Welcome to The WC, a selection of five useful and interesting handpicked by CIO Wyatt Cavalier and dropped into your inbox every Wednesday.

If you like what you read here, be a friend and send it on to 5 people you think will enjoy this.

Wyatt

Table of Contents

What in the world are edible bird’s nests?

Thanks to Covid, everyone is sort of aware of China’s unique cuisines, but before yesterday, I’d only vaguely heard of bird’s nest soup and its eponymous ingredient.

And it’s wild.

First the obvious. What I say below, I do so having a) never tried it, and b) fully understanding many of my customs and cuisines may revolt most of the rest of the world, including my wife.

So what’s an edible bird’s nest (EBN)? It’s a nest made by swiftlets using their own solidified saliva. It’s a nest made of bird spit, it’s a delicacy in China, and it doesn’t come cheap.

Four 50g nests (around 7 ounces total) will set you back nearly $600. That’s twice as much as beluga caviar.

The nests are scarce, which is why they’re so expensive, and that’s led to a growing industry around manmade EBNs.

The leading company here is Yanshiwu, which is looking to IPO later this year with a market cap of around $200m. It’s fronted by a well-known Chinese actress named Zhao Liying (think George Clooney and Nespresso).

Analysts estimate the entire industry is worth a cool $6 billion a year, which I’ll file under “billion-dollar industries I didn’t know anything about until today”.

Dig deeper into the $6 billion edible bird nest industry:

- Vietnam Seeks Millions for Edible Bird Spit Industry

- The remote island of nest gatherers

- An economic nesting ground

The countries that could dominate the 2030s

There are two countries I think could dominate the global stage through the next 15 – 20 years: Saudi Arabia and India.

Longtime readers know I’ve spilled a lot of ink on Saudi Arabia’s rise to international prominence beyond its role as an oil producing giant. Recently, the Kingdom has dedicated a significant amount of resource toward improving its reputation and diversifying its income streams.

Just in the last couple years, it has:

- Launched the LIV golf tour

- Launched a bid for the 2030 World Cup

- Lured football superstar (and credibly accused rapist) Cristiano Ronaldo to its domestic league (and rumours are Lionel Messi will join him)

- Announced ties to several tier one VC firms in the US

- Opened four new special economic zones

- Held three Formula 1 races

- Announced a ten year deal with the WWE

- Hosted a top-tier boxing match between Andy Ruiz Jr and Anthony Joshua

And on and on. The country is laser-focussed on raising its stature on the world stage, and it’s got the resources to pull it off.

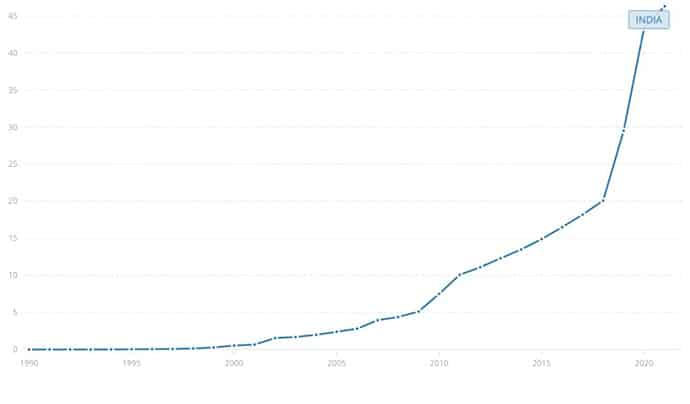

Meanwhile, India became the world’s most populous country sometime within the last couple of months, displacing China.

And that’s not the only way it’s displacing the (now) second-largest country in the world.

India is looking to become a viable alternative to China as the world’s factory floor.

The first quarter of the century saw China explode into the middle class. I think India’s going rapidly catch up.

The two countries are cooperating economically and politically as well, which could make for a powerful alliance.

Dig deeper into the next twenty years:

- Saudi Arabia shelling out on sports, athletes amid accusations of sportswashing

- India planning ‘power grid with Saudi Arabia, UAE’

- China Finally Has a Rival as the World’s Factory Floor

Luxury goods scarcity – cont.

Last week’s dive into profiting from a shortage of white oak trees delivered the biggest response to any WC story ever. People love the idea so much that several have asked how they can invest — and if I can coordinate it.

The answer is…maybe.

If you’re interested as well, please drop me an email to let me know. If there’s enough demand (people + money), I’ll put something together, or at least do further due diligence.

I want to learn more about investing in white oak trees >

While we’re on the topic of luxury goods that are too scarce, I saw a piece on Chartr about the surge in olive oil prices this year.

The spike in prices comes after a prolonged period of high demand — as consumers cooked more at home during the pandemic — but the biggest factor in the recent spike has been supply.

Spain (where I live) is the biggest producer of olive oil by far, and we’ve been hit with droughts across key regions and 36 consecutive months of below-average rainfall. During the October-February season, the country reportedly produced a yield of just 630k metric tonnes of olive oil, less than half of the 1.4-1.5 million that’s usually expected.

Anecdotally this checks out. I’ve got two olive trees in our garden, and they were both bare this year.

I wouldn’t expect this trend to continue next year even if it’s dry again. I’ve seen farmers out installing irrigation pipes and hoses throughout the groves to combat the drought.

Dig deeper into investing in olive oil:

- Extra Virginity: The Sublime and Scandalous World of Olive Oil (book)

- Europe Italy to Invest €3 Billion in Olive Oil Sector

- Prices Continue to Break Records in Spain Ahead of Dismal Harvest Outlook

Garbage companies

The companies Beyond Meat and Peloton–which were 2019 and 2020 darlings, respectively–have been punching bags for equities analysts for years.

So the “Chief Growth Officer” of $BYND is leaving abruptly, following the CFO who left three weeks ago. Remember that the story here is growth “reigniting” this quarter. pic.twitter.com/51j03v3JnC

— Diogenes (@WallStCynic) May 26, 2021

Later in the thread, Diogenes bashes Peloton too. And Lemonade insurance, for what it’s worth.

These two companies keep chugging along, but you’ve got to wonder: How long can they last?

Our buddy Diogenes again:

$BYND…I don’t even know where to start here. Nine months worth of inventory might be a good place to begin. And 14% gross margins of course means they will never be profitable. But other than that… pic.twitter.com/8kkHuiLZal

— Diogenes (@WallStCynic) February 24, 2022

The answer: Surely not much longer.

Peloton–which only added 380k subscribers during the pandemic–just recalled two million of its bikes. That sounds expensive for a company that’s already losing $2.5 billion a year.

Beyond Meat, meanwhile, which is only burning $360m a year, tried to raise $200m last week by selling more shares. That move, which didn’t inspire confidence in investors, sent the shares tumbling 18%.

It’s now 96% off its summer 2019 highs.

Why am I talking about equities when we usually focus on alts?

Because fundamentals always matter eventually, and while it’s easy to poke fun at people losing their shirts on baseball cards, Bitcoin, or sealed video game cartridges, sometimes traditional investments are the real gamble.

Dig deeper into terrible investment ideas:

Ponzi schemes – not just for rich guys

Let’s bring it home with something entertaining. The Atlantic ran a fascinating piece about an auto mechanic that pulled off one of the most impressive Ponzi schemes of all time.

It’s a long read but worth it.

That’s all for this week, hope you enjoyed it.

Seen anything totally insane lately? Send it over, if I include it in an issue I’ll send you some sweet, sweet SWAG.

Cheers,

Wyatt