyond. There’s a lot of junk right now, but there will be big winners.

That’s all for this week. I hope you enjoyed your coffee and this edition of Alts Cafe.

If you have any comments, questions, or concerns – let us know.

And, at the risk of boring you, please share this wherever you have a platform. Twitter, LinkedIn, the pub… I’m not fussy.

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our friends at Investment.com and Nucleus.

- We are holding BTC and ETC in our ALTS 1 Fund. We’ve also invested in Nucleus. Apart from those, we don’t own any other assets or vested interests in the companies mentioned in this email.