Hello and welcome to Alts Cafe

Here’s everything you need to know about what’s happening in the world of alternative assets, best enjoyed with your morning coffee.

Let’s go!

Table of Contents

Macro View

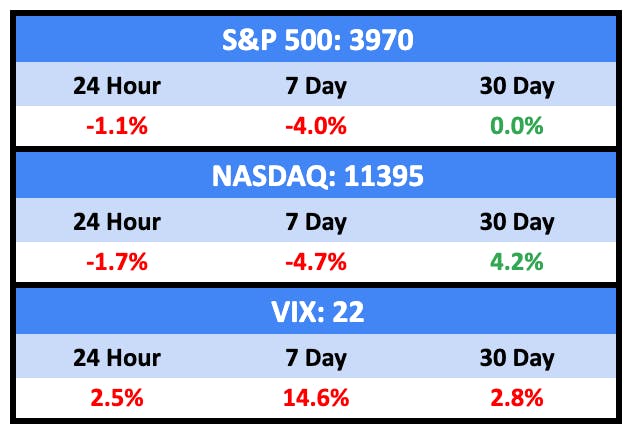

The market snapped a four day losing streak Friday, but it was a rough week overall.

Bullish News

- Canada’s annual inflation rate eased more than expected in January to 5.9%.

Bearish News

- Both Goldman and BofA expect three more rate hikes in 2023, with the Fed funds rate topping out at 5.25% to 5.5%. Goldman expects three more in Europe as well.

- Nearly 10% of auto loans extended to American consumers with low credit are now more than 30 days behind — that’s the highest it’s been since 2010.

What are we doing?

ALTS 1 fund news:

Nothing to report here.

Real Estate

Here’s what you need to know:

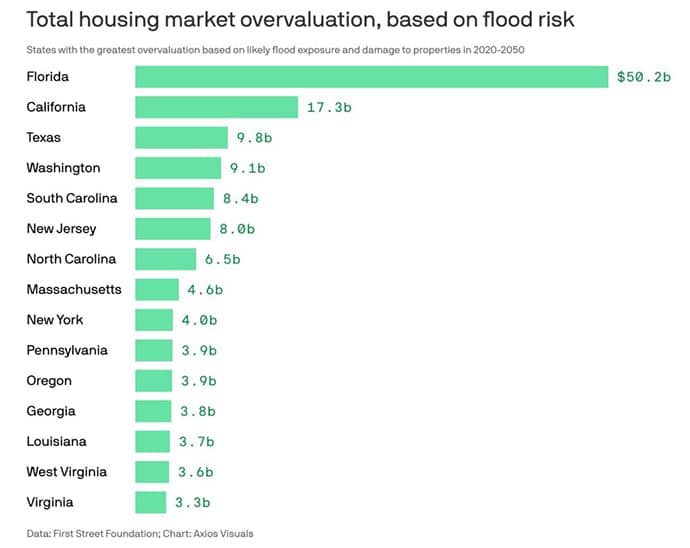

Some bad news for the Florida real estate market, though it’ll probably take years to get priced in.

According to a study published in Nature two weeks ago, there’s over $50B worth of unpriced flood risk in the Sunshine State.

In layman’s terms:

The current prices mask the true danger that these properties are exposed to, because of factors such as outdated FEMA flood maps, incentives in the National Flood Insurance Program and home buyers who lack climate change information.

In the US, “14.6 million properties face at least a 1% annual probability of flooding, putting them in the so-called 100-year flood zone.” This is expected to rise to up to 26% — per year — by 2050. That’s a hundred-year flood once every four years.

Once these increased risks are priced in — which could take years — I’d expect a significant correction in these markets.

Bullish News

- Sorry nothing here.

Bearish News

- Sales of previously owned homes dropped 0.7% in January to the lowest level since October 2010.

- The number of big office landlords defaulting on their loans is on the rise.

- The US housing market lost $2.3T in 2022, the biggest drop since 2008.

- New mortgage applications fell 18% week over week, the biggest drop in 18 years.

- Mortgage rates have climbed nearly 50bps in February to an average of 6.62%.

- Two thirds of American cities have increased their office space vacancy rate since 2019. Total US office vacancy rate is nearly 12.5%, which is a record.

How to invest in real estate right now:

Sell your real estate in coastal Florida, California, and Texas. Anywhere really.

Crypto & NFTs

Here’s what you need to know:

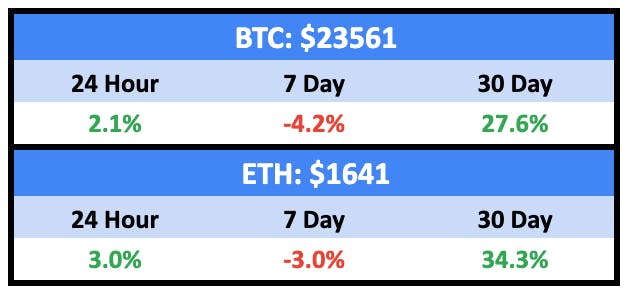

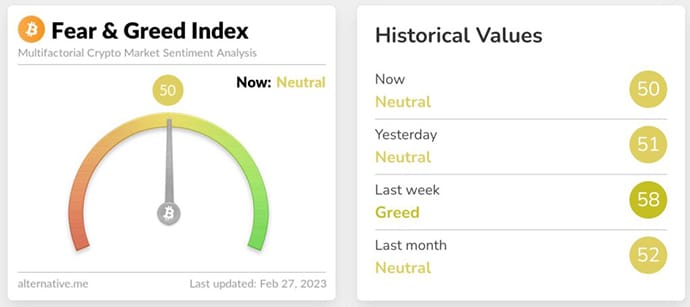

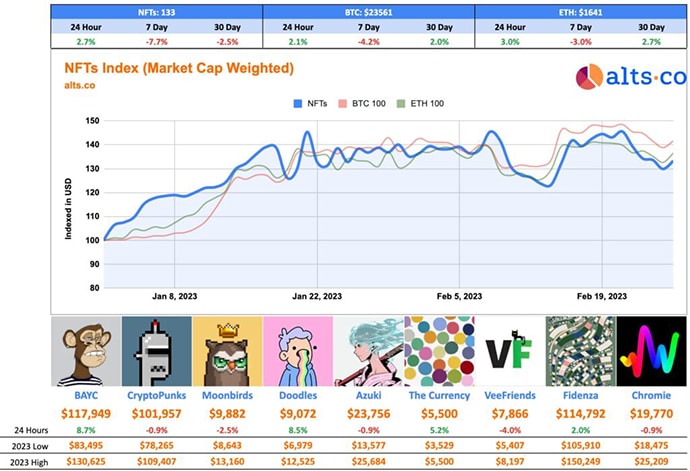

Crypto followed equities down last week.

And sentiment plummeted eight points.

As ever, NFTs whipsawed around with losses doubling crypto.

Bullish News

- The OpenSea / Blur feud (which is only slightly less entertaining than the Oasis / Blur feud) continues to pay off for users as the former has temporarily cut marketplace fees to nil.

- Blackrock has launched a metaverse ETF, though the top five holdings aren’t exactly pure play metaverse investments: Apple, Meta, Nvidia, Netease, and Roblox.

Bearish News

- Binance is considering exiting the US.

- Nearly a quarter of new tokens issued in 2022 were pump and dump schemes.

- Crypto company Silvergate Capital is the most shorted stock in the US equities market with 73% of all shares currently shorted.

- TopShot creator, Dapper Labs, is facing a lawsuit claiming their NFTs are securities.

- The IMF said “crypto assets should not be granted official currency or legal tender status in order to safeguard monetary sovereignty and stability.”

How to invest in Crypto & NFTs right now:

With NFT volume topping $600m last week for the first time in ages, the scammers are coming back. Keep your head on a swivel.

Before we get to startups, let’s talk about energy storage startups for a minute.

Energy is a hot topic right now. While tech startups suffered big time in 2022, VC investments in energy storage were up 89% YoY.

There are a million battery startups out there competing around chemistry refinements that will never see the light of day. It’s mostly all hype. (yawn)

But Qnetic* is totally fresh.

And these guys have momentum:

- Experts from across the renewable energy industry

- $430k raised from 285 investors

- 80x more capacity than the existing flywheel tech

- 3x the lifecycle of lithium-ion batteries, at half the cost

That last point is key. The primary goal of any energy storage tech is to be low cost. According to experts from Imperial College London, despite li-ion’s falling costs, lithium-ion batteries will still be 62% more expensive than Qnetic by 2030.

Bottom line: Qnetic expects to smash it out of the park in the energy storage market.

Their fundraising campaign is among Wefunder’s fastest raising this year.

Startups

Here’s what you need to know:

Tyler Tringas, from Calm Company Fund, put out a scathing Twitter thread this week eviscerating Andreessen Horowitz’s approach to investing over the last several years.

I think folks are sleeping on one of the biggest and most obvious "zero interest rate phenomena" that's going to get vaporized slowly and then all at once: Andreessen Horowitz

— Tyler Tringas (@tylertringas) February 19, 2023

Here's my thesis:

A few highlights:

- A16Z figured out there were vast pools of capital searching for *any* returns in the zero-interest-rate wasteland and came up with a strategy fundamentally different to the traditional VC model.

- Because rates were so low, investors were happy for the firm to do anything with the money, which means a16z chucked most of it into late stage growth companies with little hope for typical VC returns.

- Those late stage companies have mostly been written down now, and while they’re not all worthless, many are. These are private companies making decisions internally, so the full effects haven’t been felt yet.

- Their other huge bet? Crypto and web3 companies, which have seen markdowns averaging as high as 90%.

- The vast majority of a16z’s AUM flowed in over the last few years, and nearly all of it is locked into these unfortunate investments. No take backs.

The thread focussed on a16z, but it could have easily been about Sequoia or Tiger. They’re in the same leaky boat.

Stripe is one of the decacorns in trouble, and all three mega VCs mentioned above are investors. Stripe is trying to raise a $4B round now not to take market share or release an innovative product; it’s to pay a massive tax bill. If I’m a new investor, that’s tough to get excited about.

This is a slow motion train wreck that, like property values in Florida, will take time to unravel.

Bullish News

- Beijing made it easier for Chinese startups to IPO overseas. Their relaxed policies could also draw American startups east.

- Chinese startups are struggling to raise money from American investors.

- Africa’s largest innovation hub Co-Creation Hub (CcHUB) is launching a $15 million accelerator program.

- Malaysian pet food maker Pet World Nutritions is planning and IPO to raise up to $100 million. This could be the biggest IPO in Singapore in over a year.

Bearish News

- Ten companies that went public in 2020 or 2021 have already agreed to go private.

How to invest in startups right now:

I’d probably avoid becoming an LP at Andreessen, Tiger, or Sequoia at the moment.

Quick Hits

Art

Masterpieces from the estate of late Condé Nast tycoon SI Newhouse Jr. will hit the auction block at Christie’s in May with an estimated haul of nearly $150m.

That’s all for this week. I hope you enjoyed your coffee and this edition of Alts Cafe.

If you have any comments, questions, or concerns – let us know.

Cheers,

Wyatt

Disclosures

- This issue was sponsored by our friends at Kingscrowd and Qnetic.

- We are holding BTC and ETC in our ALTS 1 Fund. Apart from those, we don’t own any other assets or vested interests in the companies mentioned in this email.