This week we have another guest post, this one penned by Alts community member Andrew Murray.

Have you ever wondered what happens when a homeowner can’t pay their property taxes? Or what happens to vacant land when it gets inherited? Well, this is exactly where tax lien investing comes in.

Andrew is a fintech YouTuber who I met earlier this year while visiting Portugal 🇵🇹

While discussing alternative investments over cafés com leite, Andrew mentioned he has personally invested in tax liens, and would love to write about it.

I asked Andrew to share his knowledge and experience with this esoteric asset class with the Alts community.

Let’s go 👇

Table of Contents

The dark side of real estate

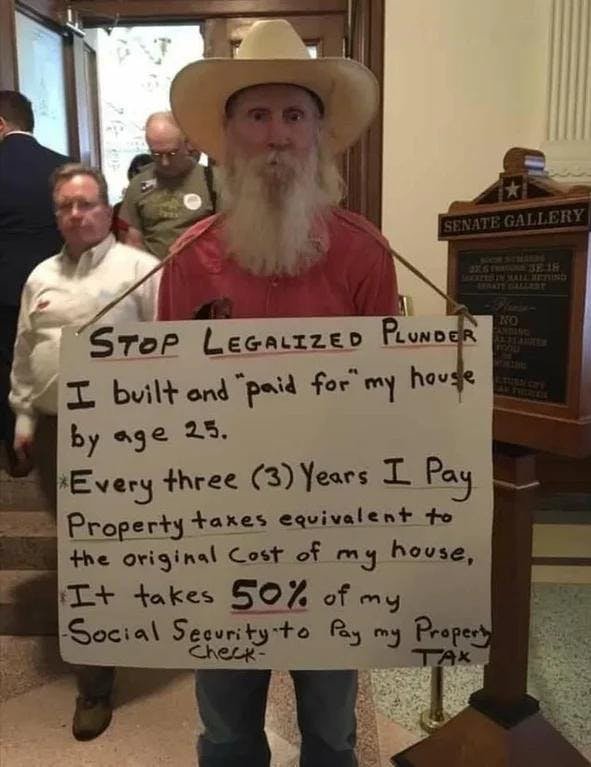

The image below is of a guy who paid off his house 25 years ago but cannot make his property tax payments, which have increased substantially over the years.

Welcome to the darker side of real estate — the kind they rarely highlight in real estate seminars. This guy learned the hard way that you never truly own real estate outright. As long as there’s property taxes to pay, someone can always take it away.

Now, you probably know that buying foreclosed homes can be a great way to invest in real estate. Foreclosures occur when a homeowner doesn’t pay their mortgage, which is owed to a private company.

But what happens when a homeowner doesn’t pay their property tax, which is owed to the state?

Property tax can be the perfect investment vehicle for those looking for a new angle into real estate. In fact, you can even get an entire property free and clear, unencumbered by a mortgage, for a fraction of its value.

Imagine getting a house for pennies on the dollar. Tax liens may be the easiest (and cheapest) way to do just that.

But like everything, it comes at a cost.

What are tax liens?

A tax lien is a legal claim against a property owner who fails to pay property taxes.

The government issues a lien and auctions it off to investors, who buy the lien outright. The homeowner then must pay the lien holder (investor) the lien amount + interest.

If they don’t pay, well, that’s when things can get really interesting.

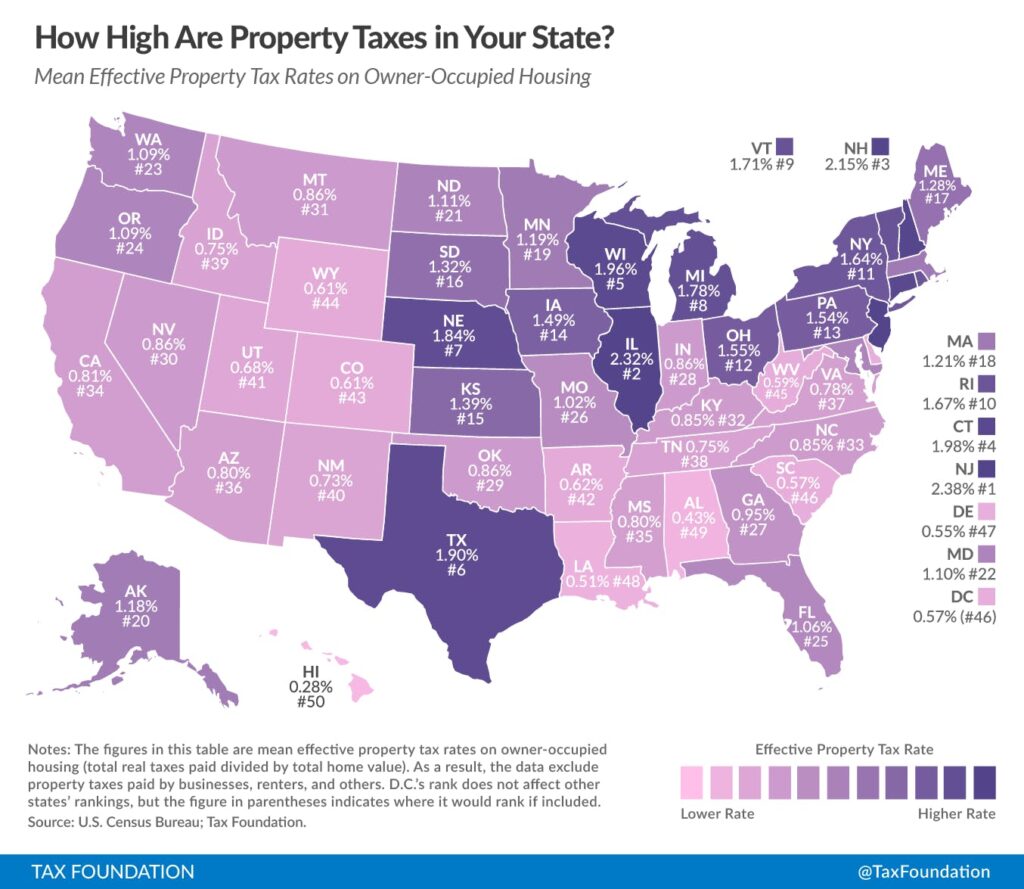

Before we go any further, I must mention that every state in the US and province in Canada handles tax law differently. There are over 3,300 counties across the United States alone, and tax liens are rife with complications and exceptions. Some areas are more friendly to investors than others.

Property tax liens are quite common, and the general public isn’t usually aware. There were $14b in unpaid property taxes across the US in 2017. Heck of a lot of opportunities here.

How do tax liens work?

Once a homeowner’s unpaid taxes have accumulated to a certain level, after letters, warnings, and phone calls, the city will place a lien on the property. The property cannot be sold or refinanced until the lien is paid in full.

When the lien is levied against the property, the local government creates a tax lien certificate. These certificates are auctioned off to the highest bidding investor.

Depending on the state, typical returns are between 12% and 18%. However, in some states, there is no bidding, and it’s a fixed rate of return. Generally, returns tend to be a bit higher return than what you can get through peer-to-peer lending.

Sometimes, liens can be purchased for under a thousand dollars. But in most cases, the homeowner will owe several thousands of dollars in taxes by the time it gets to this stage. Expect to pay between $2,000 – $10,000.

Investors can get a list of delinquent properties from the county tax office. Any property that has enough back taxes unpaid will be publicly available.

The county holds an auction (either in person or online) and sells the lien to the public.

In most cases, the lien will be paid off eventually. However, in a small number of cases, the homeowner fails to make payments, and the lien holder (investor) can get access to the property. The investor can, in these cases, initiate foreclosure proceedings and evict any persons who may be living on the property.

Oh, and the If there’s an existing mortgage, it gets wiped out.

Tax liens vs. Tax deeds

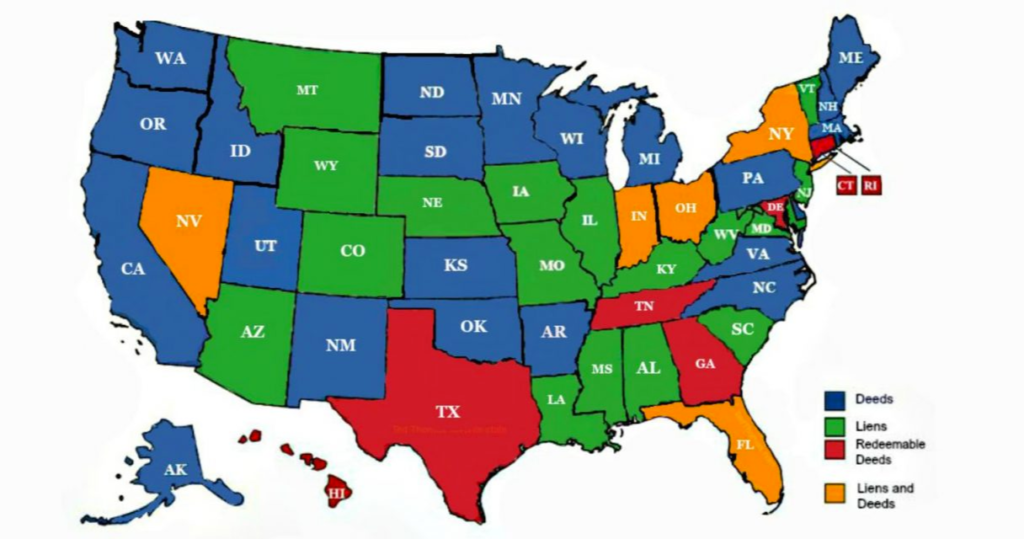

There are two ways US states deal with delinquent taxes:

- There are the tax lien states, where investors pay the property tax and earn interest (as outlined above). About half of US states are tax lien states.

- And there are the tax deed states, where investors may not earn a rate of return, but rather step in to control the entire property and obtain the deed for the property. About 20% of US states are tax deed states.

With a tax lien, you can get a deed to the property, and the mortgage could be wiped out. But in some cases, the original owner can catch up on back taxes and recover their property.

In Nova Scotia, for example, the original owner has three years after the taxes have been paid to come back and reclaim the property. That’s a bit of an anomaly, but it’s important to check the regulations in your nearby states to make sure you know the rules.

The reality is that tax liens are complicated. Make friends with the local county tax clerk. Ask lots of questions. Having someone on the inside can be super helpful.

What are the risks of tax liens?

Tax lien investing can carry some risks, so they may not be ideal for new investors. But remember, this is an asset class that is completely uncorrelated to the stock market.

Risks include:

- The risk of the unknown. Did you purchase a lien for a property with hazardous waste dumped on it? Guess what, that’s your problem now.

- Troublesome tenants can make your life hell. (This is true with all real estate, but especially in this world)

- Dilapidated properties. You could also end up with a property that can be hard to judge. It might look fine on Google Street View, but the inside is an absolute mess.

All the risk and all the reward. It’s important to become comfortable with the county tax clerk and do your research before bidding on tax liens.

When I bought my first tax lien, I ran into some of those issues myself.

My tax lien story

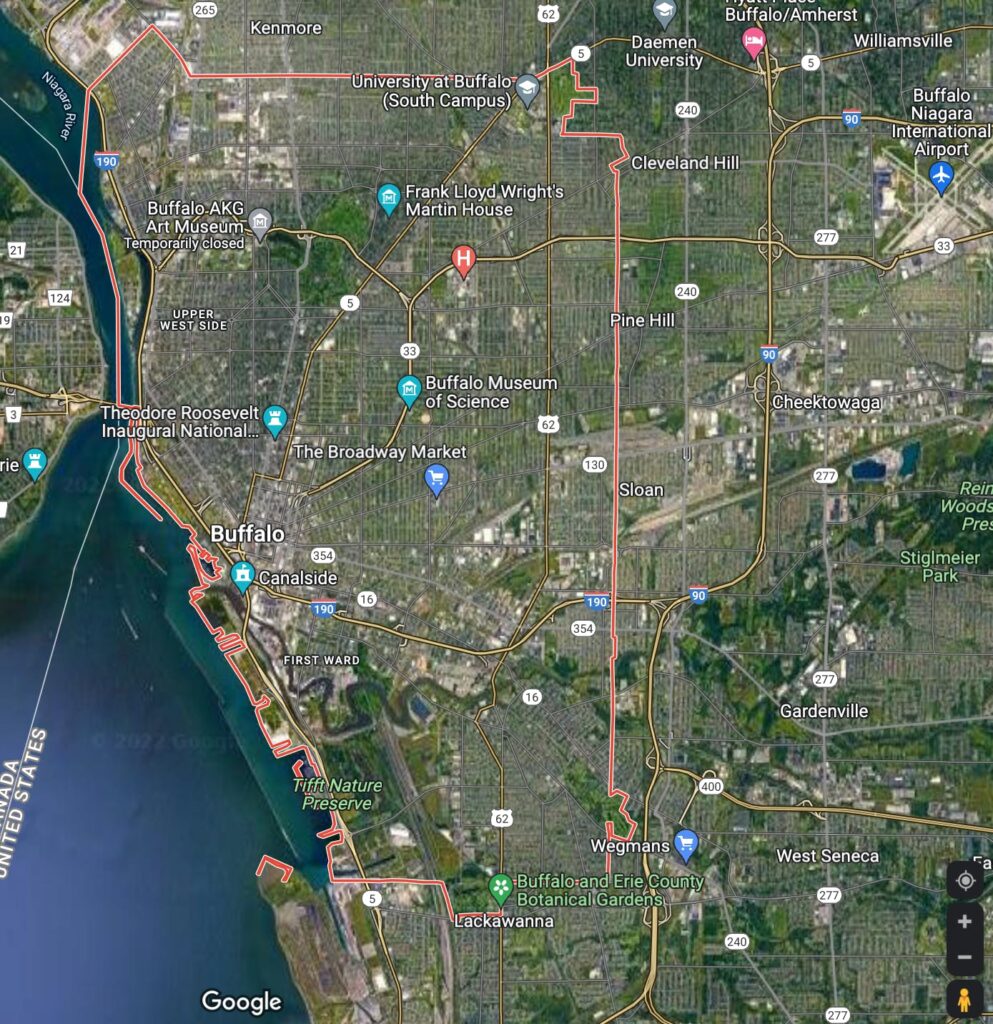

I remember when I first heard about tax liens. I lived in Toronto at the time, and I drove down to an auction in Buffalo.

I got a printout of the properties and the tax owed on each. Many were in a slum area of Buffalo, so I drove around the different neighborhoods to scope ’em out.

I remember being shocked when I saw the condition of these neighborhoods. They looked like places nobody would ever want to move into. Some of the houses had good bones, sure. But it was clear these homes were in really bad shape.

People were living in houses with broken windows and caved-in roofs. But what I remember most clearly was the emptiness. Some properties were totally abandoned and boarded up. On some blocks, 20% of properties were literally just empty lots. The neighborhood felt a bit like walking around a dystopian metaverse.

So, a word to the wise: make sure you know exactly what you are bidding on beforehand.

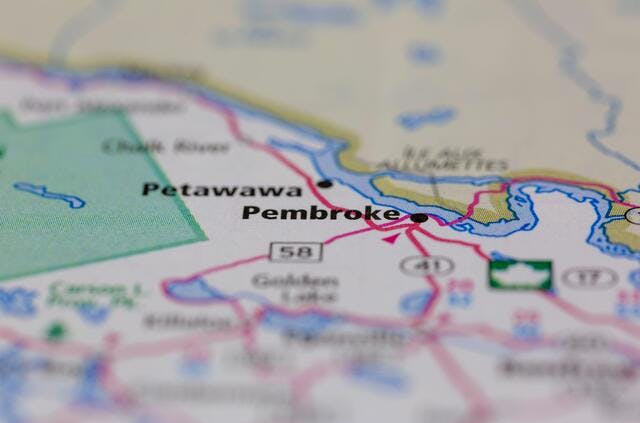

Eventually, we decided that buying a tax property would be easier in Canada, and we didn’t want to get involved with US real estate as a foreigner.

I focused on the benefit of potentially getting an entire property for the cost of unpaid property taxes.

So I looked in a small town outside of Ottawa called Pembroke and found a tax sale there.

I checked out some of the properties and managed to buy the back taxes on one of them for about $9,000. The neighborhood seemed okay, and the potential market value of this house was about $50,000, so I felt pretty good.

But once I took possession of the property, oh man. I realized that the location, which looked okay at first glance, was not desirable at all. The inside of the home needed a lot of work. The tenant had stopped paying rent as well as his taxes, so we had to evict him and take him to court.

Since the property’s tenant was the former owner, we were couldn’t charge a market-rate rent. The judge issued a term where we were being paid just a fraction of the average rent for the area. (This was frustrating knowing what the house could be worth).

It was messy. Eventually, we were able to get the tenant out and began to renovate the property. It took a ton of cleaning, retrofitting, and painting (including a new furnace) to bring the property up to standards.

Less than a year later, we successfully sold the property for about $26,000. So we got a relatively small profit, and lots of useful insight for next time.

At the time, I told myself that was it. No more. If I had been handier at fixing up properties myself, or if I enjoyed the thrill and surprise of dealing with unexpected situations, I might have gone back for another round.

But now that I’m revisiting this venture with the life experience I’ve gained since that time, the whole thing actually seems much better. In retrospect, it may not have been so bad after all.

Are tax liens a good investment?

It really depends on how much risk you can stomach, and how much time you can spend on each deal.

Look, this isn’t a world of yachts and supercars. It’s not even a world of middle-class problems.

It’s often an ugly world, filled with poor neighborhoods, undesirable properties, and a multitude of problems from beginning to end. You’ll deal with legal loopholes, dangerous situations, and folks down on their luck.

Tax liens offer a high rate of return, but it’s not a passive investment. In fact, the rules & regs alone can make it quite an active one.

You will have to deal with a multitude of unexpected situations (think tenants or new procedures), and you’ll have to be comfortable embracing “problematic real estate.”

But the truth is that money is usually made from fixing these troublesome properties.

I love how tax lien investing is not at all correlated with equity markets. I always look to diversify my own portfolio into different types of alternative assets. And tax liens are definitely alternative.

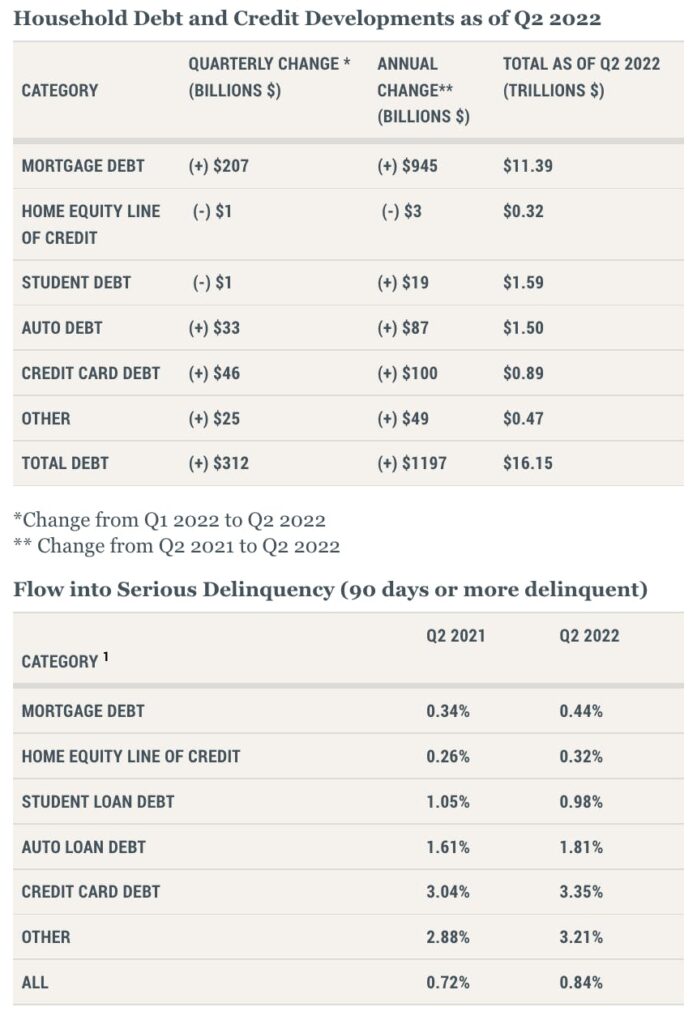

And from a macro perspective, there may not be a better time to get started than now. The real estate market is coming down from its peak, property taxes are still sky-high, and climbing interest rates are making mortgages more expensive.

What does this all mean? Foreclosures & tax liens are likely to start ramping up.

Remember, property taxes are often not bundled with a mortgage payment. This can make them difficult to keep up with and lead to more delinquencies — especially considering the rising debt levels of the average American.

So, what’s happening on the ground right now?

Well interestingly, mortgage delinquencies are still near record lows. But foreclosures are up 15% since July. We will be watching very closely. 👀

The combination of these factors suggests that investing in tax liens could be very worthwhile.

And remember — tax liens are not just for residential property. Property tax also needs to be paid on commercial properties and raw land.

Tax lien funds

Another way to invest in tax lien certificates is through tax lien funds.

Some companies have set up Reg D private placement funds (like ALTS 1) that invest in tax lien certificates.

You pool your money with other investors, while a company or fund manager figures out which tax liens to acquire. This reduces a whole lot of risk while only marginally reducing the reward.

For example, Kite Capital Partners has been investing in tax liens since 2009. Its first tax lien fund was liquidated in 2011 and provided investors with an annualized rate of return of 14.1%.

Closing thoughts

Tax lien investing is a long-term, completely uncorrelated alternative investment. But it’s risker than it sounds. You may have your investment tied up for years, only to find the property is an illiquid money pit.

It also sits, quite frankly, on the darker side of real estate. The world of missed payments and delinquent taxes is not for the faint of heart. Yes, you can get some killer deals on property, but there is a reason these deals are on the table. You need a clear head and the right stomach to get involved.

Now to be fair, it’s not always dark and dismal. You may just be dealing with someone who inherited rural vacant land, doesn’t have the funds to develop it, and doesn’t want to pay the property tax or upkeep. This happens a lot in high-tax places with lots of rural land, like Illinois and Texas. The new owner would rather let it go to waste than keep paying taxes every year.

But for an active investor who likes the thrill of the chase, and the challenge of figuring out a solution to whatever comes up, there may not be a better investment — especially right now.

A final tip: Check out a tax sale auction even if you don’t plan on bidding yourself. If you have time, spend half a day getting a feel for how the auctions work. Watch, wait, listen, and learn.

It’s an experience I’d highly recommend.

{