Welcome to Wine and Whiskey Insider.

Table of Contents

Wine and Whisky in 2022

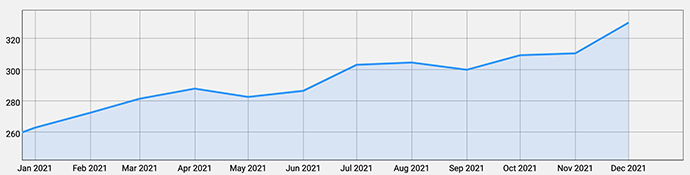

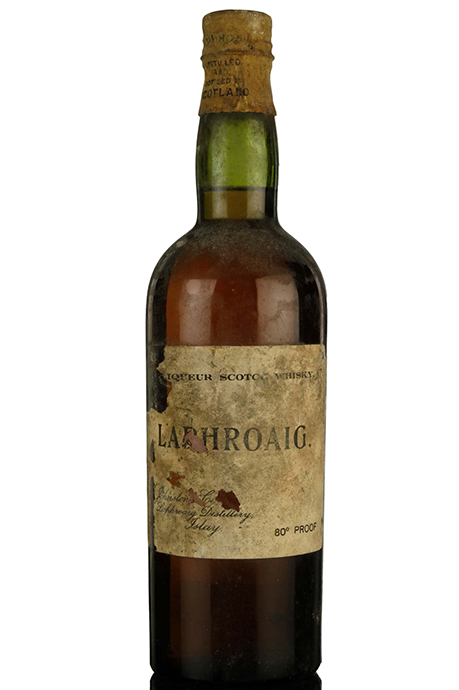

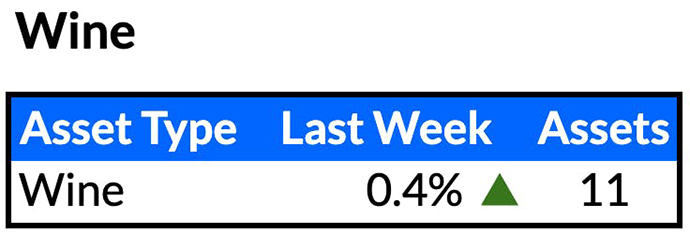

Wine on Rally rebounded after a couple of off weeks to come back to even for 2022. Overall it’s rebounded 30% since the bottom in summer 2021.

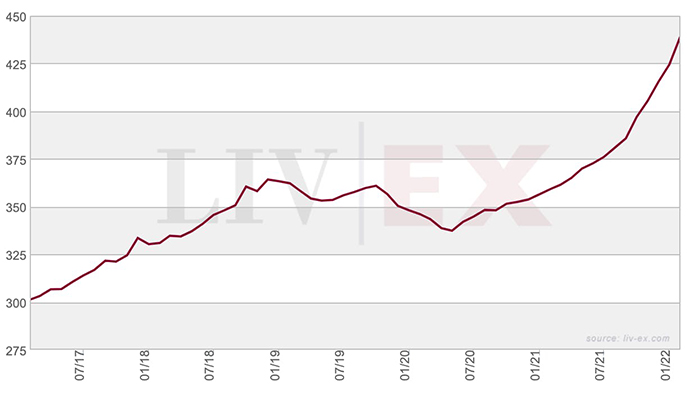

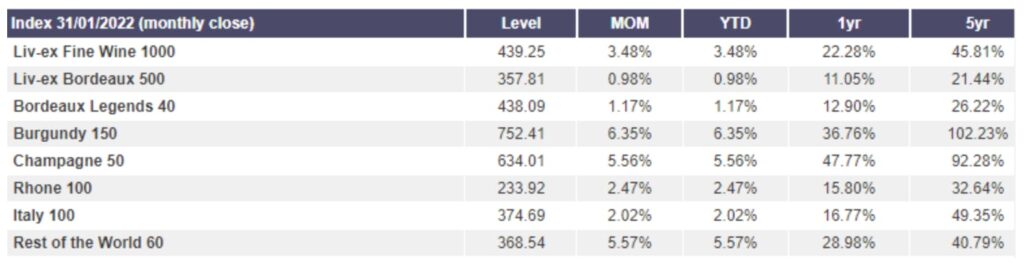

This follows the wider wine market (as tracked by the Liv-Ex 1000), which has gone up and to the right for the last eighteen months.

Every component of the broad index was up in January led by Burgundy, Champagne, and the Rest of the World/miscellaneous bucket. Each of those three categories has had a fantastic year returning 37%, 48%, and 29%, respectively.

We said this last time, but it’s worth reinforcing the point….while the last year has been a good time for wine investors, these returns are atypical.

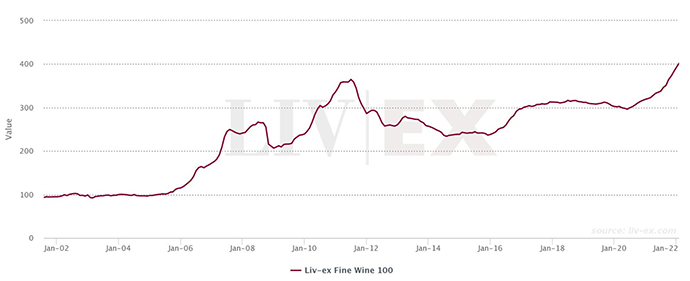

The Liv-Ex 100 is up 300% over the last twenty years, but that’s only 7.2% per year. Decent for a non-correlated asset, but nothing like the last twelve months. In fact, the Liv-Ex 100 is only up a total of 10% over the last five years, which doesn’t even beat inflation.

What’s the learning here? Picking winners is important.

How’s whisky doing?

As well as wine has done over the last twelve months, whisky has done even better.

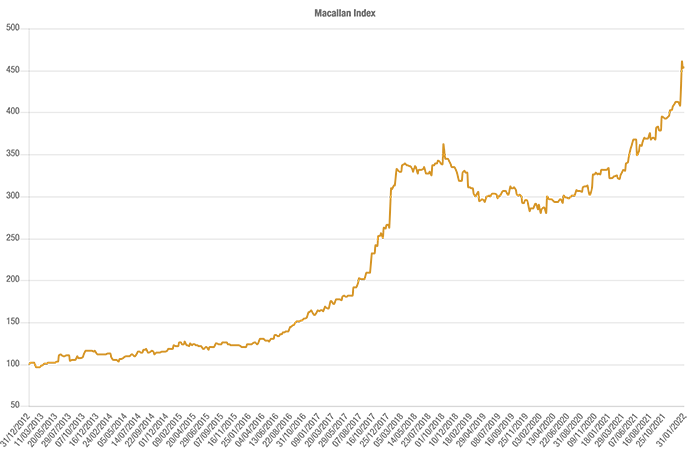

Like wine, several indices track whisky performance, and each covers a different basket of goods.

The broadest index comes from WhiskyStats, which shows an overall 27% increase year over year for whisky.

When you get into higher-end products and specific distilleries, though, returns have topped 40% for the year. Karuizawa, the silent Japanese distillery, returned 42.41% last year and shows no signs of slowing down with over 7% returns in the last month alone.

Our evolving thesis continues to prefer ultra-premium whiskies in the $30k to $60k range from distilleries that are newer to the public consciousness. Historic classics from Speyside and the Highlands seem to have plateaued a bit, and while they’ll provide a steady return, the growth stories are in Japan and other frontiers.

Next on the research radar for us are rum and tequila, which may be about to have a bit of a moment. We’ll go into this in more depth in our next issue.

Last Week in Wine and Whisky

Fractional secondary markets

A tame 0.4% advance concealed a wild week on Rally’s secondary market with a case of twelve bottles of 2000 Château Mouton-Rothschild advancing 47% while a case of 2005 Chateau Latour retreated 33%. Seven different assets gained or lost more than 20%.

Whisky starts trading this week, so we’ll have our first reports on that next time.

Auctions

Nothing of note – please let me know if I’ve missed something.

This Week in Wine and Whisky

Our Picks

Assets dropping on fractional marketplaces

Macallan 40-year-old whiskey – 2016

- Market Cap: $30k

- Inferred Value: $25k

- Drop Details: 2/16/2022 on Rally

- Recommendation: [INSIDERS ONLY]

Deep Dive

About Macallan

Located just above the river Spey (Speyside) on a 485-acre estate in north-east Scotland, Macallan is probably the most well-known single malt whisky distiller in the world. Macallan was founded in 1824 and was one of the first Scottish whisky distillers to be legally licensed.

It’s stood the test of time and has become a bit of a marketing machine not unlike its Irish neighbor, Guinness. Some whiskyphiles say it’s perhaps a bit overrated these days.

About the Whisky

One of only 500, this bottle was aged forty years in a sherry cask and bottled in 2016. Its nose is smoky, lightly peated with ginger, sherry, citrus, cinnamon, chocolate, and wood smoke.

It’s a smooth whisky accented by spice and dried fruits. It’s 45% ABV, which is a bit low, but that’s perhaps due to its long aging process.

Price Analysis

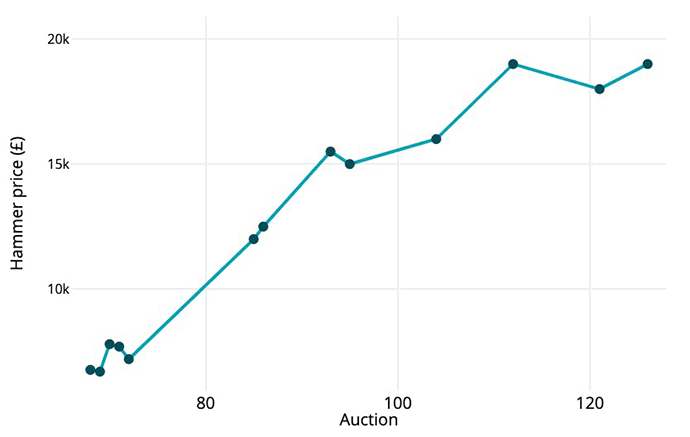

The most recent auction of Macallan 40 Year Old (2016) that I could find comes from Scotch Whisky Auctions. A bottle sold in December 2021 for £19k (around $26,500).

The bottle has done well for itself, nearly 4x since 2016, and there’s no obvious sign it’s slowing down.

In fact, the entire Macallan estate has gone bananas over the last eighteen months.

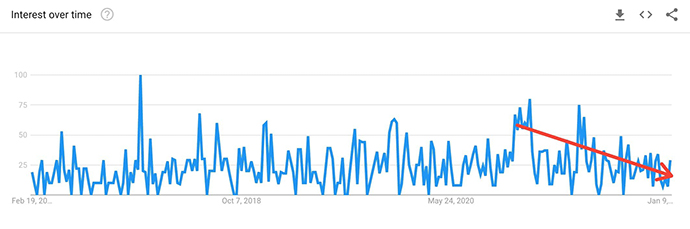

That said, data from Wine Searcher does present one or two concerns.

This particular bottle seems to be less popular on Wine-Searcher.com than it was just a few years ago.

Results from google search trends tell the same story (this is for “Macallan Whisky” overall, not the specific bottle).

Conclusions

I’m bullish on Whiskies. Who doesn’t love these returns?

That said, I think we may be top-ticking (buying at the top) Macallan here.

Summarizing a bit:

Wine and Spirits Auctions this Week

A nice-looking bottle of 40-year-old Macallan (Red collection) is at auction with whisky-onlineauctions (yeah that’s the name, sorry).

If you’re feeling adventurous, the same auction features nine bottles of Laphroaig from “sometime in the 1940s” that were stored in a cellar in Oxfordshire. The bottles look like they were targeted as part of the Blitz.

Whisky.auction (yes sorry, I don’t make up the names) was wrapping up an event featuring several Japanese lovelies from Hanyu’s 1985 Card Series. The Ace of Spades was at £16k as this writing, but I expect it (and its fellows) to go for more than double that. That’s a remarkable return for a bottle that sold for £5,010 less than six years ago.

Moving onto wine, Sotheby’s is auctioning off the “finest wines from the cellar of a world-class entrepreneur” (though they don’t name the titan of industry).

It’s packed with all the usual suspects:

- Chateau Mouton Rothschild 1982

- Chateau Lafite 1986

- Chateaux Margaux 1982

- Petrus 1986 (half case only)

A more robust event can be found at Bonhams next week as they auction off a deceased estate’s worth of vintages, including over 40 lots from Domaine de la Romanee-Conti.

Somehow buying wine off a dead person feels odd, but I bet it drinks just fine.