New here?

The WC is a selection of five useful, interesting & notable insights, handpicked by our CIO Wyatt Cavalier and pumped into your inbox every Wednesday.

Let’s go!

Table of Contents

Pearl Harbor — not so bad?

81 years ago, on a day that lives in infamy, Japan pulled off one of the most successful sneak attacks of all time. Aiming to cripple the American Pacific fleet, the attack took out five of the fleet’s eight battleships, and killed over 2,400 people.

But you’ll be surprised to learn Pearl Harbour isn’t the worst naval disaster to happen on December 7th.

Britain’s Great Storm of 1703 was an extratropical cyclone that destroyed between 1/3 and 1/5 the British Navy, including the entire Channel Squadron. It killed between 1,500 and 10,000 seamen. Nationwide, between 8,000 and 15,000 souls were lost.

Thirteen ships were completely destroyed — nine more than at Pearl Harbor. Here are some wild facts about the storm:

- 2000 chimney stacks were blown down in London.

- The lead roofing was blown off Westminster Abbey, and Queen Anne had to shelter in a cellar.

- Admiral Sir Cloudesley Shovell’s HMS Association was blown to Sweden.

- Hundreds of people drowned in flooding on the Somerset Levels, along with thousands of sheep and cattle, and one ship was found 15 miles (24 km) inland.

- Approximately 400 windmills were destroyed, with the wind driving their wooden gears so fast that some burst into flames.

- The first Eddystone Lighthouse (Plymouth) was destroyed.

- The number of oak trees lost in the New Forest alone was 4,000.

Next time grandpa tells you how he was fighting off Japanese subs when he was your age while you’re still living in your mom’s basement, feel free to say he didn’t really have it so bad.

Are we in for a jubilee 2023?

With the US midterms in the rearview, American politics is about to kick into a Presidential election cycle.

Former President Trump declared his candidacy for 2024 in November, and current President Biden is set to declare early in the new year.

What can the presidency, elections, and the party in power tell us about the likely economic performance in 2023? If you believe in small sample sizes, quite a lot, actually.

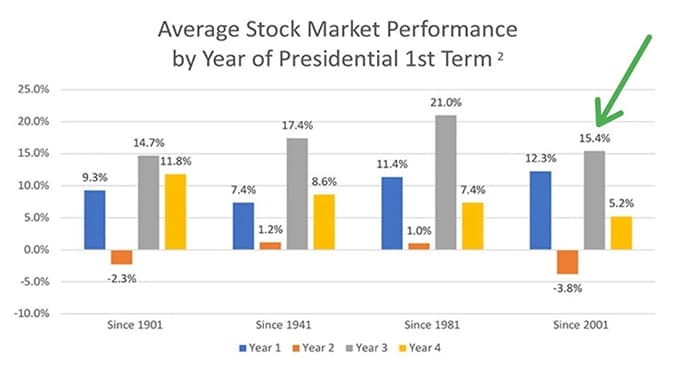

According to Presidential Election Cycle Theory, the third year of most presidents’ terms is by far the best for the stock market, and this is particularly true during the president’s first term in office.

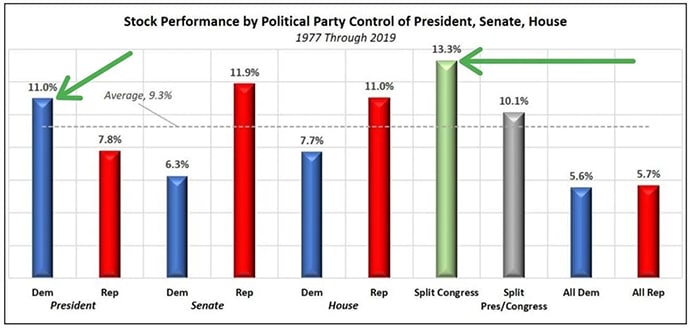

What does control of the House and Senate portend?

According to this very limited data with a super small sample size, the best possible scenario is:

- Democrat President

- In their first term

- Going into the third year

- With a split Congress

With both party’s presumptive nominees exceedingly old this cycle (Trump will be 78 in 2025; Biden 82), I’m curious to see how the market performs based on presidential age. I’ve not found that data yet, but may look into it for next week.

How do the .001% allocate their wealth?

Long Angle is a secretive club for the ultra-rich. Over 60% of its members are worth $5m or more, and 17% top $25m.

And every year, they survey all their members to get a feel for how they allocate their fortunes. Then they publish it for everyone to see. It’s a remarkable source of data, and the entire thing is worth a read.

But we’re Alts.co, so let’s see how and how much money they allocate to the good stuff.

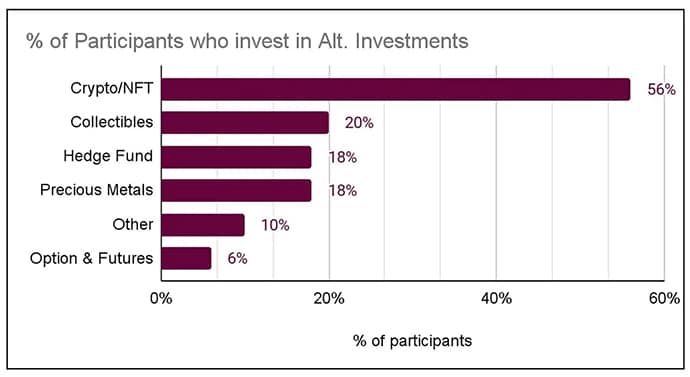

Despite the crypto winter, more than half report investing in crypto, which surprised me a bit.

But more surprising was that more high net-worth investors put money into collectibles than hedge funds or precious metals.

Surprising is an understatement. That shocked me.

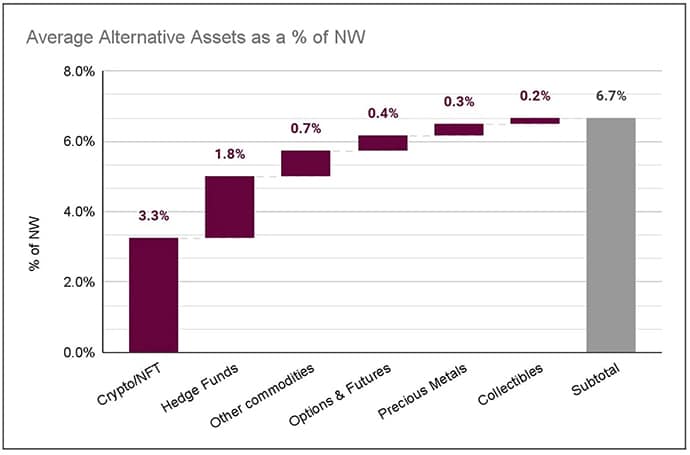

But then I read the next chart, and it made more sense.

While lots of investors have some money in collectibles, they’re mostly just dipping their toes into the asset class. Only 0.2% of their net worth is there. Assuming a $10m net worth, that would be around $20k. In other words, they’ve got a bit of art scattered around one of their vacation homes.

Some other fascinating bits of data:

- People who got rich as investment managers invest 4x to 7x as much of their net worth in alternatives, compared to people who made money elsewhere. A fair number have more than half their money there. Worth noting if you think investment managers are the smart money.

- People 39 and younger invest in alts 2.5x as much as their older counterparts.

- There’s no correlation between net worth and allocation to alts.

Looking forward to next year’s data.

Time to buy a home with your homie?

America’s largest property portal, Zillow, put out some conflicting and confusing guidance for 2023’s housing market this week. Let me sum up, so you don’t have to read it:

- First-time buyers will flock to the midwest, where homes are cheaper than in parts of the country where people actually want to live.

- A Spring 2022 Zillow study found that 18% of homebuyers clubbed together with a non-spouse relative or friend to purchase a home. That number is set to rocket from 18% to 19% in 2023. Sounds slightly interesting until you realize most of those 18% were just borrowing money from parents like people always have.

- Home prices will remain flat or fall slightly in 2023 as inventory rises, so people will be able to afford homes again.

- There’s a glut of new builds coming to market that no one can afford, despite increased inventory, so some of them will be turned into rentals instead.

- People who used low-interest loans to buy a second home over the last two years now can’t afford them anymore but don’t want to sell them, so they may rent some of them out.

Or, in other words, people both can and cannot afford to buy a new home, and will do so, possibly with their cousin or drug dealer. And even though people will definitely be buying homes again next year, everything is getting turned into a rental.

Clear as mud.

And now for something completely different

This is a stat-heavy issue of the WC, so let’s wrap things up with some flair.

Who wants to see the finale to Dirty Dancing set to the Muppets’ song? Go on, you know you want to:

Just try to forget that Swayze’s character was meant to be 25 in the film, while Grey’s was 17.

Also, with apologies to my wife…

I’m sporting this delightful moustache to help raise money for Tunrayo, who was diagnosed with breast cancer this year.

— Wyatt Cavalier (@itiswyatt) November 30, 2022

If we can get $500, I’ll keep the ‘stache through Christmas.

Donate here 👉 https://t.co/SGEVhOHUh4 pic.twitter.com/2HGOXorL7K

What caught your eye this week?

Cheers,

Wyatt