Welcome to NFT Insider for February 10th, 2022 – FREE edition, brought to you weekly by Alts.

Before we dive in, just a reminder that if you enjoy these content, you’ll probably like our podcast. We’ve chatted with movers and shakers in the NFT and Crypto space (including Les Borsai, the party-promoter-turned-NFT-fund-founder) that are well worth a listen.

Table of Contents

NFTs in 2022

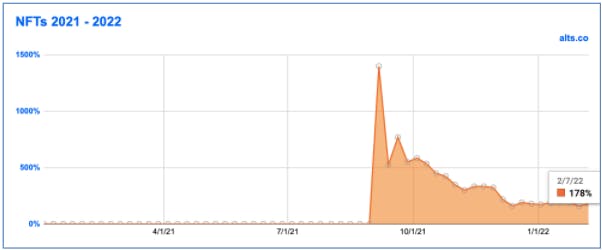

At the beginning of the week, fractional marketplaces are returning 178% ROI since we started tracking in September 2021. We expect returns to rise with Bored Ape #7359 currently netting a 90% return for initial investors after trading opened for the first time on Monday.

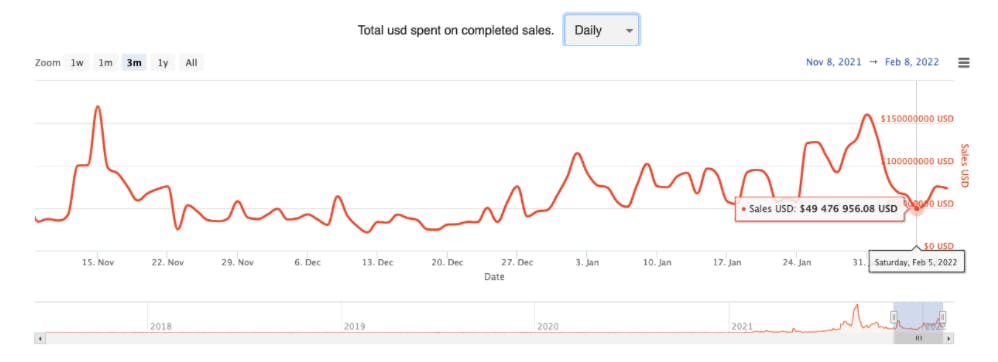

But the the broad market has certainly cooled from the run it was on last week.

Last Saturday February 5th marked the lowest daily sales volume since December 30th. We reported that last week was a historic one in terms of sales volume. The market over the past week has slowed considerably.

NFTs Last Week

NFTs on Fractional Marketplaces

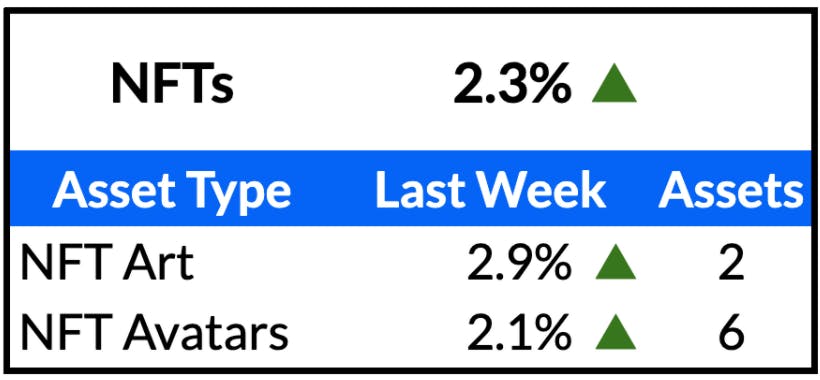

NFTs were up a modest 2.3% from the previous week.

In terms of NFT Avatars, “Leather Jacket” Bored Ape #9159 on Rally was up 70% from its IPO price. Chromie Squiggle #524 on Otis has also seen a steady rise in the past two weeks to $1.25 per share.

Rally debuted “Astronaut” Bored Ape #7359 for live trading and was up as much as 90% from the IPO when shares reached $19 for a market cap of $390k.

NFTs on OpenSea

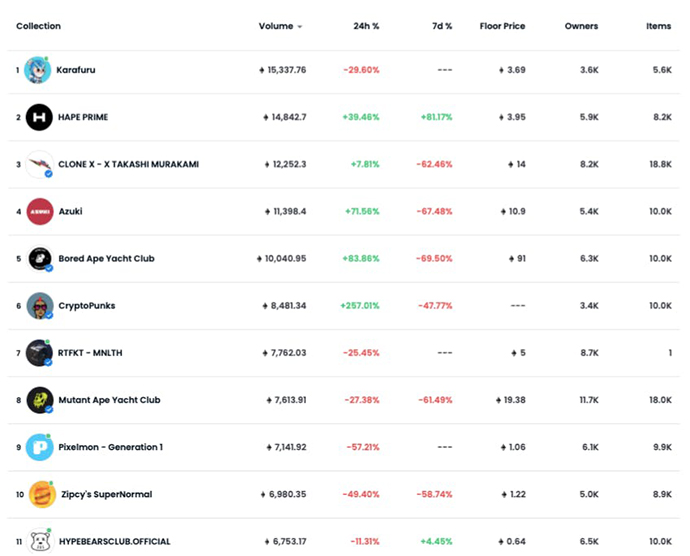

Karafuru takes the top spot this week on OpenSea. The project is centered around 12 characters created by Indonesian artist WEDE. This is a 2D project, with plans in the roadmap for a future release of 3D characters with compatibility in a metaverse land.

After two weeks of being at the top in sales volume, Azuki was fourth this past week. For a moment, the floor price for Azuki went below 10 ETH but has managed to recover back to 11 ETH.

Fractional Marketplaces

Meebit #7985

- When: February 10th @ 12 PM ET

- Platform: Rally

- Market Cap: $38k

- Inferred Value: $39k (DappRadar puts it even higher at $64k)

- Recommendation: [INSIDERS ONLY]

Mutant Ape #857

- When: February 9th @ 4PM ET

- Platform: Rally

- Market Cap: $54k ($5 per share with a 2 share cap)

- Inferred Value: $63k

- Recommendation: [INSIDERS ONLY]

Projects Minting

Invisible Friends

Minting in February

- Project released by popular artist Markus Magnusson

- The project features “invisible” animations

- There are currently more than 444k Twitter followers

- 5,000 mints are available, with nearly all of them going through a whitelist

- Whitelist opportunities must go through the project’s Discord

DigiDragonz Voxel

Minting February 13th

- Devs had a successful initial mint of 1,500 2D DigiDragonz, currently at a floor price of 0.15 ETH

- On Monday, 5,015 Voxel DigiDragonz will be minted. All current holders of the 2D project will get an opportunity to mint a 3D Dragon.

- Each Voxel dragon will have a compatible counterpart that’ll be fully functional in the ‘Digiverse’ world in The Sandbox.

- Developers will launch their own game on the Unity engine where DigiDragonz VX can battle each other and show off their traits

- The project’s mission is to create the #1 NFT community and to “create the adventure of a lifetime for our holders.”

Industry News

This week’s Industry News won’t be dedicated to the industry as much as it is to discuss buying and selling strategies.

Veteran NFT traders know they should sell before a reveal to make a decent return on pre-reveal projects.

Most projects will drop in price the moment mints are revealed because 95% (if not more) of them will not be very rare. Those that do hold could strike gold and make significantly more money if they reveal one of the 100 rarest mints, but that’s a 1% chance in a 10,000 character collection.

When looking at some of the most recently hyped projects, it’s alarming to see how quickly so much money can be lost when buying at the top. Here are just a few examples:

- Only a week ago, Hape Prime had a 9 ETH floor, now it’s below 4 ETH

- Zipcy’s Supernormal was at 4.5 ETH last week, now it’s at 1.1 ETH

- Phanta Bear, which was above 4 ETH at the beginning of the year, now sits at 1.45 ETH

Even the biggest names in NFT investment get it completely wrong.

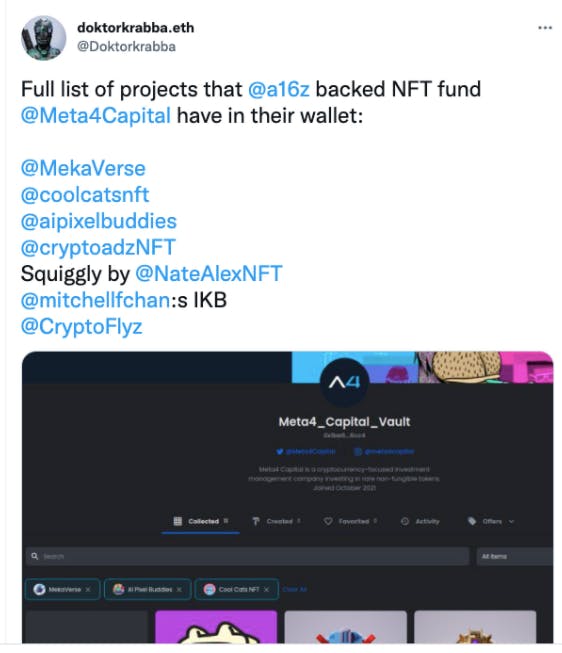

Meta4 Capital, which is raising $100 million and backed by Andreessen Horowitz, has an impressive NFT portfolio. But the fund has also bought into some duds.

Here are the misses:

- Mekaverse has been plagued with problems from the beginning, ranging from accusations of a rigged minting process to rumors of developers with inside knowledge on which pre-reveals to purchase. After being one of the most hyped projects ever, the floor is now struggling to stay above 1 ETH.

- AIPixelBuddies sits at a 0.02 ETH floor

- CryptoFlyz sit at a 0.018 ETH floor

The quick analysis on Meta4 is not meant to critique the fund. To its credit, Meta4 has also made some incredible investments. But it’s to highlight that even funds with top-level analysts, large amounts of working capital and industry connections still make their fair share of mistakes.

So what are retail investors to do?

It’s clear that the space, exciting as it is, is highly speculative and based on people buying at the top for the benefit of those that purchased at the bottom.

“So what?” you may ask. How is the stock market any better?

I’m certainly not arguing for the stock market, and can well understand defenders of the NFT market who point out that the stock market is just as rigged. What’s happening when people buy high and then lose money is no different than when traders and companies manipulate equities. And of course, there’s also no shame in selling in the open market to make a profit.

I guess the counterargument I’d make is: Is this where we want to be? Where the best defence is, “We’re only as bad as the stock market”?

The purpose of this section isn’t to criticize the NFT market. It’s to remind people to do their research, try to get on whitelists to buy at the mint price, but most importantly – to be patient. The FOMO can be unbearable, and at times it has reached the best of us all (myself included). But remember that for every Bored Ape Yacht Club, there are dozens upon dozens of failed projects.