Welcome to the NFT Insider for February 25th, 2022 – FREE edition, brought to you weekly by Alts.

Each week, we give you our analysis of the NFT market in general, as well as any current IPOs. We also give you the heads up on cool projects we think are worth checking out.

In today’s issue, we offer our view on the “Mohawk” CryptoPunk #2981 IPO’ing today on Rally, plus a recap of the OpenSea phishing scandal.

Let’s go!

Table of Contents

NFTs in 2022

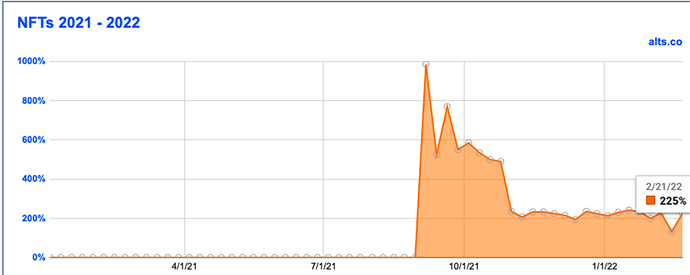

NFTs on the fractional marketplace saw a strong rebound last week, up from a steep decline two weeks ago. Since we started tracking secondary trading in September 2021, NFTs are providing a 225% ROI.

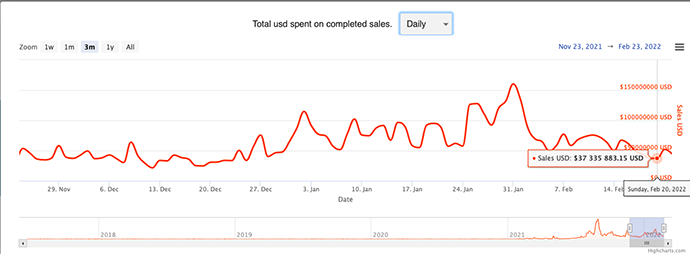

Looking at volumes traded, NFT sales have slowed considerably compared to the previous weeks. For the first time since late December, there were four consecutive days with less than $50 million in daily sales volume, according to NonFungible.com. Macro events could be responsible, as securities and crypto markets have also been sliding.

It’ll be interesting to see how the recent news on Russia affects things in this space.

NFTs Last Week

NFTs on Fractional Marketplaces

The most visible Profile Picture (PFP) NFTs, Bored Apes, have taken a considerable nose-dive in the past week, going from a floor price of 103 ETH on February 15th to below 90 ETH for the moment. Trading on the fractional markets has reflected this shift in price.

“Leather Jacket” Bored Ape #9159 on Rally has continued to slide down for two consecutive weeks. It was last trading at $6 per share for a market cap of $234k.

Rally debuted “Astronaut” Bored Ape #7359 for live trading last week and was up as much as 90% from the IPO, but at time of writing is trading at about $14.50 per share – for a market cap of $275k.

The floor price for Apes is now at 89 ETH ($245k).

At time of writing, the VR CryptoPunk #8103 on Rally is trading at $7.25 – down 30 cents from last week – for a -22% return on the initial investment. This is the only NFT asset on Rally with a negative return.

CryptoPunk #9670 has seen a slight downward slide, now trading at $39 per share for a $280k market cap, after consistently trading at or very close to $40 per share.

NFTs on OpenSea

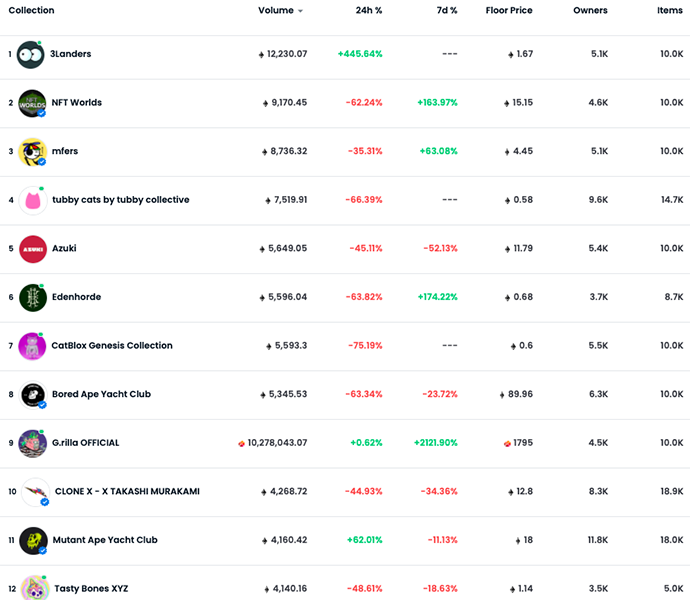

3Landers takes the top spot this week on OpenSea. The project had its whitelist sale on February 19th, followed by the public sale on February 20th. 3Landers was helped by an organic marketing campaign and a partnership with Cool Cats.

Doing our weekly Azuki tracking, the floor has dropped from about 14 ETH one week ago to 11 ETH this week.

Karafuru, which took the top spot for two consecutive weeks, is sitting near its 3 ETH floor from last week at 2.69 ETH. It’s currently 23rd in sales volume for the past week.

NFTs This Week

Fractional Marketplaces

“Mohawk” CryptoPunk #2981

- When: February 25th @ 12 PM ET

- Platform: Rally

- Market Cap: 310k

- Retained Equity: $93k (30%)

- Inferred Value: $270k – 290k

- Our view: [INSIDERS ONLY]

Projects Minting

As we explained in our last issue, when we look for minting projects to highlight, we’re not necessarily endorsing the project, more showing our reasons for why we think the project could be successful. We look for things like minting mark-ups, utility and community growth and engagement.

In case you missed it last time, and if you’re just beginning your NFT journey, here’s a guide on the basics of buying NFTs that we think you’ll find helpful, and another link to help explain public mints.

And now, here’s our pick of projects minting that you may want to check out:

Kibatsu Mecha

Public Minting in March 2022

- A collection of 2,222 hand-generated, animated NFTs by the artist Jerry Liu.

- There is no definitive roadmap with the developers focused on meeting milestones one step at a time

- This collection has a lot of “vibes” around it, not necessarily focused on the details, but on the possibilities of what can be

Howlerz

Stealth Minting …. Any moment

- By the time you read this, the stealth mint may have already occurred. The project is gaining some serious traction despite no web site, no Discord, no whitelist, and no roadmap (this is what makes it so cool)

- There are currently 22k Twitter followers, including a lengthy list of influential and respected NFTers

- Minting price will be .15 ETH + gas fees

Industry News

The past week’s biggest news was the OpenSea phishing scam that allowed the hacker(s) to steal about $1.7 million worth of NFTs.

Initially, it was believed the attack was due to a security breach on OpenSea’s network while it performed an upgrade to its contract for active NFT listings. One of the purposes of this upgrade was to weed out inactive listings on the platform.

Sensing an opportunity, a hacker sent out an email posing as OpenSea. They essentially gained permission to transfer NFTs from the victims’ wallets into their wallets when said victims unknowingly gave permission through a phishing link. Thirty-two users were targeted. More than 250 NFT transfers were conducted.

When reports of the hack first surfaced, OpenSea – predictably – took some pretty serious heat from the Twitterverse. The misinformation was also off the chain (pun intended); for example, here’s one tweet from someone with more than 100k followers:

BREAKING: Over $200,000,000 worth of #NFTs have been stolen from #OpenSea via an email phishing hack. pic.twitter.com/tHdkSCQWe0

— CRYPTO GIRL (@allyATL) February 20, 2022

Twitter is the gold standard for thoroughly vetted information, so this was a surprise.

Or how about this tweet from another account with more than 400k followers:

BREAKING: Massive Opensea “exploit” in their new migration contract allowed users to sell, steal any NFT from any users.

— Mr. Whale (@CryptoWhale) February 20, 2022

Over $200M lost already.

Another Twitter investigative journalism special.

The truth, however, is that OpenSea had little, if anything, to do with the phishing scam. To the degree that it can shoulder some of the blame, there was confusion about the upgrade and subsequent need to migrate active listings under the new OpenSea contract.

When the hysteria died down, and more facts came to light, the Twitterati made sure to acknowledge that the hack had nothing to do with OpenSea’s migration to a new contract. Still, some thought that OpenSea could have better communicated how the migration would work and anticipated a scammer taking advantage of the move.

To clarify: I didnt say the OpenSea contract was the problem. The culprit used this contract migration situation to their advantage, knowing it was a perfect time to attack. That being said, OpenSea should have expected this and better prepared for it

— JRNY Crypto 🧪 (@JRNYcrypto) February 20, 2022

JRNY Crypto’s take is one of the more sensible addressing the situation. To what extent should OpenSea have been “better prepared” for a scam? What policies can OpenSea implement to ensure that a phishing scam like this never happens again?

For example, a simple policy communicated to as many people as possible that OpenSea will NEVER send out emails with links on them would go a long way to helping users spot scammers.

Is this feasible or unrealistic? I don’t know.

But clear communication in many cases can avert disaster. Some have even argued that OpenSea can’t win with its audience (while making hundreds of millions of dollars).

The entire situation begs the following questions:

- What will happen to those defrauded by the hacker?

- Who was the hacker?

In some instances, OpenSea had compensated NFT owners when it held some blame. This happened when hackers took advantage of a listing flaw on the website, causing valuable NFTs to be “sold” for as little as 2% of the actual value. OpenSea compensated owners with the “floor price” of their NFT with comparable traits.

There hasn’t been any news about the phishing scam victims getting compensated, and it isn’t clear that OpenSea has any blame. It would, however, go a long way to see them reach out to the victims.

Lastly, who were the people behind the attack? Will this be a case of finding out who did it five years from now? Or worse, will this be forgotten, only to be used as a cautionary tale about not clicking on suspicious links and taking extra precautions with passwords and two-factor authentication?