New here?

The WC is a selection of five useful, interesting & notable insights, handpicked by our CIO Wyatt Cavalier and pumped into your inbox every Wednesday.

Let’s go!

Table of Contents

[Investing in] crime pays

RR Auction is known for selling some wacky stuff, and you won’t be disappointed by their current auction, specializing in autographs and artifacts from famous outlaws, gangsters, and lawmen.

Al Capone is best represented, and if you’ve got the cash and the interest, you can pick up a signed photo, a signed inmate record card, his medical archive, and lots more.

If you’ve got the stomach for it, the original news service photo from the St Valentine’s Day Massacre is on offer. It’s pretty grim but it’s affordable at around $1,000.

Bonnie Parker (from Bonnie & Clyde) is featured as well.

An original photograph (estimate $600) would be a neat item, but if you really want to treat your special someone, an original book of handwritten poetry composed by the lovelorn outlaw while sitting in jail would surely make the perfect Valentine’s Day gift.

Check out Stefan’s writeup on Investing in war memorabilia to learn more about profiting from dangerous items.

Opportunities in Nigeria

In last week’s edition of The WC, I gushed about the startup scene in Lagos, calling it out as one of 2023’s best investment opportunities.

Let’s put some more meat on that bone.

From this week’s Outliers, here are four specific needs being met by startups in Nigeria:

- Automotive and insurance: There are +10m vehicles on the road in Nigeria, though insurance adoption is below 1% for coverage, and sourcing qualified mechanics, and parts is a major problem. As such, there are companies looking to fill the gap with models like D2C automotive insurance (ETAP) and marketplaces for mechanics for spare parts and servicing (Mecho).

- Real estate: Many countries have well-established digital marketplaces for renting and selling real estate. One major nuance to the Lagos rental market was that a deposit of a year’s rent upfront was usually required, making the rental market much less accessible. One company solving this was Spleet, which provides a marketplace for listings of real estate plus a lending (BNPL) offering to pay the deposit for renters, including credit checks to improve the rental experience for both sides.

- Financial infrastructure: There was a lot of activity in fintech, across B2B (emerging) and B2C (cards, trading, crypto) etc., plus core financial infrastructure. This makes sense given 85% of the Nigerian economy is cash-based and, therefore, any shift to online will bring a flux of transactions online — hence companies like Kippa and TeamApt (digitizing informal economy), or Payhippo (B2B lending) are proving out the exciting trends of financial access and services for B2B vs. incumbent offerings.

- Wholesale B2B marketplaces: There was an emergence of tech-enabled wholesale marketplaces for food distribution to restaurants (VendEase) and allowing for the buying and selling of chemicals (Matta). Core marketplaces are forming to service large industries, especially ones that are core to day-to-day consumption.

Are you investing in Africa? Please let me know.

Note: TEN13 is an investor in Alts.

Taking the long view

The Cultural Tutor is one of my favorite follows on Twitter, and they put out a fantastic thread on New Year’s Day.

The thread highlights 23 surprising events that our descendants have to look forward to. A few of the best:

- 15,000 years from now the oscillation of Earth’s poles will cause the climate of the Sahara Desert to become tropical, as it was in the past (btw, if you’ve not seen Sahara, it’s low-key excellent).

- 24,115 years from now — the half-life of plutonium-239 — Chernobyl will return to normal levels of radiation.

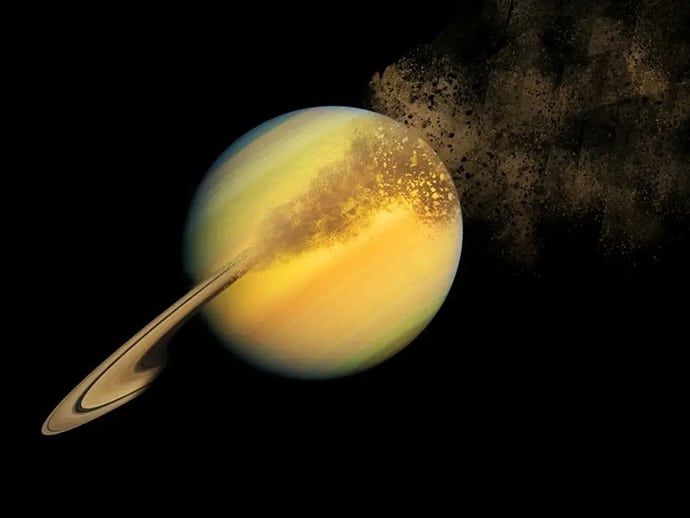

- 90 million years from now the Rings of Saturn will have disintegrated.

- 2.8 billion years from now all remaining life on earth will become extinct.

- 10 duovigintillion years from now, the universe will be almost empty. Photons, baryons, neutrinos, electrons, and positrons will fly from place to place, rarely encountering one another…

Silver linings

The remote revolution is here to stay, and New York is embracing it to solve its longstanding problem with affordable housing.

Mayor Eric Adams plans to turn all those empty offices into apartments.

YIMBY's are going mainstream in '23.

— John Belitsky (🏢,🏢) (@JohnBelitsky) January 10, 2023

Adams is talking about 20k units targeting office conversion in Midtown, Flushing, Bronx Hub.

NYC, which has had a housing shortage since World War 2, is promising massive new inventory.

https://t.co/Ew0DzjxuTo

The scheme, which could create 20,000 new apartments over the next ten years, “includes specific proposals to ease zoning restrictions and offer tax breaks to property owners”.

This plan solves a real need in the Big Apple — “Nearly 69,000 people spend each night in a shelter run by the New York City Department of Homeless Services, and the vacancy rate in apartments priced below $1,500 a month has plummeted below 1%”.

Employees come into the office far less today than they did before the pandemic, and that’s not likely to change. With office vacancy rates double what they were pre-COVID, it makes sense in New York and elsewhere.

Atlanta, Chicago, Columbus, Dallas, Denver, Houston, Los Angeles, San Francisco, and Minneapolis all have vacancy rates above 20%, and that’s likely to run to 50% as leases expire.

Who’s next?

The benefits of being short

Size matters. And not just because tall people can reach stuff on the top shelf.

- A man who is six feet tall will earn, on average, $166k more than his 5’5″ counterpart over a 30 year career.

- Male CEOs are three inches taller than the average. American presidents are even bigger.

Studies actually show there are lots of benefits to being small. Short people:

- Live longer;

- Get cancer less often;

- Consume less food.

If people were just 10% shorter in America alone, we would save 87 million tons of food per year.

If you’re single, perhaps it’s worth considering a smaller spouse. You could just save the planet.

That’s all for this week.

Cheers,

Wyatt