This week Stefan sat down with Michael Wenner, VP of Marketing at Masterworks; the world’s largest (and arguably only) platform dedicated to buying fractional shares of high-quality contemporary artwork.

In the chat, Stefan and Michael discuss:

- Artwork as the oldest “newest” asset class

- How Masterworks digitized decades of sales data; including activity, research, and other data points

- How Masterworks has published their database for anyone to see, and parallels with what Case-Schiller did for real estate

- Why effectively 0% of institutional capital is directed toward art — and why that will change

- What attributes Masterworks looks for when buying artwork (cultural significance + momentum)

- Living artists vs dead artists: Why living artists have a greater appreciation rate, but also a higher risk/loss rate

- Why selling artwork to a museum is the ultimate exit.

- The future of fractionalized artwork investing; including thoughts on the NFT artwork (spoiler: he thinks it’s a fad)

You can listen to the podcast through Spotify or YouTube.

[Stefan Von Imhof]

Hey everyone. I’m here today with Michael Wenner from Masterworks. The premier platform that allows anyone to invest in blue chip, contemporary art. So, if you follow the space, you’ve probably heard of Masterworks as they’ve been doing a phenomenal job of getting their name out there. And Michael is one of the guys behind that. He’s the Vice President of marketing at Masterworks. So today we’re going to talk all things Masterworks and all things contemporary art market. With that said, Michael, glad to have you on the show. Welcome.

[Michael Wenner]

Thanks so much for having me. And if any of my ads have been chasing you around the internet, I apologise.

[Stefan Von Imhof]

They definitely have, yeah. You’ve been doing a phenomenal job of getting your name out there. It seems like almost every couple of days, someone new talks about – because I tell them what we do at Alternative Assets, and they say, “oh yeah I’ve seen some ads for artwork lately”. I’m like “ah that’s Masterworks”. Yeah.

[Michael Wenner]

There we go.

[Stefan Von Imhof]

So how did you get involved with Masterworks?

[Michael Wenner]

So, I’ve been around the alternative investment space for a while. I worked in traditional finance doing sales and trading for about five years. Then transitioned over to the Fintech space, specifically investment Fintech companies. So, I started out at Yolt Street, which is a platform for investing in high yield debt, doing asset classes like real estate, litigation finance and refinance. After that I joined Equity Zen, which is a platform for investing in shares of pre-IPO tech companies. Helping both shareholders get liquidity and accredited investors invest in the pre-IPO technology space. And then about a year and a half ago, I joined Masterworks to [inaudible 00:02:10] marketing operation. We were about 20 employees, we launched two or three paintings. And now we’ve eclipse about 90 employees and are scaling rapidly. So, from finance, to Fintech, and to art. Here I am.

[Stefan Von Imhof]

Very cool. Yeah, it’s seems like you definitely have the right background for Masterworks. What drew you to Masterworks specifically? I’m curious. There’s so many different alternative investment classes nowadays, and you kind of have the pick of the litter for us in the industry as far as like which direction do you want to take things. So, what drew you to Masterworks specifically? Like Do you have a love for art, is art in your background at all? Tell me a little bit about that.

[Michael Wenner]

Yeah, that’s a great question. So, the funny thing about Masterworks and the people that really work here is very few, if not – barely any of us have backgrounds in art. Most of us have backgrounds in finance. Most of our sales team come from traditional broker dealer houses, and a lot of our technology team come from other finance companies. And just across the board we are a finance first company. And specifically, to Masterworks, what I think is really cool is that we really don’t have any other competition. There are dozens of people doing democratised private real estate. There are a few players like I mentioned in the pre-IPO space. A lot of people in specialty finance. A handful of people doing collectables, there’s NFT’s. But in terms of Bluechip multimillion dollar art. There’s just us. So, I really love the idea that not only are we the only ones in the space, but we’re also attracting people to the market. And it’s not sort of a zero-sum game, as sometimes it feels like the pre-IPO space for example. We just keep on growing and growing. And what we contribute to the art market, the bigger it can get.

[Stefan Von Imhof]

Yeah, that’s really interesting. Well first of all I want to say, it definitely does not come across like there aren’t a whole ton of art experts at Masterworks. In fact, we’ll get into this later. But when I go through your site and I look at all the content you’ve publish, I feel like every single person there is an absolute master. From the person who onboards you, to the person who does the indices. So yeah, I think you guys are just oozing with expertise. So that’s really really interesting to hear. What else is interesting is that you think of alternative investments right. And you were obviously going through a pretty Cambrian explosion so to speak. But there’s kind of like a bifurcation between the old alts and the new alts, right. And I look at artwork, it’s not like the oldest alternative, which is probably something like gold, but it goes back a long way. Collecting fine art has been something for hundreds if not probably maybe even thousands of years, I’m not actually sure to be honest. But it goes back a long, long way. And of course, now that has been democratised. How do you feel about arts place amongst all of the different alternative investment classes that are out there now?

[Michael Wenner]

That’s a good question. So, I like to think about art as the oldest and newest alternative asset class. This goes back to drawings when cave men were painting on the walls of their caves. There’s been art around since the beginning of mankind. But what’s really interesting is that this is a 1.7 trillion-dollar asset class. And you compare that to private real estate which is 1.6 trillion. Private equity, 3.4 trillion, and private debt just under a trillion dollars in market size. For private equity there’s over 9,000 PE firms. Private real estate, over 500 different funds and private debt there’s about 150 funds. There’s only one firm securitising art, and that’s us. So, we’ve got this gigantic asset class that has just never been tapped into from the fractionalised perspective. And really what the art market has been over the last few decades is these billionaire art collectors, institutions and foundations. Just trading the works amongst themselves. So, there has been access to real estate in the form of writs, people doing vacation homes, renting out places. There’s been ways to get access to real estate. There’s been ways to get gold. What’s really interesting about art is that it’s so so so big. And completely untapped from a fractionalised and democratised standpoint.

[Stefan Von Imhof]

Yeah absolutely. Yeah, you think about what caused the Cambrian explosion, and you think back to the regulation A and the Jobs Act. So, real estate was kind of the first stuff to really kind of get fractionalised. And now it’s just exploded. But I see what you’re saying. I mean art goes back so long and you guys are doing a great job of bringing new people into the fold. So, let’s talk about that. So, we know who the ideal fine art customer used to be right? It’s definitely changed though. So, who’s the ideal Masterworks customer today, who are you guys targeting?

[Michael Wenner]

That’s a good question and I’ll go back to something I mentioned before in terms of most of us here having a deep financial background. There is a group of people, our acquisitions team, who are the art experts. Them along with our CEO have over 75 years of experience in the industry from other auction houses like Christie’s and Sotheby’s and private galleries and sales. So, the way Masterworks really was founded was taking a data driven approach to this traditionally archaic coddling hand industry. So, when we talk about expertise, the expertise that we’re really focusing on is taking a hedge fund, quant fund approach to a very opaque asset class. So, for us, I would sort of purse it out into two separate categories. One, is where we are right now in the life cycle of our company. Is really focus on self-directed investors. Over 98% of money is managed by intermediary, third party financial advisor. But there’s this two percent of people that are managing their finances on their own. And we really find that that kind of person that’s really what we call either an innovator or an early adopter, someone that really wants to be ahead of the game with new investment opportunities, is the sort of person that has been drawn to Masterworks at first. Now we’re early in the company, so those are the kinds of people that we’ve seen so far. But as we grow and as word gets out about the asset class and how securitised and data driven, we are, that this isn’t just some fad like trading cards, or Pokémon cards of NFT’s, this is decades and decades of trading volume, decades of research, decades of data points being [inaudible 00:08:58] together. We’re moving from that sort of first mover to the early majority of people that are really trying to get ahead. And to really answer your question, these are people looking for returns. These are people looking for portfolio diversity. And then want to outperform the stock market.

[Stefan Von Imhof]

Wow, so a lot to go into there. So first of all, what’s this that you had, 98% versus 2%…?

[Michael Wenner]

…Yeah, so it’s about 2% of people – I think it’s over X amount of dollars, X amount of money managed in their own portfolio, are doing it completely themselves. A lot of times that we find that those are the people that be most ambitious and the most driven to try to outperform the market. Or there’s DIY investor. I guess as we grow bigger, we’re going to move into the RIA space, financial advisor space, institutional space. Because we are the only game in town when it comes to investing in art.

[Stefan Von Imhof]

Yeah, you are. And let’s talk about courting those institutional investors. So, I’ve noticed a push from that lately on the home page. For example, I see you guys are courting institutional investors now on the home page. I’m looking through – one of your docs here you’re talking about the market size and allocation opportunity and saying that the average asset allocation for high-net-worth individuals in art is about 5%. And then you have a big fat 0% showing for institutions. So, you’re saying that essentially 0% of institutional capitals invested in art as an alternative investment, is that correct?

[Michael Wenner]

Yes. And there’s a famous story about a British company decades ago that had art on it’s bounce sheet that ended up making a killing and having huge returns. But there’s no publicly traded companies or companies that are investing in art, or no funds that are putting it into their endowments as a store of capital or way to hedge inflation. It just doesn’t exist right now. Largely because the idea of art as an asset class is relatively new, and we’re the ones pioneering it. And you look at something like – I don’t want to draw to many parallels to us and to Bitcoin. But one of the large bull cases for that asset class over the last year or so was institutional support. And you saw companies like Tesla and Square, as well as hedge funds come in and use that either on the bounce sheet or part of their portfolio allocation strategy. And then you saw the result of that, not only does it bring trust and credibility to an asset class, but it provides institutional support. So, when there is volatility in the asset class you’re not going to see as steep declines, because there are some people in there that aren’t buying and selling every single day. You wanted sort of a long-term strategy. We haven’t come anywhere close to that in art. Again, we’ve got a small community here that is growing. But they’re the only ones in the space. There have been art funds in the past that have, for the most part, failed. But we’re pretty much, like I mentioned, the only game in town. There’s just a few thousand people that have invested in art and that’s through Masterworks.

[Stefan Von Imhof]

So, there’s a couple of items I wanted to touch on. This is really fascinating. The first is something you said a few minutes ago about – I think you used the word fad when it came to trading cards and NFT’s. I have to actually push back on that, and I want to get your take. Because on one hand we look at the trading cards market very very closely. That’s one of the markets we track extremely closely. And there’s certainly been – there’s a fad element to it in that there’s been more price appreciation in the sports trading cards market over the past four or five months than there has been in decades. So, there’s definitely something happening from a fad standpoint there. But on the other hand, the word fad to me has too much of a negative connotation in that it kind of – I think it demeans it a little bit. We see the opposite. We actually see trading cards as kind of like the gateway drug for all alternative assets. That’s kind of the lead in for something deeper and more – I hate to say real, but something more real perhaps. Like fine art. I mean, really the trading cards are artwork in a way. I mean some of them are beautiful. And so yeah, I just wanted to push back a little bit on that and get your take on maybe some of the tangential markets that are getting maybe a little bit more attention, but can also draw people in towards fine art.

[Michael Wenner]

Yeah absolutely. And I should correct myself. I think I meant that more in a – not so much in sports cards, but as a child of beanie babies and Pokémon I have seen some of these things come and go. And I think sort of to push back on your push back, I will say that a lot of these hockey stick like games we’re seeing in the sports card market, is not something that you’d ever see in the art market. I think that that – maybe fad is the wrong word, but there’s pockets of bubbles in this space. And you would just never see something like that in the art market. And I think one of the big differences – I think sports cards have this as well, but what we have that some of these other alternative assets may not have or other new sort of investible things, like collectables I’ll say, is that this rich deep history of data that we’ve collected. As I mentioned, our company is based on this price data base. What we did was we took every single auction sale that happened from the last 50 years from Christies, Phillips, Sotheby’s and we compiled it into a price database. So, you can go in, you can search Picasso, Basquiat, Banksy, Kaws, Chagall, whoever you want. And you can look at every single piece of art that’s been sold twice at auction. So, starting with this quantitative approach, and we’re not just going out there and buying art we think is interesting. First, we give this huge price data base to our data science team, and we say find us which artist markets are gaining the most momentum. Now, we say gaining the most momentum, we’re not talking about a Wayne Gretzky card that has all of a sudden doubled in that last two weeks. We’re talking about something that has been seeing 14 percent take over the last 40 years. Nothing in the art market is going to go crazy. Now we’ll see some artists that have similar sale appreciations, about 40 or so percent in certain categories. But I think these spikes are huge spikes. They’re not something you’re even going to see. So, when we got to auction, we have about 40 or 50 artists that we’re targeting at a time. And within that, we’re only looking at certain time periods and colours and styles from that artwork. So, for example, Jean-Michel Basquiat, his best year was 1982. And then within 1982 he has a few different series and themes that he touches on. And within those certain themes, there’s certainly colours that he uses and certain characters. So, when you get this niche, and that’s how we’re taking approach to it. I think a lot of other companies are saying, this thing is going up, let me invest in it. And we have a very thorough process of making sure that we are only purchasing less than 1% of the art that gets offered to us. And really making sure that whatever we buy has a trove of data behind it.

[Stefan Von Imhof]

I mean, you guys are oozing with data for sure. it’s actually really fascinating how much data you put in, compared to, I’ll say, a lot of the other platforms out there with other alternative investment classes. what we do at Alternative Assets, we do a lot. one of the things we do is we collect a lot of data, and we use that data to find mispriced, undervalued assets. We are able to grab a tonne of insights from our data. We don’t cover the art market at all yet. It’s on the road map. But this is a really good reason we don’t cover it yet. I’ll be honest, it’s because you guys are doing such a freaking, tremendous, fantastic job. There’s no need for any other analysis yet. I mean, I look through your site and it’s just pouring out content, data, you’ve got a database, full searchable database that anyone can access, or members can access. You’ve got great insight, great commentary. So yeah, I mean you guys are really doing the heavy lifting here for everyone. And first I just want to say thank you. It makes everything a lot easier you know [laughter].

[Michael Wenner]

That’s a good point. One of the things that I’m very proud about that we recently released, we have this database that was only limited to Masterwork’s members. But we actually just opened it up to the public. It’s just masterworks.io/research. You can go in there, type in an artist name and look at all these – first of all beautiful works. You can see everything, and what’s really cool is you don’t need an account or anything. You can go and click an artist’s name, click the painting, and then once you click it you can click into an excel that will show you every single piece about that auction sale. It will show you the size of the painting, the colours, the bids, the estimated range. Everything. The year, provenance, historical data, notes, auction stuff, it’s truly amazing and we really look at it as analogous to what Kay Schiller did for real estate. You had this huge asset class. And when you just start putting numbers behind it you can really see more about the market itself. And the economy overall. The art market, for better or for worse, is really a gauge of the top .001% in that the growth of that proportion of the economy. Because unless you have the people that are buying these artworks, are able to afford a $10 million Picasso. So, the more they are able to trade this back and forth is really a reflection of how that part of the economy is growing. And as we’ve seen with a lot of this wealth [inaudible 00:18:59], it’s only getting worse. But like I said, now that we’re sort being able to bring new buyers into that market, we’ll have more people be able to take advantage of that rise in price.

[Stefan Von Imhof]

Yeah. Nobody is doing anything close to what you guys are doing from a data standpoint. In any of the markets we track. It really is commendable. And I think what you do is you make it easier for the retail investor, right. Who is a little maybe nervous about dropping 10, 15, 20 grand into a painting that they probably don’t know a whole lot about. You guys really hold their hands through data, through insights, and through your onboarding. And that’s actually what I’d like to talk about next. So, one of the things that surprised me when I first signed up for a Masterworks account, was you can’t just start investing. Every single user I believe, correct me if I’m wrong, but I believe every single user essentially goes through at least one, and I think sometimes two personal onboarding calls with team members. Tell us a little bit about that onboarding strategy that you have that – we’ve seen it with other companies do this. Superhuman famously did this when they launched a few years ago. And I think we’re seeing it more and more. Tell us a little bit about that, why you do it, and how it’s worked for you.

[Michael Wenner]

That’s a great question. And it was something that I’ll say I was sceptical of when I joined on. I thought, this was 2021, well yes 2021 I joined on. But the days of needing to talk to someone, like I can order McDonald’s from my couch without interacting with a human being, why do I need to talk to someone on the phone to invest in art. And what’s interesting is that we found that because this is a brand-new asset class, because this isn’t just something semi digestible like real estate, that people didn’t really know what it was or what we were doing, or honestly if we were even legitimate. So, there were some people that were orally on before we had the phone call, were putting in tens of thousands of dollars without talking to a human being. I know, I personally would have a tough time doing that. Or at least want some live chat support or want some emails back and forth. So, our users, and most of them are very high net worth, want to talk to someone before allocating that bigger chunk of their money. They’re used to, when they are investing having a white glove service. So, we really wanted to make sure people that were putting in a lot of money into a brand-new investment actually could talk to a human being. And what we found was that they had so many questions. They wanted that re-assurance. And they wanted to learn. No one on earth has been able to invest in fractionalised art until we came along. And we wanted to make sure we had our bases covered and they were appreciative of that. On the other side, is its suitability for two reasons. One, we don’t want people going in over their heads and investing too much of their investment portfolio. Just from a risk mitigation standpoint, we don’t want a Robin Hood situation where having people putting in too much money, too higher allocation of a portfolio. And the flip side, we want to make sure that people are putting in a portion of their portfolio that makes sense. City had a report that came out, that suggested that clients allocate between 1 and 8% of their portfolio, depending on their risk tolerance to art. So, we really want to get an idea of the investors goals, risk tolerance, so we can allocate them accordingly and give them either, not so much recommendations, but guide them to the difference and teach them the difference between investing in Kaws, whose is a living artist, who may have a higher appreciation rate but a greater loss rate, versus someone like a Monet, whose like an apple, or more like an Intel Bluechip stock, in the Dow, will gain 8% a year, reliable. It’s very – a lot of his art doesn’t lose money over time. But, versus a relatively – like I said a living artist that may have different features. So, everyone’s got a different risk appetite, time horizon. So, we really wanted to make sure everyone was covered and understood what they were getting into.

[Stefan Von Imhof]

It makes a lot of sense. I mean, I think when you’re pushing the envelope forward like you guys are. And you’re basically the only ones doing what you do to the degree that you do it, that’s for sure. It is a great way to answer questions that people have. But I think it does something else. I think it actually makes them more invested, figuratively speaking, invested. It makes it more real when you have an onboarding call with someone as opposed to a fly by night idea “oh yeah, I saw your ad in the newsletter or something and I’m just going to sign up”. And what’s probably going to happen is, well nothing, they’re probably not going to invest a dime because there’s a million options out there, and what makes this one any better. But I think the on-boarding caller just makes them feel a lot more just invested in the whole process. And I’m sure it helps with your numbers as well. So, it’s really interesting.

[Michael Wenner]

Yeah, I mean we do definitely miss out on a lot of people who want that self-serve experience and just want to click an invest. That’s something we’re willing to miss out on just because we want to be safe, we want to mitigate risk. As you said we don’t we don’t really want people that don’t understand or don’t care. We don’t want someone just to click a box, put in $1000, and not understand really what they’re getting into. That’s not what we are interested in. We want people to understand what they’re allocating into, what percentage and how to think about returns and risk adjusted returns as well.

[Stefan Von Imhof]

Right, yeah. You’re not interested in vanity metrics. You’re interested in real people making real investments and helping them succeed.

[Michael Wenner]

Yeah. And I think a lot of times this transfer from real financing to tech; a lot gets missed along the way. This is people’s money, their livelihood, their savings, what they’re passing onto their children. Especially our users, there’s much more high net worth and older – and they’re not the ones are going to be flipping shares on Robin Hood day after day. This is a serious investment for them. So, we want to make sure that our onboarding process matches that.

[Stefan Von Imhof]

Absolutely. I mean, hey, look I dumped my entire 2020 IRA allocation into Masterworks through Alto IRA. So, yeah [laughter]. So, let’s make sure this goes somewhere in the long run. Cool, so how would you describe the art market today? And what market trends are you seeing right now and how has it changed over time? Particularly interested in maybe some trends around some of the submarkets, the sub art markets. How would you describe the changing marketplace?

[Michael Wenner]

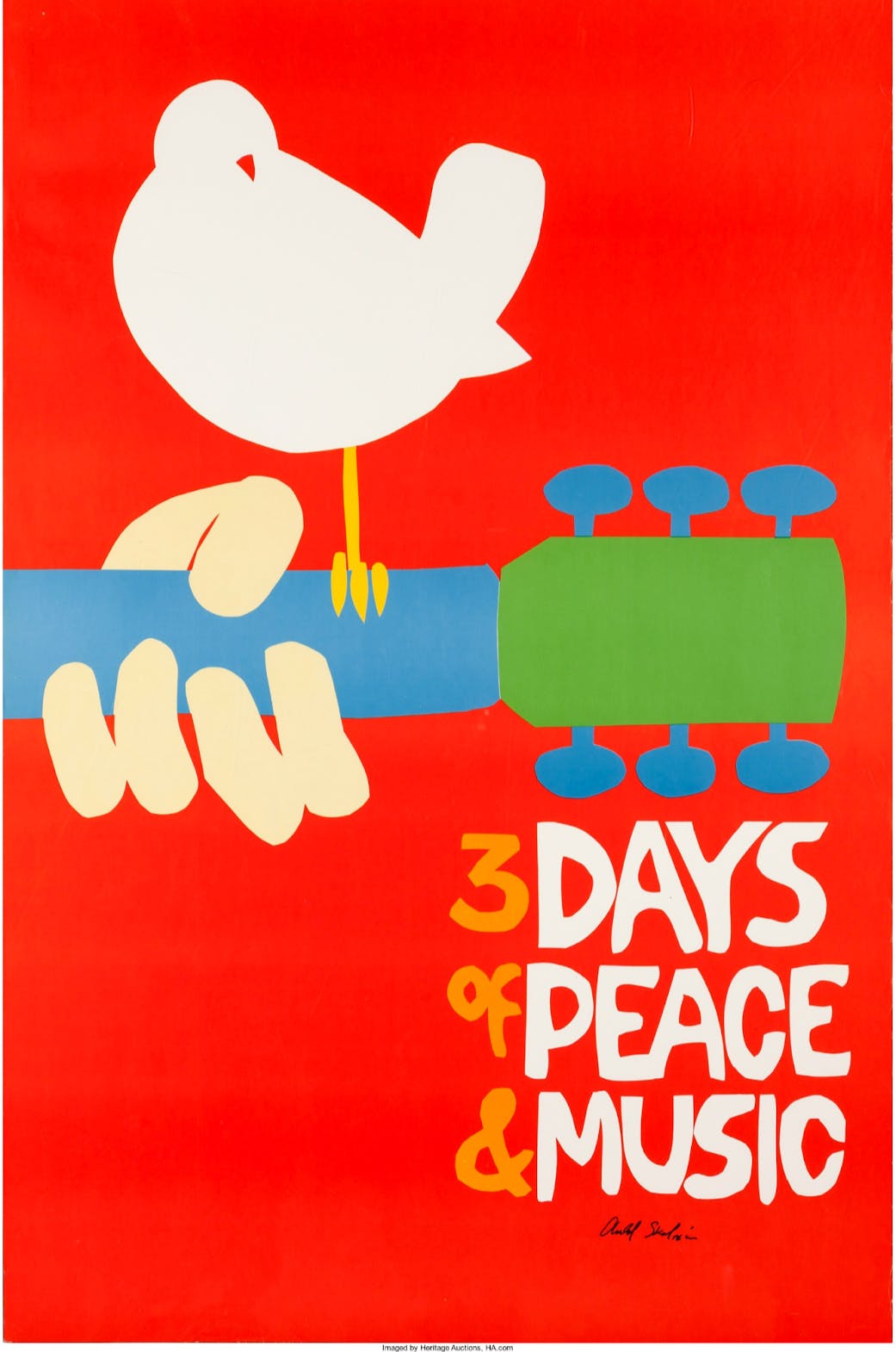

That’s a good question. I will say that we really focus on one specific vertical within the art market, and that’s contemporary art. And that’s to defined as art produced after World War Two. These are from contemporary artist that you’ve heard of, Picasso, Warhol, Basquiat. And again, it goes up until today. So that’s the larger market we plan. But within that, every single artist has a different market. And the first thing we look at when when we’re screening any artist, is what percent of the time does their art lose money from one auction to the next? So, you’ve heard of someone like Damien Hirst or Jeff Coombs who are huge artists. But if you look at the returns, you look at their loss rates, they are not great. And a lot of times people that have invested in Jeff Coombs work over a certain dollar amount, have actually lost money. So, we look at someone like Basquiat, who I believe has single digit loss rates. So, we are really focusing not just contemporary art, we’re looking ask individual artists markets, then within those specific artist markets, specific years and styles etc. So, some of the trends that we’re seeing right now. Two artists that are really hot as I mentioned, is Jean-Michel Basquiat. We look at something called cultural significance. One of the themes that he was creating art about, racial justice, civil rights, are super important today. And we’re seeing the themes and motifs of his art are becoming super important and are being reflected in his auction sales as well. And then we have someone like Banksy. We saw last year one of his pieces, but it’s a picture of parliament, but it’s all monkeys. And it set a record for him. So about 12 million dollars, and it was much bigger than his previous record. And that was great. Then along came a sketch he did, a stencil work that he – there was a viral video of him doing it, donated to a hospital in London during Covid. It was a very nice picture of a little boy playing with dolls. And you see in the background, there’s a Spiderman and a Batman he’s not playing with. But he’s holding up a picture of a doctor or nurse and playing with that. And Banksy gave to this hospital as a thank you to the frontline workers. This was at the height off the pandemic, and it was amazing. That work got auctioned off for charity in just a span of a few months. Sold for 24 million dollars. So that now becomes another data point that we put into our database. And you’ve seen his market, it’s very rare to see something like that happen. I think you have these culturally significant works, talking about race in the past. And now we’re talking about covid right with Banksy. People realise those very important moments in time and how they’re going to define our culture. So, people are seeing Basquiat as an artist who’s going to be remembered for decades and decades. And that’s really drives prices and value as well.

[Stefan Von Imhof]

It’s really interesting. It sounds like you guys are looking to preserve value fundamentally in the pieces that you choose. And like take Basquiat for example. His works are not likely to lose money. He doesn’t have the same public derision as Jeff Coombs. Anyway, Basquiat definitely doesn’t have that. The other artists who work with, pieces, they don’t have that. So, it sounds like value preservation is kind of the name of the game here is that correct?

[Michael Wenner]

Yeah. I would think that we look at loss rates. We want to make sure that the art we’re buying is not going to lose money. And then we look at momentum. We will look at a series of very similar works. So, we’re not just taking Basquiat’s work in general, we’re taking whatever offering we’re doing and we’re looking at maybe 20 to 30 other works that are very similar in terms of size, cultural significance, colour, and we are comparing it that way. And that’s how we can make sure to have a different price appreciation profile. So yeah, it’s a combination of capital preservation, and price appreciation.

[Stefan Von Imhof]

Okay. So, we talked a lot about how you guys source your art, in terms of what you look for, cultural significance, preservation of value. In one of your docs, I can’t remember which one, but you mentioned supply scarcity. And that was kind of interesting to me. I didn’t really realise that was a thing with contemporary art especially. I mean with tradition art obviously there is literally no more supply. But I was surprised to read about supply scarcity with contemporary art. So, given that scarcity, and I’d love to kind of get your thoughts on that scarcity, but within that, given that, how are you able to acquire these pieces for consignment? Tell us a little bit about the process of actually doing the actual sourcing.

[Michael Wenner]

Yeah. That’s a great question. So, I’ll first touch on scarcity. Plain and simple, Pablo Picasso is never going to produce a piece of art. Neither is Jean-Michel Basquiat or Keith Haring. There’s never going to be another one produced. And so, you have – for Jackson Pollock, you have a fixed amount. And you can always build more buildings for real estate or there’s always going to be another cryptocurrency coming along. You can print more dollars. But as a real asset, and as a hedge inflation there is a hundred percent scarcity value in what we’re doing. And as these new artists have come along, let’s say Banksy or Kaws, they understand this dynamic. They understand that if they start flooding the market with more of these works, it will diminish the value off the market overtime. Something that other artists, Coombs and Hirst may have learned the hard way. So, you’re not going to see Banksy putting out 100 different artworks tomorrow, and then 1000 the next week. He understands that there is scarcity value if he wants to keep prices high in this market. So that’s scarcity value. And another thing is that which is super important, the supply is constantly decreasing as most of these works end up in museums and institutions which have provisions to never sell them again. So, once they’re moved from private into public hands. They’re off the market indefinitely. So, you will just constantly have Jackson Pollocks and Basquiat’s just in diminishing supply. Which is something we’re looking forward to in the Ethereum community, and just making sure that not only is it a fixed supply, but it’s constantly declining. And sorry, to answer your other point about sourcing, so we are – again we start off with this fundamentally quantitative approach, and then we have our acquisitions team going to auctions, working with private galleries, and because we become one of the top buyers in the art market, we are getting offered works from everyone and anyone. Which gives us leverage to get the best deals possible. So, we’re seeing dozens and dozens, and dozens of examples offered to us on a daily basis. And that helps us be able to pick the cream of the crop.

[Stefan Von Imhof]

And when you source a peace, it’s almost all consignment correct? Or are you doing full buyouts as well?

[Michael Wenner]

So, we purchase every piece of art through [inaudible 00:32:56] capital. We own the entire thing.

[Stefan Von Imhof]

Oh interesting. You do full ownership. I’m sorry I didn’t realise that. Okay.

[Michael Wenner]

Yeah, we own it 100%. We do a regulation A offer or put in an LLC. Put it through a Reg A offering and then investors own a piece of that LLC. Which only owns the painting.

[Stefan Von Imhof]

And is there ever any retained ownership from the original owner? Or the most recent owner I should say?

[Michael Wenner]

There is not, no, we buy it out completely. For example, we do have one of our Banksies in the Amsterdam Museum of contemporary art. And we’re hoping to do more of that as more museums open back up, so we can get it back out into the public.

[Stefan Von Imhof]

Interesting. Got ya. Yeah, sorry I didn’t realise that. That’s cool. So then does each piece get appraised at the time of the purchase? Something I’ve always wondered, when you file the SCC docs, that requires a reappraisal for the purpose of the documents. Is that correct?

[Michael Wenner]

Yeah, so we get it appraised before we purchase it, at the time of the purchase and we are also getting is appraised quarterly as well. So, we just came out with a whole new batch of appraisals. So, I would encourage you to check your portfolio and to see how your art has done.

[Stefan Von Imhof]

Well, I have checked. And granted it was only a few months ago I made this injection of capital into artwork for the first time. But it hasn’t moved yet, and so I actually wanted to talk about that. How often do you re-calibrate the fair market value of each piece? And what kind of governs the rules for the cadence of how often you’re kind of updating prices?

[Michael Wenner]

Yeah, so for appraisers we use third party appraisers. We have our own internal metrics for appraisals. But the ones that you see are done by third parties as to make it as unbiased as possible.

[Stefan Von Imhof]

Got ya. Okay. So, it’s not an internal apprising, that’s all done externally unbiased third parties?

[Michael Wenner]

Yeah, so when you see an appraise value on the website that is not us. That is a third party that we’ve hired to do that appraisal.

[Stefan Von Imhof]

And does that third party, or those third parties, do they kind of help add to your database I would imagine right? You take a very data driven quant fund approach like you said. You have a tremendous amount of research. I would imagine those appraisals just feed into that database which you fundamentally own and of course disseminate to the community.

[Michael Wenner]

It’s actually interesting. So no, our database is only compromised of things that had been bought and sold at auction. 50% of the art market is done privately. So, we can’t get any data on that. But everything that’s done in auction. We record and put in. So, it must be bought and sold publicly to do that. And the reason why no one else has this it’s because we digitised it. We took 50 years of paper records from all these auction houses, which they were putting out on [inaudible 00:35:45] I’m sure you may have seen, Sotheby’s has their fall sale catalogue, and they will publish, I think now it’s digital, but decades ago it was all done by print. So, when the company first started, the way this price database was formed was physically getting – collecting all these different manual books and writing down by hand and putting them into spreadsheets, all these different return profiles. So, it was a very long and hard process. But that’s the basis of it. And it only gets updated after every live public auction sale which we monitor almost every single major one live.

[Stefan Von Imhof]

It’s really interesting. It is definitely critical to have data on your side as a weapon if you’re going to fight this battle. And its interesting how many companies have kind of come from that angle. I look at collectible for example. And they started as, I mean their history is a little interesting, but they started as basically a data play for the trading cars market. And then they kind of leverage that, and that’s still one of their biggest advantages today. And you guys are – all that data you’re saying is the publicly available stuff is the only stuff you can get access to basically. What percentages of art sales would you say are private? It is most of it?

fuck I hate this job

I think it’s about 50-50.

[Stefan Von Imhof]

50-50 okay. So, half of it is a little opaque and no one really has access to that data. But the data you do you have access to, that’s what ends up in your database. That’s the public auction data. That’s what ends up in your database?

[Michael Wenner]

Yeah. And we really only go after artists where we feel like we have a comfortable enough amount of data. If someone’s only been at auction a handful of times, we can’t really make a decision that’s statistically significant, and that we have confidence with. So, we’re going after long established artists they have a history of selling works at auction.

[Stefan Von Imhof]

Now, do you think that – you said that the art market is less conducive to bubbles, compared to some other more volatile asset classes. And that makes a lot of sense. But do you think the fact that retail capital is starting to pour into alts to a pretty insane degree, is that skewing the market at all? Do you think it will push valuations up by virtue of the fact that they’re demand is just up so highly? Or is that something you guys haven’t been concerned with?

[Michael Wenner]

So, the people that own these multimillion-dollar artworks are not going to be your typical panic sellers or trend following buyers. They are, in terms of a drawdown, someone who is able to afford a $10 million Basquiat is not going to go and sell that Basquiat the next day. Even if they try to, it’s just such a slow-moving process. It takes weeks to get things done and appraised. And they would never do that because if you do try and panic sell, it’s going to be pretty obvious that your panic selling, and you’ll get a very bad value. So, it’s not like the market is – the Dow is down 700 points, let me sell. It’s pretty public facing. So, no one’s is going to be caught with their tail between their legs and do that. And even if they tried to, art isn’t going to be the first thing to go given its illiquid nature. And in terms of retail maybe pushing prices up. The only way they’d be able to do that is through us, and we’re a drop in the bucket in terms of the total art market at this point.

[Stefan Von Imhof]

Right, yeah. That makes a lot of sense. So, what do you see happening for the future of the – well I’ll talk about the future of Masterworks. I want to get your take on that. But to start, I want to know what the future of the art market holds in your opinion. Where do you kind of see this going in the next, I want to say, five to ten years, what does the market unfolding look like to you?

[Michael Wenner]

I wish I had a cooler answer, but I think that this market is still stuck in a very old age. Most of this is still done at Sotheby’s, in Christies, and with a handful of the big galleries. [Inaudible 00:39:48], this is a very old school market. However, that gives us a great unfair advantage. Because we’re the only ones using data and quantitative analysis. These big players are not. So, I don’t think this is going to be shooting ahead in technological terms, like other asset classes that we’ve seen. We’ve still got a long, long way to go for our technology to come in.

[Stefan Von Imhof]

That’s interesting. I’ll be honest, I agree. You think art as an alternative asset, and it’s kind of one of the more, gees how do I say this, it’s a little older, a little stuffier so to speak. A little more recalcitrant. Hasn’t tend to change. There’s also a lot of legacy kind of investors I think in the art market, compared to some of the newer alts. That can be a good thing and a bad thing for sure. But you guys are clearly in a great position to capitalise on that because you are pushing the envelope forward and you’re way ahead of everyone else in terms of data and commentary for that matter. So, I think yeah, obviously you guys are in a great position moving forward. So, let’s talk about Masterworks’ future. How do you see the company unfolding? As opposed to the art market at large. Particularly, I’m actually curious about your thoughts on NFT’s. There’s definitely a hype cycle with NFTS. It’s up, it’s down. I’d love to get your thoughts on that. Especially as it relates to digital art. We’ve seen some very big, big sales in digital. I mean some of the biggest art sales ever, period, are NFT art. And that’s only in the past few months. So, in the history of art, or at least public sales that we know of, the beat bowl sale at 78 million is basically one of the biggest art sales just in history, period. So, I’m really curious, what are your thoughts on NFT, digital art, and how that relates to the art market at large and Masterworks in particular?

[Michael Wenner]

So, I’ll start by saying, you see a lot of these different alternative platforms try to start with one thing and they grow and do something else. Start with a traditional fund and then it will move to a crypto fund. They’ll start with real estate and then they’ll do something else. They’ll start with collectables and then they’ll do wine. We are focused on one thing one thing only. We have absolutely zero plans to do anything except for blue chip contemporary art. That’s it, and that’s it only for a very long time. In terms of NFT’s. I really say that there’s this moment in time that we’re living through, where art and the crypto world overlap. But I don’t think that’s going to stand the test of time. I think that you’re going to see NFT’s be used for more utility purposes. But in terms of artwork. I just don’t think that’s going to be around for much longer.

[Stefan Von Imhof]

Interesting. Yeah, no one really knows. Anyone who pretends to know is full of crap. This stuff is definitely unfolding pretty quick. I don’t think anyone could have predicted the rise of NFT’s, at least not to the degree that it happened over the past five-six months. So, I don’t think anyone’s really in a great position to say that they are inevitable, or they are the new norm or anything like that. It’s definitely interesting to watch. I will say, some of the big NFT sales are especially eye opening. But I like your approach. You’re saying look, we do one thing, we do it well. We’re the first to do it. We’re basically the only ones to do it. And that’s all there is too it. And we’re going to keep riding this horse. Cool. Well, you guys are in great shape. I love what you do, I love the data transparency especially. Nobody knows where to begin in these worlds right. And that’s what we try to do at Alternative Assets, is educate people and bring them into the fold. But you guys are doing – of all the platforms, I have to say, you guys I think are just doing the absolute best job of educating the market, bringing people into the fold, empowering them with data and insights. So, thank you for pushing everything forward. And thanks for doing such a great job.

[Michael Wenner]

Of course. I think that unlike other real estate classes, I’d say maybe except for trading cards, it’s also just a beautiful asset class. We get to see these things at the MET and MOMA and admire them. And it really causes a feeling of the sublime and emotional relationship. And so, to be able to – I think we’re seeing this trend of people aren’t just investing – people aren’t investing in Tesla because they believe in the company, but they’re doing it to be part of a community at large. Same thing with AMC, GameStop, it’s a connection to something larger. And so, we don’t have a lot of people that are coming to us saying I really love Banksy. But once they do, they’re able to have a connection that you’re able to be part of. Unlike an ETF or a bond. And so, it’s something that you want to talk about, and you want to tell your friends about. And so, I see this as really a very important part of people’s portfolio. Having things, they believe in. And luckily for us, unlike other asset classes, ours has a pretty decent rate of return with contemporary art returning 14 percent per year over the last 25 or so years. So, definitely exciting time, exciting place, and a thing you can get excited about.

[Stefan Von Imhof]

Indeed. Yeah, alts are definitely becoming very emotional. And the emotional aspect is huge. They didn’t used to be. Alts used to be kind of boring, and a way to kind of hedge against volatility. An equity market. And now it’s something different. Totally different animal. Emotional plays a huge part in it. And there’s probably no asset class that’s more emotional frankly than artwork. I really cannot think of a single asset class that has more emotion baked in, than artwork. And that includes trading cards and collectables. So, yeah, totally agree, spot on. Well Michael thank you once again. This has been an awesome chat. I really appreciate you coming on the show and telling us all about Masterworks. And thank you once again.

[Michael Wenner]

Of course, thank you so much for having me.

[Stefan Von Imhof]

Alright, take care bud.

Thanks for tuning in. We sure hope you enjoyed this episode. And if you did, please be sure to subscribe and give us a nice review for this podcast. It means a lot. And remember, you can find a transcription of this episode along with all past issues of our weekly newsletter at our website alternativeassets.club. See you next time.