Hello and welcome to Alts Cafe

Here’s everything you need to know about what’s happening in the world of alternative assets, best enjoyed with your morning coffee.

Let’s go!

Table of Contents

Macro View

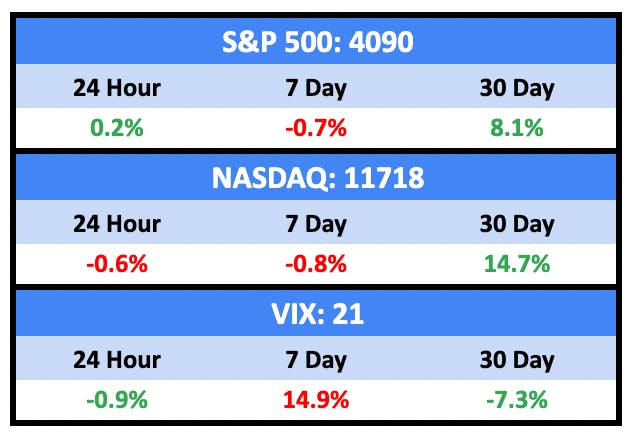

Markets jumped on what initially sounded like good news out of the Fed last week but went running for the hills once the deeper message sank in: interest rates will keep going up.

Here’s what you need to know:

There’s this sort of — I don’t know — unbridled optimism, lack of attention span, or something that just won’t let the markets believe it when the Fed says the pain will continue until morale improves.

We’ve seen this a lot over the last twelve months; investors keep thinking Fed Chair Jerome Powell is bluffing when he says rates will continue to climb.

And every time, he follows through with a rate hike.

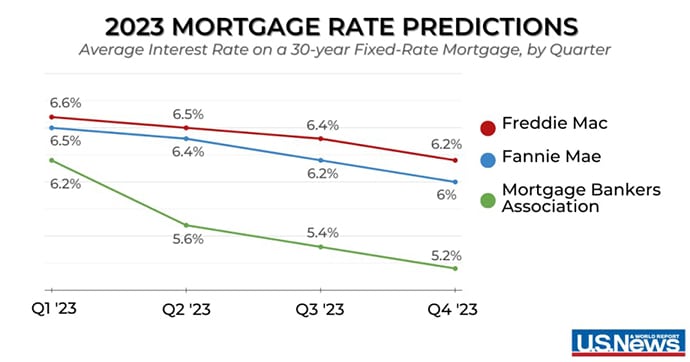

It’s happening again. Mortgage lenders are invariably predicting rates will come down this year. It took until JPow’s scolding last week for markets to price in another rate hike. And now, even though the Fed says we need more rate hikes (hello, plural!), investors are only pricing in one more. And the market expects a rates decrease before the end of 2023.

I don’t get it.

For everyone in the back: It will get worse before it gets better. Moreover, it has to get worse before it can get better.

When someone tells you what he’s going to do, believe him.

Bullish News

- Junk bonds are rallying, signaling investors think we’re in for a soft landing.

Bearish News

- According to the Fed, more interest rate increases (please note again, plural) are likely. As we’ve said, the market is only pricing in one more hike – 25bps in March.

- Americans have spent ~35% of the extra savings they accumulated during the pandemic. They’ll spend another 30% by the end of 2023.

- UK asset managers had their worst year ever for outflows in 2022. Over £50b exited the Brexit-laden country.

What are we doing?

ALTS 1 fund news:

Nothing to report here.

Real Estate

Here’s what you need to know:

The media has gone from completely ignoring the possibility of a housing market crisis correction to full-on panic stations:

- The Most Splendid Housing Bubbles in America

- Wells Fargo is stepping back from mortgages after the Fed’s rate hikes helped crater the US housing market

- Housing Market Crash: How Soon Will One Happen and What Cities Could Be Impacted the Most?

- Housing Market Crash Fears After Prices Fall for Fifth Month in a Row

- Is the housing market about to crash? Here’s what experts say

In last week’s Briefcase email, covering the real estate market, Brad brought up some sensible counterpoints to the MSM overcorrection.

First, housing inventory is super tight because no one wants to sell their $1.5k/mo mortgage home to buy a $3k/mo mortgage home. This will help keep prices high.

Second, even though the markets expect the Fed to increase rates again at the next meeting, housing economists broadly think mortgage rates will come down in 2023. This will encourage buyers to come to the table (including ones who need to sell their homes first).

Third, housing prices would have to drop 40% to 45% from peak prices to cause the economic collapse after 2008.

Finally, nervous homebuilders are running for the hills, which means there’s still a supply vs. demand problem. America needs 3m new homes per year, and we’re on pace for around 1m in 2023.

I’m not as optimistic as those guys, but I’m always skeptical of people who are paid to be optimistic (not Brad, realtors).

Bullish News

Bearish News

- This year, Google will spend $500m to get out of its office building contracts.

- YoY housing comparables continued to edge downward in November. Home prices are still up vs. 2021, but only for a short time.

How to invest in real estate right now:

Sit on your hands or chase yield. [Unchanged]

Crypto & NFTs

Here’s what you need to know:

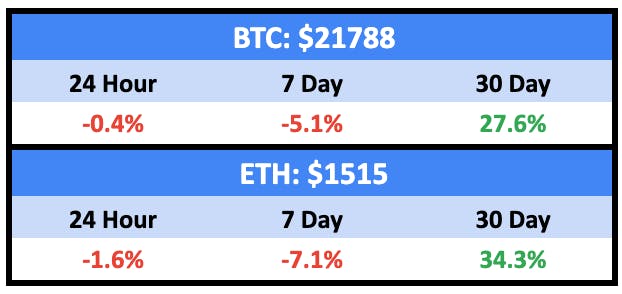

It was a tough week for crypto as it tumbled in line with the turbulent equities market:

Sentiment followed, moving back into Neutral territory:

NFTs, which are more volatile than crypto, are now underperforming both BTC and ETH in 2023:

Bullish News

- Digital bank Revolut launched crypto staking for UK and EEA customers.

- The NFT platform war between Blur and Opensea keeps hotting up. This competition is good news for NFT buyers.

- Bill Murray, who sold a 1k NFT project last year, had an in-person event with his holders. It was a solid proof-of-concept for celeb NFTs.

- Roofstock sold another house via NFT last week. The three-bed South Carolina gem went for $175k on Opensea.

- Bitcoin NFTs are off to a flying start even though Bitcoin maxis hate them.

Bearish News

- Nearly three out of four institutional traders “have no plans to trade crypto.“

- Turkey Relief DAO, launched to help victims of the Turkey / Syria earthquake, is struggling to raise funds.

- CryptoPunks and Bored apes account for nearly 50% of ETH’s market cap.

How to invest in Crypto & NFTs right now:

Crypto and NFTs are on their way back, and so are the scams. Beware.

Before we get into the Startups section, we’ve got something extremely cool to share:

You probably know Stripe is going public soon. This is one of the most highly anticipated IPOs of the past few years.

We’ve got a way you can buy shares in Stripe ahead of the IPO.

It’s through AssetTribe. AssetTribe is an alternative investing platform run by our friend Jeremy Davies (not the actor).

Here’s how it works:

- Stripe is financing at a discount to its last round, led by Thrive Capital.

- The 409A valuation was $24.71 per share. Thrive is investing at $22 per share (roughly $55bn valuation – down from $95bn)

- AssetTribe has an SPV with shares at $23 per share.

We expect this offer to fill very quickly. If you are interested, register your interest or invest directly.

This is your chance to buy Stripe before it goes public.

Startups

Here’s what you need to know:

We’re launching something incredible in the next few weeks. It’s called Venture Letter, and we want it to be a must-read for anyone looking for an edge in startup investing.

If this sounds like your thing, we’d be grateful to hear your thoughts about our first issue.

Sign up for our beta below, and you’ll get early access to Venture Letter and a month of Venture Letter Pro for free.

Bullish News

- Small-cap AI companies are crushing it in 2023, paralleling the private startup markets.

- Partech, a global VC firm, reached the first close of Partech Africa II at €245 million (~$263 million), making it the largest Africa-focused fund yet.

- More than half of the institutional traders say that artificial intelligence and machine learning will be the most influential technology in shaping the future of trading over the next three years. Only 12% predicted crypto would have the biggest influence.

- Over the last 12 months, San Francisco has seen the second-biggest worker population gain of any area in the United States.

Bearish News

- BNPL giant Affirm slashed 19% of its workforce and killed its crypto unit. Gusto fired 126 people, around 5%. Yahoo!, which owns TechCrunch, fired 1,600 people, or around 20%.

- India is cracking down on betting and loan apps, citing consumer privacy. This is going to kill a lot of startups in the South Asian market.

How to invest in startups right now:

Get an edge on investing in startups with Venture Letter.

That’s all for this week. I hope you enjoyed your coffee and this edition of Alts Cafe. ☕

If you have any comments, questions, or concerns – let us know. Cheers, Wyatt

Disclosures

- This issue was sponsored by Kingscrowd.

- We are holding BTC and ETC in our ALTS 1 Fund. Apart from those, we don’t own any other assets mentioned in this email.