Welcome to Sports Cards Insider – FREE Version.

We use Moneyball tactics to discover undervalued, mispriced, and hidden gems in Fractional Investing.

Today is a deep dive into two LeBron James limited run Autograph cards:

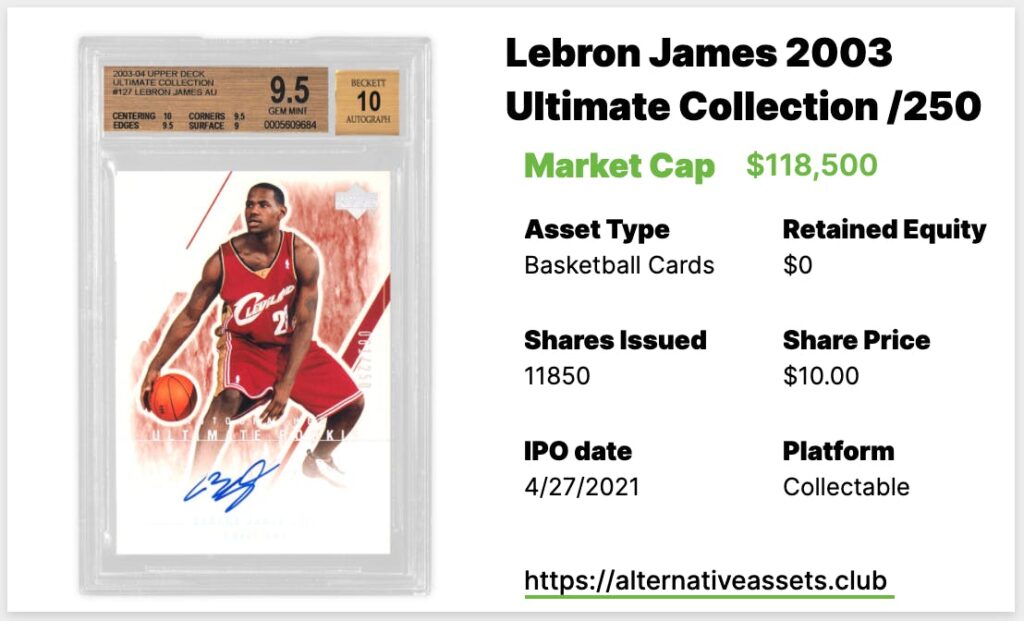

- Lebron James 2003 Ultimate Collection /250 BGS 9.5 – IPOs 27th April at 8pm EST on Collectable

- LeBron James 2003 SP Authentic Signatures #LJA BGS 10 – IPOs 28th April at noon EST on Otis

Table of Contents

What is the Lebron James 2003 Ultimate Collection /250 BGS 9.5?

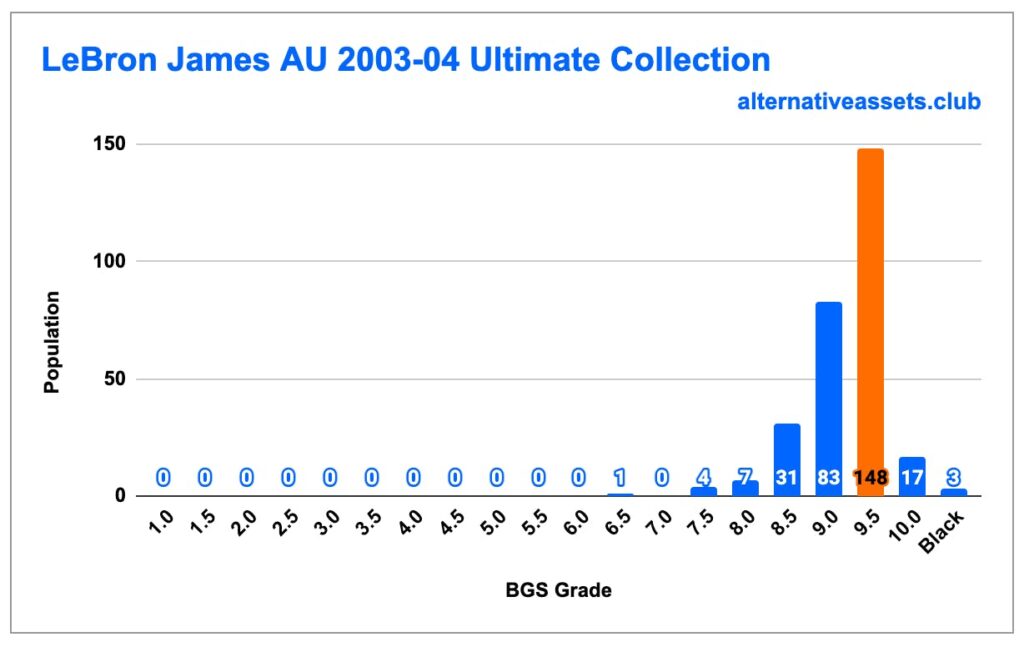

This is a limited run /250 autograph card from LeBron James’s rookie year. Graded BGS 9.5, it’s the most common grade.

There are three Black 10 cards, which is more than usual, and the 17 BGS 10s is a bit higher than you’d expect as well.

Its subgrades are 10,9.5, 9.5, and 9.0, so right in the middle of BGS 9.5.

The card IPOs with Collectable at 8pm EST 27th April 2021 for $181k with $82,500 retained equity (45.6%)

Add IPO to calendar

Cultural Relevance

We’ve discussed LeBron a lot. He’s the best player of his generation and the second best player of all time.

Inferred Value – $200k+

[Detailed Valuation for Insiders Only]

Category Strength

The sports cards category returned a 60% ROI in Q1 2021.

Subcategory Strength

Risk Profile

Recent Growth Trend

Growth Outlook and Future Catalysts

LeBron cards have plateaued, but you’ve got to think his value has staying power.

Asset Liquidity

This will have a roughly 90 day lockup period then will trade daily.

Platform Risk – Collectable

Intangibles

Retained equity is nearly 50% here, so you won’t have any say over a buyout should it come.

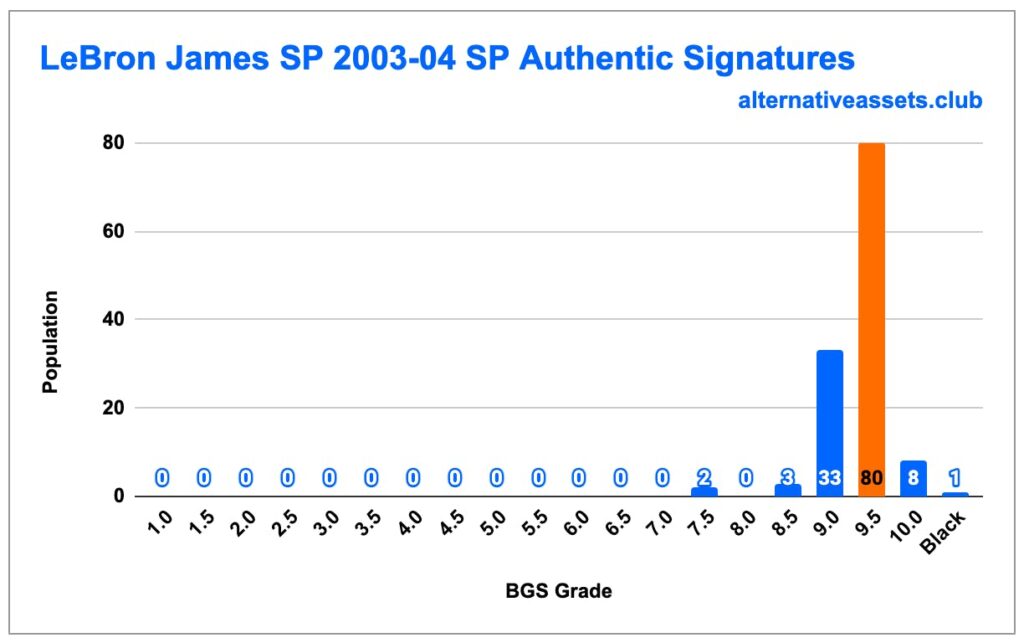

What is the LeBron James 2003 SP Authentic Signatures #LJA BGS 10?

This is a limited run autograph card from LeBron James’s rookie year. Graded BGS 10, it’s only one subgrade (corners at 9.5) away from Black status.

The card IPOs with Otis at noon EST 28th April 2021 for $63,200 with no retained equity.

Add IPO to calendar

Cultural Relevance

We’ve discussed LeBron a lot. He’s the best player of his generation and the second best player of all time.

Inferred Value – $100k to $200k

[Detailed Valuation for Insiders Only]

Category Strength

The sports cards category returned a 60% ROI in Q1 2021.

Subcategory Strength

Risk Profile

Recent Growth Trend

Growth Outlook and Future Catalysts

LeBron cards have plateaued, but you’ve got to think his value has staying power.

Asset Liquidity

This will have a roughly 30 day lockup period then will trade daily.

Platform Risk – Collectable

Intangibles

This one won’t have any direct comps, so I wouldn’t expect it to trade to more than 50% its inferred value on Otis.

Due Diligence Service

If you’re looking to make a big asset investment, we can help you perform due diligence. Stefan created and run Flippa’s Due Diligence program, and can offer the same service to you.

Enquire about Due Diligence Packages