September 6, 2022

Read time: ± 6 minutes

Hello and welcome to Alts Cafe! This is everything you need to know about what’s going on in the world of alternative assets, best enjoyed with your morning coffee.

Let’s go!

Table of Contents

Pulse check: What are the markets doing?

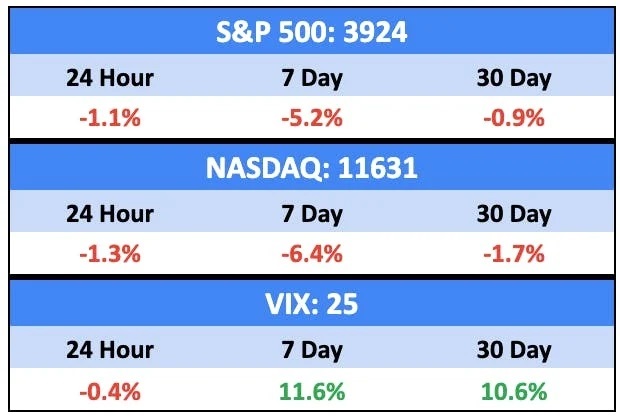

Another tough week as equities continued to slide as concerns over US monetary policy and tighter rates were exacerbated at Jackson Hole.

Bullish News

- The USD hit a 20-year high relative to a basket of international currencies.

- U.S. consumer sentiment improved further in August.

- American job openings increased again in July.

- The national average credit score is at an all-time high of 716, but… this is the first time in 15 years it’s not increased year over year.

Bearish News

- Singapore’s growth rate was revised down from 3.8% to 3.5%. The trade-dependent economy is often a leading indicator of global growth trends.

- The 2Y Treasury topped 3.5% yesterday, the highest level since November 2007.

What are we doing?

Fractional Alts picks:

No changes here.

ALTS 1 fund news:

Nothing to report.

Crypto

Here’s what you need to know:

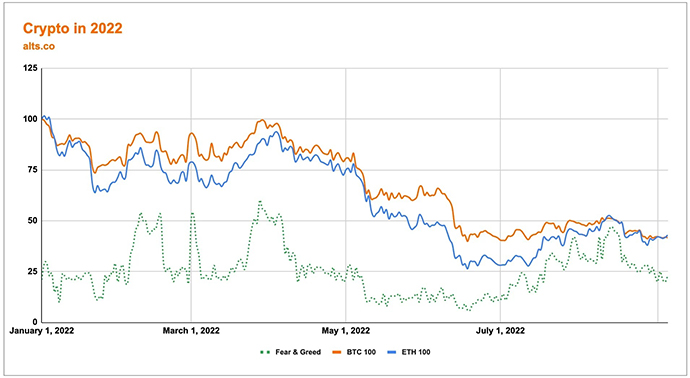

ETH and BTC have continued their divergence coming up to the ETH merge next week.

While we’re miles off the lows from a couple of months ago (the fear and greed index was in single digits), we’re also now well off local highs.

Which is worrying, because the F&G index is almost always a leading indicator of BTC and ETH prices. But they seem untethered at the minute.

Bullish News

- French Banking Giant BNP Paribas Enters Crypto Custody Space.

- NEPZA, the Nigerian government agency in charge of export processing zones, announced on Saturday that it is in talks with cryptocurrency exchange Binance to establish a “virtual free zone” dedicated to blockchain technology and the digital economy.

Bearish News

- The CEO of the collapsed Turkish crypto exchange Thodex faces extradition from Albania following arrest.

- Coinbase, FTX, Binance get inquiries as Congress looks to crack down on $1 billion crypto fraud.

What to do with that info:

For me, crypto (like everything else) is a bit scary short term, but it looks like a good entry point long term.

Real Estate

Here’s what you need to know:

The bad news is picking up steam this week, with only a tiny bit of good news (for landlords).

Bullish News

- Rent prices for single-family homes in the US has surged 13.4% in 2022. Four of the five most expensive markets are in California.

Bearish News

- Interest rates increased from 5.65% to 5.8%.

- Mortgage applications to purchase a home dropped 2% for the week and were 23% lower than the same week one year ago.

- Home prices dropped by 0.77% from June to July. San Jose led the way down, suffering a 10% decline. Four of the top six metros were in California.

- Goldman Sachs released a devastating report predicting a 20% drop in home sales in 2022 and another 8% in 2023.

- China’s falling marriage rates are leading to a structural decline in housing demand.

- 1 in 5 home sellers are now dropping their asking price.

- 40% of small and medium businesses couldn’t afford to pay rent in August.

What to do with that info:

Keep watching consumer debt and defaults. That’s when this thing is going to really unwind.

From the Q2 Fed report:

Credit card balances saw a $46 billion increase since the first quarter – although seasonal patterns typically include an increase in the second quarter, the 13% year-over-year increase marked the largest in more than 20 years.

NFTs

Here’s what you need to know:

NFTs are pretty much tracking Ethereum right now.

Bullish News

- Free to play game Limit Break raised $200m.

- Facebook and Instagram will allow US users to post their NFTs.

Bearish News

- Only half of Americans have heard of NFTs. Two percent have bought one.

What to do with that info:

If you think that last bearish bullet point is actually bullish… you know what to do. IT’S STILL EARLY!

Startups

Here’s what you need to know:

It’s a tech meltdown in the middle of a broad jobs boom. What happens now?

Bullish News

- Nada

Bearish News

- VCs have cut investments in insurtech significantly.

- Thrasio, the well-funded creator of Amazon aggregator space, went from ‘hypergrowth’ to layoffs in less than 2 years.

- Nigerian digital bank Kuda has laid off a significant number of employees.

What to do with that info:

I still think it’s a great time to invest in early-stage companies that will come out of the next two years primed to succeed.

Quick Hits

Wine

A combination of soaring temperatures, prolonged drought, and forest fires, has led to a number of grape crops being harvested weeks earlier than usual in 2022.

This can lead to high pH, cooked fruit and ‘burnt tannins’. Not great for a premium wine.

This is what Wine Searcher says we should expect from Bordeaux this year:

If previous hot years are anything to go by, a mixture of the sublime and the ridiculous. Everything from Napa-like concentration and length to wines where physiological ripeness never quite caught up with sugar ripeness. And, of course, some alcoholic dross.

Cultural Assets

A 76-million-years-old Gorgosaurus skeleton is being auctioned at Sotheby’s this month.

The complete skeleton of an earlier relative of the T-Rex was discovered in 2018 in Montana, and is the first to ever be offered at auction. It is 10 feet tall and 22 feet long and carries a pre-auction estimate of between $5 million and $8 million.

Rare books

There’s been a lot of talk about the record-setting Mickey Mantle rookie card this week, but our friends in the books hobby would like to remind you $12.6m is no big deal, really.

Here are a few books that have sold for eight figures:

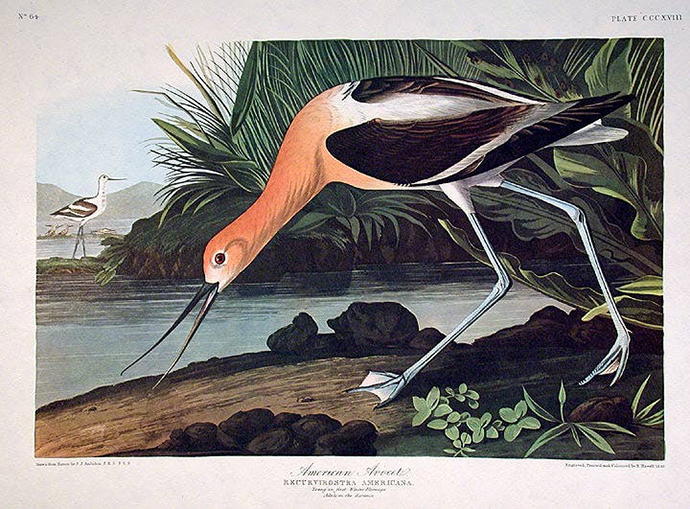

- James John Audubon’s Birds of America: $11.5m

- Shakespeare’s First Folio: $10m

- The Bay Psalm Book (The first book published in America): $14.2m

- The Rothschild Prayer Book: $13.6m

- da Vinci’s Codex Leicester: $31m

Speaking of notable sales, perhaps the most impressive collection of Herman Melville’s works ever is coming to auction.

Christie’s hosts the impressive collection, which includes a copy of the Divine Comedy annotated by the author. A first UK edition of The Whale, his masterpiece, is already up to $50k.

Music

Spotify royalties are increasing from 10.5% to 15.1%.

This is big for music publishing, and it’s also big for the companies that have acquired catalogs recently.

They’re going to generate significantly more royalty revenue.

That’s all for this week. Hope you enjoyed your coffee and this edition of Alts Cafe.

Any comments, questions or concerns – let us know.

Cheers,

Wyatt