An honest look at how it started and how it’s going.

This week marks six months since I started Alternative Assets. Given that it’s the end of the year, I figured it would be interesting to do a recap issue looking back over the past half year. How it started, how it’s going, what I’ve learned, and a whole lot more.

Let’s dive in!

Table of Contents

How Alternative Assets started

I started Alternative Assets in July, during Melbourne’s big lockdown. While Australia as a whole has fared phenomenally well throughout the pandemic (once again living up to its title as “The Lucky Country”) the city of Melbourne had a breakout in July which led to a massive city-wide lockdown.

This was one of the most disproportionally strong lockdowns in the entire world. Despite having a peak of just ~700 cases per day, roughly 15x less what similar sized cities in the US & Europe are seeing now, the government shut down nearly everything imaginable for a whopping 15 weeks.

Having nothing better to do on the weekends, I decided to start writing again. I’ve been writing on & off since college, but after a few months I would always end up stopping. This time, I wanted to commit to it.

The parent: A deals analysis newsletter

At the time, I had a very small newsletter that I sent out every few months. It was a deals analysis newsletter, where I’d take the best deals I saw on Flippa, and email a few dozen folks to let them know why I thought it was a good deal. I also wanted to see if there was anyone out there who might want to go in on a good deal with me, using sort of an “owner-operator model” that Mushfiq Sarker has a nice case study on.

During lockdown, I realized I was onto something with that “parent” newsletter. Flippa was having a great year, and I remember thinking back in June that it felt like we were “having a moment.” I still very much feel that way today.

But I also realized there was so much more to this world than digital assets… To those listening closely, the drumbeat was getting louder on a tangential world of fractional investment opportunities driven by technology; including trading cards, farmland, wine, cars, memorabilia, collectibles, and a whole lot more.

I started noticing opportunities everywhere. Owning websites was always top of mind, and I knew I wanted to keep writing about that asset class. But I began seeing passive & active investment opportunities in all sorts of places — especially in areas off the beaten VC track.

Ebooks. Artwork. Sports memorabilia. The obscure artist you’re listening to on Spotify. The billboard you drive by on the way to the beach. The farmland it sits on. The small island you see in the distance. The photo you take of it. The social media account you post it to. Even the very newsletter you’re writing.

There were so many potential assets to explore. I figured there was an opportunity to bridge all these worlds. To sort of weave everything together into a nice web that I would call Alternative Assets.

Newsletter-Market Fit

As any good product manager knows, you should validate big ideas before going too deep. The way I validated this newsletter was by whipping up a quick train-of-thought post which became issue #1.

The response I got to that first issue gave me the feeling I was on to something. There were no groundbreaking insights, just a collection of topics I was interested in, loosely tied together under a theme of “alternative assets.” But the engagement was fantastic: lots of clicks and interesting replies. It was more than enough fuel to really start exploring deeper.

When you get product-market fit, there’s often a specific moment where it everything just clicks. Other times there’s not one single moment, but you know it when you feel it. Like a series of small moments when you know you’re on to something good.

That’s how I felt writing the first few issues of Alternative Assets. It was clear not only were readers clicking, the whole newsletter itself was clicking.

It felt like newsletter-market fit.

Since starting, feedback, questions, comments, suggestions and ideas have continued to pour in. Yes it’s been a tough year and the bar is low, but still — getting to know Alternative Assets readers on a personal level has been my favorite thing about 2020.

Q&A with myself

I’ve received lots of questions from readers over the past 6 months. I figured I’d share some of them here in a Q&A format.

(Yes, this is essentially me interviewing myself. But it’s my newsletter and I can do what I want. Hooray!)

How do you decide on a topic?

When I first got going, I created a Google Doc where I put all my ideas.

At one point I was worried I would run out of topics. Sure, that list was nice, but what happens when you run out of things to write about? After all, there’s so many times you can cover investing in wine or racehorses.

But after a few months, that list had grown to three pages. In fact now it’s six pages long, and has gotten to the point where I probably scribble down a full page of loose ideas each month.

I think the fact that I am bridging worlds provides more than enough cover. I don’t see myself ever getting bored or running out of topics. There are all sorts of derivative ideas to explore, and the fact that the industry is growing so quickly means there are plenty of of other smart people out there, writing, podcasting, debating, seeding ideas and helping move conversations forward.

Lately I’ve tried to time newsletters to external events. (For example, ‘Investing in Christmas Trees’ was published during the busiest tree-buying week of the year.) But mostly I just explore whatever I want to learn about that particular week.

That’s really why I do this: To teach myself something new each week.

How do you research each topic?

Since I publish on Sunday, I usually decide on a next topic by the previous Tuesday or Wednesday.

I typically start by finding some semi-obscure podcasts about a topic, and spend a few days listening to maybe two or three episodes. This gets me in the right frame of mind. I use these podcasts to start to get inside the heads of folks in each industry, and form a mental outline of interesting sub-topics I want to cover.

I’ll be honest: There have been weeks when I delayed deciding what to write about until ~48 hours before publishing. I feel like some of those issues aren’t as good as others, so I try to really plan things out in advance now.

What was your favorite issue?

My issues are kind of like my babies, I enjoy each one for a different reason. But a few favorites come to mind:

- The Economics of ADUs . We had just finished building our ADU, and I was a bit nervous because while I had done some napkin math (okay, spreadsheet math), I had never really done the full research I should have before building. But while writing the piece, it was clear our ADU was indeed backed by some truly solid numbers, which was reassuring and felt great.

- Investing in Wine was inspired by a Netflix documentary on wine fraud that I watched a few days before. I got pretty hammered while writing it, and asked my wife to edit all the typos out before sending ????

- The World of Newsletter Acquisitions was the issue where everything really started to click. The timing was perfect — I bundled it with an interview I did with Yaro Bagriy, and saw a huge boost in subscribers afterwards. It has since been linked to by some high-profile newsletters, and to this day it remains my most highly read issue.

- The World of Billboard Investing was interesting because it’s an asset that people overlook. Listening to podcasts on the topic was eye-opening (err, I suppose ear-opening) because it made you realize there was this whole industry out there with good margins, interesting characters, and institutional knowledge. Oh, and right now probably represents the single best buying opportunity in decades.

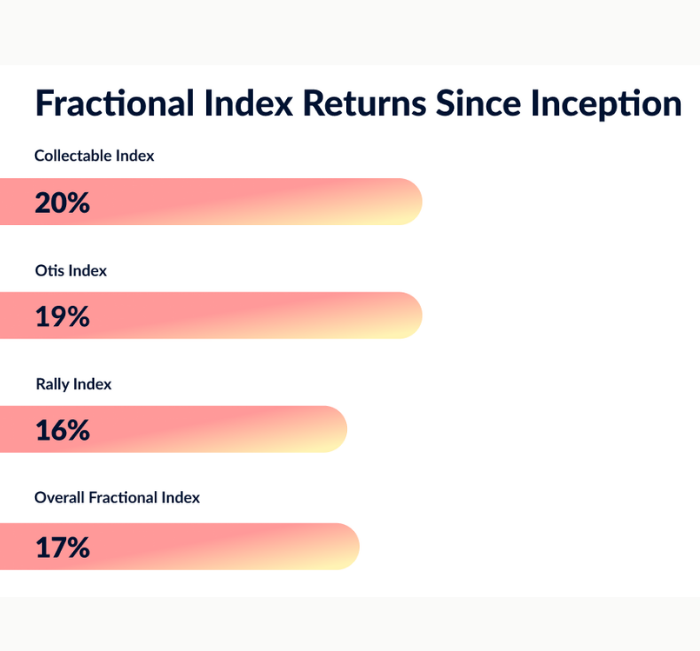

- Finally, the deep dive I did on Collectable was a lot of fun, and the interview with the CEO Ezra marked the official kickoff of the Alternative Assets podcast. One challenge publishers face is how to stay neutral in writing & reporting while also accepting advertising dollars from the very companies they write about. (At this point, TechCrunch is essentially pay-to-play journalism.) Although I’m new to this game, I feel like with that issue I tread the line carefully, made a concerted, conscious effort towards maintaining neutrality, and handled it with aplomb.

Do you find writing easy?

Fuck no. Writing can be hard, lonely work.

I happen to love doing it, sure. But that doesn’t mean it’s easy.

There’s times when I wish an issue would just write itself. There’s times when I’m deep in a rabbit hole on a topic, and feel like I could keep exploring & analyzing for days. That’s why editing is so important. It’s tough to chop off certain avenues of exploration, but it’s a must.

I think you have to really love what you’re writing about. Same thing applies to where you work, where you live, and who you spend your time with.

You should love what you do. Otherwise what’s the point?

What was your least favorite issue?

My least favorite issue to write probably the one about Facebook video gaining steam.

I put off starting that one until it was way too late, and was halfway done with the issue when I realized I simply didn’t care about the topic as much as I thought I would.

That issue reminded me of writing a high school term paper the night before it’s due. It felt like a chore.

What advice would you give someone starting a newsletter?

Make sure you’re prepared for the commitment. Consistency is everything. If you say you’re going to do a weekly newsletter, then all else being equal it better be weekly!

Also, don’t over-think your newsletter stack. Too many people get so hung up on whether to use Substack or Convertkit or WordPress or Ghost or whatever. None of it really matters. Just start writing, that’s the important thing.

Your business is in delivering words. Your readers are literally rows on a CSV file. This isn’t like using Salesforce — if a product isn’t working out you can easily swap it later. Next year I plan on switching from Substack to Convertkit. I expect this to take a few hours max.

Finally, when you’re ready to write, put your fucking phone away and stop checking Twitter. I’m not kidding. They are the enemies of productivity.

Update on personal projects

Over the past 6 months I’ve referenced a few personal projects and new opportunities I’ve been exploring. Here is an update on how some these are going.

Distressed travel website

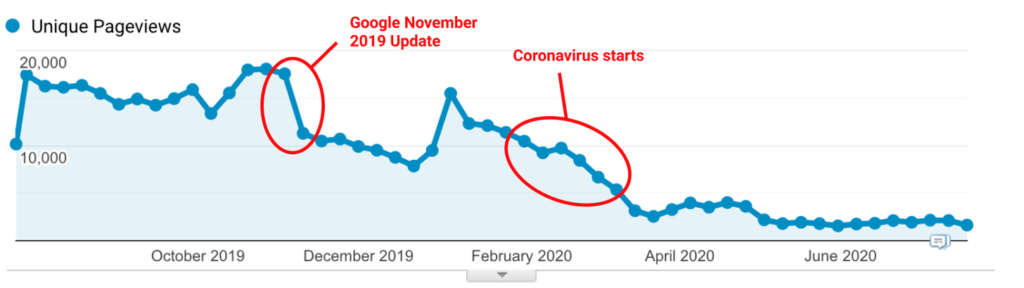

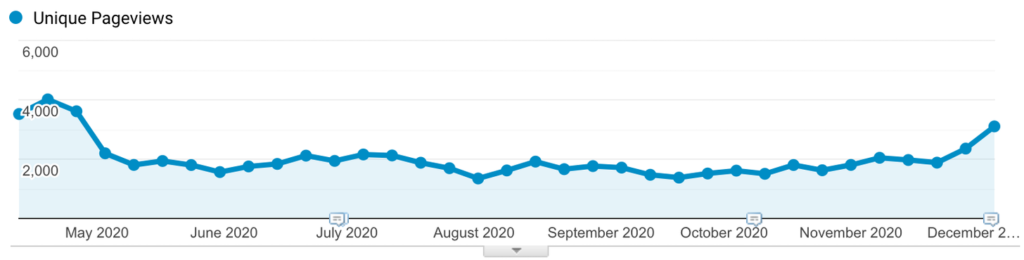

Way back in issue #2, I wrote about buying distressed websites, with an analysis of a travel blog I had recently bought just after the pandemic hit.

Like many people, I had originally figured the pandemic would be a factor for maybe 9-12 months. Sure, travel & entertainment would get nuked, but things could very well be back to normal before we knew it.

It’s clear now that optimistic projection didn’t pan out, and for a while I regretted my decision to buy the site. Traffic was in the toilet, and just like the travel industry as a whole, revenue was showing no signs of recovery at all.

After spending some money improving site speed & producing new content, I couldn’t bear to look at the numbers anymore. I decided I wouldn’t spend another dime. Instead, I would just milk it for whatever I could until the industry rebounded and traffic (hopefully) improved.

As site owner, I constantly get emails from bloggers to publish guest posts and sponsored posts. I used to ignore these requests, as conventional wisdom implies selling posts and backlinks is technically verboten. and quick ticket to a fat Google penalty. But screw it, I thought. I have nothing to lose. So I started accepting every single paid post request that came my way.

Yes that’s right — I turned the blog into a pure funnel for selling posts and backlinks, and began earning a few hundred bucks per month publishing nothing but sponsored content.

Then the unthinkable happened. The December Google update hit and, to my surprise, traffic to the site doubled overnight. ????

I’m not even kidding. Other sites I own that I’ve been putting my heart and soul into were either flat or slightly down. Yet this site, which for months I have been essentially pimping out to the highest bidder, doubled its traffic and ad revenue.

Who knows how long it lasts (probably until the next update.) But in the meantime, it’s the most unfair thing in the world. I don’t know what to make of it.

Amazon KDP e-book

Back in issue #12, I looked at the world of publishing with Amazon KDP. As part of the issue, I interviewed subscriber Stephen D., who has published dozens of ebooks through Amazon KDP under a variety of pen names.

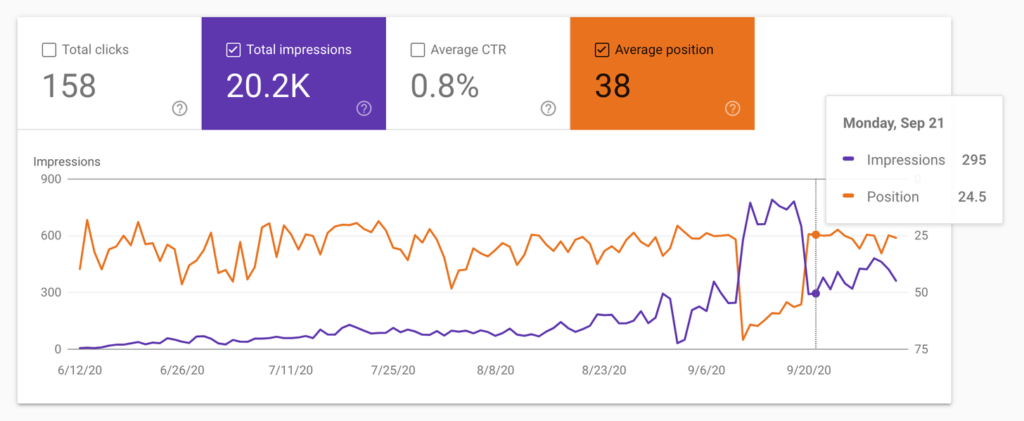

In the issue, I mentioned a massive article I had written, which I was having trouble getting to rank in Google.

On Stephen’s advice, I decided to repurpose this content by publishing it as an ebook. The process was pretty straightforward: Hire a few folks on Upwork to re-format the content and design some cover art.

I actually just hit publish yesterday, and am proud to announce that The Big Book of Australian Slang is now available for sale on Amazon!

I have no idea how well it’ll sell, but it was easy to produce and at the least should be a fun experiment.

Vinovest

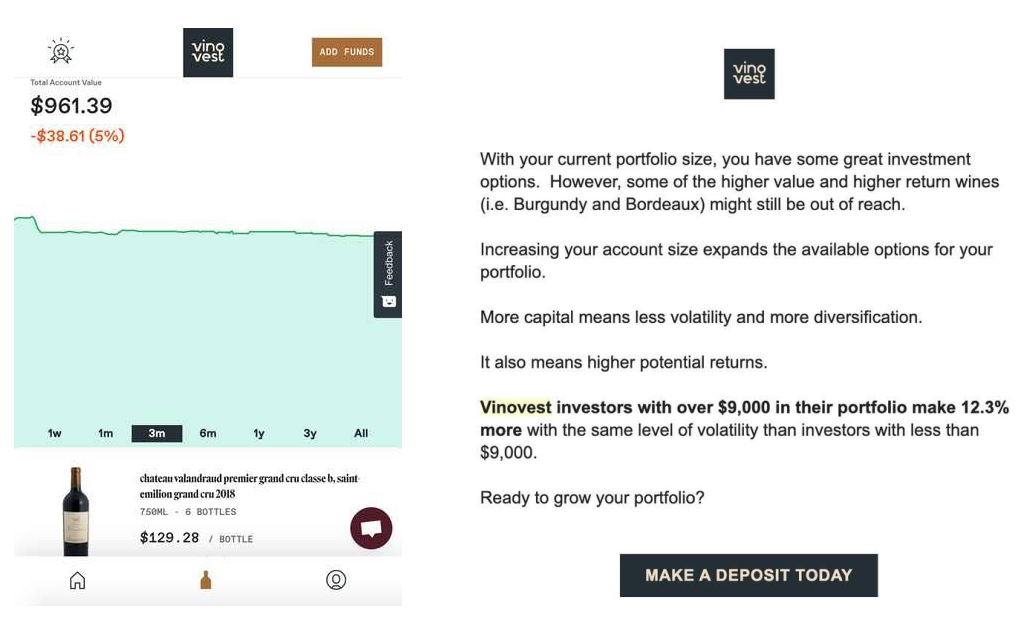

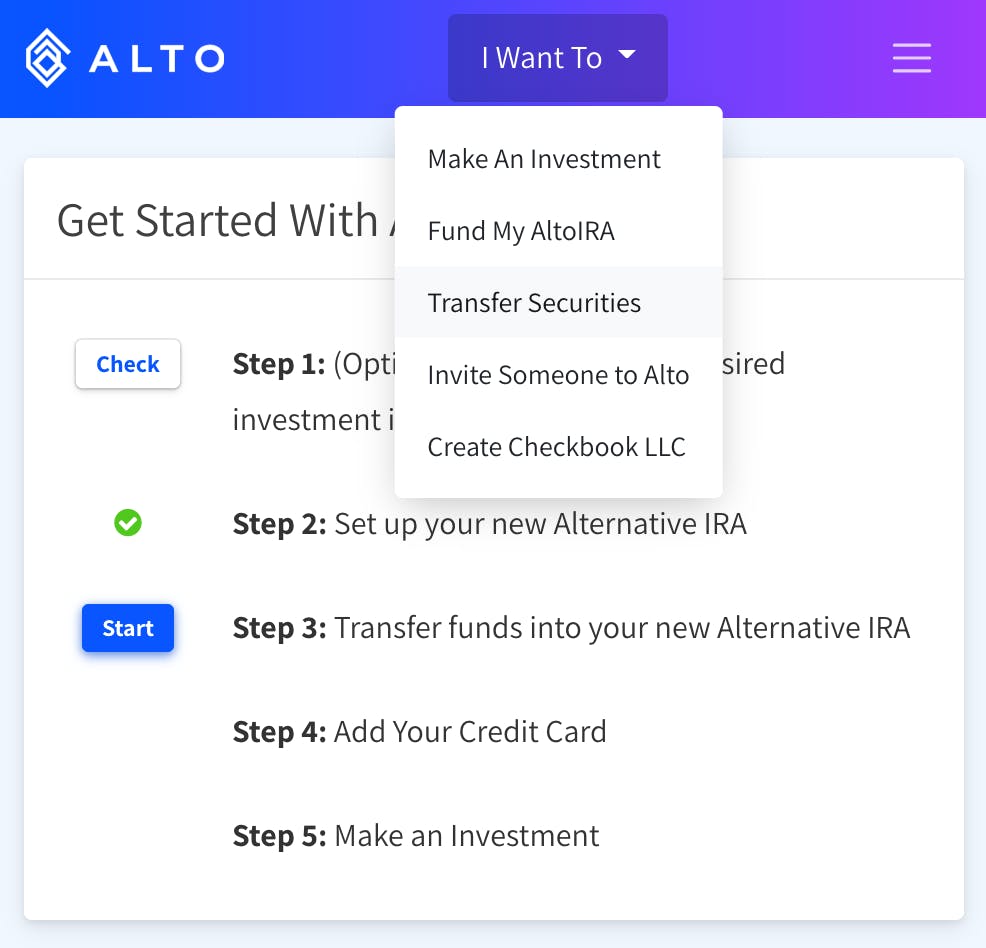

The night of my drunken exploration into wine investing, I put $1,000 into some bottles through Vinovest.

- They assigned me six bottles at ~$130 each, from Bordeaux region

- My portfolio of bottles is “down” 5% so far

- They later sent an email saying essentially, “If you want better returns, you gotta put in at least $10,000!” Which actually makes sense, but I found it off-putting.

I’m not too worried about my bottles losing value. Worse case scenario they get stored safely in a facility for a few years. If they’re still flat by the time our 20th wedding anniversary hits, we’ll order them to be delivered & celebrate with friends and family.

But I’d like to see some positive “returns” before dumping more in. This would be really simple for Vinovest to do (even if they sort of “faked” it a bit) and would be a lot more compelling of a call to action than, “Want to avoid losing money? Put more money in, sucker!”

California ADU

As mentioned above, our Accessory Dwelling Unit is going extremely well. I typically shy away from writing about real estate investments, but if you keep construction costs down, ADU economics can be truly fantastic.

International travel may still be toast, but if anything the pandemic has increased the demand for home offices, “man-caves”, unique working/living spaces, and the type of rentable, self-sustained units that ADUs provide.

If I had the expertise and time, I’d raise a fund to convert more of these. And I’m on the hunt for an ADU website as we speak. I really love this space.

Newsletter acquisition

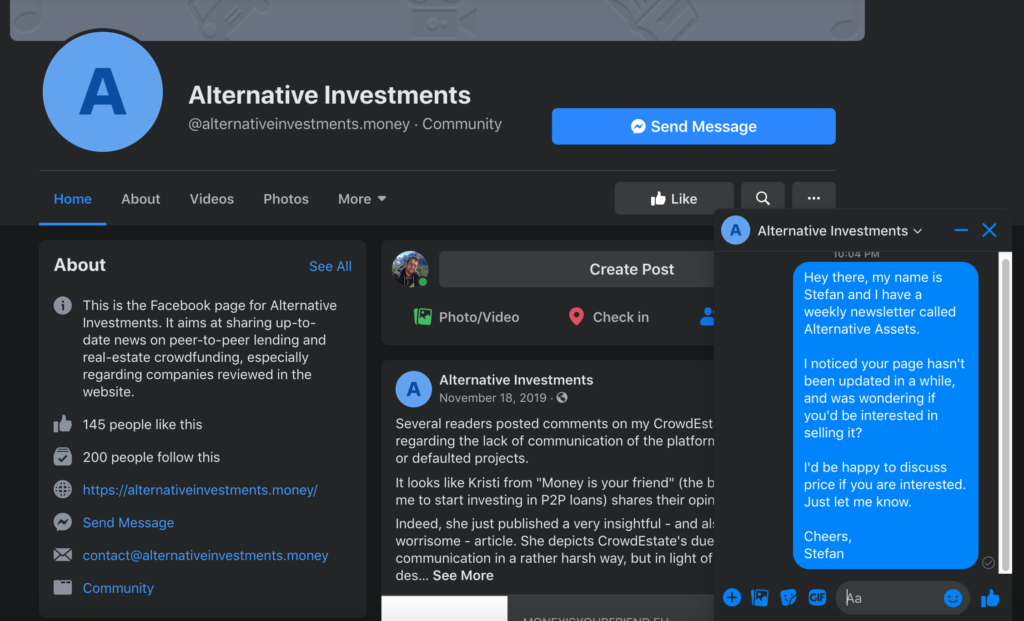

Since publishing my piece on newsletter acquisitions, I’ve been on the lookout for good opportunities to do exactly that.

My lookout recently turned into a hunt, when subscriber Jakob Greenfield (who is an absolute product machine by the way) released Newsletter Spy — a massive database of over 20,000 Substack newsletters that includes subscriber counts, descriptions, and date of last publication.

I’ve been emailing dormant newsletter owners in the finance niche, making offers to buy their audience and continue where they left off.

I’ve also been doing the same with dead Facebook Pages. There are plenty of groups which haven’t updated in months or even years. I figure page owners may be even more receptive than newsletter owners — and the outreach through FB feels a bit more “natural” than a cold email.

Thank you

Finally, I’d like to thank each and every one of you for being a subscriber

Like I said, writing a newsletter isn’t easy. There are times when I’m unsure if this whole thing is worth it.

But I love writing about this space, and get a massive amount of enjoyment sharing my thoughts with you. You guys are the fuel that keeps me going.

You have all been so helpful in this journey. Thank you.