Happy Labor Day weekend to everyone in North America 🎉

Labor Day is the perfect excuse to do an issue on free money. Not from working, not from investing, but for simply living in one specific state: Alaska.

That’s right, the Alaska Permanent Fund cuts a check annually to each Alaskan citizen. No complex requirements, no hidden catches, nothing. As long as you’re living in Alaska and you’re not a criminal, you get a free cash dividend every year.

It’s one of the least well-known social programs in the country, which is ironic since it’s a) 46 years old, b) incredibly popular with residents, and c) probably the closest thing America has to Universal Basic Income (UBI).

So what is it, and how does it work?

Let’s dig into the world of eagles, wolves, and of course, oil 👇

Table of Contents

History of the Alaska Permanent Fund

Before we start, I need to clarify that I am very biased toward Alaska.

My uncle Chris emigrated from Germany, found home in Alaska, and put the town of Girdwood on the map. Half of my family lives there, and my cousin’s wife, Natasha von Imhof, is an Alaska State Senator.

I also lived there back in 2001. (Well, I spent the summer there. But I didn’t qualify for the annual cash dividend, so I guess I can’t say I truly lived there!)

In any event, if you’ve never been to Alaska, you may have a vision in your head of freezing bears, Ice Road Truckers, or Sarah Palin. But let me tell you, Alaska is a majestic place to live. Stunning, really. Yes, the winters are dark and lonely. But the summers are the exact opposite.

20 hours of sunlight. Adventure sports galore. One bear for every two people. Living there was like a dream. I’ve never felt more alive anywhere in the world.

The Permanent Fund is just one reason this place is so cool.

The Alaska Statehood Act

While the US purchased Alaska from Russia in 1867 for $7.2m (just two cents an acre!) it wasn’t recognized as an official state until 1959, when President Eisenhower created America’s 49th state through the Alaska Statehood Act.

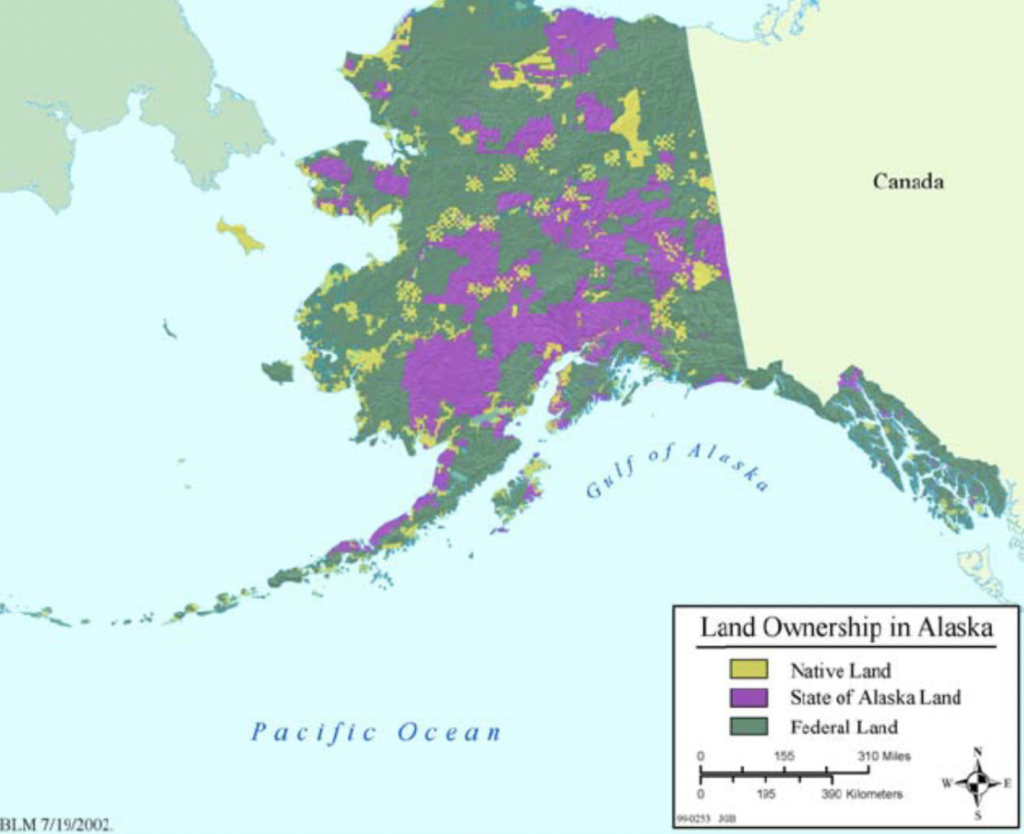

At first the new state struggled economically, and government intervention was needed to help get things going. Part of this economic boost came from of a huge land allotment from the Federal government: 100 million acres that the state could develop however it wanted.

The hope was that it would locate some natural resources to sustain its economy.

And boy, did they hit the motherlode.

Marshall’s Gambit

The man in charge of choosing the allotment was Tom Marshall, a state employee and an experienced oil geologist.

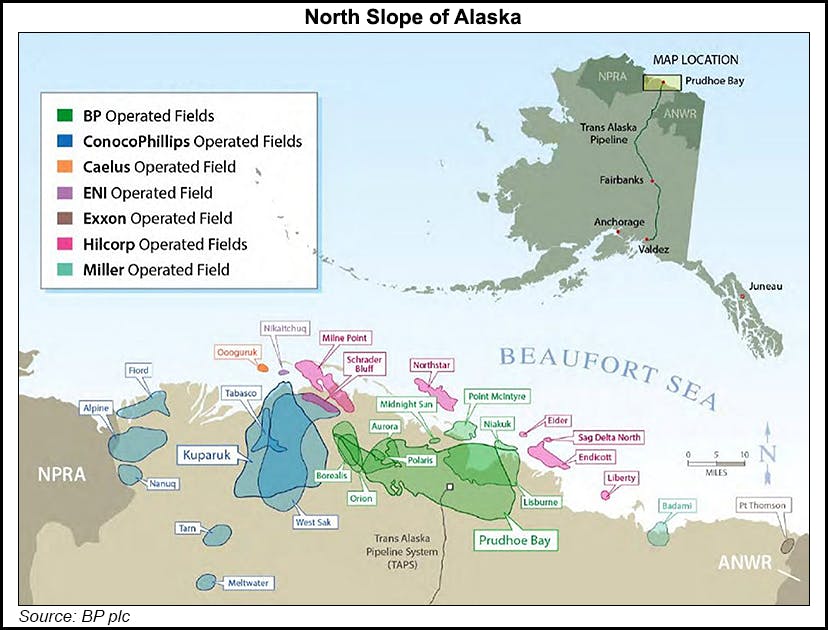

Smack-bang in the far north of the state sat a frozen, desolate area called the North Slope. It looked barren, but Marshall recognized the geological make-up from his work uncovering natural oil wells in Wyoming. He wanted Alaska to choose this land to develop, but governor Bill Egan hated the idea and rejected his recommendation.

After all, this was an arctic wasteland, thousands of miles away from where most people had settled. It was completely frozen over in permafrost, getting there was a nightmare, and finding anything valuable in this land seemed like a massive gamble.

Governor Egan eventually agreed to take the land, but the public was dumbfounded. One day, he awoke to find his giant map of Alaska vandalized, with two words scrawled across it: “Marshall’s Folly.”

For half a decade, the public was right — it seemed like a disaster. The search was fruitless. Oil companies drilled six wells (in what is now known as Prudhoe Bay) without finding a drop. Time and money were running out.

Then in 1967, ARCO and Humble Oil joined forces to give Prudhoe Bay one last shot, and what they found forever changed the history of Alaska. They hit an ocean of oil so large that the oil rig they were standing on violently shook.

Yup, Prudhoe Bay was absolutely sopping with oil. The field held approximately 9.6 billion barrels of oil — the highest amount ever discovered in the US.

A hundred years prior, Alaska was known as gold rush country. But it turned out Prudhoe Bay contained the real gold ⛏️

Creation of the Alaska Permanent Fund

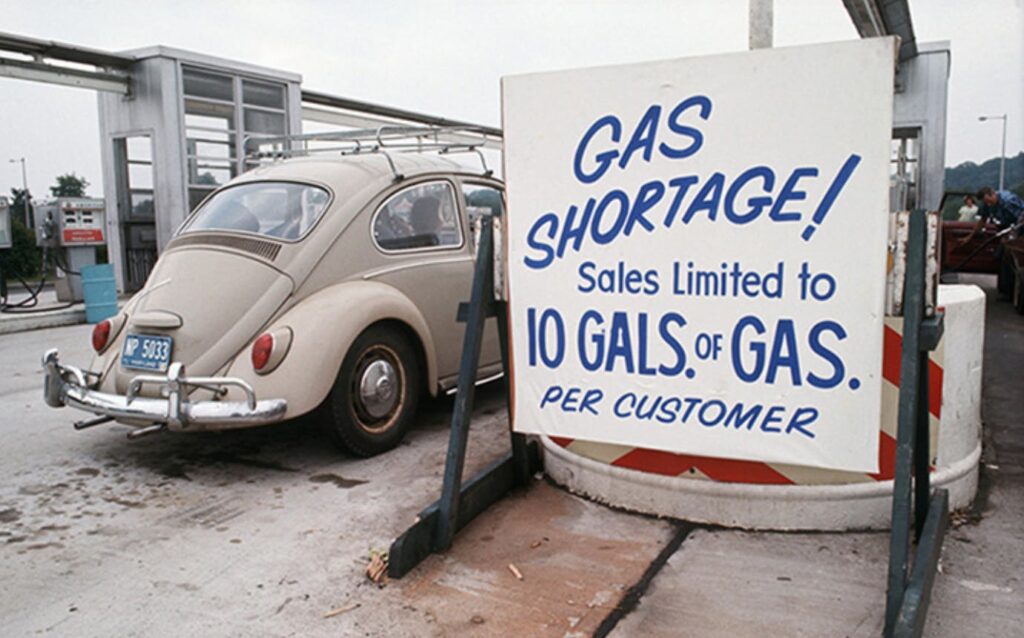

The discovery was huge, but actually getting the stuff out of the ground and distributing it was another story. In fact, it took the 1973 oil crisis to make it economically viable.

With President Nixon’s backing, construction began on the Trans–Alaska Pipeline — a massive system designed to carry oil from Prudhoe Bay down to the Port of Valdez in Southern Alaska, where it’s loaded onto tankers and shipped to American and international cities.

Construction was completed in 1977, and suddenly Alaska became the United States’ greatest source of oil.

But the government was smart. They knew their precious oil resources wouldn’t last forever, and if they weren’t careful, only the current generation would benefit. They wanted to create a — you guessed it — permanent fund, so Alaskans could reap the economic rewards for decades to come.

At the time, the Alaskan constitution didn’t allow for state-owned funds. So, the state voted to amend the constitution, and the Permanent Fund bill passed!

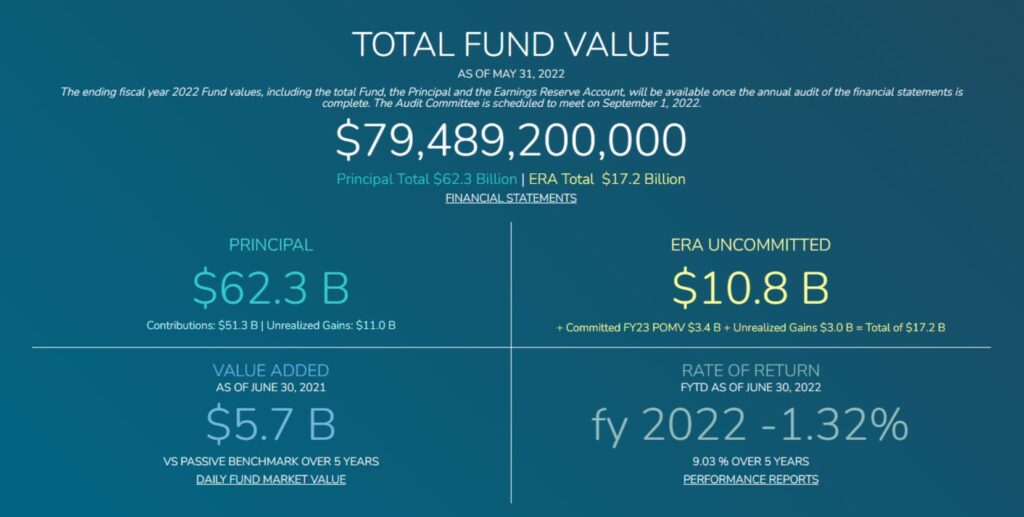

The bill proposed that 25% of oil revenue would be invested in a managed fund, with the goal of a 5% annual return.

What is the Alaska Permanent Fund?

The Alaska Permanent Fund aims to protect the future economic stability of all Alaskan citizens by setting aside a percentage of revenues from oil, minerals, and other natural resources in investment accounts for the benefit of all Alaskans.

It’s a sovereign wealth fund (SWF) managed entirely by the Alaska Permanent Fund Corporation, a group charged with maximizing the fund’s investments.

Initially, the fund was designed not as an investment vehicle, but as a sort of cash reserve. This was a major reason it got support from the public: citizens saw it as a way to prevent government waste. Instead of spending all the oil revenue, they would be forced to save it for later.

But another big reason for the fund’s long-lasting success was the decision to invest in stocks and bonds instead of directly investing in local infrastructure and businesses. This reduced the potential for pork-barrel projects, bridges to nowhere and political grandstanding.

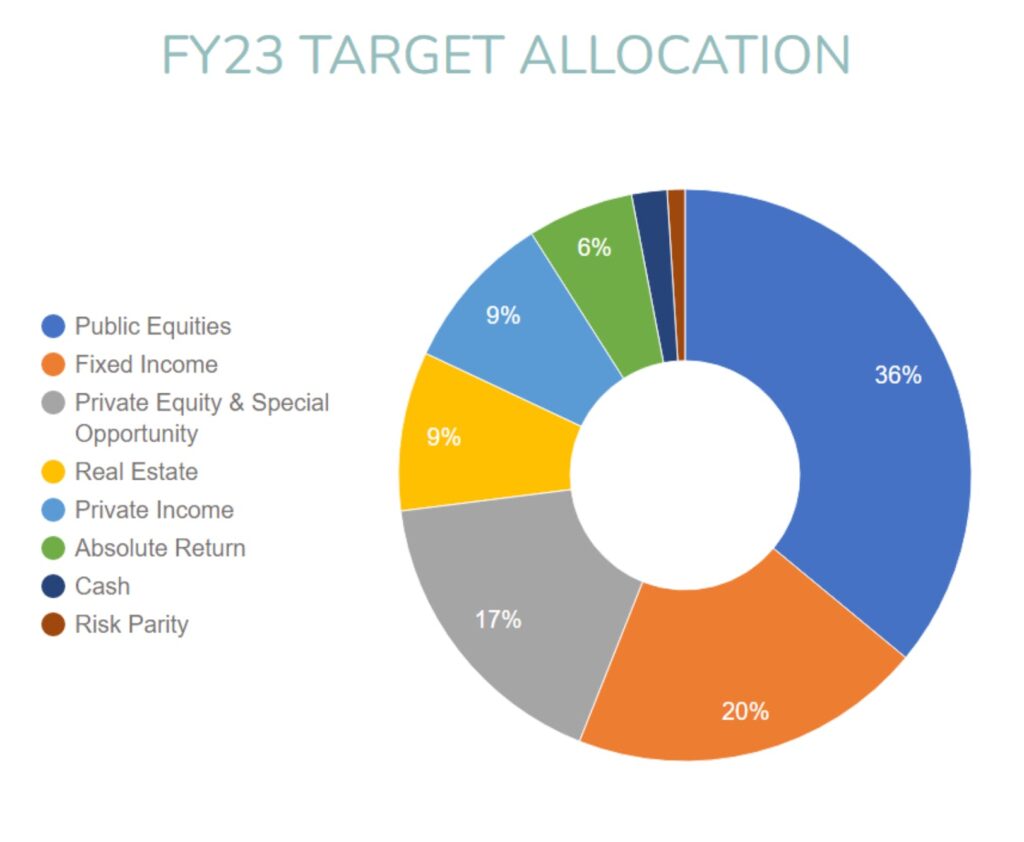

What does the Alaska Permanent Fund invest in?

Being a sovereign wealth fund, the Alaska Permanent Fund favors lower-risk assets — bonds, fixed income securities, and blue chip US stocks.

Their top 50 holdings look very similar to what you find in any S&P Top 50 fund, including companies like Microsoft, Amazon, Visa, and Pfizer.

But recently, the managers have started incorporating new investments. Earlier this year, the APFC announced that by 2023, $3 billion would be invested into alternative assets. (Oh yes, that’s right baby, come to papa.)

The exact specifics are yet to be disclosed, but the plan is to commit:

- $1.2b to private equity

- $1.1b to private income, and

- $700m to real estate

No word yet on whether the APFC will be deploying capital into ALTS 1. But I’ll do my best to pull some strings! 😀

The Alaska Permanent Fund Dividend

The annual dividend is what makes the fund truly special.

By 1979, just three years after the fund’s creation, Alaska’s revenue from oil quadrupled to $13m. The government had mounds of money essentially sitting in a savings account, with no clear direction on how to use it.

So they thought, “What if we distributed revenue from the fund to residents as a cash dividend?”

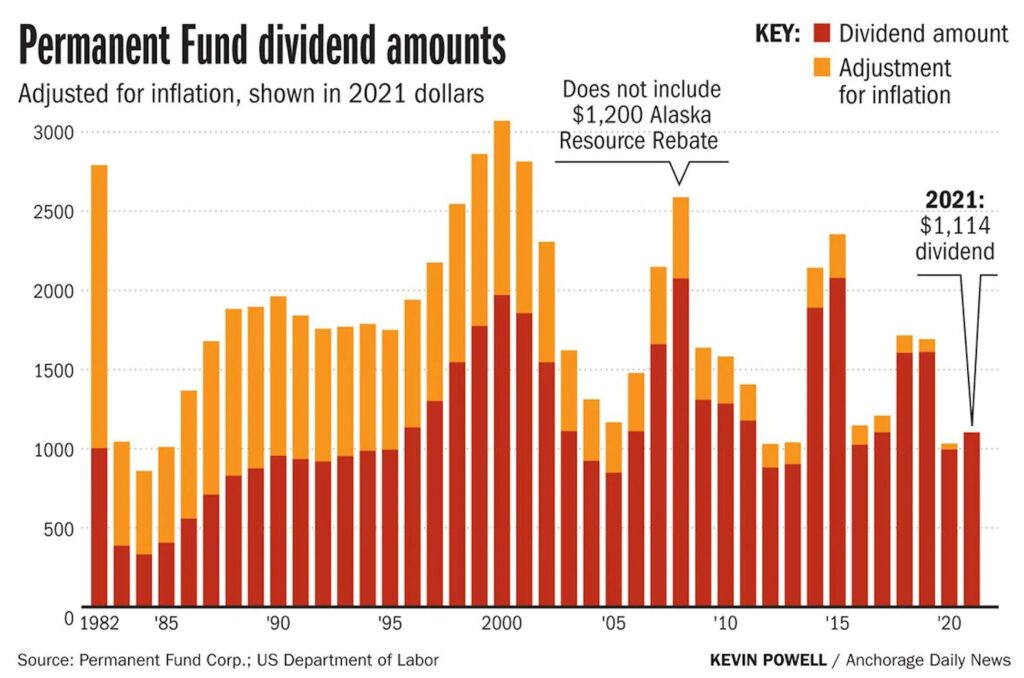

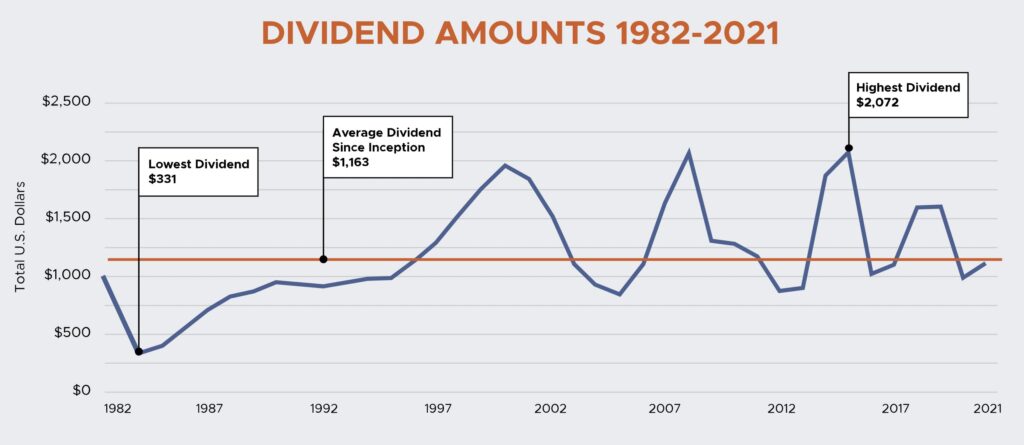

How much does the Alaska Permanent Fund Dividend pay?

The Permanent Fund Dividend (PFD) uses a formula to determine an annual payout. At a basic level, it takes the five-year average of net income from investments, multiplies it by 21%, subtracts prior year expenses, then deploys it as follows:

- 50% is equally divided among citizens

- 50% stays in an earnings reserve, available for appropriation

By the mid-90s, Alaskan residents were receiving dividends of over $1,000 every year.

Who’s eligible for the Alaska Permanent Fund Dividend?

There are a few requirements for Alaskan citizens to be eligible for the PFD, but they aren’t very hard to meet.

If you’ve lived in the state for a full calendar year and have no intention of leaving, you will receive the annual dividend.

Exceptions include:

- If you’re absent from Alaska 180+ days per year (you have to be there at least half the time)

- If you were convicted as a felon in Alaska

This is all pretty crazy to think about. If we assume a child was born in Alaska and turned 18 this year, they would have $24,723 sitting in their bank account. Add on compound interest, and that figure is likely over $30k.

If you’re an OG Alaskan, you’ve received over $46k since inception.

Alaska Permanent Fund as a basis for UBI

It’s funny to me how little Americans bring up the Alaska Permanent Fund given all the rising chatter around Universal Basic Income.

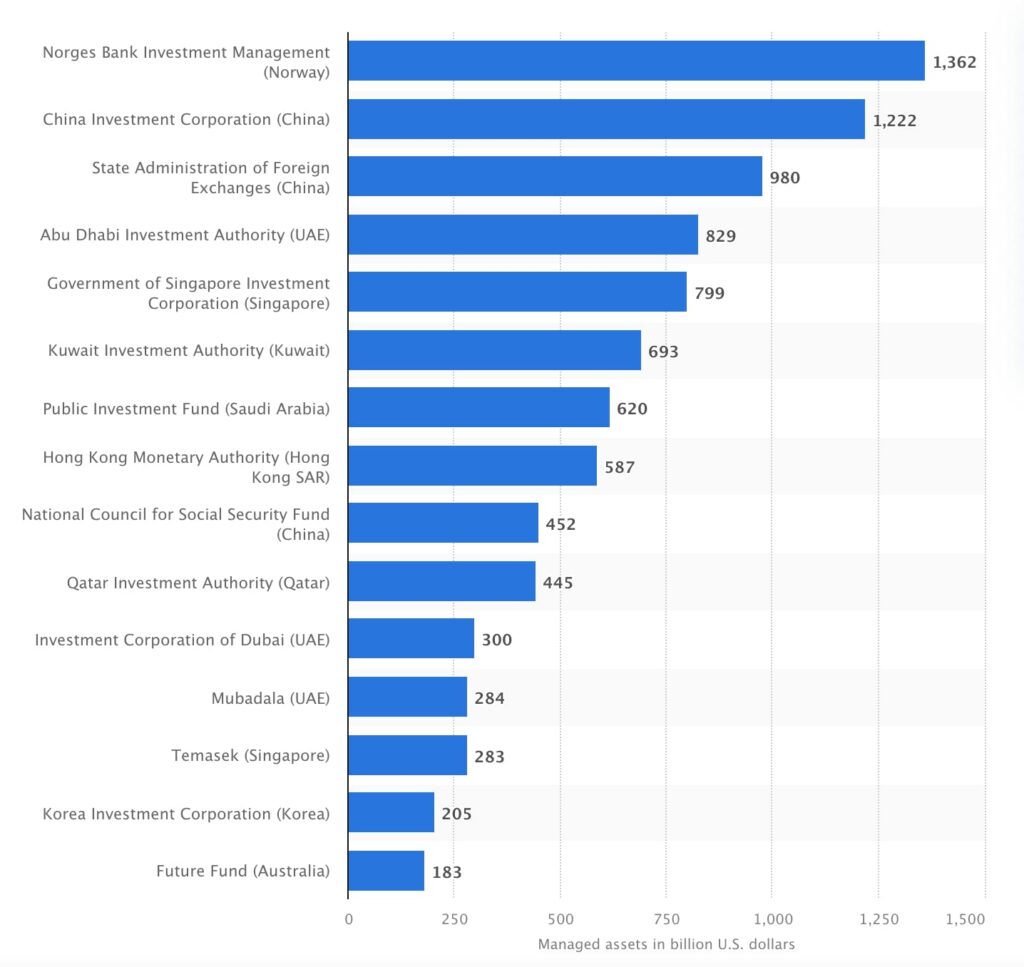

Alaska is far from the only place to have a social fund based on oil/mineral revenue — nearly 50 countries have one, including China, Singapore, Australia, and of course, Norway, which has the world’s largest.

But Alaska’s fund is much closer to UBI than the others.

See, the major difference is that most of these other funds serve as a government reserve or pension offset! They impact people indirectly through government spending, but the citizens themselves don’t directly reap the rewards like they do in Alaska.

- The Wyoming Mineral Trust is a similar fund to Alaska’s, but they use the money to offset tax elimination. No dividends.

- Texas has two funds, but they’re both used to assist the development of public schooling and universities. Again, no dividends.

- Norway’s Government Pension Fund (NGPF) is the world’s largest SWF, with over $1 trillion in assets. Still, funds are put towards pensions. This is great for retirement, but does nothing to help day-to-day. (It’s almost like the government doesn’t trust people with how they spend their money!)

A few papers have been released using the APF as a basis for a widespread universal basic income.

Outcomes were mixed and interesting:

- A common counter-argument is that UBI will lead to a reduction in employment. However, a 2018 study found that the APF dividend increased part-time work by 17%

- A 2019 study found a 10% increase in substance abuse in the month following the APF dividend payment. However, this was met with an 8% decrease in property crime.

- Studies from 2011-15 demonstrated the PFD helped reduce poverty in the Indigenous Alaskan population by 22%.

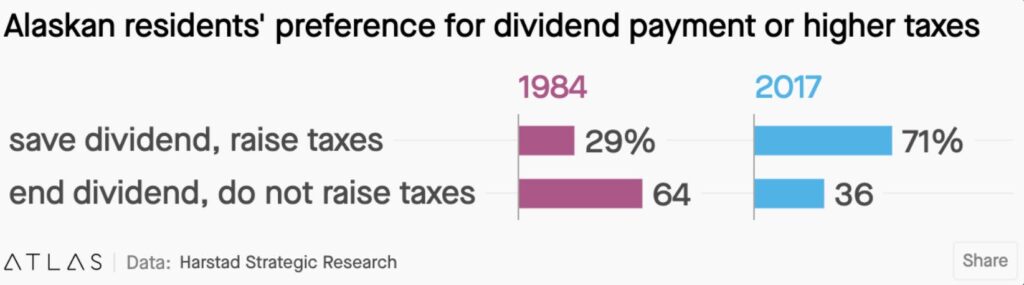

- A fascinating 2017 survey showed that 71% of the population would prefer to keep their dividend and raise taxes rather than scrap the dividend and lower taxes.

Criticisms of the Alaska Permanent Fund

Studies aside, there are a few reasons why Alaska may not be a realistic case study for UBI’s efficacy.

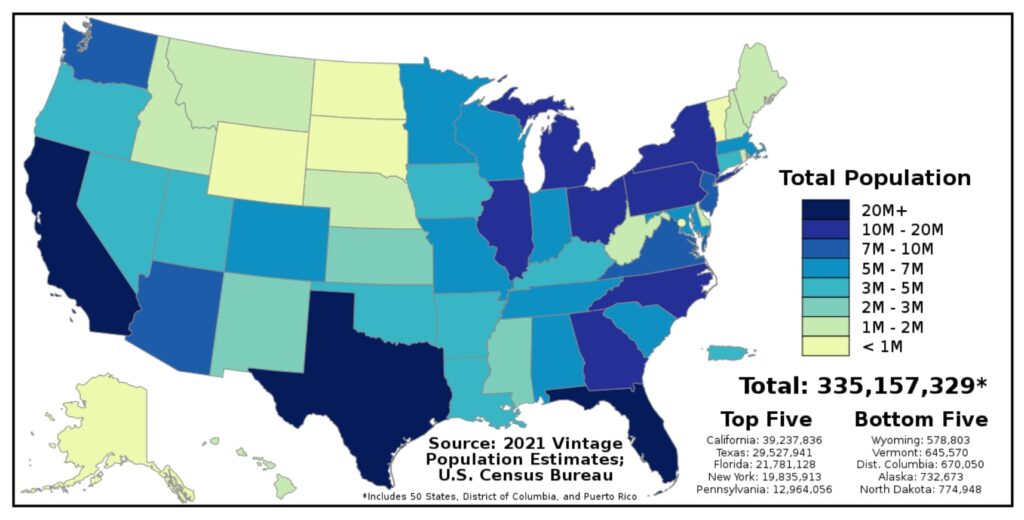

Alaska is one of the least populated states. If the 2021 APF dividend were re-distributed to the entire state of, say, California, the cash payment would be ~$19 per person. Yippee.

The idea of equally distributing fund dividends somewhat falls apart without this perfect combination of low population and high oil revenue.

And despite Alaska’s best efforts to keep politics out of the picture, the PFD has been weaponized as a political tool, with politicians securing their Alaskan seats by promising an unsustainable rise in annual payments.

Closing thoughts

Regardless of your politics or thoughts on UBI, the Alaska Permanent Fund is a pretty fascinating program.

After 40+ years, it has full support from both democrats and republicans, and is extremely popular with residents. (Who would have thought free money would be so popular?!) At this point it’s basically an Alaskan institution.

Spare me the “Har har, freezing winter” jokes. Alaskans pay no sales tax, no state income tax, and they get paid to live in what is essentially America’s Alps. It’s a magical place.

The program has its flaws, of course. Long-term sustainability is always a concern, and people will try to game the system whenever free money is involved. Example: fisherman Roland Maw claimed 6 years’ worth of dividends while not actually living in Alaska. (He was charged with fraud and eventually had to pay back $9k+ in restitution.)

But personally, I’m a huge fan. Unlike other sovereign wealth funds, the APF actually puts money directly into the pockets of citizens. This provides a huge leg up to young people trying to navigate the world. It’s like an allowance everyone gets from a young age.

Remember, if you’re born in Alaska, you start earning the dividend as a baby. So by the time you graduate high school, you could have enough money to put a down payment on a house, start a business, or pay for college. This is what many people do! And I think it’s terrific.

Will the APF ever expand beyond Alaska? Will it inspire other states and countries to implement a similar scheme?

One thing’s for sure: Alaska is a fiercely unconstrained state. People there are built tough, and an independent streak has run through Alaska since the very beginning.

This clearly works for Alaska. The fund isn’t going anywhere (after all, it is called the Alaska Permanent Fund), and Alaska will continue to do things its own way. 🦅