Staycations, as opposed to overseas holidays, have seen a huge boom over the past 18 months. Which has caused thousands of buy-to-let landlords to consider switching to short-term lets. Should you consider switching to short-term lets? What are the advantages?

Table of Contents

What is a short-term let?

A short-term tenancy is when a landlord offers a rental property to the market for six months or less. If the property is being offered for 6 to 12 months it is considered a medium-term let, any longer and it is a long-term let.

Why are landlords switching?

ARLA Propertymark, a professional body for letting agents, says that over 230,000 UK landlords are ‘likely’ to switch to short-term lets. They also state that 1 in 10 landlords are tempted to join investors who have already made the move.

Landlords have had a difficult couple of years with the pandemic threatening profits and reforms to everything from stamp duty to tax relief.

Reasons they want to switch:

- 50% of landlords prefer the flexibility of short-term lets offer.

- 4 in 10 landlords fear increasing regulations in the renting sector.

- 25% of them said short-term lettings offered greater profits.

UK short-term let rules

The rapid increase in short-term letting has led countries to impose some restrictions.

UK restrictions:

- Short-term rentals in London are limited to 90 days per year. Longer periods need planning permission for ‘change of use’.

- For the rest of England, Wales and Scotland properties can be available for 140 days. More than this and you’re liable to business rates rather than council tax.

- Landlords in Northern Ireland must have a certificate from Tourism NI to provide tourist accommodation.

Benefits of Airbnb

Higher return on investment – When comparing the average price per night for a typical Airbnb in London compared to the average rent, landlords can make an additional £27 per night!

Simplified tenancy process – Airbnb hosts are constrained by less regulation than regular landlords. Regular landlords must go through a list of procedures to sign new tenants, such as handling deposits. This can add a lot of stress and delay to the tenancy process.

Peace of mind against damage – It’s all too common that when your tenant leaves, you go around and find carpets wrecked, broken door handles and lost keys. Then you have to fight the tenant to claim the deposit. The benefit of Airbnb is that most tenants don’t actually spend much time in the property, meaning wear and tear is greatly reduced.

Typically, the disadvantage of short-term lets is that they’re more likely to have long-vacant periods. However, in April 2020 Airbnb introduced a ‘long term’ booking feature, meaning that people can book stays of 28 days or more.

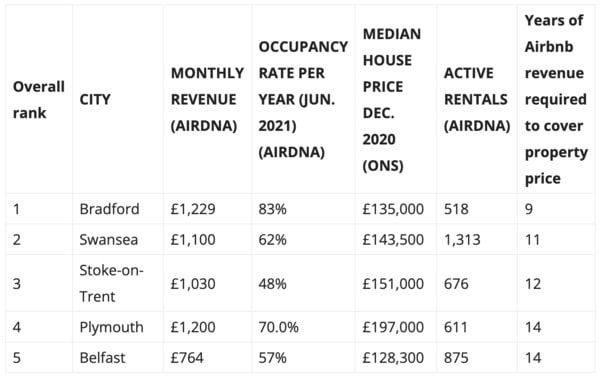

Top 5 most profitable areas

Bradford offers the best combination of low house prices and high Airbnb revenue. That’s good news for you, since Proptee is looking into listing properties from Bradford! Luton, London and Leicester are the UK’s least profitable cities to be an Airbnb host.

It would take nine years of Airbnb income to pay off a property purchase in Bradford compared to 42 years in Luton.