Today we’re exploring Litigation finance. This is a niche but growing asset class completely uncorrelated to other markets.

It has increased accessibility and is opening up to fractionalization. Oh, and it can even be used for the public good. Let’s take a look! 👇

Table of Contents

What is litigation finance?

Justice isn’t always blind.

In many countries, the legal system is (unfortunately) heavily weighted towards wealthy people who can afford the best lawyers.

Consider the average prices in the US for taking someone to court:

- Legal fees: $250-$600/hour for a lawyer, depending on the state

- Court fees: $350 to file a suit, and $.50 per sheet of paper filed

- Expert witness fees: Median initial retainer is $2,000

The average cost of a “simple” lawsuit in the US is roughly $20,000. But this can be much higher depending on the number of witnesses, the complexity of the case, etc. Complex cases which drag on can easily cost upwards of $50,000. Yikes.

Litigation finance to the rescue

So yeah, it can be a struggle for average citizens to even afford to bring a case to court. This is where litigation financiers come in.

Litigation financiers cover the upfront costs in exchange for a portion of settlement winnings.

Litigation finance is almost always used to fund plaintiffs, not defendants. The potential payouts are larger, and there is a smaller cost to losing. Because of this, some industry groups oppose it, and feel it is unethical – akin to “ambulance chasing. However, in recent years defendant funding has risen up to the surface.

You can think of litigation financing as a loan, but it’s actually more similar to an investable asset in three important ways:

- No collateral is involved

- Getting litigation finance doesn’t affect the plaintiff’s credit score

- If the plaintiff doesn’t win, the financier usually does not receive a return on investment

Famous cases funded with litigation finance

Let’s take a look at how this plays out IRL:

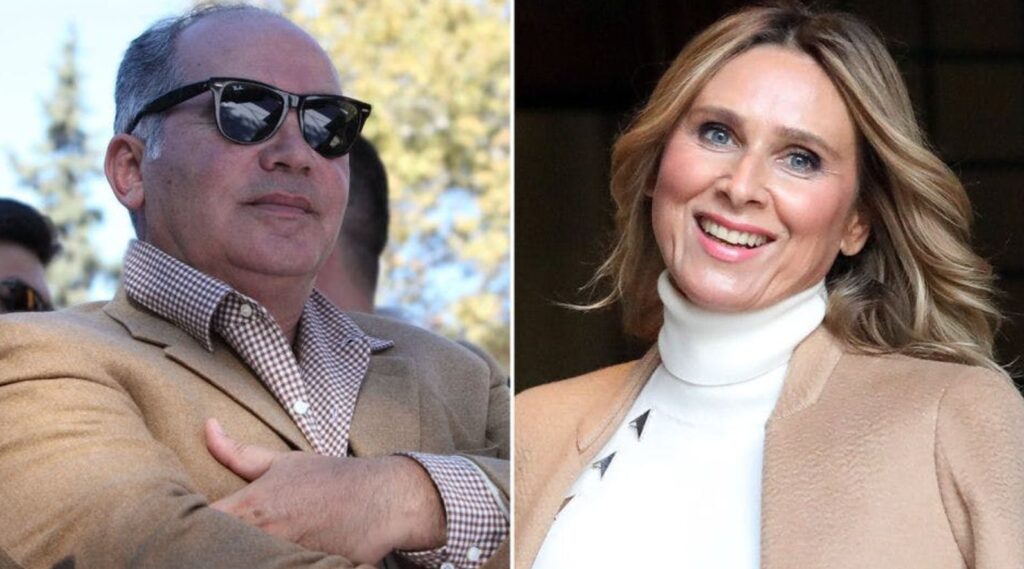

Case 1: Britain’s most expensive divorce

Litigation finance company Burford Capital has been known to invest in high-profile, long-running legal cases — even when they’re personal.

Perhaps their most notable case was the divorce battle between Russian oligarch Farkhad Akhmedov and Tatiana Akhmedova. Worth nearly $480 million, it was the most expensive divorce Britain has ever seen.

Akhmedov lost the original court battle in 2016, then hid over $100 million worth of assets to avoid paying the massive settlement fee. This was when Burford came into the picture.

The next five years largely revolved around Mr. Akhmedov’s yacht, which changed custody multiple times over the case. It culminated in Ms. Akhmedova hiring ex-SBS (Special Boat Services) operatives to storm and reclaim the boat for her.

But the real winner was Burford Capital. Despite all the setbacks, a spokesperson for the litigation financing company claimed they profited over $70 million from their investment.

Case 2: Lead poisoning in South Africa

A tragic class-action suit was started in 2020, with law firm Mbuyisa Moleele representing 10,000 Kabwe children in conjunction with British human rights lawyers Leigh Day.

The case was brought against mining behemoth Anglo America South Africa Ltd after studies showed that children living near the mine had dangerously high lead levels in their blood — up to 100x higher than the “safe” amount.

The fees for expert opinions and witnesses, and the vast majority of proceeding costs, are being covered by litigation funding company Augusta Ventures.

This is just one of Augusta’s portfolio of legal investments; they are also taking on major retailers ASDA (owned by Walmart), Tesco and Sainsbury’s, as well as various financial entities.

Using litigation financing gives plaintiffs a higher chance of winning such public interest cases like this. The Kabwe mining case is expected to be resolved sometime in 2022.

The case against litigation investing

Litigation finance is a tricky investment.

- It’s risky. Finance litigation is a bit like venture capital in that there are often only two outcomes: fail or succeed wildly.

- Low liquidity. The legal system is known for being slow. Complex cases can last many years (though payouts typically arrive faster than they do in VC)

- High barriers to entry. As we’ve seen, a difficult case can set you back over $50k. Few individual investors will have the means to take on such capital risk.

- It may be illegal where you live. As the market grows, some countries (like Australia) are passing laws that mean you need to hold a Financial Service license before investing.

The case for litigation investing

That said, there are three big reasons we like this asset category for retail investors:

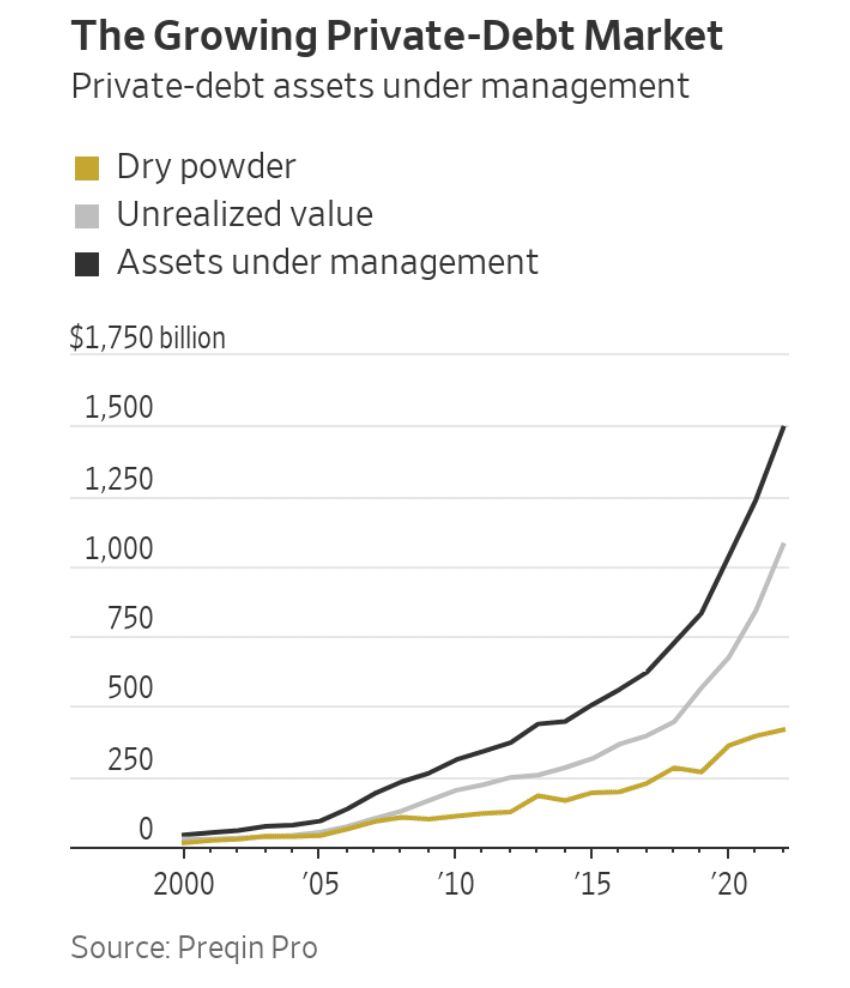

Reason 1: It’s big and growing

It’s expected that the investment market in litigation finance is expected to grow 6.7% between 2020–2026, eventually raking in around $20 billion per annum.

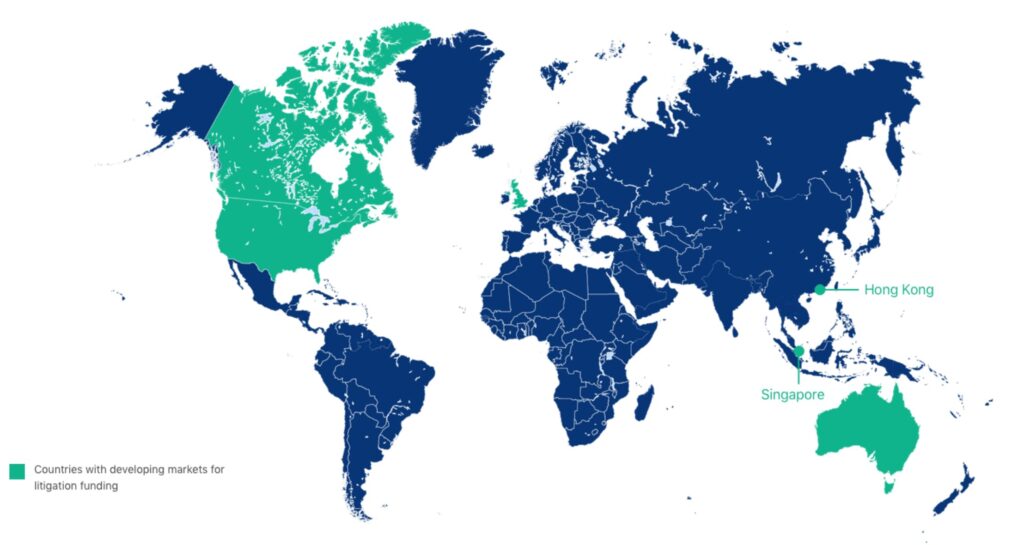

And looking at this map, it’s clear there’s room for expansion:

Reason 2: It’s uncorrelated to equities

By their nature, law settlements have essentially no correlation to equity markets.

This makes it a powerful diversification opportunity for venture capitalists, hedge funds, and institutions.

Reason 3: Fractionalization is coming

In the past, it was mainly hedge fund managers and other high-capital businesses that could get involved with litigation finance. Individuals were largely excluded from investing in cases, either due to legal restrictions (like Australia’s license requirement) or because they simply didn’t have the funds.

But the landscape is changing. Individuals can now invest directly through litigation finance platforms.

Retail access to litigation finance platforms

Litigation financiers are beginning to open opportunities to everyday investors — largely on the back of fractionalization. Several platforms exist where accredited investors can put money towards funding a specific case. Sometimes, you can even invest in a range of lawsuits.

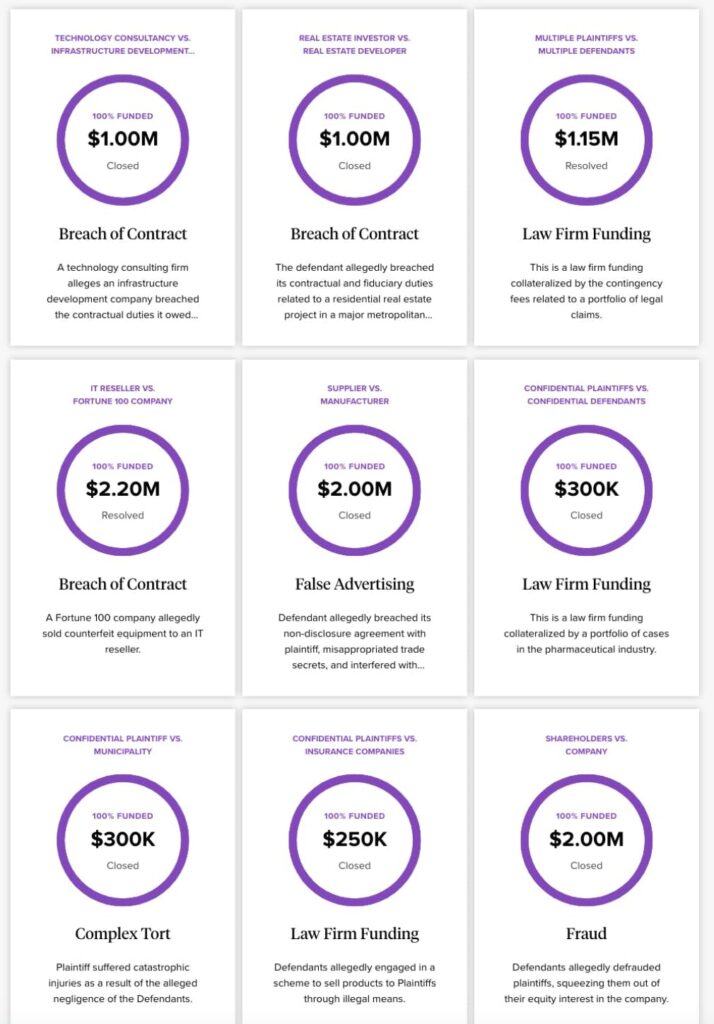

LexShares

LexShares was pretty early to the game, having been around since 2014. Their team of 15+, headed by CEO Cayse Llorens, has evaluated over a million cases. They’re highly selective with the cases they take on, and only invest in about 5% of the opportunities they are presented with.

The website hosts a comprehensive portfolio of funded cases, giving prospective investors context for the type of lawsuits LexShares targets. They also vary the types of suits they invest in — singular cases, portfolios, and even “direct law firm fundings”.

In 2020, LexShares raised $100 million to deploy their first privately-managed fund. The fund is used for every investment made by the company and was supported by alternative asset management company Titan Advisors.

LexShares also has a funding platform for accredited and institutional investors. They evaluate and fund a case before opening it up for public investment, to recoup their investment and mitigate some of their risk. Third-party investors then receive a portion of any settlement winnings. If you’d like to learn more, sign up here.

Ryval

Ryval is a startup collab from blockchain company Aval Labs and investment platform Republic. They noticed that most litigation financing investments were low-liquidity and exclusively available to institutional or accredited investors, excluding a large portion of society.

The platform essentially tokenizes investment opportunities in civil law cases using the popular Avalanche blockchain ($AVAX). Members can purchase tokens for a specific case and either trade them on an open market, or hold them. The values of these tokens will vary based on the length, outcome, and popularity of any given case.

If a big ruling is made, the token’s value might increase. However, if it is extended (or it looks like the case is on the verge of losing), investors can cash out before the token’s price drops. Ryval’s team targets an impressive annualized return of 50% in an asset class worth well over $10 billion.

It’s worth noting that there isn’t much info on Ryval’s performance or how effective tokenization is for illiquid cases.

Yieldstreet

Yieldstreet is an alternative assets platform we’ve covered in the past, through our deep-dive on Yieldstreet, and our Insider look at their Pantera Early Stage Token Fund.

The company released its European Legal Finance Fund in late 2021 to great success, resulting in a second and third Fund offering in the following months.

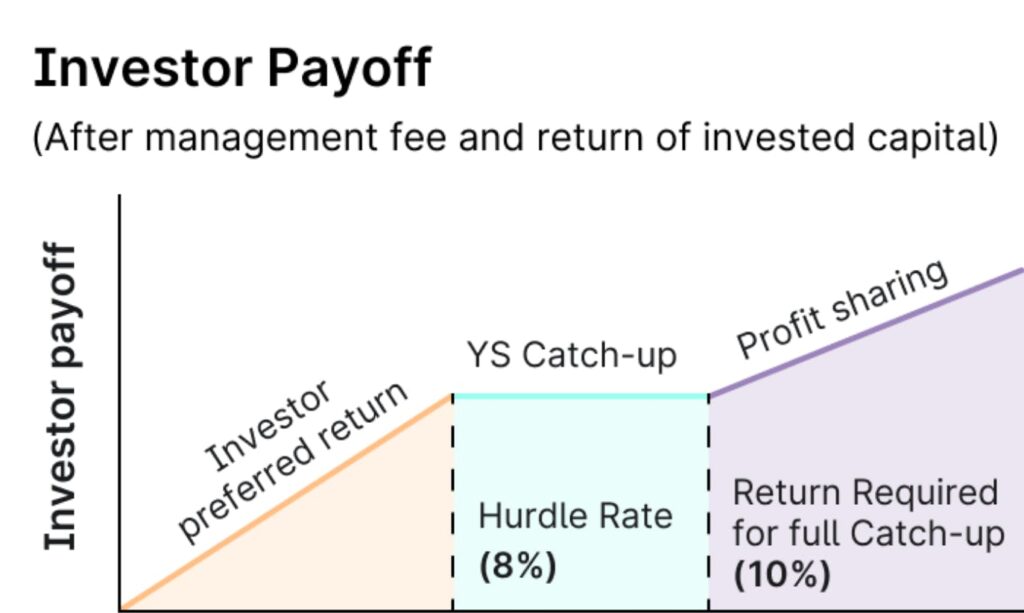

Litigation finance, and law in general, is quite complex, and Yieldstreet’s fund aims to simplify the investment process. The platform selects 2–4 civil cases they believe can hit their targeted 11–13% annualized returns. The initial investment period is 48 months, but there are two individual 12-month extensions that can be applied if a lawsuit drags on.

The way profits are paid out differs slightly from other Yieldstreet offerings. If the fund exceeds its expected return, 80% of excess profits are divided among investors.

Yieldstreet has a broad range of cases they consider. Potential suits include antitrust, bankruptcy, securities fraud, whistleblower, etc. Yieldstreet varies the suit type, geography, expected trial length, and represented law firms of their cases to diversify their offerings.

Wrapping up

Litigation finance isn’t the sexiest or most easily digestible asset class. It’s a high risk investment with relatively low liquidity, and often the “exciting” court cases are pretty boring.

But it’s a potentially lucrative and relatively underdeveloped investment opportunity. Considering third-party lawsuit funding has only been around a few decades, it’s only recently that new and innovative opportunities have opened up for everyday investors.

Fractionalization may be the future for litigation finance. It solves a couple of the issues with the asset class by increasing liquidity and lowering the barrier for entry. But it’s more than just potential profit. Litigation finance is very closely associated with class-action lawsuits, which can sometimes be for the greater benefit of society as a whole.

Investors can make a quantifiable societal impact and act upon their moral ideals. Not only can you make a good return, but you can help someone in need, and you can trigger a change towards something you believe in.

That’s as good of a reason to invest as any.