Hello and welcome to Alts Cafe

Here’s everything you need to know about what’s happening in the world of alternative assets, best enjoyed with your morning coffee.

Let’s go!

Table of Contents

Macro View

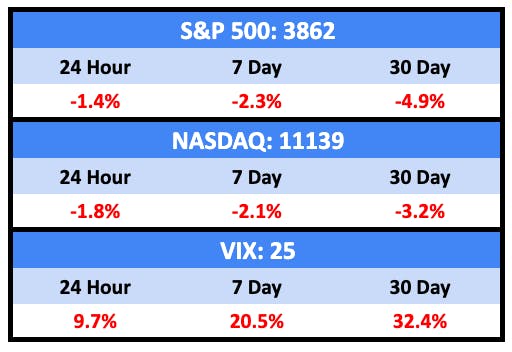

Over the weekend, we saw the biggest bank collapse since 2008. Silicon Valley Bank, home to perhaps 50% of early stage startup deposits, was wound up by the American FDIC Friday. The markets were not pleased.

Bullish News

- Deposits at both SVB and tagger-on Signature bank, which was also rolled up over the weekend, were backstopped by the USG.

- Layoffs by U.S. companies over January and February touched the highest since 2009, with the tech sector accounting for more than a third of the over 180,000 job cuts announced

Bearish News

- I won’t rehash everything to do with SVB, but here’s a good overview of what’s happened. Bear in mind the situation is super fluid.

- Investment grade and high-yield funds had combined outflows of $8.3bn in February.

What are we doing?

ALTS 1 fund news:

Worth reporting here that our fund’s funds aren’t anywhere near Silicon Valley Bank.

Real Estate

Bullish News

- Mortgage rates should come down this week as bank deposits flock to treasuries.

Bearish News

- The monthly mortgage payment needed to buy the median-priced home for sale in the US has increased from under $1,500 2 years ago to over $2,500 today.

- US mortgage applications are at the lowest level since 1995.

- The SVB collapse will make the office vacancy problem worse.

- Sales of luxury homes dropped 45% during the three months that ended Jan. 31 compared with the same period the year before.

How to invest in real estate right now:

There will be a flight to treasuries as bank clients empty their accounts. This should bring interest rates down temporarily if you’re looking to grab a loan.

Crypto & NFTs

Here’s what you need to know:

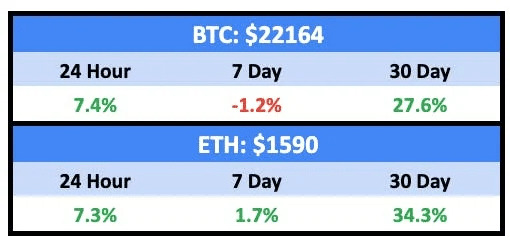

Big jump overnight as the US government announced it would bailout SVB depositors. I didn’t have “Big Fiat Bailout Saves Crypto” on my March 2023 bingo card, but here we are.

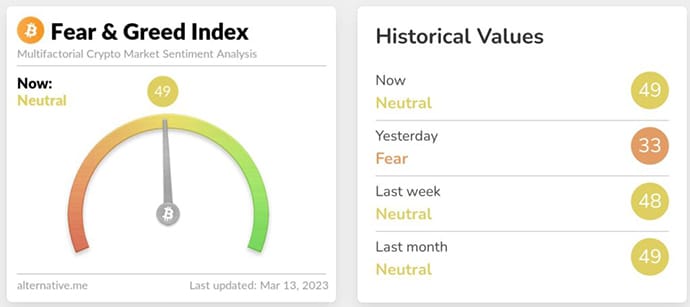

Fear and Greed has gone roundtrip starting the week at 48, plunging down to 33 on the SVB news, and bouncing back on the bailout. What a world.

NFTs, with lower volume and trading activity, and slingshotting around more, but the pattern is more or less the same.

Bullish News

- ERC-4337 is live, and it’s super important. It sounds boring, but this Ethereum upgrade will allow:

- Wallet recovery

- Two-factor authentication (byeeeee seed phrases)

- Gasless transactions

- You can now trade Punks on the Blur marketplace.

- Mastercard and Bybit launched a crypto debit card in Europe and the UK.

- Doodles released a roadmap of sorts.

- Amazon is reportedly launching an NFT marketplace in April.

- The Utah State Legislature passed Act HB 357, the Utah Decentralized Autonomous Organizations Act (Utah DAO Act). This new law provides legal recognition and limited liability to DAOs, legally framing them as “Utah LLDs.“

Bearish News

- Crypto-focussed Silvergate and Signature banks were both wiped out.

- AI artist Claire Silver announced she was premiering a new solo collection at the Louvre in Paris, but it turns out she was rugged. The invite was bogus.

- USDC, which is supposed to be pegged to the USD, fell below 87 cents over the weekend when Circle announced it had funds tied up at SVB.

- The Fed is setting up a squad of “crypto specialists.”

How to invest in Crypto & NFTs right now:

Crypto — and everything else — will be yanked around by this banking mess. I’ve got no idea now much contagion there’s going to be, but it’s going to be interesting.

Startups

Bullish News

- The US government announced it would make all SVB depositors whole, giving them 100% access to all funds Monday.

- Enterprise fintech companies are gaining ground (from a fundraising pov) on their retail counterparts.

- Music nerds rejoice, Apple has finally launched a classical music app.

Bearish News

- Stripe is still trying to close out its mega-down-round.

How to invest in startups right now:

Throwing up my hands here until everything plays out for a week or two.

That’s all for this week. I hope you enjoyed your coffee and this edition of Alts Cafe.

If you have any comments, questions, or concerns – let us know.

Cheers,

Wyatt

Disclosures

- This issue was sponsored by our friends at Finlete and Otherweb

- We are holding BTC and ETC in our ALTS 1 Fund. Apart from those, we don’t own any other assets or vested interests in the companies mentioned in this email.