New here?

The WC is a selection of five useful, interesting & notable insights handpicked by CIO Wyatt Cavalier and dropped into your inbox every Wednesday.

This week’s five insights are possible thanks to a new alternative investing player in the arena.

Table of Contents

China is curb-stomping the world

China is now #1 in 37 out of 44 critical world technologies.

This may or may not surprise you, but China continues to demolish the rest of the world in scientific advancements.

Some of these 44 fields are serious business, too. They include:

- Energy

- Robotics

- Defense (!)

- Biotechnology

- Space technology

- Advanced materials

- Artificial Intelligence

- The environment (?)

- Quantum technology

Key facts and takeaways:

- For some technologies, 100% of the world’s top 10 leading research institutions are based in China

- Collectively, these universities generate 9x more high-impact research papers than the second-ranked country (usually the US).

- 20% of these high-impact papers are authored by researchers with postgraduate training in the US, Australia, the UK, New Zealand or Canada.

- Over the past five years, China generated 48.5% of the world’s high-impact research papers into advanced aircraft engines, including hypersonics (5x the speed of sound)

China is winning, and it’s no longer close. I’m not even sure the rest of the world knows it’s losing yet.

Whether or not you see this as a problem depends a lot on where you’re from, but it will be tough for the rest of the world to catch up.

China’s got a decades-long laser-beam focussed lead on this stuff and a government that can helpfully (or not) direct private companies to do whatever it wants.

Dig deeper into China’s technical dominance:

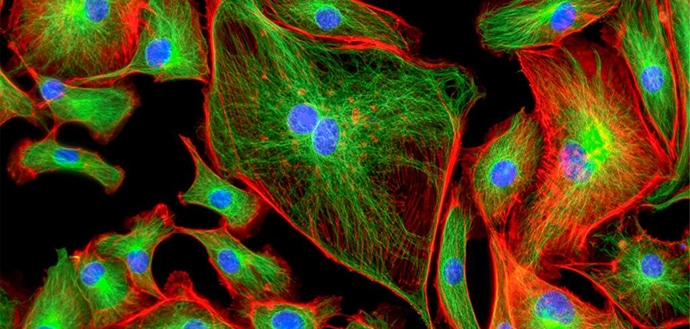

Cell painting: Not just tattoos

Developing a new drug is an exhaustive and exhausting process that takes years.

An important first step is introducing the new compound to a cell in a petri dish, watching what happens, then taking notes.

Then repeat. Dozens, hundreds, or thousands of times.

But recently, a new technology called Cell Painting was released, and it can potentially render all this into obsolescence.

How cell painting works:

- 100,000+ pictures are taken with a special microscope

- Software labels cells with unique tags to reveal interactions between them

- Next, a 3D map is created, with unprecedented detail.

- This is all stored in a database until researchers come looking for a compound that has X effect

This all means researchers can visualize what is happening in each cell. It also means they can study massive numbers of cells simultaneously.

The implications of this methodology when combined with machine learning and artificial intelligence are magnificent. Given a massive data set and desired outcome, and how long will it be before the tech can predict a new wonder drug?

And who will be the first to create these wonder drugs? The US? China? Sweden? Somewhere else?

Dig deeper into Cell Painting:

- Cell Painting – A Cellular Imaging and Machine Learning Approach to Drug Discovery

- A technique called Cell Painting could speed up drug discovery

- What is the JUMP-Cell Painting Consortium?

Finance 101 – What is duration matching?

[Note: Please read this section in the voice of Roy Kent, because the whole thing makes me so f^$# mad]

There have been a ton of really dumb takes on why SVB collapsed last week. It was too woke! Jim Cramer supported it! (I mean, he did, but that’s not why it failed). And on and on.

There were several contributing factors, but a lot of people have made themselves look dumb over the past week. Very few are talking about what actually happened. So I’m gonna help us all become instantly better at treasury operations than SVB was.

[This is vastly oversimplified; I know]

See, SVB had lots of deposits. Over $150 billion worth.

When their clients want their deposits back, they have to pay them. And in a startup environment where no one’s raising big rounds anymore, money is leaving the bank faster than it’s going in.

Banks make money by lending out money at a higher rate than they borrow it. SVB paid out 0% interest to its depositors and bought a bunch of 10-year treasuries paying ~1.5%. Hooray for free money!

But because interest rates have gone up so much, all those long-dated treasuries are worth way less than when SVB bought them. Like 80 cents on the dollar.

So SVB had to suddenly sell those $150b worth of bonds, it would only get ~$120b for them.

Now remember, they’re still paying 0% interest, and the 1.5% delta was still yielding them $2b/year in profit.

This is all fine, until clients suddenly want their money back all at once.

- Bank clients: Hey SVB, I’d like my money please

- SVB: Sure, how much?

- Clients: All of it. $150b

- SVB: [immediately vomits]

This clever scheme to pick up $2b a year in profits from the interest rates delta resulted in a $30b loss because the bank didn’t match the durations.

To put this another way:

- The asset duration is 10 years

- But the liability duration is “right fucking now.”

And just like that, it’s all over.

Time for a bank run!

Dig deeper:

How do bank runs actually work?

Again, SVB would have been fine if no one yanked their money out.

This leads us to the second finance lesson of the day: How does a bank run work?

A bank run is when everyone (or enough someones) take all their money out of the bank, because they think it’s about to become insolvent (via, e.g. improperly matched asset and liability durations). When everyone takes all their money out, and the bank doesn’t have enough on its balance sheet to stay in business (or cover all the withdrawals), it’s game over.

So in many ways, banks stay in business based on hope and belief.

Put another way, banks are like magic airplanes.

This magic airplane is full of passengers whose belief in the airplane’s ability to stay aloft is in fact what keeps it aloft.

- Passengers can come and go, some can go to the toilets, and a few can fall asleep. But as long as the vast majority still believe in the plane, their magic pixie dust will keep it aloft.

- At the rear of the plane, there’s an exit that transports passengers to another airplane. It’s super easy, and there’s no good reason not to do it, except for laziness and inertia.

- Now imagine that suddenly, a few loud passengers start to worry the plane is gonna crash. They instantly bolt out the rear exit, and suddenly the plane’s going wobbly. Not enough pixie dust for a smooth ride, but not enough to crash. It’s still ok.

- But then, our next wave of passengers get airsick, and say it’s better to bail out than risk it.

- Now the plane is getting rocky, and suddenly everyone wants off before it crashes.

Unfortunately, once a bank run has started, it pays to join the stampede.

Sadly, there’s limited upside to staying put, and huge potential downside. Herd mentality is ugly, But it’s logical.

So everyone rushes to exit the plane at once, and just like that, boom. It crashes.

And that’s a bank run.t

Note: This metaphor works for currencies as well. Bitcoin is powered by faith in bitcoin. The US dollar is powered by faith in the US dollar. And round and round we go.

Dive deeper into bank runs:

Life of Pi

Yesterday was Pi day (3/14), and while the occasion may have passed you by, I’m here for the annual celebration of circles.

Here are some Pi facts you probably don’t (and now wish you didn’t) know:

- Since the exact value of pi can never be calculated, we can never find a circle’s accurate area or circumference. You can also use it as a stress test for a computer.

- Rajveer Meena, from Vellore, India, holds the record for reciting the might digits of Pi. He recited it to 70,000 decimal places, and it took him seven hours. He wore a blindfold.

- A 19th-century Briton named William Shanks spent most of his life manually calculating Pi to 707 digits. It was discovered after his death that he’d made a mistake, and only the first 527 digits were correct. (What a moron!)

- All those digits, while impressive, aren’t actually useful. You only need nine digits to calculate the earth’s circumference to within 1/4 inch.

Dig deeper into Pi:

- Last year’s Pi Day activities (YouTube)

- Pi Day – William Shanks, the human calculator who made a mistake

- Pi Day activities fun for the entire family

That’s all for this week.

Cheers,

Wyatt