Hello and welcome to Alts Cafe

This is your weekly quick-fire analysis on all thing Alts investing.

TLDR:

- How, or if, the debt ceiling gets resolved will drive everything

- Real estate still struggling; US home prices saw their biggest annual decline in 11 years

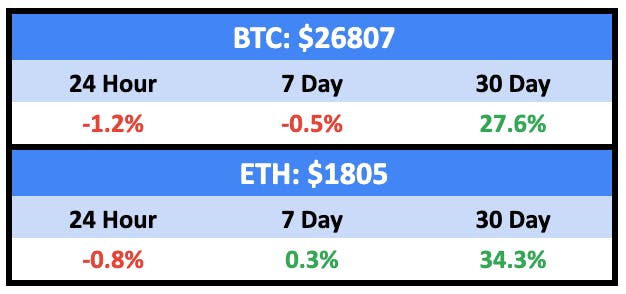

- Crypto is plateauing after a strong start to Q2

Like these post? Please give us a shout on Twitter, we’d appreciate it.

Wyatt

Table of Contents

Macro View

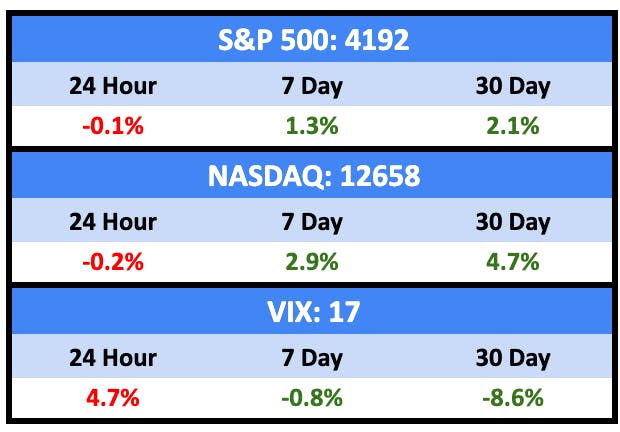

It was a pretty ok week in the markets, but the debt ceiling issue is yet to be resolved.

Bullish News

- The Fed might not hike rates in June.

Bearish News

- China’s economy, which was the bright light for global growth, is slowing. Youth unemployment is hitting record highs. Consumer inflation is at the lowest level in two years.

- Consumer sentiment in the US slumped to a six-month low in May, due to debt ceiling worries.

- The US Fed says rates are unlikely to decrease anytime soon and may rise.

- Total consumer debt hit a fresh new high in the first quarter of 2023, at just over $17 trillion.

- Related, consumer debt delinquencies are on the rise.

- Institutional investors are more pessimistic now than at any previous point this year.

What are we doing?

ALTS 1 fund news:

We finalised our lead investment in Webstreet’s Round Five. For more information, feel free to email me directly at [email protected].

Real Estate

Bullish News

- Home prices were up 1% MoM due to a lack of inventory.

- The S&P Composite 1500 Homebuilding sector hit a new 52-week intraday high Wednesday.

- Homebuilder sentiment is back to even for the first time since July 2022.

Bearish News

- Commercial banks are being forced to sell real estate loans at a loss.

- CRE prices will fall 10% followed by a rise in defaults, says overly optimistic Moody’s chief economist Mark Zandi.

- CRE investors are finally pricing in climate change when analysing coastal properties, which will drive prices lower.

- Starwood REIT is receiving redemption requests more than double its allowed maximum.

- Nearly 8 in 10 Americans say it’s a bad time to buy a home.

- US home prices saw their biggest annual decline in 11 years.

- CRE saw its first annual decline since 2011.

- April 2023 was the 15th month of slowing rent growth; Rents in the Midwest continue to increase faster (4.9% Y/Y), while rents in the West (-2.6% Y/Y) and Sunbelt market (-2.5%) were lower than a year ago.

- A possibly racist home owners’ association in Texas kicked out a bunch of black residents.

- New mortgage originations in the US totalled just $323.5 billion, the lowest level since the second quarter of 2014.

- An oversupply of summer rentals in the Hamptons is spurring price cuts of 20% or more.

- Fund managers have cut their exposure to CRE to the lowest since 2008.

- NYC office vacancies are at a record high.

How to invest in real estate right now:

I’m still out of the real estate market [no change].

Crypto & NFTs

Here’s what you need to know:

Crypto is taking a breather after plunging ahead for the month.

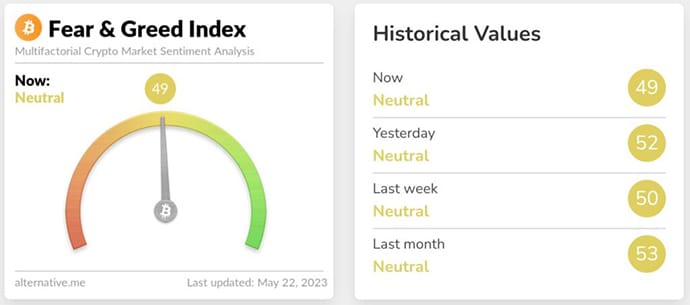

Sentiment remains neutral, but is slowly declining.

NFTs were up a skosh this week and remain in the green for 2023:

Bullish News

- The U.S. cryptocurrency enforcement tsar is stepping up scrutiny of crypto exchanges.

- Coinbase’s subscription service is out of beta and will serve the US, UK, Germany, and Ireland.

Bearish News

- North Korean hackers stole $721 million in cryptocurrency from Japan.

- Crypto fraudster Do Kwon is out on bail.

- Binance is pulling out of Canada.

- BlockFi customers won’t get their money back. Voyager customers will get 35% back.

How to invest in Crypto & NFTs right now:

Crypto broke out in the first quarter of 2023, but now it’s feeling more and more tied to the macro climate. A debt default in the US should pump the digital currencies, but it probably won’t.

Startups

Bullish News

- WeWork fired its CEO, and struggling ride share company Lyft has fired its CFO after less than a year and a half on the job.

- Elon’s made his first Twitter acquisition, buying a recruitment startup from shitposting buddy and serial entrepreneur Chris Bakke.

- Vietnamese EV maker VinFast is IPO’ing in the US via SPAC.

Bearish News

- Tiger Global Management is seeking to offload hundreds of millions of dollars worth of private companies into the secondary market.

- VC investment in indoor farms was $75 million in the first quarter. That’s down from $1.45 billion two years ago.

- Montana passed an unenforceable bill to ban TikTok.

How to invest in startups right now:

Gonna keep saying it — stay far away from AI startups that are just ChatGPT skins.

Quick Hit

Whisky

Exports of Scotch whisky surpassed $6 billion for the first time in 2022. Delivery of the liquid gold jumped 33% in the US alone.

Speaking of gold, according to a recent study, £100,000 put into whisky casks in July 2018 would have been worth £214,000 by the end of last December. A £100,000 investment in gold over that period would be valued at about £151,000.

Sticking with the gold theme, an explorer has uncovered a ship that sank in Lake Michigan 170 years ago. Inside, he’s found chests of gold and 170 year old whisky. Any surviving whisky would be priceless (if drinkable).

Also, the genetic makeup of corn was different in 1854, which means it would taste different to what we’re used to today.

That’s all for this week. I hope you enjoyed your coffee and this edition of Alts Cafe.

We’ve noticed other newsletters jump up lately doing the same sort of thing as us.

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our very clever fractional friends at Nada and sliceNote.

- We are holding BTC and ETC in our ALTS 1 Fund, and as I mentioned further up, we’ve finalised our lead investment in Webstreet’s Round Five. Apart from those, we don’t own any other assets or vested interests in the companies mentioned in this email.

- I don’t care if it’s gross, I’d love to try a 170 year old whisky.