September 26, 2022

Read time: ± 6 minutes

Hello and welcome to Alts Cafe!

This is everything you need to know about what’s going on in the world of alternative assets, best enjoyed with your morning coffee.

Let’s go!

Table of Contents

The Big Picture

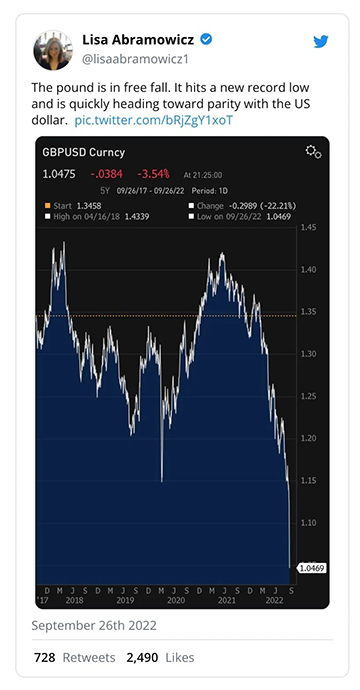

The biggest story (for me) over the last several days has been in the currency markets. It sounds boring, but they’re hugely important. The USD and GBP hit near parity over the weekend, down from around $1.40/GBP not too long ago.

That’s going to exacerbate the UK energy cost crisis this winter, but should at least prop up the property market there slightly.

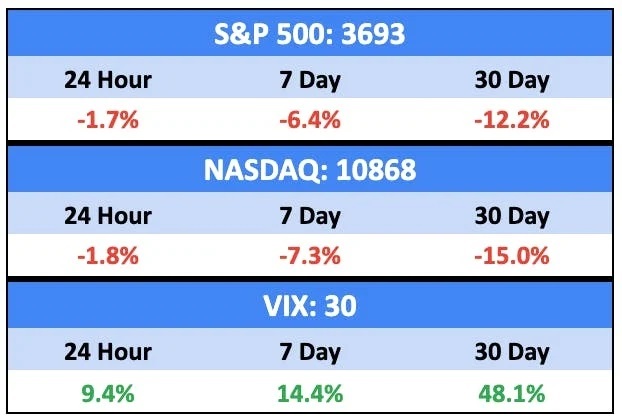

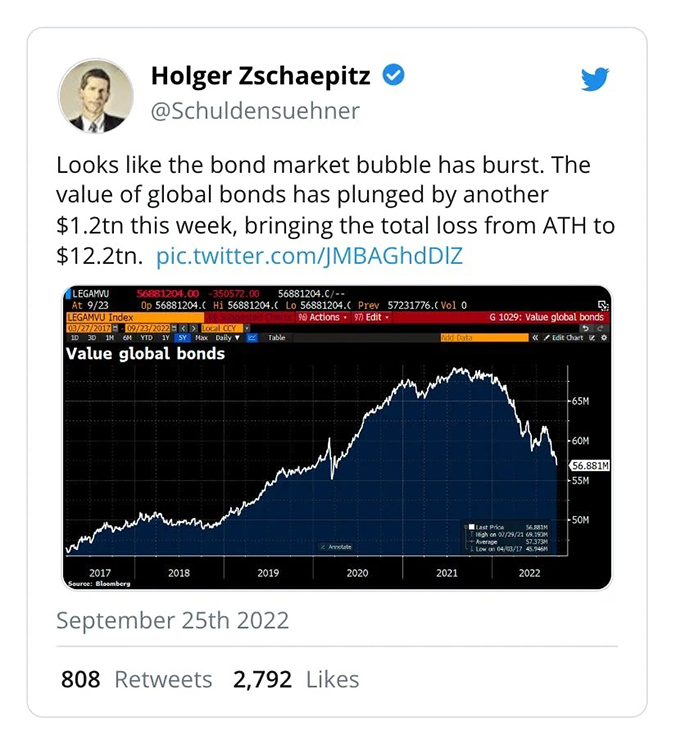

Equity markets everywhere were off last week. But when equities are falling, you can always rely on bonds, right?

Bullish News

- XXX

Bearish News

- The unemployment rate in the US has ticked up from 3.5% to 3.7% and is forecast to hit 4% next year. We think it’ll go even higher. And things look even worse in Europe.

What are we doing?

Fractional Alts picks:

No changes here.

ALTS 1 fund news:

We’re accumulating wine and whisky

Crypto

Here’s what you need to know:

Crypto has been surprisingly resilient over the last week/month, as it began outperforming equities over both timeframes.

It’s not immune to macro forces, but it is holding up better than equities at the minute.

Sentiment around crypto hasn’t changed much over the last several weeks. It continues to slowly melt down.

Bullish News

- NFT transactions on the Solana network are at an all-time high, surpassing 1M in the week ending September 12th for the first time ever and 900,000 in the week ending September 19th.

- Delio Bank, South Korea’s largest Virtual Asset Service Provider, teamed up with blockchain infrastructure firm Blackdaemon, to offer the service to retail users.

- The White House released its framework for crypto regulation.

Bearish News

- Proof of work mining cratered after Ethereum’s Merge.

- The economy is shitty.

What to do with that info:

If you think crypto has begun to decouple from the broader market as institutional money flows out, now could be a good time to start dipping your toes into BTC and ETH.

Real Estate

Here’s what you need to know:

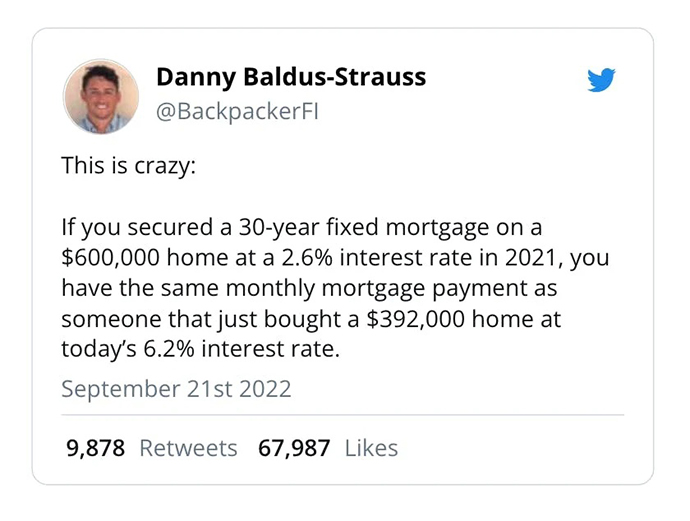

Interest rates will continue to rise through at least 2023, which will continue to push down residential, commercial, and industrial real estate prices globally. Most analysts in most countries expect another 150bps or so.

It’s already bad but it’ll continue to get worse.

From the always-excellent Grit:

Sellers don’t want to sell because: a) They would record a loss (~20-25%) if measured from Feb 2022 highs, and b) They’ve locked in such a low fixed rate that purchasing a new home at the current, higher fixed rate would be extremely unaffordable.

Buyers aren’t buying because: a) There isn’t much inventory due to the above, and b) They can’t qualify for a mortgage at the higher rates, and if they can, again—it will be highly unaffordable.

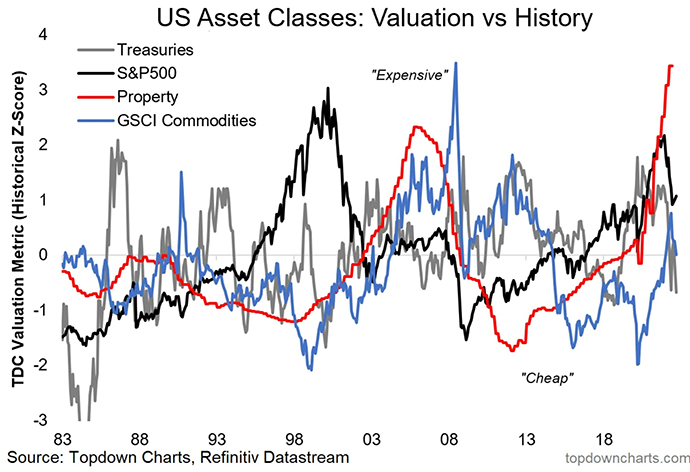

Because of this, real estate is still significantly overpriced in the US. How overpriced? More than it was in 2007.

Anyone who can wait to buy a new house, will. This should continue to push up rental prices.

Bullish News

- John Lennon’s family home is for sale.

Bearish News

- The fed funds rate is expected to rise past 4.5% next year, which would push mortgage rates above 8%.

What to do with that info:

I’m sitting on my hands right now, though I don’t think it’s too late to short this market. There’s more blood to come.

NFTs

Here’s what you need to know:

Azuki saw a huge bump a few days before news leaked that the project was about to announce a significant capital raise. It’s mostly back in line with other projects now.

NFT prices in USD are down significantly for most projects over the last seven days, and volume continues to be a dumpster fire.

From the Defiant:

Secondary sales volumes continue their abysmal streak, with just $123M traded in the week ending September 19. Volume in dollar terms has now dropped for six straight weeks.

That said, NFT floors are mostly flat in Ethereum terms, which is encouraging if you’re doing some paired trading (long NFTs and short ETH).

Bullish News

- Disney is getting into NFTs.

- Chiru Labs, the Los Angeles-based creator of the Azuki NFT collection, plans to raise at least $30 million in an upcoming Series A funding round. Funny how the floor price jumped up right before the announcement.

- Crypto firm Chain, which builds cryptographic ledgers and cloud infrastructure, will be the New England Patriots’ new “official blockchain and web3 sponsor”.

Bearish News

- Bankrupt crypto lender Voyager’s CFO resigns.

- FIFA Collect, which is FIFA’s version of NBA Top Shot for the upcoming World Cup, has sold fewer than 10% of its available inventory.

What to do with that info:

As I said above, if you’re bullish on NFTs, the only real way to decouple the performance is a paired trade against ETH. Unless, of course, you have insider information about upcoming capital raises.

DISCLAIMER: DO NOT PARTICIPATE IN INSIDER TRADING.

Startups

Here’s what you need to know:

There are whispers of venture markets loosening, particularly at earlier stage companies:

Tl;Dr: Nothing is happening at the series C and beyond, but series A and seed rounds are getting done if founders don’t mind a down or flat round.

Bullish News

- Fintechs are getting more specialized, which has boosted their investability.

Bearish News

- Buy now pay later (BNPL) companies continue to struggle. The landscape will continue to deteriorate as unemployment rises and mortgage rates go up. That said, Affirm is expanding to Canada, and another company has come out of stealth to help companies extend lines of credit to their customers.

- Consumer fintech is struggling as the economy continues to sour.

- SoftBank, the largest investor in Oyo, has cut the Indian hotel chain’s valuation from $10 billion to $2.7 billion.

What to do with that info:

Capital-constrained environments force startups to focus, and that specialization could reap significant rewards coming out of this downturn. Capital efficiency and clarity of vision are more important now than ever.

That’s all for this week. Hope you enjoyed your coffee and this edition of Alts Cafe.

Cheers,

Wyatt