Welcome to Startups Insider for 15th December 2021.

We analyze deals across AngelList, Republic, WeFunder, and more.

Today we’re doing a deep dive into a startup that may actually change your life, Tap Systems, Inc. Or at least relieve your carpal tunnel.

Table of Contents

Deep Dive into TAP Systems, Inc

Investment overview

Tap Systems, Inc

- Raising: $1.5m (currently oversubscribed)

- Valuation: $51.2m pre-money

- How to invest: Available on WeFunder

- Recommendation: [Insiders Only]

The Disappearance of the Keyboard

Keyboards may not exist in the future.

The keyboard is a vestige from the age of typewriters, and has largely remained unchanged. Though Apple has streamlined keyboards and made them far more ergonomic than they once were, they’re often too small to be comfortable or too large to be portable.

And talking ergonomics, they still use the QWERTY layout which was intentionally designed to be inefficient (because fast typing caused key jamming in typewriters).

An industry ripe for disruption, you’d think. And you’d be right.

The problem with alternative keyboards

While alternative keyboards have been around for a while, they’ve certainly experienced a mixed bag of results.

Let’s take a look at the issues faced by these technologies, and the opportunity this creates for Tap With Us.

Virtual keyboards

First we have virtual keyboards, where a laser-projected keyboard allows typing onto any flat surface. Comfortable and portable, these allow for typing on full size keyboards, without the need for transporting physical keyboards.

They have their manufacturing drawbacks, however, as many Amazon reviews show. Buyers complain about the devices not working for them, or being hard to see in the wrong lighting. And they still use the good old fashioned QWERTY layout.

Voice recognition

Enter voice recognition technology, one of the most successful evolutions of the keyboard we’ve seen so far. Touch-free typing and searching lets us be productive on the move, multitasking in a way classic keyboards don’t allow for.

And thanks to the ongoing retail competition between Google, Amazon and Apple, voice recognition algorithms continue to improve (great news if you’re not an American male). However, voice recognition is not practical for data input that must be confidential or secret, like passwords.

Gesture recognition

Lastly, gesture recognition has struggled to take off due to the prevailing paradigm of large haptic gloves or using computer vision for hand recognition. Another practical issue is that XR headsets require holding large controllers which must be kept charged.

Darwin vs. Mouse

Keyboards are only one half of the input to devices – the other is the mouse, and while the aforementioned alternatives allow for typing, cursor control has only seen usage in Wii and smart remotes.

The mouse is still necessary, but mice haven’t evolved much at all. Touchpads and mice alike are very hard on hands and wrists, and typists are forced to alternate between the keyboard and mouse which is both inefficient and uncomfortable, as anyone who’s suffered from carpal tunnel syndrome will testify.

So what is Tap With Us?

Founded in 2015, Tap With Us is a first-of-its-kind haptic keyboard for typing and cursor control, and it successfully addresses many of the issues we’ve covered so far. It’s founded by a trio of stellar inventors and entrepreneurs (more on them next), and at time of writing has a $50 million pre-money valuation.

But first… Let’s understand this product.

How does it work?

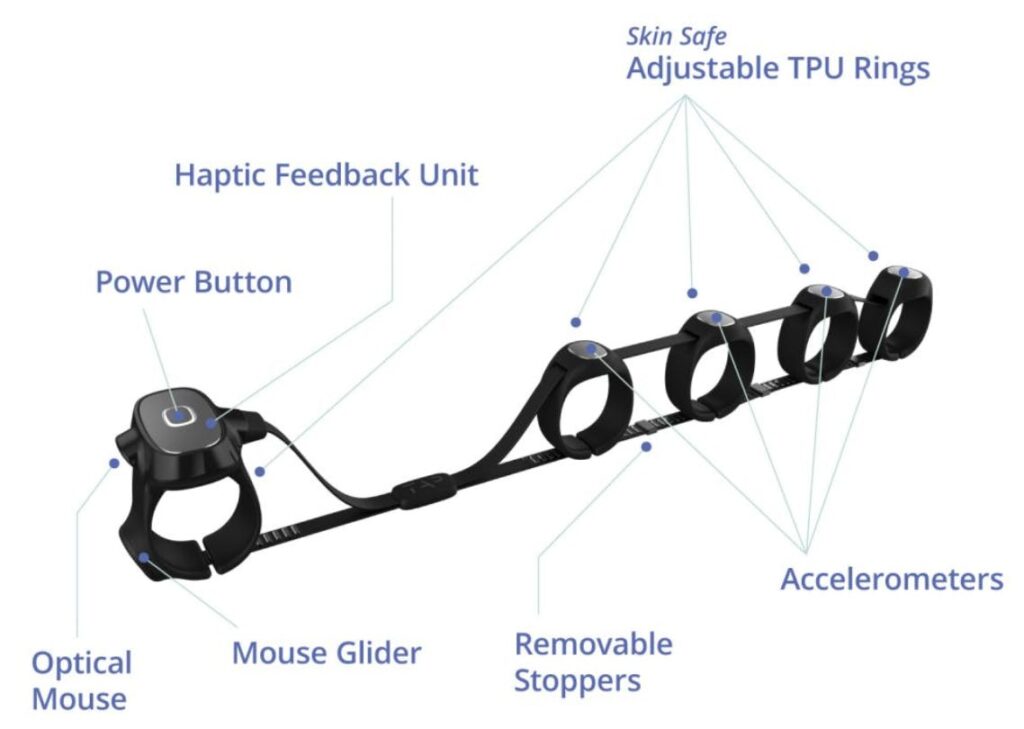

The TapStrap takes the form of banded loops that are worn on the fingers, containing accelerometers and an IMU (gyroscope) which interpret the finger movements as various keys, and then connect to HID-compatible devices using Bluetooth. Tap integrates with laptops, smart devices, smart televisions, and VR headsets.

The neatest feature of Tap is that it can play the role of three different devices depending on the orientation of the hand:

- Parallel to a surface, it operates as a keyboard.

- Parallel to a surface with the thumb on the surface, it acts like a conventional mouse

- Perpendicular to a surface, it works like a touch controller for a VR headset, like a mouse in 3D space.

Typing Mode

To use Tap like a keyboard, you need a small flat surface (even an arm) and various combinations of the fingers to make letters. For example, to spell the word, “INTO”, you would tap the following sequence:

- I = Middle Finger

- N = Thumb+Index

- T = Index+Middle

- O = Ring Finger

In action, it’s a bit like a watching Ian Curtis re-incarnated into a hand:

30 days of training, 60 wpm speed record #TAPwithus #TapWPM pic.twitter.com/yTRMFtVEof

— Chris Topher (@creemama) February 18, 2019

Mouse Mode

To use Tap like a cursor you just move your whole hand. Mouse clicks are done by stretching one finger and flicking left or right. To scroll, stretch two fingers and flick in the direction of the scroll. And for the Most Minority Report Thing Ever, you can pair to an iOS device and change screens by pinching together your thumb and index finger.

The bull case for Tap

Controller Mode

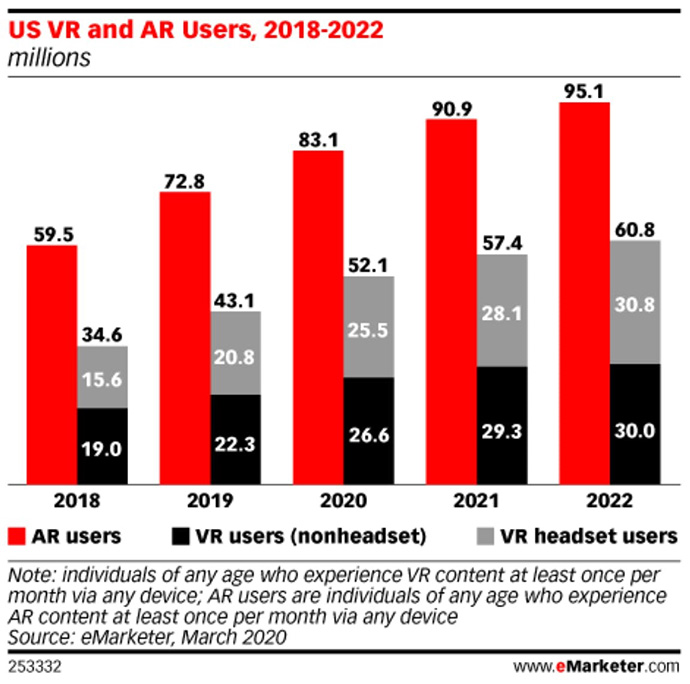

Combined with a VR headset, Tap allows for typing entirely within the confines of virtual reality space, without the need for a simulated keyboard. Virtual reality in the workplace boomed during the pandemic, and traditional controllers were more suitable for gaming than for typing.

Tap With Us presents an attractive alternative, by innovating the gesture control interface, and creating one piece of kit that effectively does the job of several.

The Team

Tap With Us has a phenomenal team of founders, Dovid Schick, Sabrina Kemeny and Ran Poliakine. Let’s take a look at each individual:

- Schick, a UPenn alum, was the Inventor of the first real-time digital dental X-Ray devices. The company that he founded to sell the technology was sold for nearly $2 billion.

- Kemeny, a Columbia PhD, co-invented the camera-on-a-chip technology which revolutionized digital imaging and is at the core of every cell phone and digital camera. The company that sold this technology was bought by Micron, which went on to dominate the image sensor market.

- Poliakine is a serial entrepreneur. Tap With Us is his 7th company. His previous six are powering healthcare practices across the world. His first company, Powermat Technologies, was a wireless charging technology company that among other clients, allows Starbucks to offer wireless induction charging in their tabletops.

All three are serial inventors, experienced and accomplished electrical engineers, and hold hundreds of patents between them.

Fundraising Details

Tap With Us is raising its second crowdfunding round, and now that the crowdfunding ceiling has been raised to $5 million, that is the new goal (in case you’re wondering, its previous round was oversubscribed and raised the maximum amount allowed for crowdfunding at the time, $1 million).

In addition to crowdfunding, they’ve raised an impressive $13 million from VC. According to their financial statement on Wefunder, the company has been backed with $8mm in equity and $5mm in convertibles.

This second fundraising event is to introduce a new line of product into the Tap ecosystem – a bracelet version called the TapXR Band. Amazingly, this nifty little wristband still allows for the same movements and controls as the previous product, while looking much less conspicuous. It also uses proprietary technology not built into the Strap version.

It’s worth noting that the TapXR band will retail for $299, over $100 more than the TapStrap.

After closing this round, Tap’s runway will be 8 months before further capital is necessary. A breakdown of how they’ll use the funds is as follows:

- 40% for Research & Development costs

- 25.5% for Sales & Marketing costs

- 18% for General & Administrative costs

- 10% for line-of-credit repayment

- 6.5% for the Wefunder intermediary fee

Market Fit & Opportunity

The Tap Strap sells primarily through Amazon, to both consumers and enterprise customers, as well as through its own site.

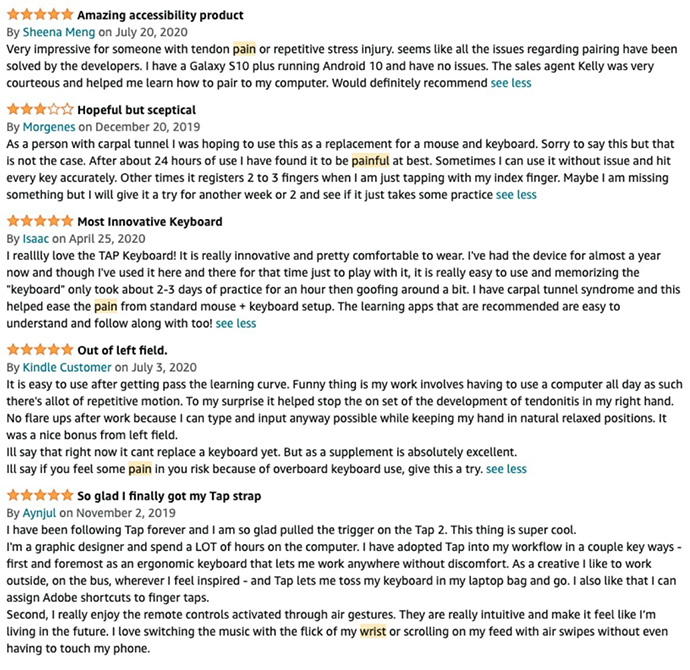

Sitting with a pretty average 3.7 star rating, many users sing its praises, where others complain about the device completely not working. Perhaps unsurprisingly, others lament they can’t remember its controls (the founder admits it helps to have a certain level of cognitive and physical ability, though neither need to be perfect).

Both Schick and Kemeny are very active in providing responses to inquiries and complaints on Amazon and their website, as well as Wefunder. Although one could cynically call Tap With Us a typical example of a money-burning startup that foists itself on crowdfunding investors, the founders’ engagement with customers suggests that it is due not to duplicitous intent on behalf of the company, but the unfortunate consequence of ambition in the name of innovation. This really is new stuff, and that’s always going to have teething problems.

Financials

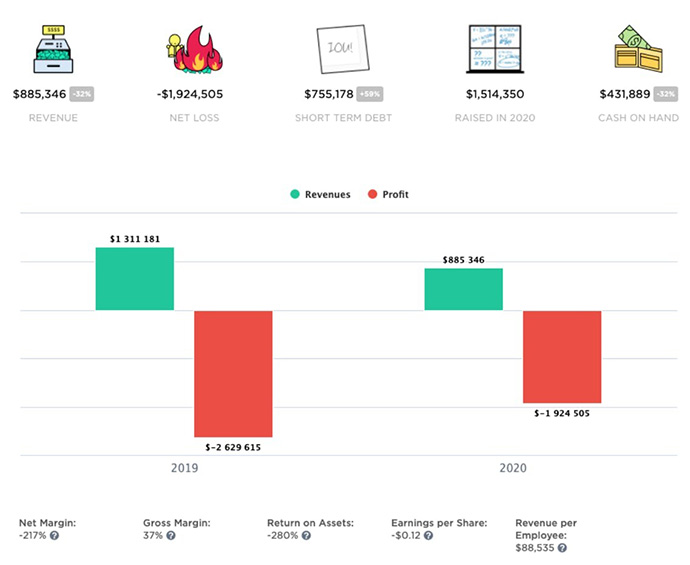

Tap averaged $75k a month revenue in 2020, and as supply chains improved in 2021 that revenue increased, though between 2019 and 2020 the average monthly revenue came out to ~$50k.

Tap With Us manufactures its technologies in China, and the disrupted supply chains caused revenue decrease, and significant burn ($1-2 million net loss 2019 and 2020).

Who is Tap’s competition?

Tap With Us is in a field of its own. They are on the brink – if they can standardize their manufacturing process, secure their supply chain, and guarantee a reliable working product – of completely changing both the virtual keyboard and haptic markets.

And they’re protected – all three of its founders are veterans of the intellectual property minefield, and Tap is covered by ITC patents as well as “secret sauce”. If we assume that the TapXR works, even expanding the capabilities of the product, then the massive burn rate due to R&D is not for nought.

Pison Technologies is another company working on gesture interfaces, using the groundbreaking technology of electroneurography or electromyography. This is the detection of electrical potential energy associated with the movement of muscles, or in more basic terms: it converts muscle movement to electricity. This is the same technology that promises to allow paralyzed patients the ability to control robotic limbs.

Schick does not believe this is developed enough to be used commercially, but observing the TapXR band, there is a possibility Tap is using similar technology, and Schick is downplaying the field’s advancement (perhaps thanks to Tap With Us’s R&D efforts).

Facebook is similarly working on technology that would allow Oculi to allow for manipulation of virtual environments (such as keyboards) without hands (using neural networks trained on cortical activity according to their released report). Schick believes such technology requires custom setup for each user that again makes it impractical for commercial use. Facebook could make the Oculus ecosystem closed, but Schick believes that Facebook will continue to support the nascent OpenXR protocol, which allows cross-platform compatibility. Facebook is also working on a wrist-based haptic device.

I believe that these competing technologies will improve but so will Tap’s. Where these competitors are still in the R&D stage, Tap has a product. At worst, Tap will be the more ergonomic approach to hand free VR typing until technologies that can be built into the Oculus itself are GTM. This is not a space that suffers from more competition.

Risks & Flaws: A tricky business model

Tap With Us relies on the US-China supply chain for both its manufacturing and the manufacturing of its components. As is evident, this is extremely risky.

And given the reliance of TapStrap products on multiple complex components such as IMUs, accelerometers, and circuit boards, plus the fact that assembly and design talent is scarce and expensive, there is an extremely high input cost associated with the raw manufacture of Tap devices. And when we say “extremely high”, what we mean is that COGS has averaged a whopping $17,999/month so far this year.

However, the highest cost incurred in Tap’s operations is research and development. That’s not unsurprising; it is that research that has allowed for Tap With Us to offer a far more streamlined (but of course, not yet market proven) alternative to its current offering.

But once the hardware is ready to go, shipping and logistics is another major risk. Extreme weather conditions caused damage to 2,000 devices during an ocean-shipment in November 2020. Ouchie.

China-based manufacturing adds the risk of IP theft and duplication, but as aforementioned, Tap’s patent property is internationally enforced.

Exit Strategy

Schick is not discussing M&A interest, inquiries, or plans at this time. I suspect that the heavily debt-laden financing will delay any acquisition plans for the time being.

That being said, I suspect that Microsoft could and would acquire such a company for its IP assets. Microsoft’s venture into XR in both the workplace and the military field means an effective means of XR typing and gesture control would be immediately implementable and therefore valuable.

It’s interesting to note that both Schick and Poliakine have backgrounds in medtech, and relationships with contractors of healthcare institutions. In hospitals where nurses have to keep hands clean as well as perform data entry, such a keyboard alternative would be a potential lifesaver. However, the TapStrap likely does not cooperate with disposable gloves.

If the TapXR works (and the crowdfunding is majority funding the development of it) then this would not be an issue. Assuming Schick and Poliakine can leverage their medtech experience, they could establish a stable B2B strategy that would then pay down their immense debt spend, and wean Tap off relying on the riskier direct-to-consumer model.

Conclusions

Tap With Us is a promising company that is still very early in its development financially, having only started selling in 2018. Most of the crowdfunding raise will likely be spent on research and development.

I believe that Tap’s founders can leverage the wealth of IP the company sits on. Understand that when you invest, you’re investing in research and development into what could be, if the founders’ past companies are to be considered, a historic development in the evolution of keyboards and haptics.

Would I invest in this company?

Another way of asking this question is, “given its $50m valuation, do I think there’s better than a 1/20 chance this company will be acquired for a billion dollars or more?”

Facebook acquired Oculus VR for $2B seven years ago. I think there’s a pretty decent chance they (or Microsoft) would splash $1B on this project. Certainly more than a 5% chance.

I’d actually give it a 10% to 20% chance of being acquired for $1B or more within three years, which puts an expected value of a $10k investment at $20k to $40k [($1B*10%)/$50m)*$10k].

Doubling your money in three years yields an IRR (internal rate of return) of 26%, and a $40k return on $10k is 59% IRR. Tiger Capital, which is known for its stellar returns, boasts 24%.

It’s worth noting that this could get much much bigger than $1B. If this turns into the devices you see in films like Minority Report, they could be both ubiquitous and essential within five to ten years.

It could (and probably will) also go to zero.

This is a decent addition to a well-diversified portfolio of moonshot companies.