Welcome to our Crypto Insider for January 28th, 2022 – FREE edition. By popular demand, we’re bringing you the smartest insight, analysis, and investing tips for all things Crypto.

Everyone knows about and talks about Bitcoin and Ethereum, but what about the rest of your crypto portfolio? Unless you’re neck-deep in the space, it’s hard to know what to invest in.

That’s why our focus is specifically on coins and projects you may not have heard of. Where to find moon shots before they take off.

Table of Contents

Podcast

This week, Horacio sat down with Desiree Dickerson, Co-founder and CEO of THNDR GAMES.

THNDR GAMES is a free mobile gaming app where you earn satoshis, the smallest possible denomination of bitcoin, for playing games. Desiree is on a mission to bring BTC to the mainstream and is a leading voice in the future of BTC adoption. Not to be missed.

This is our third issue, and today we’re giving you an overview of Fantom $FTM, one of the fastest-growing cryptocurrencies in 2021.

Before we begin, several readers asked for more info about how to invest in Popsicle Finance last week. Thanks for all the feedback, and here’s the best video I could find on the topic. It’s a pretty solid primer, and I hope it’s useful.

Introduction

$FTM Fantom was one of the fastest-growing cryptocurrencies in 2021.

Fantom, like Ethereum, is a Layer 1 (L1) chain, allowing decentralized apps (dApps) to be built on the network.

Throughout 2021, Fantom’s ecosystem has helped it become a top L1 chain, as it offers a fast, reliable, and cheap (in terms of transaction fees) alternative to Ethereum.

Fantom $FTM at a glance:

Fantom CoinMarketCap

$FTM (at time of writing): $2.06

- Market Cap (at time of writing): $5,235,192,629

- Twitter: https://twitter.com/FantomFDN

- Community: https://fantom.foundation/fantom-community/

- Discord: https://discord.com/invite/3FZdd3YEG6

Why It Could Moon

We wrote about $MATIC Polygon, a Layer 2 chain, and why we’re bullish on it in our last issue. It’s not overly important that one is L1 and another is L2 – they more or less still compete in the same manner regardless.

$FTM has the potential to moon because it could provide a great alternative to Ethereum, the largest L1 chain in cryptocurrency. As we talked about last week, transactions on Ethereum are extremely expensive, with gas fees anywhere from $80-$150, and a single transaction can require paying gas multiple times.

It’s fairly common for transactions to cost $300+ and I’ve personally paid $350 in gas for a failed transaction. Talk about frustrating.

The good news? Transactions on Fantom cost just a fraction of what they do on Ethereum, and they’re notably faster.

That’s probably why several dApps have started to use it, though it’s notably lacking in the NFT space.

But the main opportunity lies in liquidity pools, with some APRs topping 100%.

We won’t be diving too deep into DeFi at this point, as it’s a little beyond the scope of the article (but something we’re working on covering in future issues).

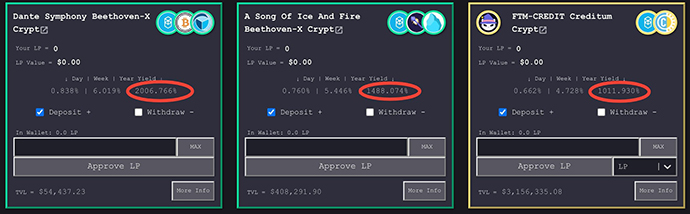

However, to give you a sense of how lucrative it can be here’s a quick screenshot of a few liquidity pool opportunities on Reaper, a popular dApp on Fantom:

Yes, you’re looking at this correctly – these three options are all above 1,000% APY (annual percentage yield). Of course, there are risks to using liquidity pools and any dApp, but you can certainly see there is some reward.

Here’s a video explaining how it works.

And here are some great Twitter accounts that tweet about a lot of DeFi on Fantom:

- https://twitter.com/Route2FI

- https://twitter.com/milesdeutscher (who has just posted a fantastic thread on the unfolding Wonderland scandal)

Quick note: These accounts are not exactly beginner-friendly… But if you’re already trading crypto, these are good sources of info to stay up to date.

The deep-dive

Price

$FTM Fantom started 2021 at less than $.0165 and peaked as high as $3.30, a 200x increase (though short-lived). While it failed to maintain that price, it still ended 2021 at a ~140x at $2.36.

Despite extreme volatility in the finance world the past week, $FTM is ~4% higher at the time of writing than at the end of 2021. It’s still roughly 30% from its all-time high (ATH) and has tested $3.00 several times. One reason it’s holding so strong is that it’s the 3rd largest defi protocol by value locked, which just happened during the past week.

Fantom Project Roadmap

Fantom is a fairly mature project at this point. Because of this, we’re not worried that Fantom hasn’t publicly released a roadmap for 2022. Instead, Fantom seems to be spending more time and resources integrating with other projects and supporting other teams to build dApps on the ecosystem.

While I’m admittedly not an expert on blockchain technology, I can say that using the Fantom network is smooth and cheap. I’ve never had issues with it personally (unlike Ethereum, Harmony, and Cordano), so focusing on increased adoption makes sense.

Community

Fantom has a fairly active community on various channels. Its discord alone has almost 45,000 community members. However, similarly to Polygon, Fantom’s community engagement on discord isn’t too important. The developer community is a better indicator of the growth of the Fantom ecosystem.

Unfortunately, it’s hard to get a true sense of how active the development community really is, but looking at the sheer number of released dApps (100+ already), it’s safe to say it’s pretty solid.

Strengths:

- Undervalued based on total value locked vs. market cap

- Fast-growing DeFi network

- Extremely fast, reliable, and cheap chain

- Has a strong team that has proven ability to deliver

- Limited supply at 3.175 billion FTM (no inflation)

- Community-governance with on-chain voting, which is favored by the cryptocurrency community

Weaknesses:

- Plenty of competition, including Ethereum and Polygon amongst others

- Government crackdown on DeFi could negatively impact $ FTM’s adoption

Competition Analysis

Any L1 and L2 solutions are considered to be Fantom’s competition. That includes the most established network, Ethereum, and other quickly growing networks such as $SOL, $MATIC, and $AVAX.

Like we did with $MATIC Polygon, we’ll compare $FTM, which currently has a market cap of $5,235,192,629, to $ETH, which currently has a market cap of $285,371,971,336. With these numbers, $ FTM’s market cap is just barely over 2% of $ ETH’s.

Suppose $FTM can get to just 10% of Ethereum’s current market cap (though, the market cap of $ETH is expected to continue to grow). That would represent almost a 5x increase for $FTM to get past $16.00.

Want to invest?

Disclosure: This is not financial advice. This article is for entertainment purposes ONLY. I am a holder of $FTM.

And just a reminder – we don’t go through crypto safety best practices in this section. It is your responsibility to keep your information safe and secure.

How to Purchase $MATIC:

There are multiple ways to do this – we’ll go over the route that we imagine most beginners would go through.

- Sign up with https://binance.us/ (binance.com works if you’re not a US citizen)

- Get approved through the KYC process (I didn’t, and I had $1,000 stuck in there for 2+ months… ouchie)

- Deposit fiat through bank account

- Purchase $FTM