New here?

The WC is a selection of five useful, interesting & notable insights handpicked by CIO Wyatt Cavalier and dropped into your inbox every Wednesday.

Like what you see? Please share it on any platform you have – Twitter, LinkedIn, send round your cleverest mates… We’ll take it.

Wyatt

Table of Contents

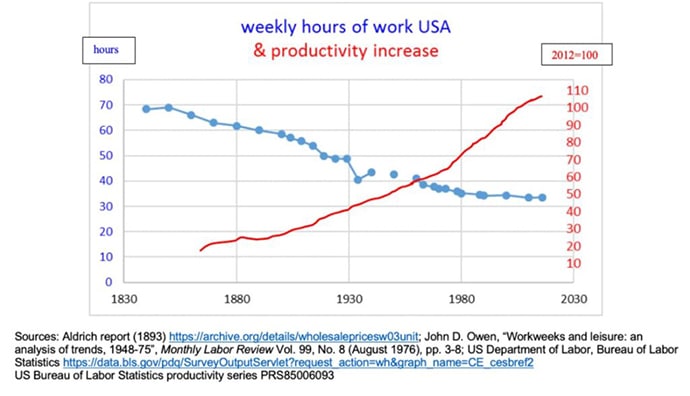

I’m not working Fridays anymore

One of my first post-university jobs was working for the federal government, and because I was in grad school at the same time, I got to make my own schedule as long as it totted up to at least 40 hours a week.

So I’d be in there Sunday on my own getting stuff done; I’d show up to work at 5:30am and leave after lunch, and I’d have Thursdays and Fridays totally off.

It was great, and I was more productive for it.

Covid, it seems, has caught the rest of America up to what I learned twenty years ago — fewer, but more intense days of work are more productive.

In fact, someone working flat-out two days a week will be more productive than the average office worker, who is only really doing something useful around three hours a day.

But let’s say that’s not likely — productivity craters around 3pm regardless of where you are or how many days you’re working. Just three days working from 9am to 3pm (with an hour for lunch) will bring you to parity.

So is it time to nix the five day work week? Works for me.

No one gets anything done Fridays anyway.

Dig deeper into how to do more in less time:

- A four-day workweek would make our lives — and the economy — better.

- 4-Day Work Week Impact on Real Estate

- Top 10 most productive countries

Slapstick foreign affairs

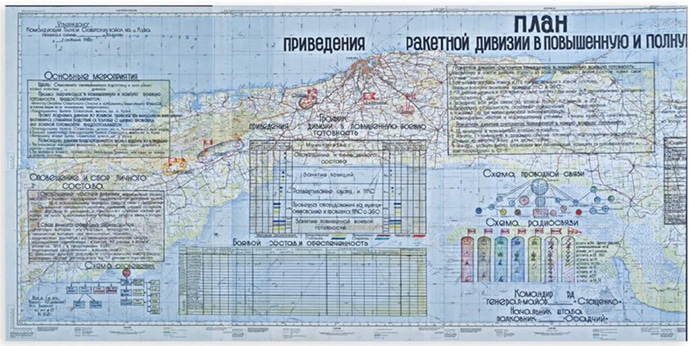

The ongoing war in Ukraine has turned many armchair historians into experts on the 1962 Cuban missile crisis.

The parallels are obvious, but there’s another layer that’s been uncovered recently due to Moscow’s (slightly bizarre) declassification of documents.

The entire Foreign Affairs article is worth a read, but here are a few of the best bits:

- Soviet leadership vastly overestimated the number of palm trees in Cuba, so the missiles were much easier to see than anticipated.

- The USSR’s movement of missiles to Cuba was largely to deter the US from trying (again) to invade the small island nation. But Khrushchev wasn’t just trying to deter the US — he thought China “would exploit a defeat in Cuba to challenge his claim to leadership of the global communist movement.“

- At the top of the proposal, Khrushchev wrote the word “agree” and signed his name. Some distance below are the signatures of 15 other senior leaders. If the operation failed, Khrushchev wanted to make sure no other members of the leadership could distance themselves from it.

Theres loads more in there, and it paints a startling picture of just how close the world was to annihilation.

Dig deeper into the Cuban Missile Crisis:

- Blundering on the Brink

- Sixty years on from the Cuban missile crisis, the US has learned its lessons – but Putin has not

- Timeline of the Cuban missile crisis

Where to invest in real estate

Moses Kagan is a well-respected and much-followed voice among real estate influencers on Twitter, and sometimes he puts prompts out there that deliver gold.

Without talking your own book:

— Moses Kagan (@moseskagan) April 10, 2023

If you were forced to buy real estate (any asset class in any American market) at today’s pricing, what would you buy?

(Going to contemplate my own answer & then post as a reply later.)

Some of the best ideas:

Are you a real estate deal junkie, in a big city, and can't find deals right now

— Barrett Linburg (@DallasAptGP) April 11, 2023

I have a challenge for you

Find a nearby town/city that is ~100k population

Meet with head of Economic Development

Ask about problem properties and what they would give you to fix them

and…

warehouses for vertical farming

— Daniel Sigal (@DanielSigal) April 10, 2023

and…

I feel as though I should qualify all my answers lately with “keep in mind, I am a stupid person”

— Ohio Capital Ideas (@ohcapideas) April 10, 2023

But, I’d keep it simple and buy single family homes in places with good weather and still reasonable prices. Thinking Knoxville or Orlando.

And my favourite:

100+ acres of farmland, roughly 50 miles away from major metros

— Sean O'Dowd (@SeanODowd15) April 11, 2023

You can find that in a LOT of major cities today

That land is too far away to be the suburbs today

With self driving cars (way faster), that land can be suburbs

My guess is it’s a 10-25 year hold….but a huge…

The point above could be an entire decades-long investment thesis. Something I’m going to noodle on a bit.

Check out the entire thread. See if anything inspires you.

Dig deeper into unorthodox real estate investing:

Tech layoffs; more to come?

Since the beginning of 2022, more than 200k tech workers have lost their jobs.

That’s a lot of people out of work and possibly struggling. And if you’re in this space all day every day, it feels like everyone is losing their job.

But the reality is something much different.

These 200k people, while objectively a lot, is only 8% of the number of jobs added by the biggest tech companies since 2019. Despite the blood bath, there are literally millions more people working in tech today than in 2019.

There are two ways to look at this if such a relatively small number of folks have got the sack:

- Maybe it’s really not that bad.

- Maybe it’s going to get much much worse.

Perspective is important.

Dig deeper into the tech jobs market:

- Analysis: Layoffs At Big Tech Companies, Brutal As They Are, Have Walked Back Only 8% Of Pandemic Growth

- A comprehensive list of 2023 tech layoffs

- Tech companies hiring now

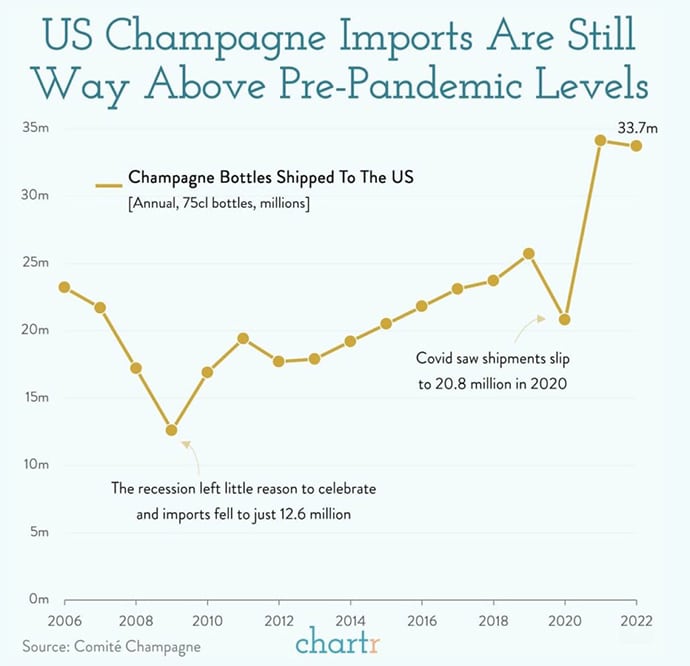

Champagne wishes and caviar dreams

You may be surprised (I was) to learn that the US is the second biggest consumer of champagne in the world, swilling nearly $1b worth of the stuff in 2022. That’s up 31% from 2019.

Total champagne sales for the year topped $6.6b, and nearly one in every six bottles went to America.

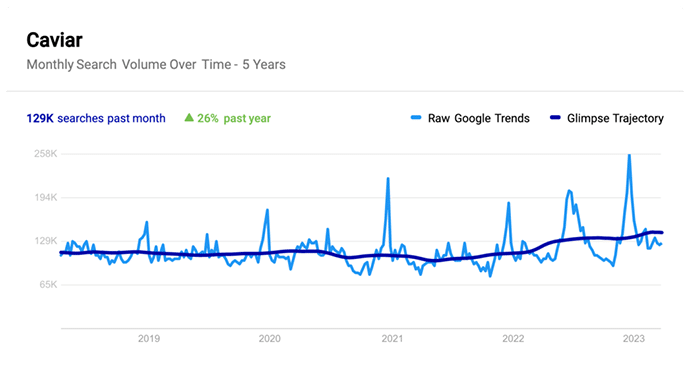

And this move toward indulgence isn’t limited to champagne. Caviar is having a moment in the US as well with analysts expecting Americans to consume $730m worth of the grotty stuff in 2023. Those same boffins forecast the market to grow nearly 10% per year through 2028.

I’ve got no idea what the mid-summer 2022 spike was around caviar, but the trend is clear — up and to the right.

Any ideas, dear readers?

Dig deeper into eating and drinking like a rich person:

- Caviar Market By Product Type

- How to Create Perfect Champagne and Caviar Pairings

- Caviar, Explained: Where to Find the Very Best and How to Serve It

That’s all for this week, hope you enjoyed it. And if you did, be a friend and spread the word. We appreciate it

Cheers,

Wyatt

Disclosures

- This issue was sponsored by our good friends at Invesment.com and Nada.

- I own one bottle of cheap champagne (I live in Spain where cava tastes just as good to me tbqh) and wouldn’t eat caviar if you paid me.