Table of Contents

Whisky Cask Flipping – Managed Fund

Whisky is an ancient craft, and while it’s quickly becoming one of the most popular spirits in America, the industry itself could be more efficient. If you have access to the right casks at the right time, returns of 25% to 40% per year are achievable, and 15% to 20% is common.

Deal overview

Deal Sponsor: The Whisky Cask Club

Minimum Investment: $20k

Projected Returns: 16% to 20% net of fees

Fees: 2% management + 20% carry

Duration: 3 years

Vehicle: Singapore-domiciled SPV – Managed Fund. Accounting and setup via Corporate FinEdge in Singapore.

How it works

The Whisky Cask Club (WCC) works with you to form a Special Purpose Vehicle (SPV) to buy and sell whisky casks. As a broker deep in the heart of the whisky industry, WCC identifies arbitrage opportunities that allow the SPV to buy a lot of whisky at a discount in one geography and sell it for a premium elsewhere.

Every investment decision is put to the SPV’s investment committee (which the investor sits on), so the client retains complete control over which investments to pursue and which to pass on.

From Alexander Knight , CEO at WCC:

Ideally, we’ll buy stock that can be turned for a 10-15% upside within two months. It could be anything from new-fill to in-demand casks. This is a very opportunistic OTC business, so the investment committee must be small and agile.

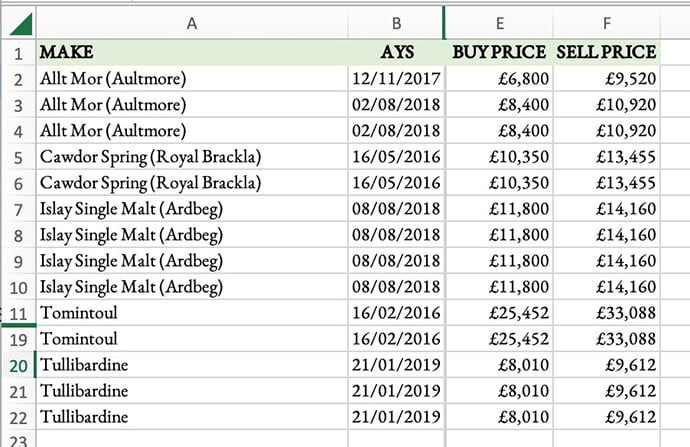

Alexander shared one month’s worth of trades for an existing client, and it’s representative of how the SPV generally works:

A bit of detail, again from Alexander:

We purchased 18 casks of the 2018 Allt More for £8,400 from our supplier in Scotland, and a broker in Australia sold them all a few days later for £10,920 each. They are Bourbon hogsheads with an RLA of an average of 165 litres and an ABV of 63%.

The average ROI for that month was 20% to 30% from a two-day to a two-month hold period.

I was on the phone with Alex Wednesday, and he shared two live deals that are representative of what he’d put into the managed fund:

Deal One:

Alex’s team is financing the purchase of vats of whisky, putting them in casks, and selling them for a 5% markup a month later. The suppliers and buyers are lined up, and this process is repeatable indefinitely.

Deal Two:

Alex’s team is buying pre-filled casks and selling them to an already-identified buyer for an 8% markup over two months.

These annualize out to 60% – 80% return over twelve months.

What I like

As well as those specific returns, there’s a lot to like about the whisky industry generally. It’s inflation resistant, not (very) correlated to the equity markets, and a self-limiting asset — people are going to drink some of those bottles.

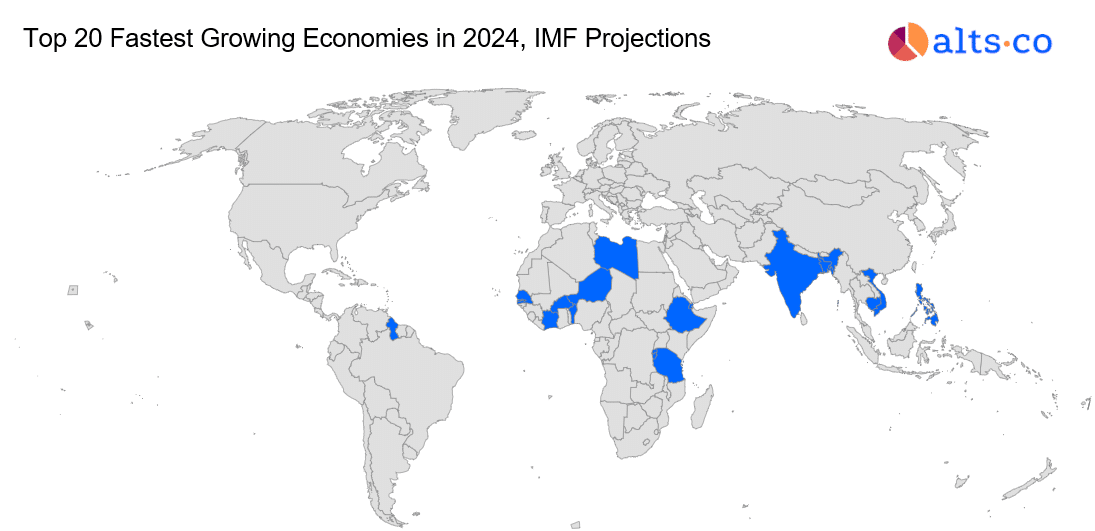

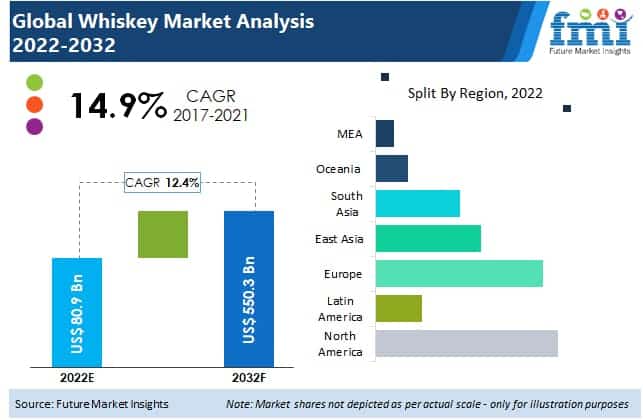

And it’s bigger than you’d think:

- 53 bottles (70cl @40% ABV) of Scotch Whisky are shipped from Scotland to around 180 markets around the world each second, totaling over 1.6bn every year.

- In 2022, Scotch Whisky exports were worth £6.2bn.

While it’s had a great run the last decade, there’s still room for whisky to grow.

Within the more specialized Scotch market, sales are set to double between now and 2031 to $108B.

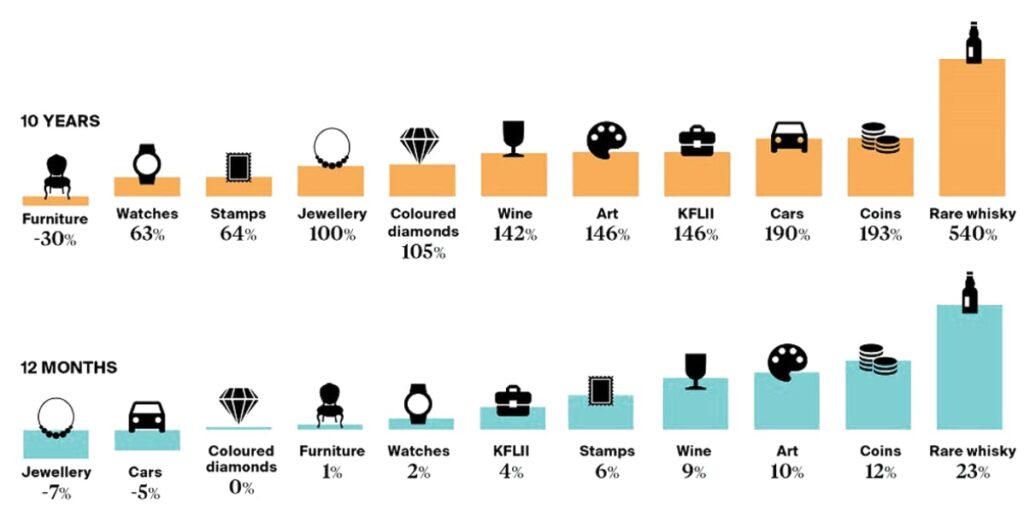

And it beats the hell out of other alternative assets.

Whisky’s 10-year historical yield beats watches, wine, art, jewelery, diamonds, coins, cars, branded handbags, furniture, and antiques with a 563% return on bottles.

And there’s a lot to like about the fund itself as well.

- It’s a regulated market trading within bonded warehouses

- It’s executed in a tax-free environment

- The fees are reasonable for something so actively managed.

The risks

The deal itself relies a lot on Alexander’s team to execute. There’s some key man risk here, so there’s a slight worry if Alexander were to retire.

The whisky market has been hot for the last ten years and has shown signs of cooling down lately. You may feel differently, but I don’t think this is a huge risk for two reasons:

- The market never really bubbled — it showed steady, consistent growth, and

- You’re not betting on whisky to go up over the years; you’re betting WCC’s brokers can arbitrage inefficiencies

And not really a risk but more something to be aware of — the SPV requires a three-year commitment; if you want your money out early or give less than one year’s notice, there’s a hefty £50k penalty.

How to invest

There are two ways to invest in this managed fund. First, you can invest directly through WCC with a £500,000 minimum investment. Second, you can express interest below for as little as $10k, and Alts will set up a feeder fund where we combine a number investments together to meet the overall £500,000 minimum.

Direct Investment

If you’ve got £500,000 to invest, you can get in touch with Alexander’s team directly.

Feeder Fund

If you want in but would prefer to invest a smaller amount, fill out this non-binding expression of interest.

How to get more like this

You’ve just read The Big Deal Pro, which costs $20/mo ($200/yr).

Next month, we’ll bring you another investment idea — the one we’ve got queued up is completely different but features returns in the same ballpark and has a much lower minimum investment.

If you want the full version again next month, sign up to the Big Deal Pro.

A reminder of what you get with each:

Big Deal Free

- One idea a month with deal info, analysis, and recommendation, but identifying information is removed.

Big Deal Pro

- Everything from the free version plus identifying info about the investment.

- Reduced fees and carry when you invest.

- Access to lower investment minimums.

- Invitations to exclusive AMA sessions with the deal sponsor.

- Access to The Big Deal one week before Free members.

- Membership in our Big Deals community, where you can share deal flow and get insights from some of the best investors on the planet. (coming soon)

Disclosures

We’ve not received any compensation or consideration for featuring this deal. If there’s sufficient interest for Alts to form a feeder fund, we will charge fees on that. We may also choose to invest in this deal via our ALTS 1 fund.