Here’s everything you need to know about what’s happening in the world of alternative assets, best enjoyed with your morning coffee.

Let’s go!

Table of Contents

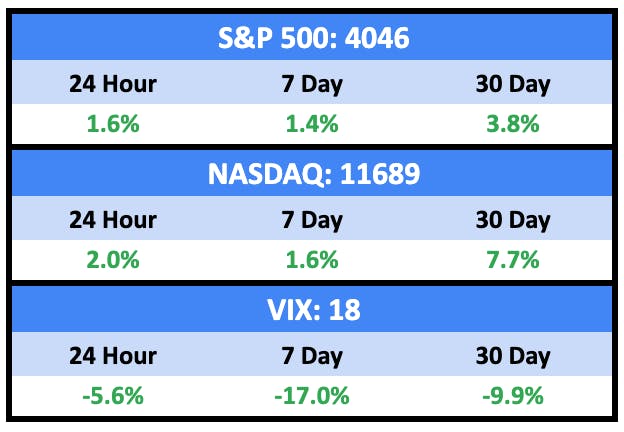

Macro View

It was a choppy week in the equities markets with all the gains coming on Friday.

Bullish News

- Inflation in the euro zone eased slightly to 8.5% in February.

- The US labor market is finally cooling.

Bearish News

- Futures markets are pricing in a 20% chance of a 50 bps rate hike this month.

- BofA and JP Morgan both think Fed rates might top 6%.

- UK grocery price inflation hit a record 17.1%. Milk, eggs, and margarine grew the most.

What are we doing?

ALTS 1 fund news:

Nothing to report here.

Real Estate

Bullish News

- US pending home sales rose by the most since June 2020.

- Amazon employees can use their company shares as collateral when buying homes under an arrangement with online mortgage lender Better.com.

Bearish News

- Mortgage rates topped 7% last week. Demand is at a 28 year low.

- Apartment rents fell in every major metropolitan area in the U.S. over the past six months through January.

- Home foreclosures have ticked back up over the past four months.

- Blackstone blocked investor withdrawals from it $71 billion REIT in February.

How to invest in real estate right now:

Rates are going to keep climbing, rents are going to keep falling, and there’s really nowhere left to hide.

Crypto & NFTs

Here’s what you need to know:

Tough week for crypto markets as the situation continued to deteriorate at both Binance and Silvergate.

But sentiment only dipped a few points, which may indicate insiders have priced much of this in.

The cumulative market cap of the NFT space continued its upward trend for the 7th consecutive week. This rise in market cap comes after the NFT ecosystem just had its best 7-day weekly volume statistics since May 2022, signaling increased activity and demand.

Bullish News

- A group of large Japanese companies agreed to work together to create a “Metaverse Economic Zone” for the country.

- Crypto’s correlation with U.S. equities and macro events is weakening.

- Ordinal inscription #1 has been listed for sale for 100 BTC ($2,365,328).

Bearish News

- Things are getting worse for Silvergate. It could be dead this week.

- And for Binance. Binance’s stablecoin, Binance USD, has seen around $6 billion of outflows following a U.S. regulatory crackdown on the company.

How to invest in Crypto & NFTs right now:

For the first time in a long time, NFTs feel stronger than crypto.

Startups

Bullish News

- Bluesky, the decentralized project that originated within Twitter, has arrived on the Apple App Store as an invite-only social network.

- Stripe is close to raising its $4b round.

- South African chemicals and energy company Sasol has announced a €50 million decarbonisation fund.

- ClimateTech was one of the few bright spots in 2022. Pitchbook has a view on companies to watch this year.

- Bain Capital Ventures has secured $1.9 billion in commitments for two new vehicles.

- OpenAI launched an API for ChatGPT.

Bearish News

- Accounting data shows revenue growth declined substantially in 2022 compared to 2021across fintech, ecommerce, Saas, and healthcare startups.

How to invest in startups right now:

If you’re looking for safety, healthtech is the most recession-proof sector during recessions.

Quick Hits

Sports Finance

Two London-based hedge funds, Fasanara Capital and Tifosy Capital & Advisory, are pairing up to create a fund of up to $500 million targeting soccer teams.

Instead of focusing on ownership stakes in teams, the fund will seek to tap into revenue streams such as broadcast rights and ticket sales.

That’s all for this week. I hope you enjoyed your coffee and this edition of Alts Cafe. ☕

If you have any comments, questions, or concerns – let us know.

Cheers, Wyatt

Disclosures

- This issue was sponsored by our friends at Kingscrowd and Qnetic.

- We are holding BTC and ETC in our ALTS 1 Fund. Apart from those, we don’t own any other assets or vested interests in the companies mentioned in this email.