New here?

The WC is a selection of five useful, interesting & notable insights, handpicked by CIO Wyatt Cavalier and pumped into your inbox every Wednesday.

OK, let’s go!

Table of Contents

Tulip mania never really happened

One of the most pervasive and annoying myths in the investing lexicon is the Dutch tulip bulb bubble — tulip mania.

It’s such a thing that Warren Buffet talks tulips when arguing against Bitcoin:

The Dutch tulip bulb market bubble (or tulip mania) was a period in the Dutch Golden Age during which contract prices for some of the tulip bulbs reached extraordinarily high levels and then dramatically collapsed in February 1637; the rarest tulip bulbs traded for as much as six times the average person’s annual salary at the height of the market.

The common perception of the event comes from Charles MacKay’s 19th-century work, Memoirs of Extraordinary Popular Delusions and the Madness of Crowds.

Many who, for a brief season, had emerged from the humbler walks of life, were cast back into their original obscurity,” wrote Mackay. “Substantial merchants were reduced almost to beggary, and many a representative of a noble line saw the fortunes of his house ruined beyond redemption.

Sounds bad! Let’s learn lessons and laugh at these people!

The problem? It’s mostly bullshit.

First, the original account (MacKay’s above), which all our current sources rely on, was written nearly 200 years after the fact. It relies on satirical pamphlets and poems released by contemporary social commentators.

The reality?

- Holland experienced an explosion of international commerce subsequent to its independence from Spain (hello, Dutch East India Company), which minted lots of newly wealthy people;

- A total of 37 people paid more than 300 guilders for a tulip bulb (around $80k today);

- Only 350 people have been confirmed to have traded tulips;

- No one ever declared bankruptcy from tulip mania.

In short, it was a super fashionable thing for nouveau riche people to obsess over for a year or so.

The prices people “paid” are completely false. The reported prices were options contracts sold to speculators, and the clue here is in the name. The speculators had the option to buy bulbs at those prices, but most never did. In fact, the average price paid relative to the options contracts was 3.5%.

Why didn’t they pay for the options? Because the tulip target market (Germany) unexpectedly lost phase one of the 30 years war, collapsing demand for the product. That’s the “collapse” people talk about.

Why has the myth stuck around for so long?

“It’s a great story and the reason why it’s a great story is that it makes people look stupid.”

Dig deeper into the tulip mania myth:

AI might hate banks

Bryce Elder at the FT got bored listening to an earnings call the other day and plugged a bunch of bank names into Midjourney’s text-to-image AI processor. The results are slightly….telling? Suspicious? Entertaining at least.

Here’s my favorite:

Dig deeper into AI:

- Artificial intelligence pioneers back $550mn fund for AI start-ups

- Midjourney Founder Admits to Using a ‘Hundred Million’ Images Without Consent

It’s not just you — good films are getting worse

Since 2000, viewership of the Academy Awards has decreased 65% from 46m to 15m households. Part of that is pandemic-related, but no one was tuning in before Covid either — stats were off 50% from 2000 to 2020.

There are a lot of reasons for this, but the biggest is that the Academy and “normal people” like the same things way less than they used to. In the late 20th century, the Academy did the peoples’ bidding, more or less.

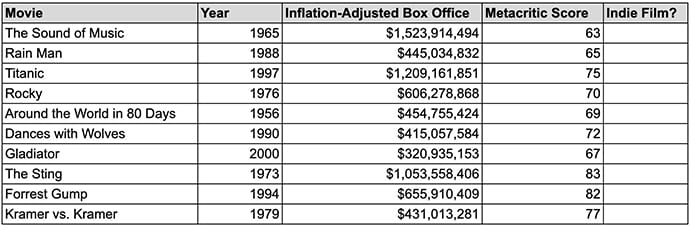

That era’s Best Picture winners were mostly big box office films that critics hated:

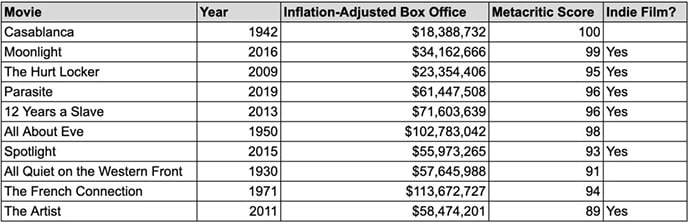

But since the turn of the century, the Academy has given the award to box office stinkers that critics love:

In 2011, a silent film about silent films won the Best Picture award. Talk about being out of touch.

But there was a time (from around 1040 to 1970) when critics and normies agreed. Best Picture winners from that era included films that both made a lot of money and were well-reviewed. Stuff like The Sound of Music, The Godfather, and My Fair Lady.

Most incredibly, the top box office hit ever, was a four-hour Civil War drama.

Gone with the Wind grossed and inflation-adjusted $4.2B.

Dig deeper into film industry stats:

- Are Best Picture Winners Getting Worse? A Statistical Analysis.

- The Five Types Of Nicolas Cage Movies

In Australia, it’s shark week every week

A couple of weeks ago, we dug into asteroid mining. The implications there are immense. Today, let’s stick closer to home.

At the bottom of the Indian ocean, a submersible found a shark graveyard full of extinct species, new species, and lots of Megalodon teeth. It’s a treasure trove for scientists and eBay shills (ancient shark teeth fetch hundreds of dollars on the auction site).

If you can get yourself 3.5 miles below the surface of the water, they’re all yours.

Dig into undersea mining:

- Sunken Treasure (Paid subscription)

- The Case Against Deep-Sea Mining

Saving the world with water

Speaking of salt water… Let’s talk about solar-powered reverse-osmosis desalination.

Every year since 2000, Europe has lost 84 gigatonnes of water due to climate change. That’s “roughly equal to all the water in Lake Ontario, or five times the average annual flow of the Colorado River through the Grand Canyon.“

Closer to home (if you’re American), in 2021, drought cost California over $2B in crop losses and19,240 jobs.

But as of a couple of years ago, there’s an end (and a solution) in sight:

2.4 billion people live within 100 kilometers of the coast, and a great deal of that population is very, very poor. Cheap solar energy providing abundant fresh water will be a step forward in improving their quality of life and the local economies.

It also presents a massive investment opportunity.

And it’s not a sci-fi pipe dream. It’s already happening in the Middle East.

- Investing in Desalination Companies

- Assessment of desalination investment opportunities in the SEMED Region

- Norwegian company Ocean Oasis presents prototype for desalination using wave power in Canary Islands

That’s all for this week.

Cheers,

Wyatt