Welcome to Real Estate Insider for March 15th, 2022 – FREE Edition.

In today’s issue, our new writer Jack gives you the scoop on everything multifamily – what makes build-to-rent properties such an attractive proposition, how to get started investing, and more.

Let’s go!

Table of Contents

But before that…

If you like our Newsletter, you should definitely check out our Podcast.

In this episode, Horacio invites Co-founder and CEO Ryan Frazier and VP of Investments Cameron Wu to talk about Arrived Homes – a new way of investing that makes the wealth-building potential of owning rental homes a lot more accessible. They talk about the beginning of the platform in Arkansas, key home characteristics, and investor opportunities.

What is Multifamily Investment?

After I relocated to the United States from Australia, I was blown away by the size of the multifamily (or build to rent) investment market. Multifamily basically means condos, or blocks of apartments. One or multiple buildings in a complex, with individual units, rented out to tenants.

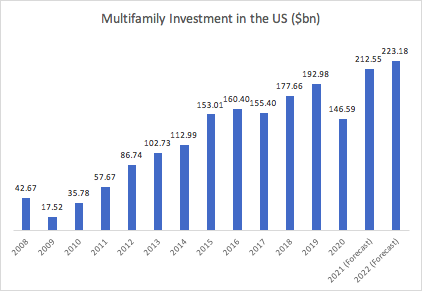

Within the US, investment in the sector totaled $213bn in 2021 alone, proving that multifamily is a strong and alluring mainstream asset.

What’s more, according to the Global Commercial Real estate’s website:

The multifamily sector is set for a record-breaking 2022 amid solid fundamentals and heightened investor interest. With tremendous liquidity and a growing range of debt options available, multifamily pricing will be as strong as ever.

For comparison, the current build-to-rent pipeline in Australia is only around $8bn in total. Quite the difference.

While this figure has also grown over the last few years, there are plenty of reasons why both local and international investors aren’t flocking to build-to-rent in Australia in the manner they have elsewhere, and specifically – in the US.

Why multifamily?

Let’s look at why multifamily investments are a smart move right now:

- High demand, low supply – it is the basics of economics – when you find a market with high demand and a shortage of supply, it’s safe to assume it will prove an attractive investment. According to the 2021 National Multifamily Housing Council, the US will require approximately 4.6 million more apartments by 2030. That’s more than 500,000 units a year, more than double the 243,000 units that have been developed each year between 2011 and 2017.

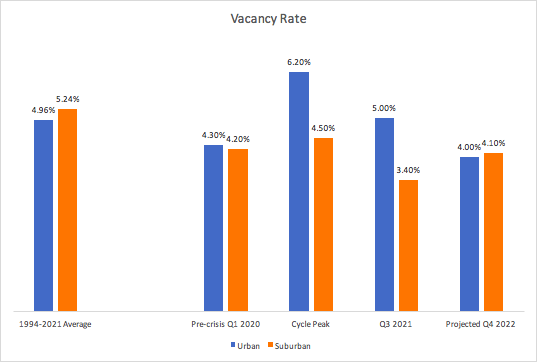

- Record low vacancy – according to CBRE, the vacancy rate in the multifamily residential sector is currently 5%, forecast to fall to 4% by the end of 2022, compared to the average office market vacancy rate of 15.7% across the top 50 major markets in the US.

- Tenant diversification: unlike an office building that may only have a few large tenants or an industrial one that may only have a single tenant, multifamily developments benefit from a large number of smaller tenants. Although this could potentially become a nightmare for building management (I’m sure we’ve all had annoying neighbors at one stage of our lives), it means that rental income is better protected when tenants move on.

- Rental growth: with demand from renters forecast to continue, net effective rental growth is also anticipated to increase by around 8% for 2022 and beyond. Net effective rent is the average rent paid by a tenant, minus any landlord contributions or incentives, which are less common in residential leases anyway.

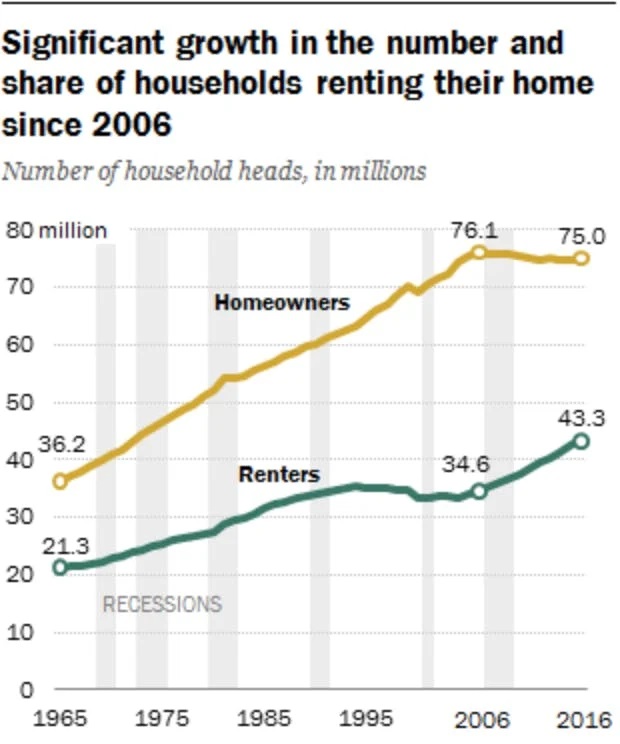

- Shift towards renting: Although homeownership is regarded by many as a pillar of the American Dream, a significant proportion of the population face hurdles to reach the goal of being able to afford a house. The down payments are high, the student debts are large, and the availability of credit is low. As a result, there has been a shift in attitude towards renting which has been a major contribution to the boom in multifamily investment.

How can you invest?

So, we know the pros to making this type of investment. Now let’s look at how you can get a piece of the action.

REITS

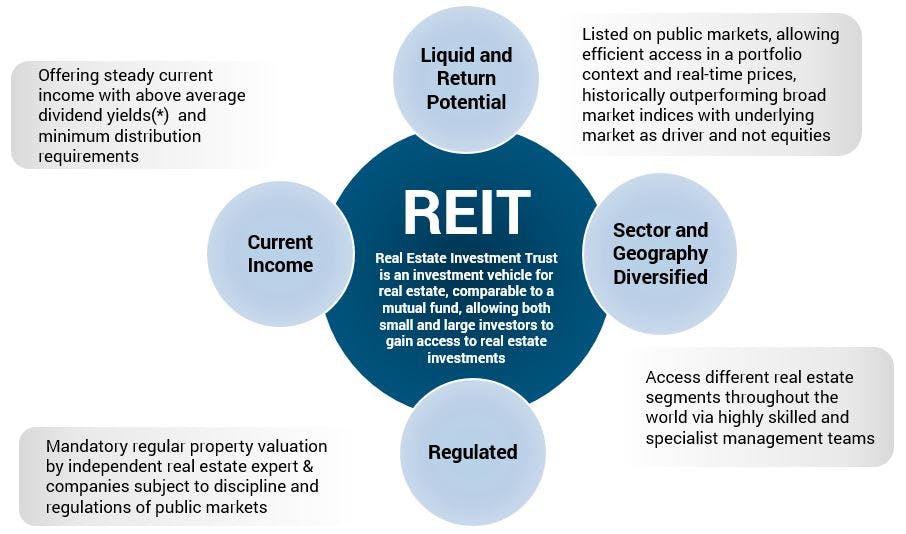

A REIT (Real Estate Investment Trust) is a company that owns, operates, or finances income-producing real estate investments and is generally traded on a major stock exchange.

The properties owned by the Trust are selected and managed by an investment manager, who is usually paid an annual management fee.

While there are some solid positives to working with the Trust, there are also a few negatives you should be aware of when investing in REITS. I’ll explain more about both below.

Pros:

- Low entry cost – generally, there isn’t a minimum investment required to buy into a REIT. Units are usually acquired at either the market share price or a unit price derived from net tangible assets, divided by the number of units.

- Diversification across assets – because investment in a REIT is investment in a portfolio, the risk of your investment is spread across the portfolio, rather than one, single asset.

- No work is required in managing the properties – the REIT is run by an investment manager, so the day-to-day property management of the portfolio is taken care of by professionals and the fee is deducted from the income of the portfolio.

Cons:

- Investors have no input to the assets they own – as a REIT is technically a company that invests in a portfolio of real estate assets, investors have no input in the acquisition process. They can, however, still vote at the Annual General Meeting (AGM) to remove the investment manager (if they’re unhappy).

- Impacted by stock market volatility – as REIT’s generally trade on the equity markets, they are going to be impacted by market volatility and other macroeconomic factors that often don’t impact real estate investments. The value of a REIT should reflect the NTA per unit, however, this is often not the case when trading on the equities market.

REITs in the US

There are a number of prominent multifamily REIT’s that operate within the US and trade on the major stock exchanges. The top 5 largest multifamily REIT’s, including their ticker code and the closing price at 03/09/22, by market cap, are:

- Equity Residential (EQR/$87.78)

- AvalonBay (AVB/$244.46)

- United Dominion Realty Trust (UDR/$57.27)

- Apartment and Investment Management Co. (AIV/$7.22)

- Essex Property Trust (ESS/$342.37)

Fractional Ownership

The other option is through fractional ownership.

As you may know, fractional ownership generally involves direct investment in a single property/development.

Similar to REIT’s, there’s still an investment manager who takes care of the day-to-day management of the investment, but fractional owners have more say in things, as a result of only owning the one asset. That, of course, comes with its own pros and cons too:

Pros:

- Choice of a specific development – investors can choose the specific development/investment they’ll put their money into. That way, they get the change to understand the specific market their investment resides in, as well as other market demographics.

- No correlation to the stock market – being an unlisted, single investment vehicle means that the asset valuation will not be impacted by fluctuations in the equities market.

- Professional investment managers – similar to REIT’s, these assets will still have professionals taking care of the day-to-day management so that investors don’t have to worry about the minor details of owning a property.

Cons:

- Fewer options for ownership – unfortunately, due to their size, most multifamily investments make the notion of fractionalizing the investments difficult. They generally require a much larger equity contribution than single-family units, and therefore, raising the money often requires higher minimum investments.

Some of the companies that offer fractionalized multifamily investments and their current offerings are outlined below.

HoneyBricks

HoneyBricks focuses on a category of US real estate it calls Core Plus multifamily buildings.

Core Plus properties are “high-quality, stable assets in good locations” that offer a moderate rate of return ranging from 8 to 12%.

The onboarding process is relatively straightforward; create an account, connect your digital wallet, and buy tokens representing fractional ownership of an asset. Through this arrangement, HoneyBricks can deliver rent payments back to your wallet in your choice of cryptocurrency.

HoneyBricks token holders can also take out loans

For more information on HoneyBricks, check out our issue on real estate tokenization

Yieldstreet

An alternative investments company that offers a variety of alternative investments, ranging from single offerings to portfolios of assets and funds based on investor risk appetite. You can read more on our in-depth analysis of Yieldstreet here.

- Dallas Fort Worth Multifamily Equity I. Offers investors the chance to invest in a 97% leased, 3-story garden-style complex, built in 2012. $11.4m offering size. Targeting 14 – 16% annualized returns with investment amounts ranging from $15k – $500k.

- Nashville Multifamily Equity II. Opportunity to invest in an apartment building in Downtown Nashville completed in 2010. Offering a size of $19.2m and targeting annualized returns of 17 – 19%. Minimum investment amount ranging from $15k – $1m.

Realty Mogul

An online investment company that was founded to provide accredited investors access to real estate investments that had previously only been accessible to institutional investors.

And here’s a couple of their current offerings that look good to us:

- Ascent, Milwaukee. A 259-unit apartment development, with construction 60% complete at the time of offering. Located in the heart of Milwaukee the development is targeting an IRR of 17.68% with a minimum investment of $125k.

- Azura Apartments, Phoenix. A 387-unit apartment community in the Phoenix suburb, North Mountain. A minimum investment of $35k that targets an IRR of 16.10%.

Conclusion

It’s pretty clear that multifamily is a mature market in the US and forecast to prosper in the coming years.

At the moment, the best bet for regular investors to reap the rewards of the thriving asset class is to invest in one of the many REIT’s that trade on the NYSE. However, as companies like Yield Street and RealtyMogul have shown with their single asset offerings, fractionalized multifamily investment is possible.

Hopefully, as demand in the space grows, these types of companies will be able to offer investments with lower entry prices, giving everyone the chance to benefit from the multifamily boom in America.