June 8, 2022 | ± 4 minutes

New here? The WC is a random mix of useful / interesting / notable stuff that gets pumped into your inbox every Wednesday.

And yes, we know WC also means toilet. I’ve had to live with these initials for 43 years.

Let’s go!

Table of Contents

Is it America’s turn to go off a cliff?

In last week’s WC, I talked a bit about how the UK is in a death spiral.

Now I think it might be America’s turn.

The difference? The UK’s problems are obvious (hello, Brexit + incompetent PM); it’s much more subtle across the pond.

The problem? The American consumer is in big trouble. Stuff costs too much, and rather than putting off big purchases (and little ones), Americans continue to spend.

…and now we know why April Retail Sales held up. Credit card spending growth of 19.6% continues to outpace that of cars/student loans of 7.1%

— Danielle DiMartino Booth (@DiMartinoBooth) June 7, 2022

April “total credit increased $38.1B from prior month after downwardly revised $47.3B gain in March” Median @bloomberg estimate was $35B pic.twitter.com/MyoLG7pvSz

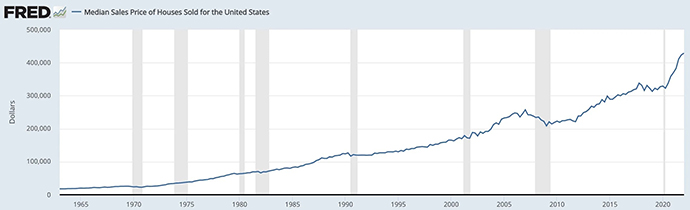

In case you live under a rock, this is how housing prices look:

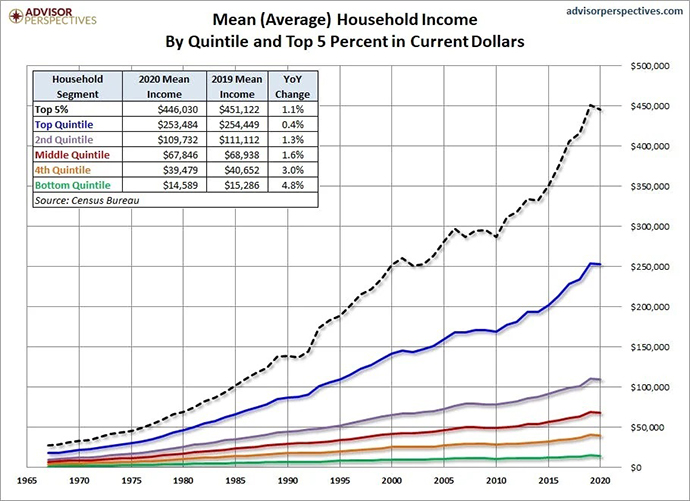

But both those data points are fine, as long as wages increase to match, right?

Looks ok, right? I’ll do the maths for you:

- Top 5% – Wages increased 56% since 2010

- Top quintile – 48%

- 2nd quintile – 47%

- 3rd quintile – 30%

- 4th quintile – 33%

- 5th quintile – 33%

So, housing prices have doubled, with no slow down in sales. Credit card spending is up nearly 20% year over year. And non-inflation-adjusted wages are up less than 50% total over the last 12 years for all but the top 5% of Americans…

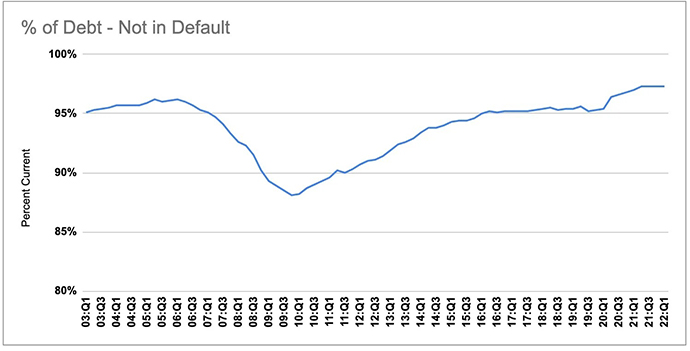

The good news? Americans are still paying off their debts, and they’re doing so at historic rates.

How long do you think that’s going to last? (More on this in a moment.)

Everyone’s getting fired!

In tech, anyway.

Coinbase has a hiring freeze.

Clubhouse is firing people.

Tesla is cutting 9% of its staff. And trying to force even more to quit.

#Tesla no longer allowing remote work@TeslaPodcast @SawyerMerritt @WholeMarsBlog @garyblack00 @GerberKawasaki pic.twitter.com/DKAgh9ptSX

— Sam Nissim (@SamNissim) June 1, 2022

It’s got so bad that TechCrunch has started a tracker.

Recall the chart above showing that only the top 5% of workers are really increasing their wages. Welp, most of the folks getting laid off here are in that camp.

Wine is king (again)

Every year, Wine-searcher.com publishes its list of most-searched for wines.

Two years ago, something funny happened. Five of the ten most-searched-for wines weren’t wines at all. They were whiskies.

This year, all ten are actual wines again, and only 13 whiskies made the top 100 (down from nearly 40 two years ago).

So what do people want? They like red wine, they like Bordeaux, and they like blends.

From those 250m searches on the platform, over half the top 100 bottles are red Bordeaux blends.

There is more vodka in the top 100 than Riesling and Sauvignon Blanc combined.

Bitcoin is back, baby (maybe)

It’s not been a great 2022 for Bitcoin.

But the price seems to have stabilized around $30k for the last several weeks. Perhaps more tellingly, nearly a quarter of all 2022 inflows into exchange-traded Bitcoin funds have happened in the last seven days. What does that mean?

That institutional (smart) money is getting back into Bitcoin in a big way.

How about BTC’s little bro, Ethereum? Ninth straight week of outflows, I’m afraid.

Here’s a great thread breaking down all last week’s data.

1/ crypto sentiment is tricky to untangle, especially in the echo chamber that is crypto twitter

— Meltem Demirors (@Melt_Dem) June 6, 2022

at @CoinSharesCo, we use data to inform our view on the market. here are some data points that provide helpful context. pic.twitter.com/6FrP0vlal3

Distribution > Product

People say that first-time entrepreneurs obsess over the product, and second-time founders obsess over the distribution.

That’s because, without fantastic distribution, no one cares about your product. The world will not, in fact, beat a path to your door if you invent a better mousetrap.

Case in point – Zelle vs Venmo. By all reasonable measures, Venmo is a superior product. Looks better, easier to use, better support, all that. But Zelle’s focus on integrations with lots and lots of banks (over 1,000 at last count) means it transacts far more volume.

If you’re building something, figure out how you’re going to sell it first.

Zelle isn’t cool, but it’s larger and growing faster than the competition. pic.twitter.com/BjRtOTvDvI

— Rex Salisbury (@rexsalisbury) June 7, 2022

What caught your eye this week? Respond to an any email. We always read our inbox.

Cheers,

Wyatt