Welcome to The WC, a selection of five useful and interesting handpicked by CIO Wyatt Cavalier and dropped into your inbox every Wednesday.

If you like what you read here, please forward it to a friend. We appreciate it!

Wyatt

Table of Contents

Does money grow on trees?

What’s an acorn?

It’s an oak tree, in a nutshell.

Now we’ve got our forestry humor out of the way, there’s a slow-motion car crash coming over the next twenty years that’s going to mess with your bourbon supply.

But it’s fixable, and there’s perhaps an investment opportunity here.

The best bourbons are aged in white oak barrels, and while there’s no shortage of these slow-growing behemoths today, the species has a demographics problem that’s going to hit soon.

In the eastern USA, where the trees thrive, over 75% of the current stock is mature trees. For a variety of reasons, there aren’t enough seedlings and saplings to quench demand once those trees are cut down over the next 10 to 20 years.

There are conservation groups looking into this, but we’re here to talk investment ideas. So let’s see how much money you can make investing in white oak trees.

While a white oak tree can live more than 500 years, it reaches 60 feet tall and three feet wide within two decades, so that’s our timeframe.

Planting one acre of white oak trees today to sell in twenty years – an investment scenario:

1. Initial investment

- White oak trees you can grow per acre: 100

- Cost per sapling: $50 ($5,000 total)

- Cost to buy one acre of land: $1,000

- Cost to clear an acre of land (totally guessing here): $10,000

Upfront investment = $16,000

2. Value of trees after twenty years

- Value per tree: $6,500 to $8,500, so let’s say $7,500. There’s actually a glut of white oak now, so this number is much lower than what we’ll see in 20 years, even accounting for inflation.

- Number of trees: 100

Value of trees at maturity = $750,000

Turning $16k into $750k over twenty years is a 21% annual return.

While I’m certain I’ve missed out lots of costs, there are probably also profits to be made on this acre while the oaks are maturing. Set up AirBnb units, take the kids camping, grow ginger, whatever.

Plus, white oak trees are relatively abundant now (cheap) and will be scarce in 20 years (expensive). So this feels about right.

I’ll drink to that

Dig deeper into investing in white oak trees:

- The White Oak Shortage That Could Ruin the Bourbon Industry

- How Much Are Oak Trees Worth?

- How Bourbon Producers Are Rallying to Preserve America’s White Oak Industry

AI is coming for your job — *Hollywood edition*

Every time a new video media technology or business model emerges – television, VCRs, streaming – Hollywood’s writers have to strike to force production houses to ink contracts that reflect the new reality.

The emergence of AI is no different; It’s a hugely disruptive technology that’s redefining how television shows and films are made.

And studios are jumping at the chance to replace writers, editors, and even actors with artificial intelligence.

AAAAAGGHHHHHHHH WHAT THE FUCK pic.twitter.com/YtaLe4R4AR

— Elizabeth May/Katrina Kendrick (is away working) (@_ElizabethMay) May 6, 2023

So in 2023, writers are striking again to ensure their place in a computer-powered Hollywood.

It’s impossible–for now–to replace blue-chip talent, but what about the bottom 80%? Or soon-to-be 95%?

Young writers spend a lot of time doing mundane stuff AI could easily replicate. UCLA students make $150 a day as extras on daytime TV shows.

Studios don’t need an intern sifting through scripts when AI can summarise and rate submissions. And they don’t need extras anymore when you can just do a 360 degree 3D scan that lives forever.

Another fun thing Studios do with extras is take full 3D scans of them, for no extra pay, so they can add them in later and have no obligation to not sell the 3D scans to other productions for whatever other use is needed

— Jack Ryan Yuran (@YackJuran) May 6, 2023

These unsung cogs in Hollywood’s production machine — the ones buried in small print when credits roll — comprise the vast majority of actual human beings who make things work. But their future is precarious at best.

And there are second and third order effects that will ripple through the economy as the bottom of Hollywood’s pyramid is gutted.

For example, who’s going to serve the food if there are no starving actors? Who’s going to eat the food if 95% of the city’s industry is automated?

Hollywood’s writers are, I believe, the first industry to take direct industrial action against AI, but they’re far from the last.

This is the first of surely dozens of actions like this, across hundreds of disrupted industries over the next few years.

Dig deeper into Hollywood before it disappears:

- Find yourself a job as an extra while you can

- All About the Writers Strike: What Does the WGA Want and Why Are They Fighting So Hard for it?

- A history of Hollywood writers’ strikes

AI is coming for your job — *Education edition*

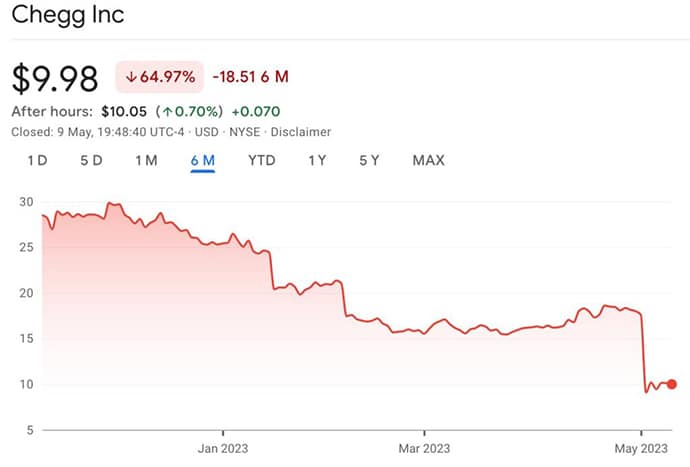

Why would a student (or more likely a parent) pay $20 a month for low-level homework help from a company like Chegg, when ChatGPT can do the same thing for free? And probably do a better job of it?

It turns out you wouldn’t, and Chegg’s CEO is sort of bummed out about that. From their earnings call last week:

“Since March, we saw a significant spike in student interest in ChatGPT. We now believe it’s having an impact on our new customer growth rate.”

The day after he said this, the company’s share price was down 47%, wiping out nearly $1 billion in value.

To fight back, they’re rolling out something called CheggMate (get it!?), but it may be too little too late. Kids move on quick, and Chegg may get left in the dust.

Further, Chegg’s jobs board includes 46 open positions but none specialising in AI, so I’m not super confident in their ability to turn this around.

While this is obviously bad for Chegg, it’s fantastic for all the kids who can’t afford $20 a month for homework help. This sort of technology can help educate a billion kids over the next decade.

Dig deeper into how AI will change education:

- Book recommendation: The Diamond Age

- EdTech Is Going Crazy For AI

- AI In The Classroom: Pros, Cons And The Role Of EdTech Companies

Amazon always wins

Longtime readers know how much I love selling sawdust.

When a company “sells its sawdust,” it’s turning its waste product into a profit centre. Used coffee grounds, the sluice from desalination, and the gunk leftover from tequila production all have their follow-on uses.

Amazon riffs on this in a slightly different way — they create a product or internal service that costs a lot of money, then they sell or license it to everyone else. Amazon Web Services is the best example of this strategy of turning a cost centre into a profit centre.

And now they’re doing the same thing with original video content from Amazon Prime.

That is, Amazon is licensing a significant number of its original films and TV shows for other services to broadcast.

While Amazon and other streaming studios have dabbled in this before, the scale of today’s initiative is unparalleled. They’re looking to shift a significant chunk of their blue chip stuff including “The Marvelous Mrs. Maisel,” “Borat Subsequent Moviefilm,” “Coming 2 America,” “Goliath,” “Hunters,” “The Tender Bar,” “The Tomorrow War,” “The Voyeurs” and “Without Remorse,” among others.

Streaming is insanely competitive — it’s actually called the Streaming Wars — so why would Amazon do this?

Byrne Hobart has a unique take:

One result of Amazon’s unique demand function for content is that it’s less likely to be the ideal high bidder for a given movie or show for the entirety of that media product’s existence, so, in traditional Amazon fashion, anything that functions as an internal cost will be externalized as a profit center.

Amazon values this content less than other streamers do, so it may as well sell some of it off.

No word how this will affect the writers who scripted the shows. They’ll probably get f*cked, though.

Dig deeper into the Streaming Wars:

- The golden age of the streaming wars has ended

- Amazon Prime Video to sell content on competing streaming services

- Only 37% of viewers finished Amazon’s extremely expensive Lord of the Rings series

Film

Last week, Grace and I spent our ten year anniversary in southern France. While there, we spent a cozy evening drinking (too much) Malbec and watching a film about Reddit co-founder Aaron Swartz.

He had the misfortune of being a brilliant activist programmer when the US government was looking for someone to make an example of.

If you care about access to information, privacy, tech culture, or just enjoy a good (if very sad) story, I recommend it.

It’s free on YouTube.

Dig deeper into the cost of free information:

That’s all for this week, hope you enjoyed it.

And if you did, be a friend and spread the word. We appreciate you

Cheers, Wyatt