August 11, 2022 | ± 4 minutes

New here? The WC is a random mix of useful / interesting / notable stuff that gets pumped into your inbox every Wednesday.

Let’s go!

Table of Contents

The bigger they are, the harder they fall.

If you’re not a cryptobro, you might not know who Michael Saylor is.

Until recently, he was the CEO of a company called MicroStrategy. It was founded decades ago to be a business intelligence provider for big companies. Enterprise software sales with around $450m per year of revenue.

A bit boring but pretty good.

Two years ago, he also got bored of that, so he started using his company’s treasury to buy up Bitcoin.

$4B worth of Bitcoin, to be precise. It was a pretty big distraction from what was meant to be the main function of the company — boring enterprise software sales — but whatever, Bitcoin was mooning…

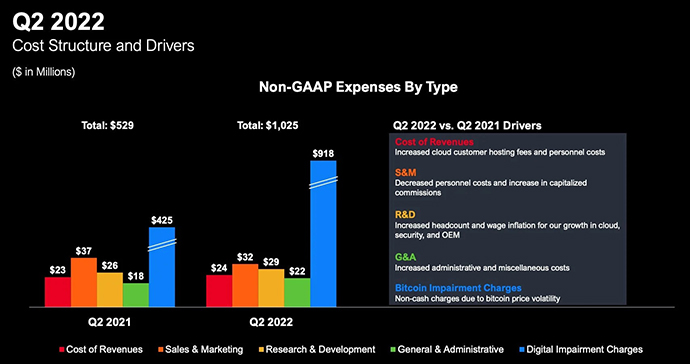

…Until it wasn’t. And last quarter, the company lost over $900m in just three quarters.

He’s no longer the CEO of the company.

Remember when you lost $1,000 on LUNA? Welp, at least you’re not this guy.

Treaties don’t work

There are over 250 000 active international treaties today, and most of them are useless.

The majority doesn’t work, and some of them actually produce effects opposite to the treaty’s intended purpose.

The two treaties that have done the most harm:

Signatories to the UN Convention on the Rights of the Child of this treaty have:

- Lower Amnesty International human rights ratings

- No improvements in health outcomes

- Worsened human rights practices

- Increases in child labor

The reason for this is the “paradox of empty promises.”

Repressive governments face few negative consequences and reap diplomatic rewards for signing human rights treaties without meaningfully implementing provisions that may be counter to their interests. Once diplomats get the treaty signed, they’re off somewhere else while the despot continues to oppress and destroy.

The best way to become a millionaire vineyard owner?

Start off as a billionaire.

The second best way?

Buy marginal vineyard land that will become more fruitful as temperatures rise.

With traditional wine regions boiling over this summer (105 F in Burgundy; 96 F in Willamette Valley; Bordeaux on fire), pieces of land that used to be too cold for wine are suddenly looking a bit better.

The UK is now producing (mostly) drinkable wine. West Sonoma, which has been useless for centuries, has started to pop.

And just last week, a French insurance company picked up Platt Vineyards, which lies on the “extreme climatic edge of viticulture.”

As for me? I’m moving to Tierra del Fuego.

Now you can short NFTs

Are you sick of all those kids using their monkey jpeg money to buy Rolexes and Ferraris? Are you convinced it’s all a scam that’s going to collapse any day now?

Now you can put your money where your boomer mouth is with SynFutures.

Here’s how it works:

“NFTures bases its contracts on spot price oracles from decentralized exchanges such as Uniswap and SushiSwap, as well as NFT fractionalization protocols such as Unic.ly and Fractional. Similar to traditional futures markets, the spot and futures prices eventually converge on a set periodic schedule.”

Got that? Just smash the big red X.

NOT FINANCIAL ADVICE, OBVIOUSLY.

Speaking of gambling on NFTs….

Last week, we purchased our second NFT for the ALTS 1 collection – a PROOF Collective NFT. This gives us access to the 1,000 member community, as well as any future airdrops they release.

Previous drops have included Moonbirds, Oddities, and Grails, and PROOF is giving its members another opportunity to roll the dice.

This week, they released mint passes for the Grails II collection….and we’ve got one.

Here’s how it works:

PROOF reveals the 25 pieces of art but not the artists. You find that out once you’ve minted. So it’s a real gamble to mint one -you could get a Beeple, or you could get a Gary V.

The current floor price for a mint pass is around 3.5ETH. Average value of items from the Grails I collection is north of 7ETH, but the median value is only around 3.6ETH. And that’s for the first collection, which is likely to be more valuable than the second.

What would you do? Sell or mint?

Last but not least, our Podcast

In this episode, Horacio spoke with Max Album, the Chief of Staff at Blockbar. Max talks about how blockchain technology safeguards against fraudulent wine and spirit products.

He also deep-dives into how brands use NFTs to leverage customer relationships, and discusses the relationships Blockbar has cultivated with luxury brands, limited-run offerings of tequila and cognac, and more.

What caught your eye this week?

Cheers,

Wyatt