Welcome to Sports Memorabilia Insider – Free Version.

We use Moneyball tactics to discover undervalued, mispriced, and hidden gems in Fractional Investing.

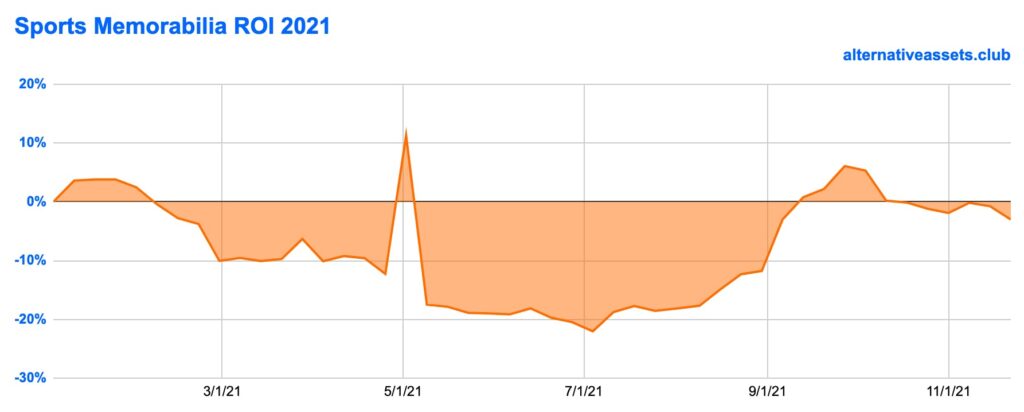

Sports memorabilia continues to hover around breakeven for the year after a sizeable recovery in July and August.

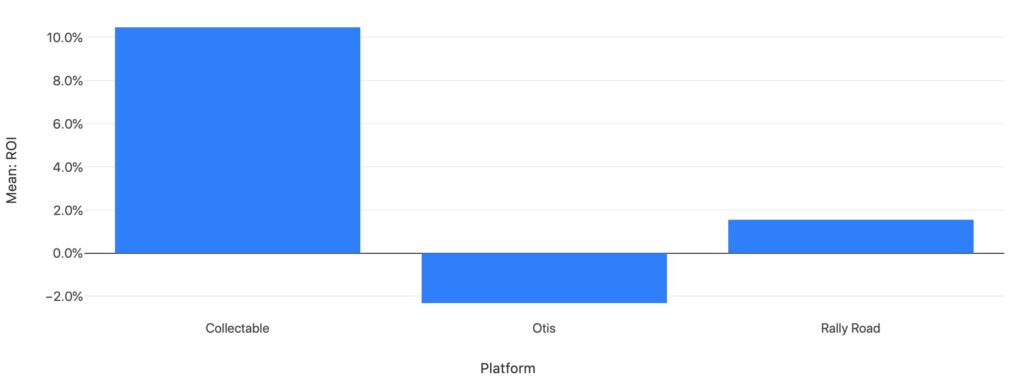

A few weeks ago, we talked about what might be causing the dip in sports memorabilia, particularly on fractional platforms like Collectable, Rally and Otis. A disproportionate number of memorabilia assets are on Collectable, so we wondered if it’s an asset issue or a platform issue.

It looks like…probably not a platform issue.

The lifetime ROI for sports memorabilia on Collectable significantly outpaces that of other fractional platforms. In this case, Collectable is keeping the asset class above water if anything.

Table of Contents

Last Week

Fractional secondary markets

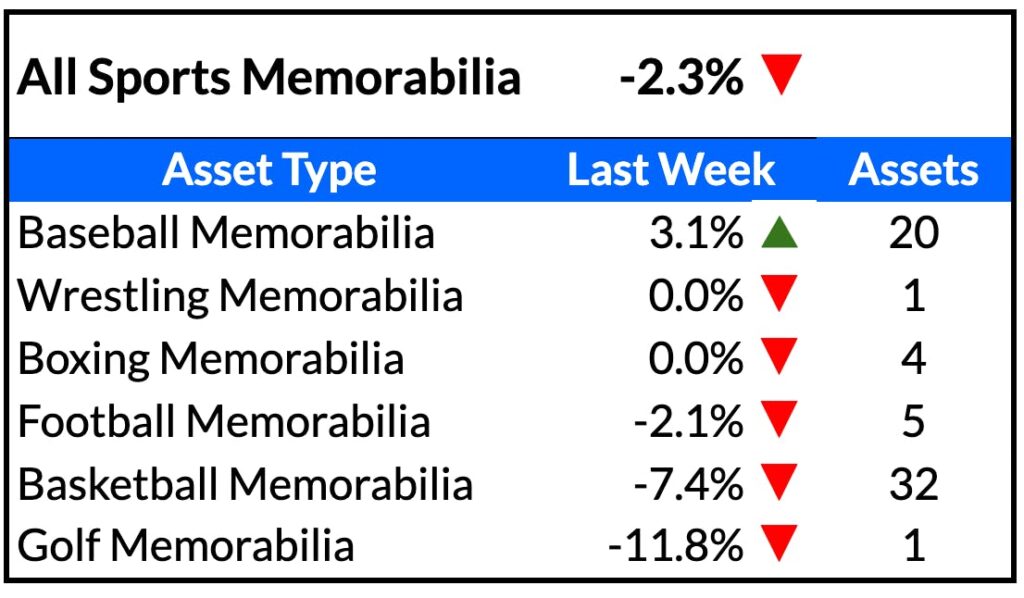

The sports memorabilia category continued its recent weak performance with a decrease of 2.3% last week (down 6.5% over the previous two weeks). A recent buyout should help buoy sports memorabilia’s performance this week (more on that below).

The sub-category of baseball memorabilia led the way with a 3.1% advance. Leading the decliners were basketball (-7.4%) and golf memorabilia (-11.8%) highlighted by a 20% decline in the Kevin Durant high school jersey and a pair of Kobe assets declining by over 15% each (2006 jersey down by 18.6% and final season game worn sneakers down by 17.6%).

This Week

Assets dropping on marketplaces

No IPOs or assets new to trading this week as Rally switches to live trading and the Thanksgiving holiday in the US causes a slow week on the various platforms.

Buyouts

Stephen Curry ‘12-’13 Nike Player Exclusive Game Worn Sneakers

- Market Cap: $78,500

- Inferred Value: $60,000

- Platform: Collectable

- Buyout Offer $110,000 (33.8% gain from IPO price) was accepted by 80% of owners.

Auctions

Heritage completed their November auction last week with some of the lots providing good comps for sports memorabilia trading on the fractional platforms.

2007 Brett Favre Game Worn, Signed and Inscribed Green Bay Packers Jersey Photo Matched to 11/4 vs. Chiefs (Heritage Auctions November 18 – 20 Fall Sports Collectibles)

- Final sale price of $11,100

- A basket of three game worn jerseys, including a Favre, is currently trading on Collectable at a market cap of $30,426.

- Recent comps for other jerseys in basket indicate a total inferred value of $53,700 (inferred value updated to $53,700).

1946 Joe DiMaggio Game Worn & Signed New York Yankees Jersey Photo Matched to Home Opener (Heritage Auctions November 18 – 20 Fall Sports Collectibles)

- Final sale price of $216,000

- Rally has a DiMaggio 1950-51 game worn jersey from Joe’s final seasons that last traded at a $442,000 market cap.

- The 1946 jersey is a superior asset to the Rally jersey (earlier in the Yankee Clippers career with the added backstory of being worn in his first game back from military service in WWII; autographed by Dimaggio).

- Updating inferred value of Rally asset to $200,000.

1931 Babe Ruth Single Signed & Inscribed 571st Career Home Run Baseball (Heritage Auctions November 18 – 20 Fall Sports Collection)

- Final sale price of $156,000

- Rally trades a Ruth signed non-game used baseball for a market cap of $60,600.

- Another Ruth ball sold at the same Heritage auction for $66,000, which is a more direct comp for the Rally offering (same time period/non-game used/same autograph rating of PSA 7).

- Updating inferred value of Rally asset to $66,000.

1954 Mickey Mantle Game Worn and Signed New York Yankees Jersey, MEARS A9 (Heritage Auctions November 18 – 20 Fall Sports Collection)

- Final sale price of $615,000

- Rally has a 1960 game worn and signed Mantle jersey with a current market cap of $850,000.

- The Rally offering is graded one level higher than the Heritage piece, but is from 6 years later in Mantle’s career; neither jersey is photo-matched, but based on trends from the era, were most likely worn in the same number of games.

- Heritage sold a 1958 Mantle game worn and signed jersey for $240,000 in August 2021 with a MEARS rating of A7.

- Updating inferred value of Rally asset to $300,000 (premium over 1958 jersey due to higher grade, but lower than 1954 jersey).