Welcome to Inverse Cramer by Alts.co: Tracking Jim Cramer’s stock picks so you can do the opposite.

New here?

- See fund performance and holdings (SJIM and LJIM)

- Read past issues

- Sign up for the Inverse Cramer newsletter

And a big Booyah to the 419 new subscribers who’ve joined since last week

It was an awkward week in Cramerica. After last week’s heatfelt apology for his repeatedly bullish Silicon Valley Bank calls, Cramer was a no-show for 2 days, and his voice sounded horrific. For real, it was like listening to the Babadook.

Which is too bad, because JC’s got a lot to say as the Fed charts a course between controlling inflation and managing bank failures. He seems torn on the Fed’s actions. But he gives them credit for consistency, which is more than we can say about his Nvidia calls. More on that later.

Table of Contents

Monday Mar 20

Vacation

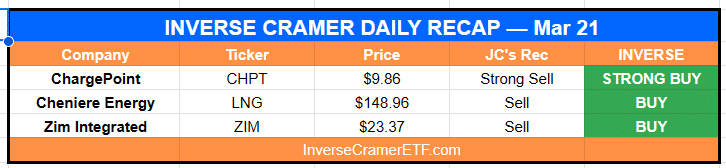

Tuesday Mar 21

Jim decried both the “overwhelming negativity” in the media, and the “herd mentality” of the market, encouraging everyone to be bullish and take the long view.

She said deposits will be protected if that’s what they have to do, meaning we have to be more positive.

– On Janet Yellen

Maybe yesterday’s decline was insane. We honestly have no idea. But people sure don’t act that way. They act so sure in the moment. Just because it’s unknown short-term, doesn’t mean it’s unknown long-term!

-On First Republic Bank (whose long-term future is absolutely unknown)

But most surprising was his sudden bullishness on Nvidia.

Yes, the stock of Nvidia has had quite a move already. But Nvidia is now making cards that will create the unimaginable for all.. It is that powerful a story and its lead is stunning

— Jim Cramer (@jimcramer) March 22, 2023

He continued:

We saw great news from Nvidia. People are much more excited about Nvidia because they should be. Generative AI has suddenly become mainstream, it’s the iPhone moment and they have the technology to power this stuff!”

Jim’s been all over the place with his stock, making directionally wrong calls at both the highs and lows.

Back in September 2022, he called it a loser at $130. It’s up 125% since then.

Nvidia up +125% since Jim gave up on it at $130 in September, “it’s a loser”

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) March 22, 2023

Now at $270+ he’s bullish, come on!😂 pic.twitter.com/HfzEFSgtrI

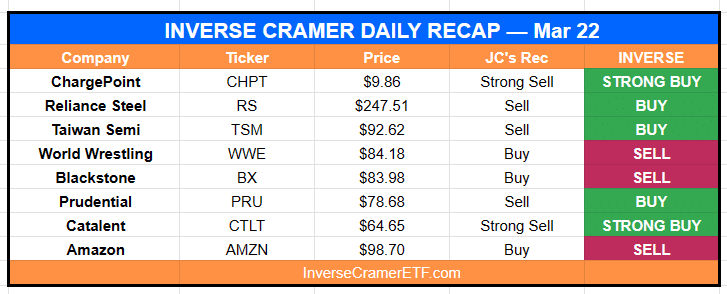

Wednesday Mar 22

Wednesday’s show was painful to listen to. His voice was so bad, the worst I’ve ever heard it.

It actually made me kind of sad. Just watch:

Tip: Go home, have some more of your lemon tea, and spend an entire month not talking.

Thursday Mar 23

Much needed day off. We’ll give him this one.

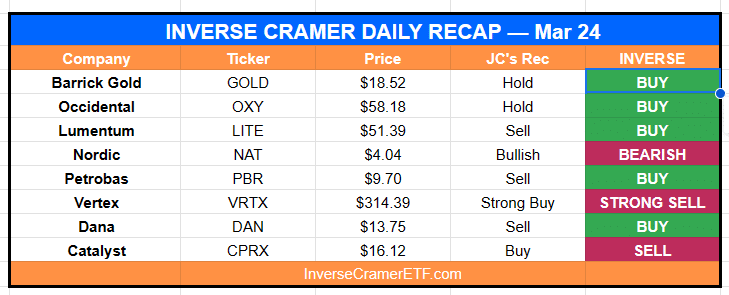

Friday Mar 24

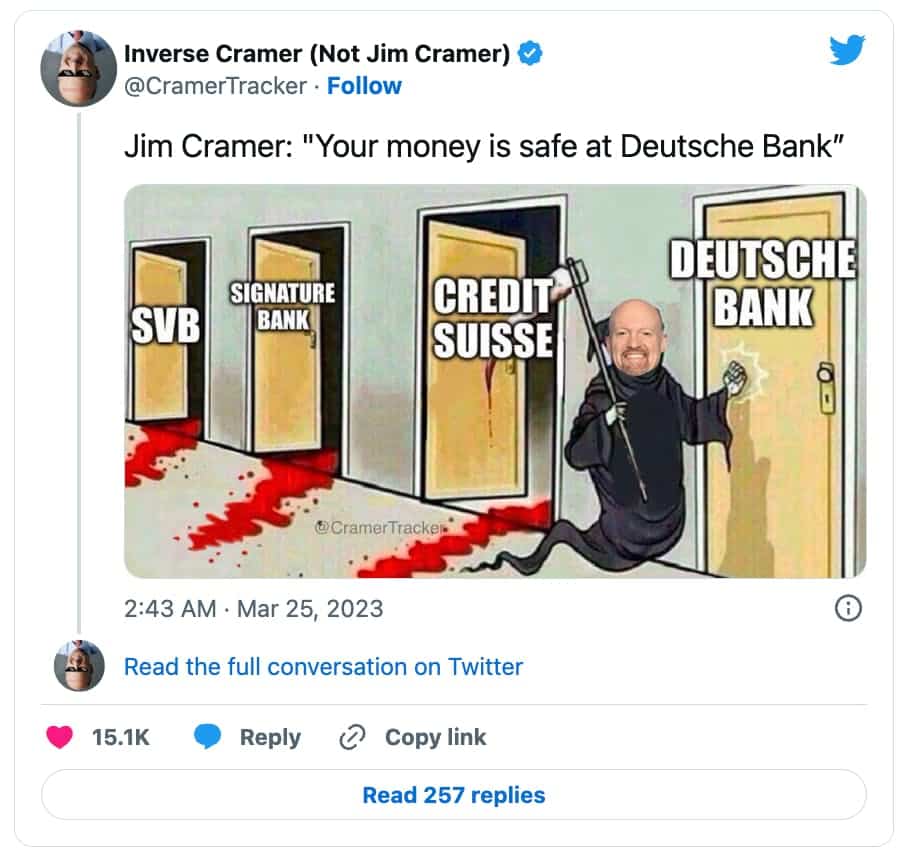

US markets opened down huge thanks to news of Deutsche Bank, but bounced back in the afternoon as investors realized they don’t live in Germany.

It has been one of the worst investments of the year. It could easily go down a lot more from it’s current price of $12, it’s already fallen from $166 a few months ago. If people continue to lose confidence, it could end up like SVB which went to zero.

– On First Republic Bank

I have to do as best I can. Right now, one of the better things I’ve done is to own very few banks. But one of the worst things I’ve done is to own any banks at all.

I have no doubt that unless the CCP throws in the towel, we’re not gonna be looking at a lot of TikTok, we’ll be looking at Reels. Zuckerberg is spending a lot of time on Reels, and it’s only a matter of time before Reels is better than TikTok anyways. Yes there are 150 million people on TikTok, but how many of them vote? They’re like 12!

– On TikTok, which actually has over 1 billion users worldwide

Weekend Bonus

Cramer Classics

The Cramer Curse continues

Cramer Curse pic.twitter.com/9N4n4UZxOY

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) March 21, 2023

That’s a wrap. As always, we’ll be following Cramer’s every move so you can do the opposite.

Enjoy the week ahead.

-IC

Disclosures

- This issue was sponsored by our friends at Mortar Group

- We have no ALTS 1 or personal investments in any companies mentioned in this issue.