Welcome to the Sports Memorabilia Insider – FREE VERSION.

Today we have are looking into two assets that are IPOing at Collectable this week:

- 2003 Kobe Bryant Signed Game Worn Sneakers on Friday, August 20th at 2:30 PM ET

- (2) Tiger Woods Signed Tournament Worn Shirts on Sunday, August 22nd at 8:00 PM ET

Table of Contents

2003 Kobe Bryant Signed Game Worn Air Jordan

About the Asset

This is a pair of game worn and signed Kobe Bryant sneakers from the 2003-04 season, specifically photomatched to a December 28th, 2003 game. They are “French Blue” Air Jordan 12s, and it was rare for Kobe to wear Air Jordans in a game.

If you were signed up to Insider (start a free trial), you’d also learn:

- Projected future growth

- Asset class ROI, volatility and risk statistics

- Detailed valuation with recent sales

- Our verdict

About the Drop

This asset will drop on Collectable at 2:30 PM ET on August 20th, 2021 for $89,000. There is no retained equity. Collectable has been scheduling their IPOs for trading around 3 months after they fund, though recently some assets have been pushed back further than that.

Add IPO to calendar

About Kobe Bryant

There have been a lot of Kobe items on fractional sites, and we’ve written about him many times. Most recently, I wrote about a different pair of sneakers that Collectable IPO’d here.

Category Strength

Sports Memorabilia posted a -15% ROI in Q2 2021.

Subcategory Strength

Recent Sales and Current Valuation

[Detailed Valuation for Insiders Only]

Growth Potential and Future Catalysts

In my last Kobe write-up I mentioned the Lakers playoff performance could spur his items – but unfortunately, they did not make a deep run. There will be hype for “Kobe Day” on 8/24, but that won’t stretch far enough to affect the secondary market for this asset. I don’t see any reason these particular sneakers or Kobe items will pop separate from the overall memorabilia market.

Verdict

[Full Evaluation for Insiders Only]

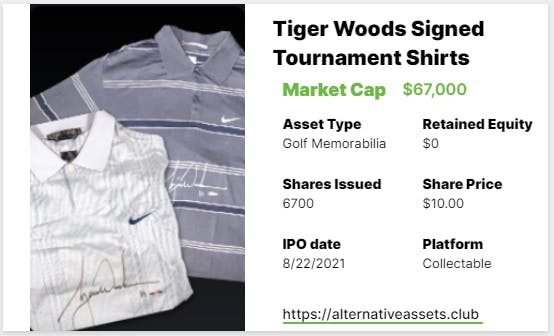

Tiger Woods Signed Tournament Shirts

About the Asset

These are two separate Tiger Woods tournament-worn and signed shirts, both from 2004. One is from the Wachovia Championship, in which he finished tied for 3rd, and one is from the British Open (one of golf’s 4 majors), in which he finished tied for 9th. Both shirts have been photomatched and authenticated.

If you were signed up to Insider (start a free trial), you’d also learn:

- Projected future growth

- Asset class ROI, volatility and risk statistics

- Detailed valuation with recent sales

- Our verdict

About the Drop

This asset will drop on Collectable at 8 PM ET on August 22nd, 2021 for $67,000. There is no retained equity. Collectable has been scheduling their IPOs for trading around 3 months after they fund, though recently some assets have been pushed back further than that.

Add IPO to calendar

About Tiger Woods

Wyatt wrote about Tiger Woods at length here. But you know who he is – one of the greatest golfers ever and a global superstar at his peak. Though most of his newsworthy stories (with the exception of the 2019 Masters) in the past decade-plus have not been too flattering.

Category Strength

Sports Memorabilia posted a -15% ROI in Q2 2021.

Subcategory Strength

Recent Sales and Current Valuation

[Detailed Valuation for Insiders Only]

Growth Potential and Future Catalysts

If Tiger ever makes a miraculous comeback, it would certainly drive interest in his memorabilia, but in the short-medium term, his market is cold.