Today we’re looking at luxury watches, with a special issue guest-written by Alts community member Marc Montagne, a long-time collector and author of The Art of Watch Collecting.

In today’s issue, we talk about what’s been happening lately in the luxury watch market, and the different ways professionals invest — with a particular focus on auctions.

By the end you should have a good understanding of what to look for when investing in watches, what tools to use, pitfalls to avoid, and how to bid confidently.

Let’s go 👇

Table of Contents

What’s been happening in the watch market?

Over the past two years, industry developments have felt like a roller coaster.

The high end is still flying high…

This gorgeous Patek Philippe Nautilus Tiffany Blue dial (The ‘Holy Grail’ of sports watches) just sold at auction for $6.5m — more than 120x its retail price.

Since the auction, all of the remaining 169 models are either sold out or already allocated to top VIP Tiffany customers.

This is a hugely bullish sign for the ultra-high-end of the market.

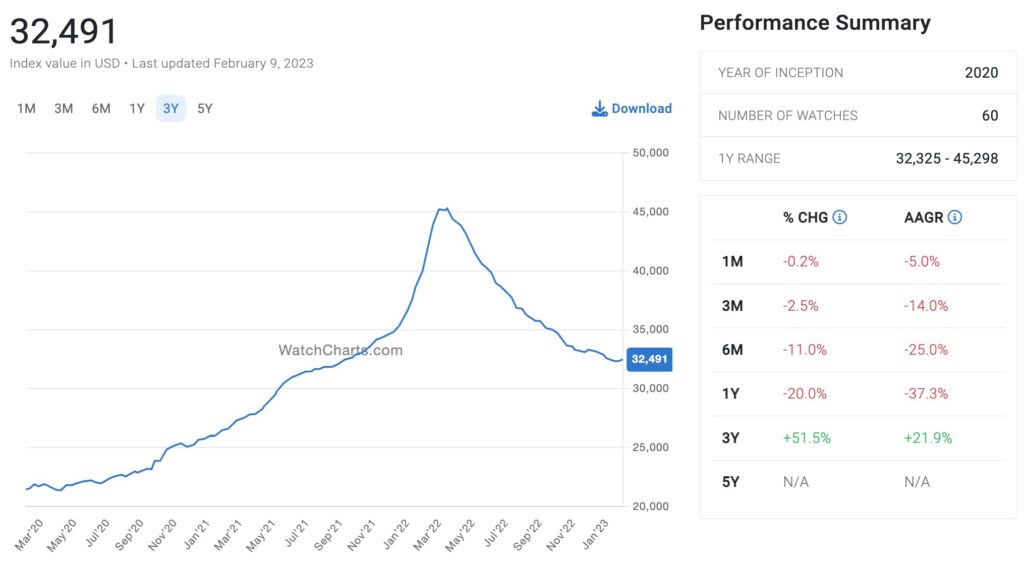

…but the secondary market is hurting

On the other hand, stainless steel Rolex Daytona prices have gone down from about $50,000 to $30,000 over the past 12 months. In fact, most sought-after watches have seen their secondhand price drop by about 30%.

Yes, that’s a big drop. But it’s not as bad as it sounds. It comes on the heels of years of gains. So despite the decline, secondary market pieces are still worth 2x their retail price. And word on the street is that waitlists at authorized dealers aren’t getting any shorter.

To be perfectly clear, luxury watches are still in a bear market. But if you squint at the graph above, in the right light, you just might see a bottom forming.

At least, that’s the opinion of Dovi Spigelman, one of Melbourne’s premier luxury watch dealers:

Look, the watch market is still going down. I don’t think we’ve hit a clear bottom yet. I think we’ll see a bottom this year, but not in the next few months. If you want to invest, I’d recommend waiting at least six months or so.

– Dovi Spigelman, luxury watch dealer Feb 11, 2023

Mergers, acquisitions, and investments

M&A activity has been heating up lately.

- Bernard Arnault, the founder and CEO of luxury juggernaut LVMH, and oh yeah, the richest person in the world (sorry Elon) recently made an investment in Chrono24, the world’s largest watch marketplace.

- Swiss manufacturer De Bethune, which was acquired by Chrono24 competitor WatchBox last year, has itself acquired a majority stake in REUGE, an historic Swiss producer of mechanical music boxes. (We’ll cover this asset class at some point — these things are true works of art)

Pushing the craft forward

And finally, Omega’s Speedmaster Super Racing has set a new standard for accuracy.

Omega shows its relentless dedication to movement innovation, with an unparalleled Certified Precision Rating of +2 seconds per day.

What are the main ways investors buy watches?

Whether you have set your eyes on modern or vintage timepieces, there are multiple ways to get ’em.

Watch dealers

There are two types of watch dealers: ADs and independent merchants.

Authorized dealers

The first are called Authorized Dealers, or ADs. These guys have a business relationship with watch manufacturers to distribute their watches, and their watches only. Some are dedicated to a single brand, others are multi-brand.

This is the equivalent of “buying retail.” ADs get the new stock when it comes in, and technically speaking, it’s available to purchase. But as we mentioned last time, ADs don’t sell watches to any geek off the street. They hang on to their stock tightly, and only release it to special VIP clients who have shown loyalty over the years.

You need to build relationships, over years, before they take you seriously enough to offer you new stock.

In recent years, watch brands have been favoring monobrand distribution to tighten the grip on the end-user experience, get closer to their customers, and yes, increase their margins.

Independent merchants

The second kind of watch dealers are independent merchants that have specialized in buying and selling watches, almost always pre-owned.

Dovi Spigelman is a perfect example. He deals in all sorts of pre-loved watches.

You can’t just walk into a retail shop and buy new, so you come to dealers like me. I’m biased of course, but I think developing a relationship with a respected dealer is the best way to buy a watch. Why? Because it doesn’t take years, just a few months. You know what you’re getting, you know you won’t get ripped off, and you know they have your back.

-Dovi Spigelman

Dovi’s point about not getting ripped off is a salient one. It’s the biggest concern for collectors, and part of what scares newbies away from the market.

At the same time, since buying retail is impossible for nearly everyone, the preowned market is on track to finally surpass the primary market. To counteract the fraud, more and more ADs are offering Certified Pre-Owned watches, or CPO.

Even brands themselves are starting to create CPO programs:

- Rolex made headlines when they announced their CPO program last month.

- FP Journe has their Patrimoine program where they even list the specific watches they are looking for.

- MB&F just rolled out a similar program to FP Journe.

What are the big watch platforms and marketplaces?

You’d think the watchmaking industry would be savvy in adopting new technologies, but you’d be wrong.

Unlike other “old-school” alternatives (artwork, wine) watch industry leaders seem oddly hesitant to change. As late as the mid-2000s, trading mostly took place on eBay and online forums. And as a perfect example, some of the biggest watch brands in the world (including Rolex) still don’t have an ecommerce website!

It took a while, but the industry has mostly caught up:

Marketplaces (3P)

Third-party marketplaces connect buyers and sellers, while offering protection services (escrow, financing etc.)

The original big player is eBay, which introduced its Watch Authenticity Guarantee program where watch experts are inspecting and vetting select pieces (look for the blue checkmark).

The biggest player is Chrono24 where as mentioned above LVMH is a new investor. Chrono24 charges a 6.5% fee to the seller (which is in the higher range for sure) but nothing to the buyer.

Platforms (1P)

On the other side are platforms that buy their own inventory.

The big players are:

- Watchfinder was founded in 2002 and is the original. It’s going strong with 3,500 watches for sale

- Chronext was founded in 2013 but its inventory is twice as large (7k+ watches)

- Watchbox is the latest big entrant. They launched in 2017 and already have 2,600 watches

But as any ecommerce retailer can tell you, sitting on huge piles of inventory comes with big cashflow and depreciation risk. Last July, Chronext announced they were laying off a third of the company as the secondary market was changing.

As the market matures, the two models are blending into each other. 3P marketplaces are starting to buy a bit of stock of their own, and Watchfinder announced its building its own 3P market.

Private sales

Social media killed the old-school forums and created new ways for collectors to trade.

Watches are small, lightweight, and easy to ship around the world. So collectors trade within global circles where confidentiality and trust are preserved.

The most popular private trading avenues are Facebook Groups and Reddit’s r/WatchExchange.

Auctions

Of all the ways to acquire watches, my personal favorite is still auctions. Why? Great deals, live action, and a taste of adventure.

Auctions have always been a place where luxury watches are bought and sold. The big auction houses all have dedicated watch departments.

All sorts of watches can be bought at auctions, and this is where most of the major record sales happen. Paul Newman’s record-breaking Daytona was auctioned by Phillips for $17.8 million, placing it third on the list of most expensive watches ever sold at auction.

But let’s not get distracted by those millions. Affordable luxury watches are offered each day at auctions, sometimes even below their market price

How watch auctions work

The market

Since the pandemic, the watch auction market has been booming. In 2021 auction houses nearly doubled their YoY sales.

It’s interesting to note however that compared to other departments, watches only represent a small portion of the auction world. In 2022, Christie’s did $8.41b in total sales, and yet just 2.4% of that was from watches.

This gives perspective on how much room for growth there still is.

Auction houses to know about

All auctioneers worth their salt sell watches, whether a piece here and there, or through dedicated watch departments. This is certainly the case for the big players:

Some auction houses are even dedicated to watches. This is the case of Auktionen Dr. Crott or Antiquorum. (It was actually Osvaldo Patrizzi from Antiquorum who created the first watch auction house back in 1974.)

Today, all of these auction houses now offer online bidding, and we have seen the emergence of online pure players like Catawiki with weekly online auctions, or specialized ones such as Loupethis, founded by famous watch dealer Eric Ku.

Historical data

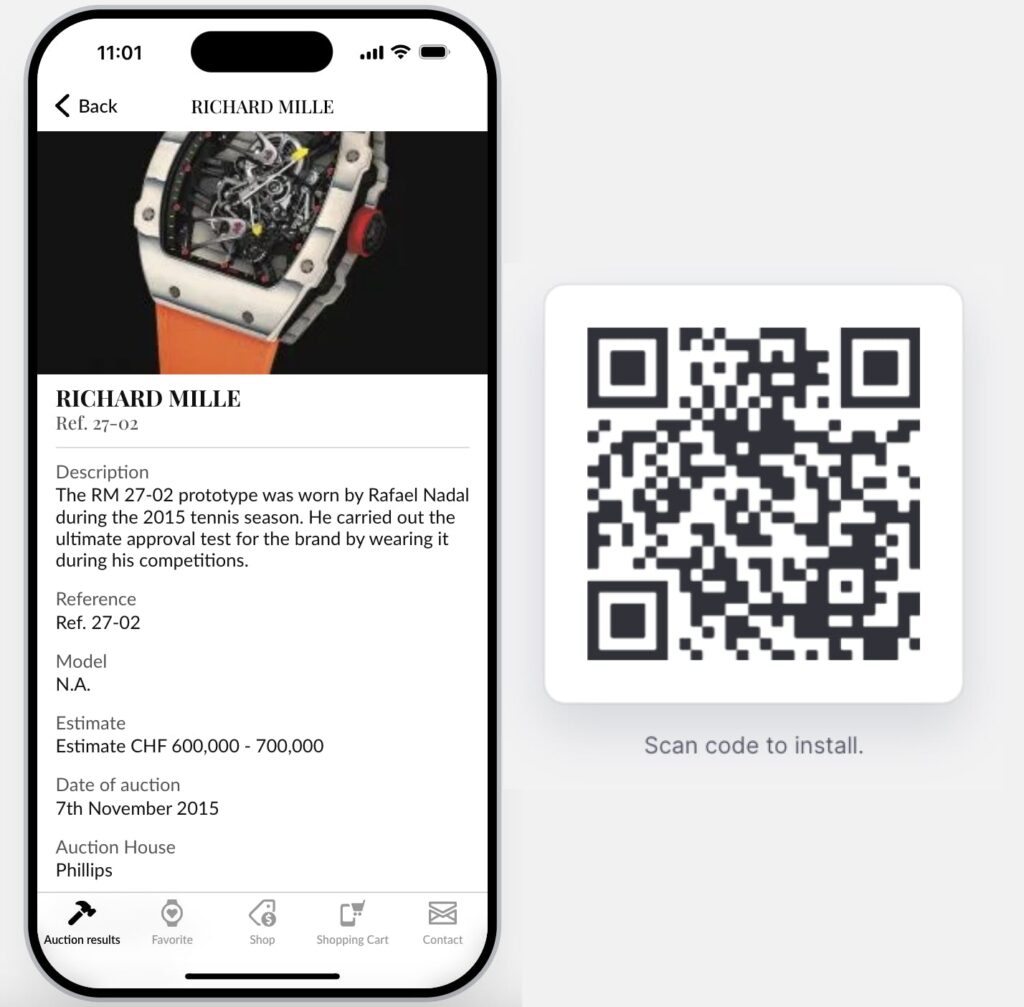

Buying at auctions is exciting and rewarding. But you need to know what you’re getting into.

The worst thing you can do is arrive at an auction unprepared, let your adrenaline flow, and get carried away in the moment. This is how you end up overpaying.

The first step is knowing precisely what to pay for each piece. We live in a time of data abundance, use it to your advantage.

So where do you find all the data?

WatchAuctionHQ has the world’s largest database of public watch auction results. Tens of thousands of historical datapoints from all the major auction houses. There’s no good reason to go anywhere else. (Although it would be nice if you could change the default currency from Swiss Francs.)

Aggregators

Once you’ve mentally set your maximum price for the watch you want, finding one for sale can be quite of a challenge. This is where aggregators come in.

Rather than manually browsing catalogs from each auctioneer, aggregators allow you to set alerts for a given brand or model.

A few players are starting to do this – and not just for watches either. You can use aggregators to track the price of the Kelly handbag we discussed in our recent issue on luxury handbags.

LiveAuctionneers and Invaluable can notify you via email or browser the moment your dream watch is being put up for auction. Super useful.

Tips for bidding at watch auctions

- Know your price. The main difference with buying at auctions is the price. You can either get a great deal, or you can get caught up with emotion and overpay. You need to establish a limit beforehand, and stick to it. Bring your phone and check prices ‘on the fly.’

- Email your absentee bid. Depending on the auctioneer, you can place a bid live from the floor, over the phone, online, or even through email. Most people don’t realize this, but you can email the auctioneer your highest absentee bid. This is especially useful when bidding on international auctions in difficult timezones.

- Request additional images. If you’re bidding online (or can’t get to the live auction), study the pictures carefully, and request additional images (or even videos) if you must. Condition makes all the difference between a good or a terrible watch investment. Don’t take this lightly.

- Authenticity remains a challenge. Yes, major auction houses do due diligence and can generally be trusted. But even they have an occasional horror story. (To be fair, this can happen with anything that is preowned and collectible. Even the authenticity of the world’s most expensive painting is being debated.)

- Don’t forget to factor in the buyer’s premium, which in this world can be high. As a rule of thumb, add between 25% to 30% to the hammer price.

- Play it safe. Finally, for the ultra-important lots that you don’t want to miss, request to bid over the phone and monitor the auction online live. There’s no worse feeling than being forgotten by an auctioneer while your desired watch gets hammered away at a ridiculously low price.

Closing thoughts

Watches are more correlated to equity markets than other alternative asset classes. After an incredible run over the past few years, luxury watch prices have fallen in line with equities since January 2022.

But we believe a bottom is forming, and now is a good time to try and snag a luxury piece at auction for a long-term investment.

Don’t bother with retail. You’re probably not rich or VIP enough to get a Rolex fresh from Geneva. (And tbh if you are, then you can turn around and immediately sell it on the secondary market for a quick huge flip. Hooray!)

For most people, your best bet is building a relationship with an independent dealer, or buying at auction.

Live auctions can be thrilling and extremely rewarding, but be ready. Figure out what you want, come prepared with research and data, establish your max price, and stick to it.

Understanding the market dynamics and history of each piece while avoiding getting outbid isn’t easy. But it’s easier than you think.

It’s like anything else: The way to get good is to just start doing it yourself. 💪

Further Reading

- For inspiration, including 100 investment-grade watches worth exploring, check out Marc’s book, Invest in Watches: The Art of Watch Collecting

- A Blog to Watch is possibly the most aptly-named blog ever, with A Collected Man a close second. Both are terrific.

- Last year we published some tips on how to identify a fake luxury watch

Disclosures

- The web version of this issue contains an Amazon affiliate link to Marc’s book. If you buy the book through this link, Marc gets paid, we get a small cut, and you get a great book. Everyone wins.

- We have no watches ALTS 1 Fund, but we may invest before the end of 2023. We believe the market is bottoming and are watching the numbers closely 👀