Welcome to NFT Insider. Today we’re going back into NFTs to explore a concept that has long been familiar to the art world: provenance.

To haters, it feels like the tech industry is shoving NFTs — along with the Metaverse and “Web3” — down everyone’s throats. A messy, unnecessary layer on a recalcitrant world. The backlash is gaining steam, and some great Web3 bear sites have sprouted up ????

But the fact is, so much interesting stuff continues to happen in this space. Just this week:

- Bitwise launched the world’s first passively managed NFT “blue chip” index fund

- Nike bought RTFKT, a company that creates avatars for the Metaverse

- 500px is launching an NFT photography marketplace

This last one excites me the most. As I wrote last week, digital rights management is an actual pain for photographers, and NFTs could present a real solution someday. It’s early, but it appears 500px may be the first to link together photography, NFT ownership, and payments.

The point is, love them or hate them, NFTs aren’t going away. It may be a confusing, flawed space, full of grifters and rug pulls. But to write this all off as an unnecessary gold rush is, I think, unwise.

The California Gold Rush lasted a decade, and then it was over. But it changed the trajectory of the state for the next 150+ years. So it’s essential to understand how these markets work, as unserious as they may seem.

In today’s dive, Horacio does a great job exploring provenance in the NFT market. Enjoy!

– Stefan

Table of Contents

The origins of NFT value

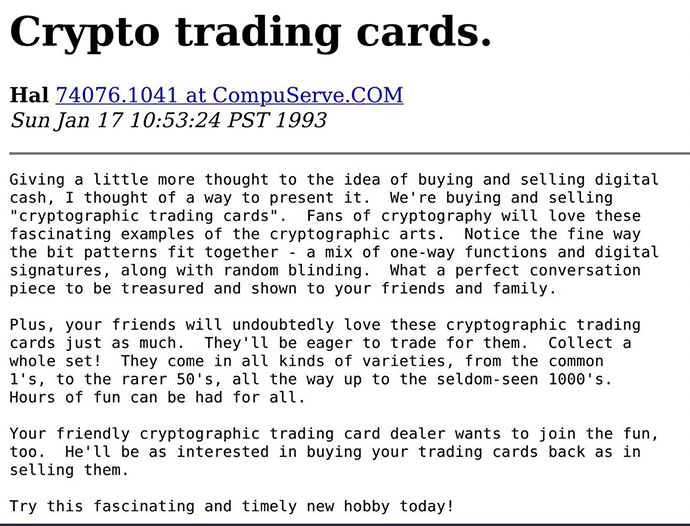

Nearly 30 years ago, Hal Finney, the Bitcoin pioneer and legend (who is speculated to be Satoshi Nakamoto), had a vision of what NFTs would someday become.

Before Google, before smartphones, and before most people even had home Internet, Finney predicted what cryptography in the digital age would turn into.

Finney’s description of what would come to be known as non-fungible tokens (NFTs) correctly predicted that “card dealers” would be “as interested in buying your trading cards back as in selling them.”

But from where would these crypto-cards derive their value? Indeed, these NFTs would have to be beautiful, eye-catching, and fitting with the times. With one picture, memes do more to convey messages and feelings than a 2,000-word essay ever can (except for this one, right?)

We are living in a meme-filled world. The adage, “A picture is worth a thousand words,” has never been less accurate. An adaptation might read, “A meme describes a thousand words.”

The visual appeal of NFTs has borne out, with collectors gushing over their new acquisitions. But what else could drive someone to pay $69 million for a JPEG (this is not a right-click-save argument)?

There’s utility, there’s status, but ultimately, the actual value boils down to proof of ownership, i.e., provenance.

What is provenance?

The term provenance has been used in English since the late 18th century, meaning “origin.” It’s derived from the French verb provenir, or “to come from.” Provenance is used in various fields, especially in the physical art world, where a work’s origin is crucial to its authenticity and value.

For many rare artworks and artifacts, proving provenance involves combing through hundreds of years’ worth of historical records. The Bitcoin blockchain that Finney helped pioneer has enabled cryptographers and NFT enthusiasts alike to search a digitally recorded “open ledger.”

The ledger is designed to be impermeable. Documents can no longer be lost or destroyed. So long as civilization has electricity and the Internet, the blockchain will exist forever in a decentralized system of millions of computers.

But while some blockchains are nearly impossible to alter (Bitcoin, so far), other blockchains have had no choice but to change their ledgers when faced with severe attacks, like Ethereum’s infamous DAO hack. The prevention of these attacks, and the preservation of provenance, means everything in a decentralized network.

Provenance in the physical art market

Value is built upon several overlapping and intricate factors in the physical art market. Of these, provenance is without question one of the most important.

A painting may be worth $20m if it came from an anonymous collector, but if David Geffen once owned it, congratulations; it’s now worth $30m.

Art dealers even have a pecking order of preferred ownership. At the top are museums, followed by famous collectors. Beneath that are the new money types: Tech & hedge fund managers who buy their way into the scene.

Just like with classic cars and watch dealers, you can’t just walk into an art gallery and buy whatever you’d like. Oh, you’re a baller? It doesn’t matter. The dealer needs to get to know you first. Before they sell their best pieces, they want to make sure you’re someone who will add to the piece’s provenance, not detract from it.

Technology has inserted itself into the physical art market. Companies like Masterworks and Artnet have complied massive databases of transaction history, digitized them, and ushered in transparency to the art world.

This took lots of time and effort, but it has been a good thing. Increased transparency leads to increased liquidity and tradability.

But since NFTs live on a blockchain, much of this transparency has been baked in since the beginning.

A sign of NFT authenticity

Original NFT pieces ultimately arise from a single creator’s blockchain address. Every single transfer from creator to owner leaves a permanent record on the blockchain. The artworks are effectively tokenized and contain data to track their source of origin and their transfers.

Being tokenized means every NFT has a Token ID within a collection, used to track its movements. The token ID and NFT image link to the InterPlanetary File System (IPFS), a protocol and peer-to-peer network for storing and sharing data in a distributed file system.

The image below is a screenshot of Bored Ape #4303 on Etherscan. Anyone can track the token’s movement, all the way from its minting, to subsequent transfers. You can also verify that the mint came from the address of Yuga Labs (Creators of BAYC).

“Sleepminting” fraud

Yes, blockchain technology allows for seamless tracking of an asset. But there is still plenty of room for fraud.

Some hackers, unable to alter the blockchains themselves, have found ways to manipulate them. One method of doing this is called sleepminting.

Sleepminting allows hackers to mint an original piece from an artist’s crypto wallet, and then transfer that piece back to the hacker’s wallet. The transactions are legitimate on the blockchain, as if the artist had approved the transaction. It’s almost undetectable.

We can look at a case study of sleepminting involving Beeple’s “the first 500 days.” Shortly after “the first 500” sold for $69 million at a Christie’s auction, a hacker/prankster known as Monsieur Personne sleepminted the piece.

He returned it to his wallet and listed it for sale for 0.25 ETH on Rarible. An exact copy of “the first 500” even appeared as Rarible-verified (!), with a black and yellow check beneath the Creator heading.

Hence, to spot a sleepminted piece from an original, one must check if both the mint transaction’s sender and the NFT’s sender match Beeple’s correct address. If not, it’s a fake.

Provenance as added value

We’ve established that authenticity and proof-of-ownership through the blockchain add value to NFTs. But provenance also refers to an NFT’s previous owner. Does celebrity ownership add value to NFTs? Let’s look at the recent Bored Ape acquisitions of basketball star Stephen Curry, and late-night show host Jimmy Fallon.

Curry bought his Bored Ape #7990 in August for $179k. On OpenSea, which has a feature for open offers, the highest bid on record is also for $179k. Fallon bought his Bored Ape #599 for $224k in November, with a high offer bid currently standing at $182k.

At the moment, it does not seem as if the Apes bought by Curry or Fallon are attracting a premium based on their celebrity. The truth is, it’s too early to know if the provenance of NFTs belonging to famous people will have the same effect as personal items belonging to famous people.

Secondary markets have shown that tangible, “celebrity-owned” items have value. But it’s one thing to own an NFT that Curry or Fallon once owned, but it’s another to hold a Curry game-worn jersey or a mug used by Fallon during “The Tonight Show.”

A celebrity advertising that their NFT is for sale could lead to a jump in value. And that’s to say nothing of the potential of a celebrity incorporating their NFT into their existing brand. (Would Fallon’s Bored Ape ever appear on a mug on his late-night show? Would Curry ever put his Ape on his sneakers to raise awareness for a charity?)

The possibilities and opportunities are out there. It’s a matter of whether or not they line up with the agendas of Hollywood’s image-makers. But in direct contrast to a celebrity flipping an NFT they never really used, a “branded Ape” (i.e., one that has been used to create another story or narrative) would have significant added-on value.

Branding leads us to our next section. Before minting, creators should clarify the project’s licensing agreements for the soon-to-be owners. While this provenance does not record on the blockchain, it is an important legal consideration for anyone looking to make a substantial investment into a PFP (profile picture) project.

Provenance tied to IP rights

While Bored Ape owners have the intellectual property (IP) rights to the underlying artwork of their NFT, CryptoPunk owners do not. This has created a rift between some Punk owners and Larva Labs (creators of the Punks). And some OG whales have now abandoned the project altogether.

Punk4156, as he’s known on Twitter, bought his punk for nearly $1.3 million back in February. With his new NFT in hand, he quickly built an entire brand around his new PFP, amassing 100k+ Twitter followers and using his influence to co-create and launch the Nouns DAO project.

With his investment and the brand he had built around it, it was safe to presume that he was a Punk for life. But even the most gifted and savvy market innovators in the NFT space can at times fail to consider the fine print.

For months, Larva Labs has been non-committal in specifying Punk owners’ licensing and IP rights. Over time, when Punk owners wanted clarity on the copyright, and when Larva Labs vacillated from an open license to a limited copyright license, some had enough.

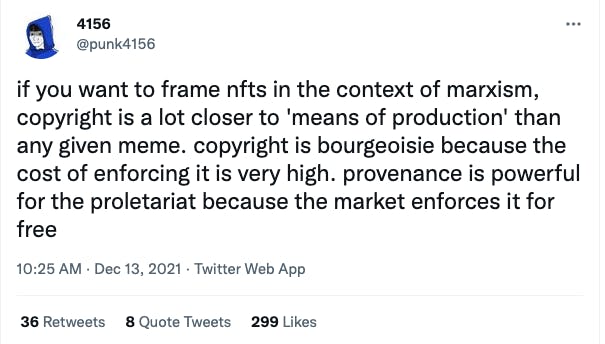

On Dec. 9, Punk 4156 sold his Punk for $10.2 million. He was no longer a Punk. 4156’s core belief of an open-source internet within a broader ownership structure did not align with Larva Labs’ legal entitlements.

Larva Labs brings the fight

It was inevitable that copycat projects would sprout everywhere with the value of some CryptoPunks rising 100,000x in two years. To fight this, Larva Labs has been aggressive in enforcing the Digital Millennium Copyright Act of 1998 (DMCA).

The DMCA balances the rights to a project between the copyright holder and the users. Its legal precedent determines if copyright infringement has occurred in the digital world. Larva Labs has issued takedown notices to the CryptoPhunks (A Polygon-based CryptoPunks ripoff) and Ryder Ripps; who copied a CryptoPunk and sold it as his own.

In the case of the CryptoPhunks, should those creators be allowed to copy and flip the Punks and sell the collection as left-facing originals? To what extent does Larva Labs get to stake a claim to its creation through its copyright?

Where you land on this boils down to your worldview. Some of the earliest NFT adopters grew up with the Bitcoin ethos of a government-free, fully democratized, and decentralized currency. This worldview believes that Creators have every right to profit, but their creations should also be available for others to use through a creative commons license with no rights reserved (CC0). It is the CC0, these OGs believe, that will genuinely liberate the Metaverse (Web3 community) from the current “web2” setup.

Just look at what 4152 has spawned through Nouns Dao. Because of the Nouns DAO open-source programming, Head DAO and Noundles have emerged and taken a prominent position among NFTs.

On their Substack, Otis wrote about Nike’s RTFKT acquisition:

Nike may be bringing its aggressive approach toward [IP] into the metaverse, and it will be interesting to see the ramifications….Earlier this year, Nike filed patents for digital versions of its iconic swoosh, as well as a host of other trademarks. The terms for RTFKT’s Clone X project also prohibit fractionalization and commercialization. Some have argued that this approach goes against the democratic principles at the core of blockchain tech. (emphasis mine)

Brands are hungry for new markets, and the Metaverse certainly provides one. But within the Web3 community, there are mixed emotions about companies establishing corporate “old-world” agendas. I expect these worldviews to clash for a long time.

Conclusion

What Hal Finney was describing 30 years ago was both revolutionary and staid. He told of a new form of technology engaged in the age-old commercialization practice. Finney was known as a builder, preferring to avoid the arguments that were all too common during Bitcoin’s early development in favor of improving the protocol.

What stance would he take in these IP battles, pitting crypto OG’s and a generation of younger kindred spirits raised on Instagram and TikTok, against the corporate behemoths who are coming to get theirs in the virtual world?

Will the dream of a truly, fully decentralized economy come into existence in the Metaverse? Or will the Nikes and Metas (ugh, still can’t believe we have to call Facebook that now) stake their claim to virtual lands that can only exist with the power of our collective imaginations?

One thing is for sure, the 4152’s of the world aren’t going down without a fight.