Welcome to the Sports Memorabilia Insider – FREE VERSION. Today we are looking into two assets that are IPOing this week:

- Kobe Bryant Debut White #24 Jersey on Tuesday, August 24th at 8:24 PM ET at Collectable

- 1960 Mickey Mantle Game-Worn Jersey on Friday, August 27th at 12:00 PM ET at Rally Road

Table of Contents

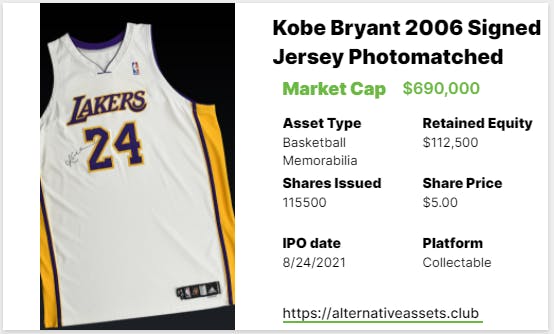

Kobe Bryant 2006 Signed Jersey Photomatched

About the Asset

This is a signed, game-worn Kobe Bryant jersey from the 2006-07 season, most notable for being the first after he switched from #8 to #24 (Kobe is the only player to have 2 different jersey numbers retired by a franchise). The jersey has been photomatched to 8 games, and is the only signed, game-worn photo-matched white jersey from that season known to exist.

If you were signed up to Insider (start a free trial), you’d also learn:

- Projected future growth

- Asset class ROI, volatility and risk statistics

- Detailed valuation with recent sales

- Our verdict

About the Drop

This asset will drop on Collectable at 8:24 PM ET on August 24th, 2021 (get it, Kobe Bryant time on Kobe Bryant day?) for $690,000. There is $112,500 in retained equity, leaving $577,500 available. Collectable has been scheduling their IPOs for trading around 3 months after they fund, though recently some assets have been pushed back further than that.

Add IPO to calendar

About Kobe Bryant

I just wrote about a pair of Kobe’s sneakers that IPO’d last week and we’ve obviously written a lot about him here. His 2006 season was not a championship season (they lost in the 1st round of the playoffs) but Kobe had an excellent individual year, winning the scoring title and being named to the All-NBA 1st team and All-Defensive 1st team.

Category Strength

Sports Memorabilia posted a -15% ROI in Q2 2021.

Subcategory Strength

Recent Sales and Current Valuation

[Detailed Valuation for Insiders Only]

Growth Potential and Future Catalysts

This is what I wrote when the Kobe sneakers dropped last week: “In my last Kobe write-up I mentioned the Lakers playoff performance could spur his items – but unfortunately, they did not make a deep run. There will be hype for “Kobe Day” on 8/24, but that won’t stretch far enough to affect the secondary market for this asset. I don’t see any reason these particular sneakers or Kobe items will pop separate from the overall memorabilia market.” I’m barely seeing anything on Twitter about “Kobe Day” as of now.

Verdict

This is a fairly unique 1/1 item and we’ve seen some ridiculous prices for those because it only takes one interested buyer.

[Full Evaluation for Insiders Only]

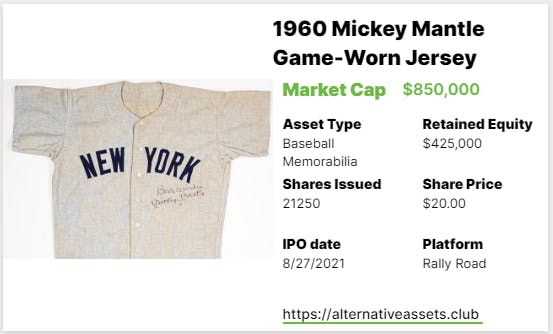

1960 Mickey Mantle Game-Worn Jersey

About the Asset

This is a signed (and inscribed) game-worn 1960 Mickey Mantle road jersey that has been graded A10 by Mears. It was originally purchased by Rally earlier this year for a total of $800,000 – $385,000 in cash and $425,000 in retained equity.

If you were signed up to Insider (start a free trial), you’d also learn:

- Projected future growth

- Asset class ROI, volatility and risk statistics

- Detailed valuation with recent sales

- Our verdict

About the Drop

This asset will drop on Rally Road at 12 PM ET on August 27th, 2021 for $850,000. The seller is retaining $425,000 in equity, leaving $425,000 available. Rally Road typically schedules the first trading window between 3-5 months after the IPO funds and the assets are supposed to then trade quarterly, but the schedule has been erratic.

Add IPO to calendar

About Mickey Mantle

There have been a lot of Mantle offerings, with Wyatt most recently writing about one here – and most extensively here. The 1960 season for Mantle was squarely in his peak — he hit 40 home runs, finished 2nd in the MVP voting (to teammate Roger Maris) and led the Yankees to the World Series, where they lost in 7 games to the Pittsburgh Pirates.

Category Strength

Sports Memorabilia posted a -15% ROI in Q2 2021.

Subcategory Strength

Recent Sales and Current Valuation

[Detailed Valuation for Insiders Only]

Verdict

Before investing, consider the combination of 50% retained equity (so you have no power in any potential buyout offer) and the lack of liquidity currently available at Rally – big factors in whether or not it’s worth it.