New here?

The WC is a selection of five useful, interesting & notable insights handpicked by CIO Wyatt Cavalier and dropped into your inbox every Wednesday.

Table of Contents

You think you’re lonely?

“I still haven’t showered. But then, I’m an extreme sportswoman. I could go another 500 days.”

So said Beatriz Flamini when she emerged from the solitude of her 500 day stay at the bottom of a Spanish cave last week.

Why would anyone spend a year and a half at the bottom of a cave?

She wanted to “study how the human mind and body can deal with extreme solitude and deprivation.”

Thought to be a record for the longest anyone has stayed alone at the bottom of a cave, Flamini’s journey of self-discovery was apparently relatively straightforward.

“For me at least, as an elite extreme sportswoman, the most important thing is being very clear and consistent about what you think and what you feel and what you say,” she said. “It’s true that there were some difficult moments, but there were also some very beautiful moments – and I had both as I lived up to my commitment to living in a cave for 500 days.”

The worst part? The flies.

“There was an invasion of flies. They came in, they laid their larvae and I didn’t control it and so I suddenly ended up enveloped by flies.”

That’s me out of the cave.

Dig deeper into how to do more in less time:

- Spanish woman emerges after spending 500 days living alone in cave

- 19 Of The Most Bizarre World Records You Never Knew Existed

- We talked to 100 people about their experiences in solitary confinement – this is what we learned

You’re not as smart as you think you are

Are you a younger man? An older woman?

You’re probably 5 – 15 IQ points less intelligent than you think you are.

Do you think you’re smart?

You probably also think you’re far more physically attractive than you are.

Those are just two two key points from a recent study that compares how people view themselves vs objective reality.

But the most telling bit came out of how people view themselves as they age.

Perhaps unsurprisingly, men tend to think less of themselves when they grow old while self-confidence increases for women as they mature. This factors in across several metrics:

- Intelligence

- Emotional intelligence

- Attractiveness

- Healthfulness

God give me the confidence of a young man or mature woman.

Dig deeper into how you’re probably not the person you think you are:

Unlikely covid victims

When something as cataclysmic as a pandemic rocks the world, there are bound to be unintended consequences and little-known victims. Second, third, and fourth order effects of both the event and humanity’s response to it.

This week I came across two victims you may not have thought of.

First, I’ve said a lot about office vacancy rates and the decline of in-person working, and some of the victims there are obvious. Corporate landlords are hurting.

But there’s an entire ecosystem that fed off the in-person teat. Cleaning staff, onsite food and drink vendors, downtown happy hour hot spots, and a new one:

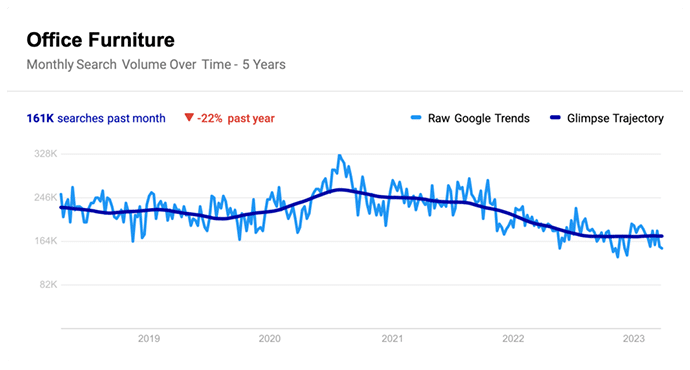

Office furniture suppliers have seen a 50% decline in search volume compared to prior to the pandemic.

There was a brief spike in mid 2020 when everyone frantically searched for kit to do up the home office, but it’s been a downward slide since then.

Second, you’re probably heard the box office is struggling. Despite lifted restrictions, US domestic box office receipts were 40% lower in 2022 than they were in 2019.

That affects loads of people in Hollywood, but let’s not forget the company responsible for all those cheesy adverts before the trailers roll.

National Cinemedia, which was valued at some $600m pre-Covid, just declared bankruptcy. Shares are now trading for literal pennies.

It’s always useful to think about how the butterfly flapping its wing across the globe might just cause your own personal typhoon.

Dig deeper into unorthodox real estate investing:

Profiting from AI

Over the last six months, I’ve spent a lot of time noodling on the AI value chain. Who will reap the rewards here?

A lot of VC investors think it’s a wave of startups that are little more than thinly skinned ChatGPT clones.

Others think it’s factories and manufacturers.

But Jakob Greenfied put me onto a thought piece by Justin Mares that looks at SaaS companies through the lens of direct to consumer brands.

The logic goes like this (via Jakob’s newsletter):

- A few years ago there was a ton of hype around direct-to-consumer (DTC) brands. Shopify, “arming the rebels”, that kind of stuff.

- But since it was so easy to launch new brands, the landscape quickly became incredibly competitive. As a result, DTC brands were far less promising businesses than they initially seemed.

- Now with the advent of all these new AI tools something similar is about to happen to SaaS businesses.

- Just as there was a flood of DTC brands after infrastructure companies like Shopify made it super simple to launch one, there will be a flood of software products as a result of Chat-GPT and Co.

- So the SaaS world is about the enter hard times, just like the DTC world did.

- The big winners, just as it was the case for DTC brands, will be (1) infrastructure platforms and (2) companies that own distribution.

While I don’t necessarily disagree with the thesis, there’s more to it.

I think AI can help incumbents develop a deeper moat if they’re proactive and lean into the technology.

Salesforce is a great example. There’s not much SF does that an AI or any other CRM system can’t do. In fact, AI can make huge improvements to CRMs in terms of lead enrichment, finding the right person to contact, relational diagrams, and more.

And there will surely be loads of startups that do that — there are already more than 300 in Crunchbase.

But what if Salesforce gets ahead of the curve and builds this out themselves? Or quickly acquires talent / companies to add this functionality?

Rather than a race to the bottom, I think this creates an even more unassailable moat for the SaaS behemoth.

Dig deeper into the tech jobs market:

Heavy Metal Scandal Part 3

Remember when we made it fun to learn about investing in nickel last month? No?

Let’s refresh your ageing memory — it turns out crime is the secret ingredient to profiting from nickel trading.

Hilarious Fraud 1: Prateek Gupta sold $500m worth of “nickel” to globally-renowned metals trader Trafigura. Except it wasn’t nickel. It was steel.

Hilarious Fraud 2: Someone (a great many someones?) told the London Metals Exchange (LMX) warehouse they were depositing nickel. Except it wasn’t nickel. It was bags of rocks.

For all those desperate for (a) an update (b) more hijinks, you’re in luck.

It turns out Trafigura (the super massive metals trader) bought loads of that nickel that was actually sacks of rocks.

In 100% unrelated news, Trafigura’s CEO has come out to say the LMX nickel contracts are “no longer fit for purpose.” That’s British for “an acrid pile of steaming shit.”

In further unrelated news, Trafigura’s COO, who had been with the metals trader for 28 years, unexpectedly announced he’s leaving the company. No explanation has been given why he’s leaving. He’s only 50.

Oh and our boy Prateek has asked for more time to prepare a bullshit defense for his “alleged” fraud.

And now, JPMorgan has fired dozens of base metals clients and slashed bankers’ bonuses as they attempt to flee the sinking ship.

Dig deeper into how to avoid buying sacks of stones instead of nickel:

- 5 tips to help avoid metal frauds

- The biggest warehouse frauds of recent times

- $1bn investigation linked to company championed by British government

That’s all for this week, hope you enjoyed it. And if you did, be a friend and spread the word. We appreciate it

Cheers,

Wyatt