Welcome to Inverse Cramer by Alts.co: Tracking Jim Cramer’s stock picks so you can do the opposite 🙃

You are subscribed to receive Weekly updates.

We now do Daily updates as well. Get Daily updates here.

Quick links:

Table of Contents

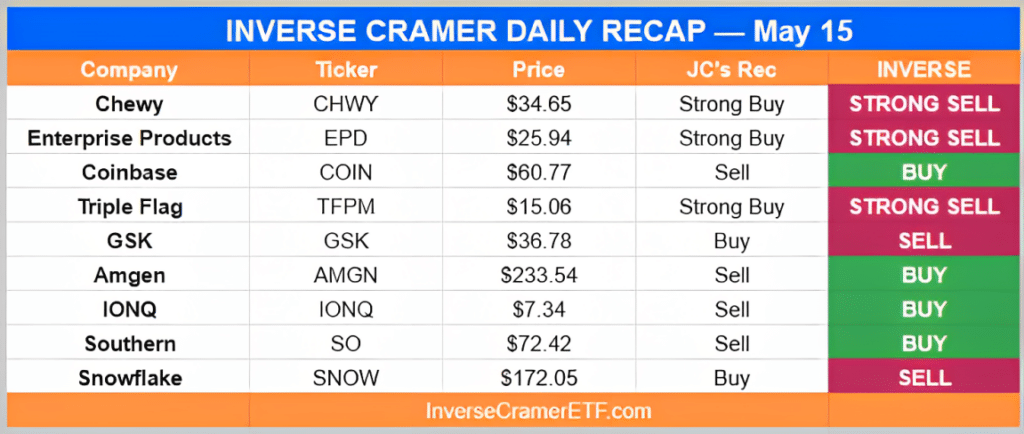

Monday May 15

They are pivoting that makes me feel that they’ve got the right numbers. I’m excited by the fact that they’ve got religious in making money, too.

– On Chewy ($CHWY)

They are the 4 most natural gas liquid pipeline in the country. After what I saw today, I’ve gotten to like them even more.

– On Enterprise Products ($EPD)

I’m not a believer in them. I don’t like companies that picks fight with the SEC. It’s too hard. The SEC plays with unlimited capital and they are not to be trifle with.

– On Coinbase ($COIN)

It’s an inexpensive stock and it’s for a reason. It doesn’t have the earnings power that I want. The company needs a shakeup. There’s so many other pharmaceuticals company that I like more. I’m gonna have to send you to Eli Lilly.

– On Amgen ($AMGN)

Loved it at $475

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) May 16, 2023

Hates it at $60😂 pic.twitter.com/GdRuQSr2Nh

Tuesday May 16

No-show

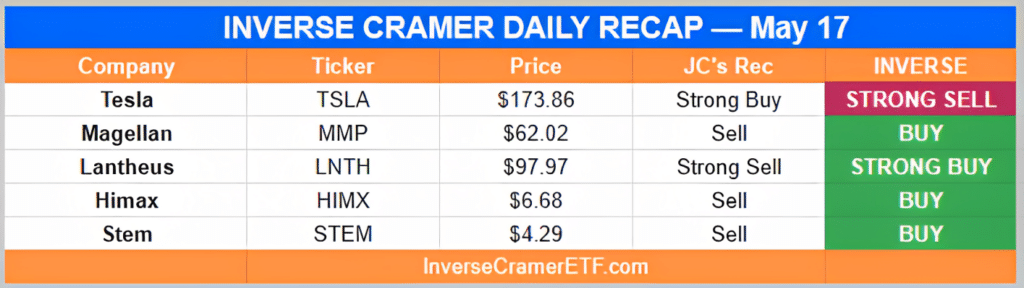

Wednesday May 17

Absolutely yes! Add it to your portfolio (BUY, BUY, BUY)

– Tesla ($TSLA)

Note: The guy is turning into a bit of an Elon simp.

We don’t really care for those pipeline companies. I say take the money and stock and run.

– Magellan ($MMP)

The only problem is they’re in Taiwan. I don’t want the risk. I listened to Elon last night, I’m going to be addressing the question on what’s happening in Taiwan. I don’t need that headache on top of they’re semiconductors.

– Himax ($HIMX)

Unbelievable pic.twitter.com/T9IFpApPKl

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) May 17, 2023

Brilliant insight Jim pic.twitter.com/qky6m5oZTw

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) May 17, 2023

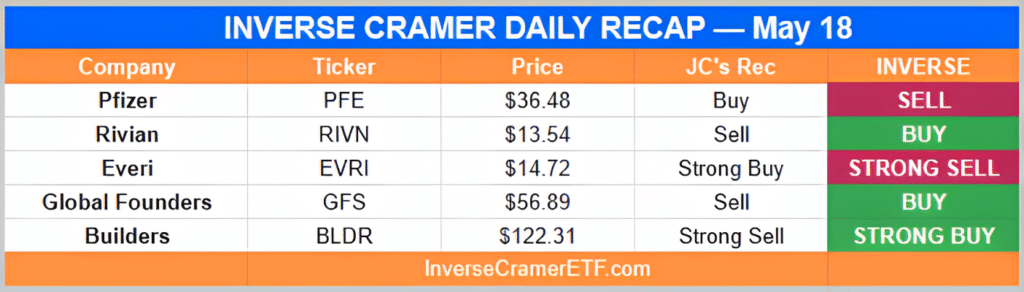

Thursday May 18

I’m a little concerned. You’ve FTC that’s going wild. I think they have a good 4.5% yield, but I don’t buy stock for yield. I buy them for growth. That’s why the club likes Eli Lilly.

– On Pfizer ($PFE)

You’ve got to cut that position tomorrow (SELL, SELL SELL). Why? I didn’t like the Home Depot foreign numbers. I’m worried about lows. You take the profit and run!

– On Builders ($BLDR)

This is the biggest worry, The downgrade in 2011 crushed the market.. It can't be allowed to happen again https://t.co/5vS73tbfjT

— Jim Cramer (@jimcramer) May 18, 2023

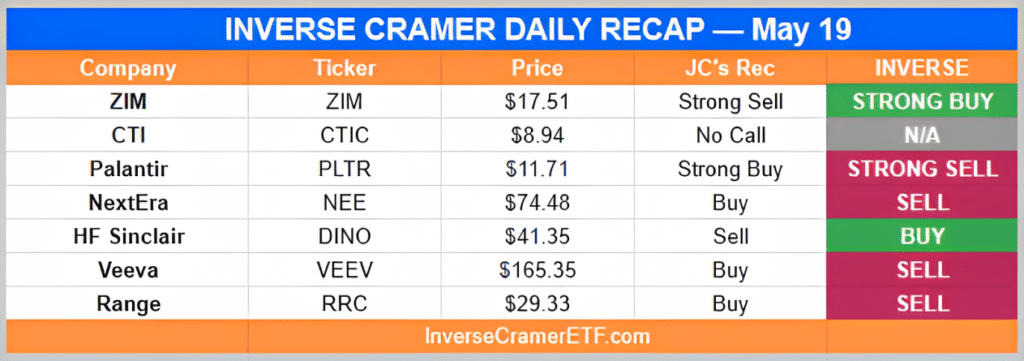

Friday May 19

I doubled down on my negativity. I don’t want you anywhere near that stock. I’ve been dead right (SELL, SELL, SELL).

-On ZIM Integrated ($ZIM)

They shifted. They have gotten more religious. They’re doing a pivot. Look out; Palantir is doing some great stuff. I’m positive (BUY, BUY, BUY).

-On Palantir ($PLTR)

Long or short jim?

— Crypto Rand (@crypto_rand) May 19, 2023

Cramer Classic

Jim looked like he got hit with a flashbang when he heard “Cramer Coin” 😂

— Not Jim Cramer (@cramercoin) May 16, 2023

Loved coinbase at $320

Not a fan at $60

Many such cases pic.twitter.com/icGZxmhyGp

Weekend Bonus

https://t.co/w0ZFzSh7kV pic.twitter.com/ZNOPYY9ADj

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) May 18, 2023

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) May 15, 2023

That’s a wrap. As always, we’ll be following Cramer’s every move so you can do the opposite.

Enjoy the week ahead.

-IC

Disclosures

- This issue was sponsored by Tuttle Capital and Franshares

- I am long $COIN (unfortunately)

- We have no ALTS 1 investments in any companies mentioned in this issue