Welcome to Farmland Insider – the free version.

We analyze deals across FarmTogether, AcreTrader, FarmFolio, and other farmland investment platforms.

(New here? Read our primer on farmland investing)

For our second farmland analysis, we look at an avocado farm from the Land Down Under being offered by AcreTrader – The Mareeba Avocado Orchard in Queensland, Australia.

Let’s go

Table of Contents

Offering at a Glance

- Platform: AcreTrader

- Available: November 17th

- Location: Queensland, Australia

- Crop type: Permanent

- Crops: Avocados

- Capital being raised: $8,365,000

- Acres: 415.5

- Price per Acre: $20,132

- Price per Farm Acre: $22,031

- Est. Ownership Duration: 10-12 years

- Min. Investment: $35,000

- Average Net Cash Yield: 10.6%

- Net Annual Return: 12.8%

About The Farm

Crops

The farm currently grows avocados on 240 acres and a mix of citrus (mangos/lychees/lemons) on 139 acres.

The citrus acres will be replanted as avocados, so the future output of the farm will be 100% avocados (64% Shepard/34% Hess).

This transition is expected to take two years (2022-2023). Avocados take 4 to 5 years to reach maturity. The current avocado acreage will continue to produce while the newly planted acres mature.

Avocados are a permanent crop that carries a higher risk profile than annual crops, which are replanted each year. Permanent crops take multiple years to mature (exposing them to loss due to drought and other environmental conditions) and additional upfront capital in the costs of the young trees.

Summary: The orchid has an elevated risk level due to singular concentration of crop type and long lead time for maturity and production

Geography

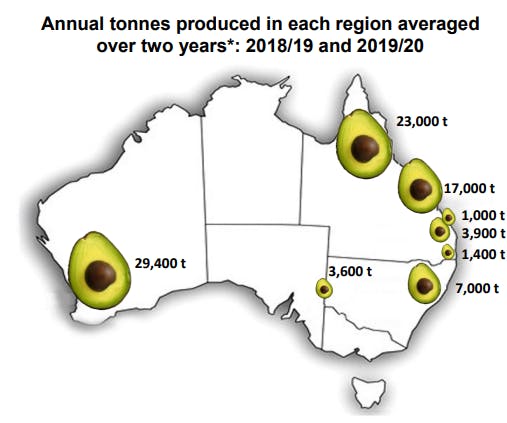

The farm comprises four non-contiguous plots in Paddy’s Green – a rural locality in Mareeba, Queensland. Queensland produces 69% of Australia’s avocados, with Western Australia the other top region.

The Mareeba region averages 30 inches of rainfall per year, but Queensland has experienced severe drought conditions over the last few years. 2021 saw a return to normal rainfall levels, leading to a record crop (more on this below).

Summary: Australia and Queensland have favorable climates for avocado growth, especially in a record year in 2021, but the region has a recent history of drought

Water Rights

The orchard has access to 1,552 megalitres of water per year. The water is sourced from permanent entitlements (460), well water (942), and on-farm storage and spring water (150).

- Avocados require 5 megalitres of water reserves per hectare per year in an area that receives 60 inches of annual rainfall.

- The Mareeba region, as noted above, receives 30 inches of rainfall in an average year.

- The avocado farm will require 10 megalitres of water reserves per hectare.

- The Mareeba orchard has 153 hectares, so 1,530 megalitres of reserves are required.

Summary: Water infrastructure is sufficient for current needs. Improving rainfall conditions would lessen the need for water reserves

Access to Infrastructure/Capital Expenditures Required

The farm currently produces avocados and citrus, so no initial expenditures will be required for harvesting or infrastructure purposes.

However, management plans to convert the citrus portion of the farm to avocados over two years. The managers project that this will cost $2.7 million USD.

Summary: The time and expense required to convert the farm to 100% avocados elevate the risk profile due to potential time and budget overruns

Owners/Management

In addition to the funds raised through the AcreTrader offering, the deal’s sponsor, Aqua Ceres LLC, will contribute $250,000 of capital. The sponsor’s role is to bring the offering to AcreTrader and work with them to take the deal to market. Sam Mitchell is one of the principals of Aqua Ceres.

Wealthcheck, a farm management company, will perform the day-to-day operations of the ranch. Sam Mitchell is the founder and owner of Wealthcheck, which creates related parties between Wealthcheck and Aqua Ceres, but this type of relationship is often seen in the sponsor/farm management structure. Wealthcheck manages over 100,000 acres of farmland in Australia, including 2,500 acres of avocados in Queensland.

Summary: No red flags. Management and owners have prior experience in the avocado industry

Economics of the Deal

Purchase Price

Purchase Price Analysis for Insiders only

→ Unlock Full Report ←

Cash Flows

Cash Flow Analysis for Insiders only

→ Unlock Full Report ←

Additional Financial Considerations

The company is assuming debt as part of the purchase of the orchid. $7.2 million USD debt will be obtained to finance the acquisition and development of the additional avocado acres. At 55% of the purchase price, this is a high debt to land value ratio.

Wealthcheck will receive a 1.5% annual management fee for its oversight of the farm. The fee is higher than other recent offerings on AcreTrader and other fractional farm platforms (.75 – 1.3%). The 4% procurement fee ($610,000) also eats into the returns to shareholders.

Initial distributions to shareholders are projected to start in 2022 (9.1%). Distributions will decrease over the next two years as the citrus acreage is converted to avocados. The yearly returns are projected to average 10.3% in years 1 – 9.

These returns seem aggressive due to the depressed avocado market.

Recommendation

Recommendation for Insiders only

→ Unlock Full Report ←