Our goal here at Alts is to bring you unique investing opportunities. Stuff outside the mainstream. Under-explored assets, companies, and markets.

It’s a big wide world out there. There is so much emphasis on the US (and for good reason — America has the most interesting companies and the most dynamic economy in the world.)

But the fact is opportunities lie all over the place. And some of the most under-discussed opportunities are in investing in other countries.

It’s interesting how few newsletters focus on international investing opportunities. I’m inspired by Stew Glynn and the fine folks at Ten13, who in 25 issues of their excellent Outliers newsletter are spotlighting on startups (especially fintech startups) across Asia, The Middle East, and Africa.

Caleb Maru from Proximity Ventures is another inspiration. His Tech Safari newsletter is the go-to source for all things African tech. A lot happening over there, and Caleb is all over it. 🤘🏽

So this week, we’re kicking off an international investing series, starting with the Philippines 🇵🇭

Why the Philippines?

Ordinarily I wouldn’t start with this country. Nations like India and Brazil have bigger markets, and places like Israel & Romania punch way above their weight.

But as it so happens, I’m in the Philippines this week. I’m here visiting one of our employees in Baguio City, and attending a good friend’s wedding ceremony in Cebu. While here, I got a firsthand look at how the country operates, and had the pleasure of chatting with Vinci Roxas and Russ Malangen, two interesting and well-connected Philippine startup investors.

Let’s go 👇

Table of Contents

Demographics

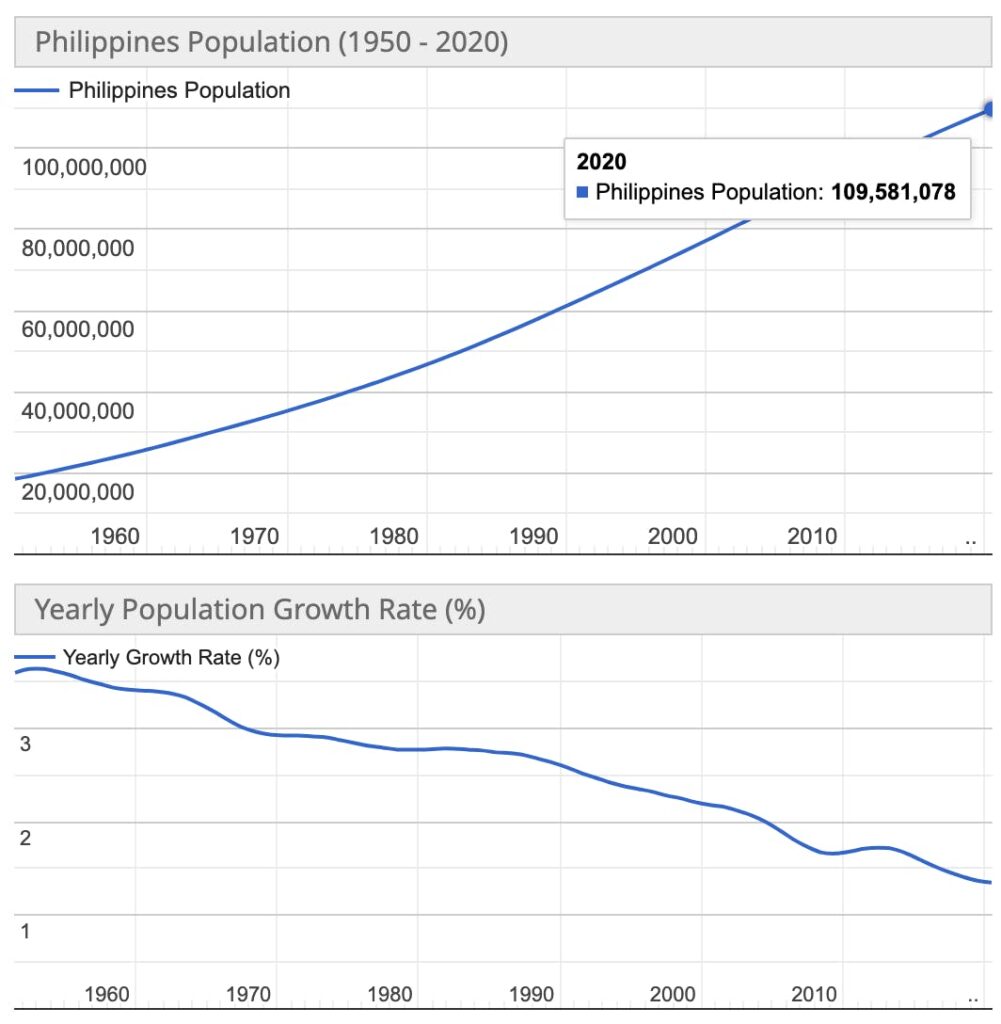

When you think of the world’s most populous countries, it’s easy to forget about the Philippines.

China, India, Brazil, Russia, Nigeria, America, and maybe Indonesia. These are the household names that come to mind.

Meanwhile, the Philippines sits there quietly in the South China sea, sneakily the #13 most populated country in the world. A massive 109 million people spread across a stunning archipelago of 7,600 gorgeous islands.

The Philippines has a young population. The median age is just 25.7 years old (compared to America’s 38), but it’s less urbanized than you’d expect. Manila is massive and densely populated, but only 47% of the country’s population is urban (compared to 80% in the US)

Oh, and some cities aren’t sure exactly how many people live there. But we’ll get to that later.

With a rich history of ties to the US since 1951, English is one of two official languages taught in schools, and it’s the only Christian nation in Asia. This prevalence of English gives the Philippines a huge advantage in international labor markets.

But what’s fascinating to me is that, despite 1.5m new Filipino babies each year, the country has negative outward migration.

This is due to an enormous & important program called the OFW.

Economy

The Philippine economy is disgustingly simple: it’s all based on exporting labor.

The nation is a net exporter of people through the OFW, or Overseas Filipino Worker program. Each day, over 6,000 Filipinos leave home to temporarily work in countries like Saudi Arabia, UAE, Singapore, and Qatar (← no surprises there).

You cannot understand the Philippines without understanding OFWs. There are currently 1.8 million OFWs overseas, working hard to pay for their children’s education, buy a home, start a business, and to save for retirement.

These workers send home an astonishing $43 billion dollars per year back to their families, and these remittance payments power the entire service economy.