Hello and welcome to Alts Cafe

This is everything you need to know about what’s going on in the world of alternative assets, best enjoyed with your morning coffee.

Let’s go!

Table of Contents

Macro View

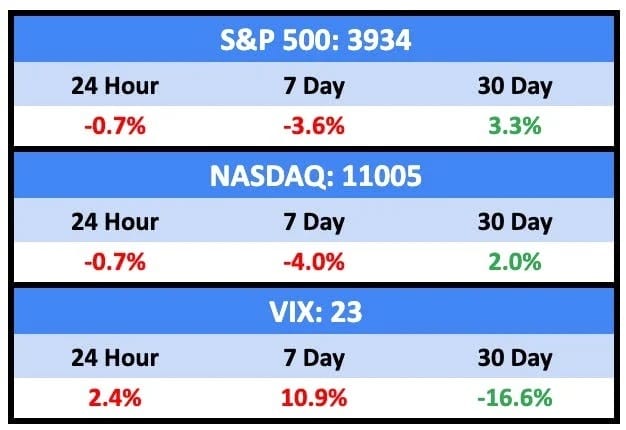

Tough week for stocks as the PPI came in higher than expected.

It’s also an exceptionally busy week from a macro point of view, as several key central banks report rate hikes this week. The US will be announcing on Wednesday, a day after the monthly inflation (CPI) report.

Bullish News

- New orders for US-manufactured goods increased more than expected in October amid strong gains in demand for machinery and a range of other goods.

- Fed Chairman Jerome Powell says lower rate hikes will come soon, possibly as early as this week. Markets currently predict a 75% chance of 50bps for December and 50% chance of 50bps in January.

- The eurozone annual inflation rate dropped to 10% in November. This is the first drop in inflation in 17 months.

- Emerging markets saw their biggest bump in foreign investment in nearly a year and a half.

- The US average for regular unleaded gasoline has declined to $3.29 a gallon, below its average of $3.36 last year.

- Prices for online goods in the US fell at a nearly 2% annual pace in November, which is a sign inflation is slowing or reversing.

- Canada may be done raising rates.

Bearish News

- In this week’s sign of the apocalypse, Nigel Farage now has an investment newsletter. (Spoiler alert: he likes gold).

- American jobless claims were up a bit last month.

- Everyone is predicting an awful 2023.

- US exports hit a seven-month low.

- Consumer spending is slowing down.

What are we doing?

ALTS 1 fund news:

We made an offer on a historic grail last week.

Crypto

Here’s what you need to know:

Crypto outperformed equities again last week as it mostly moved sideways during the previous seven days.

Likewise with the Fear and Greed Index:

Since the FTX displacement took crypto down 20% last month, it’s pretty much just moving sideways along a narrow band.

There’s so little happening with crypto that two of Milk Road’s five newsletters last week were dedicated to nonsense topics (a paid post for Roofstock and an interview with Tim Ferris):

So what did happen last week?

Regulation!

Bullish News

- Miami’s Art Basel looked fun, despite everyone there losing money this year.

- You can now earn Bitcoin by sponsoring solar projects in Africa via a new platform called SunExchange.

- Binance has seen a 30% jump in transaction volume since its CEO killed off FTX.

- The Ethereum merge has reduced emissions by 99%, and could represent a reduction in energy demands as big as some medium-size countries.

Bearish News

- Both America’s IRS and the UK’s HMRC are coming after your crypto. Leave it to the government to start taxing something when no one’s making a profit.

- America’s FTC is coming after all the celebs who shilled for crypto.

- Nexo, the last-remaining crypto lender in America, is leaving. The company cites a “regulatory dead end.”

- Coinbase is predicting a 50% drop in revenue.

What to do with that info:

Barring any more scandalous collapses, crypto feels ready to melt up.

Real Estate

Here’s what you need to know:

It’s a small thing, but today is the first time I’ve seen a fractional real estate marketplace list a new property with 0.0% forecast appreciation.

Props to Lofty for telling it like it is.

Bullish News

- Average rent in Manhattan has topped $5k/mo.

- Applications to refinance homes rose 5% last week (though they’re still down 86% YoY).

Bearish News

- Over the last decade, there was an influx of Americans into regions where climate change is making wildfires and extreme heat more common.

- Mortgage demand fell again.

What to do with that info:

Keep an eye on the CPI report tomorrow and hope it’s low.

NFTs

Here’s what you need to know:

It was a mixed week for NFTs.

Bullish News

- Sarah Ferguson, Duchess of York, has announced that she will not only launch a collection of NFTs but also an entire digital gallery to display them.

- Music NFT platform sound.xyz has paid out over $4m to artists this year.

- Opensea paid out $1B in royalties.

- Stripe has recently launched a new embeddable and customizable fiat-to-crypto onramp for its payments platform.

- Starbucks has finally opened beta testing its NFT project, Starbucks Odyssey.

- Crypto wallet-maker Ledger is launching an NFT-friendly version of its device.

Bearish News

What to do with that info:

Now feels like a good time to start accumulating.

Startups

Here’s what you need to know:

The sky’s not falling everywhere.

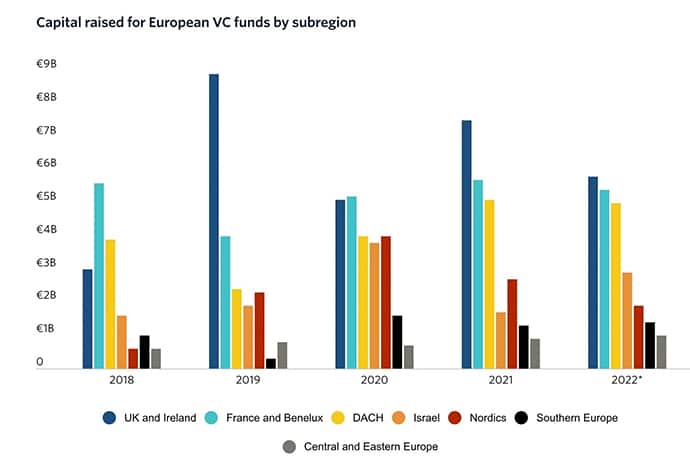

Despite significant headwinds in western Europe and the US, startup investment is actually up in some parts of the world:

Southern, Central, and Eastern Europe showed strength, while Israel nearly doubled its capital raised in 2022.

In other European news, London is now the biggest center for fintech fundraising, overtaking both Silicon Valley and New York in 2022.

Bullish News

- Goldman Sachs is going shopping for undervalued crypto startups.

Bearish News

- Slack CEO Stuart Butterfield is leaving the company in January.

- Venture investments are set to be the lowest for twenty years.

- In Q3, shares of private tech companies traded at a median discount of over 40%, compared to their most recent primary fundraising valuation.

- Things just keep getting worse for Carvana.

- Plaid has laid off 20% of its workers.

What to do with that info:

The Goldman Sachs news rings true to me. There are a lot of bargains out there.

Quick hits

Wine

Liv-Ex released its 2022 wrap-up this week.

Here are some of the highlights:

- The number of wines trading has overtaken the 2021 record, although the rise is slowing.

- The Liv-Ex Fine Wine 100 recorded it first dips in 18 months.

- Bordeaux’s market share fell to yet another low this year – 34.5% of total trade by value.

- The number of Burgundian wines traded on the market rose to over 4,000.

- Market sentiment for Champagne and Burgundy has begun to decline, with many high-value Burgundies becoming increasingly difficult to sell.

- Warning signs in the various Liv-Ex indices point to a period of drift for the fine wine market in the short term.

Sportscards

Fanatics, which acquired Topps, has raised over $700m at a $31B valuation.

This feels insane to me. The company raised $645m at an $18B valuation last year.

That’s all for this week. Hope you enjoyed your coffee and this edition of Alts Cafe.

Cheers,

Wyatt