Hello and welcome to Art Insider for March 17th, 2022 – FREE Edition.

We’ve prepared another special article for you today – an in-depth analysis of the Currency (both NFTs and traditional artworks) by Damien Hirst.

And it’s extra special because our guest contributor, Nicholas Shorvon, an art investment expert and advisor, actually owns one of the pieces. In this article, he talks about the Big Choice, which one’s better, and why it all matters.

Let’s go!

Table of Contents

The Burn: A Personal Dilemma

What it’s all about

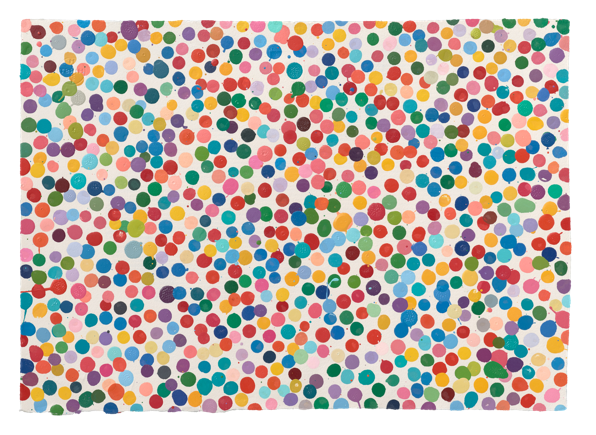

If you’re into NFTs and Art, you know about the Currency by Damien Hirst. If you don’t, then you should.

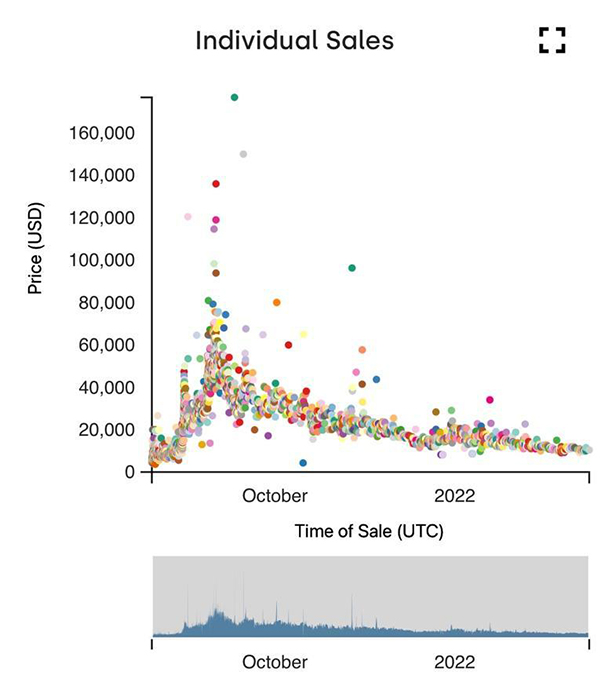

I bought mine for 2,000 USD from the mint at the end of July. By the end of October, the floor price peaked at around 60,000 USD. Today it’s worth 9,000 – 11,000 USD.

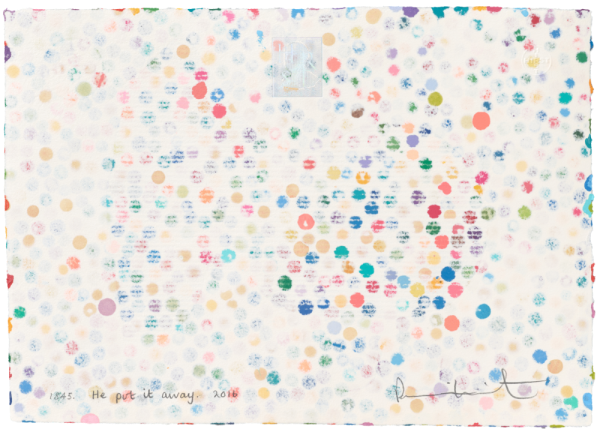

At present, you can buy a Currency NFT and still decide whether to keep it as an NFT, or exchange it for a physical painting (from which the NFT has been made).

The deadline to exchange is the 27th of July this year. After that date, any NFTs will forever remain NFTs, and the corresponding paintings will be exhibited before being burnt.

This will be a big event with expected extensive press coverage. Likewise, if you choose to exchange the NFT for the painting, the NFT will be sent to a burn wallet on redemption of the physical.

So what’s the appeal?

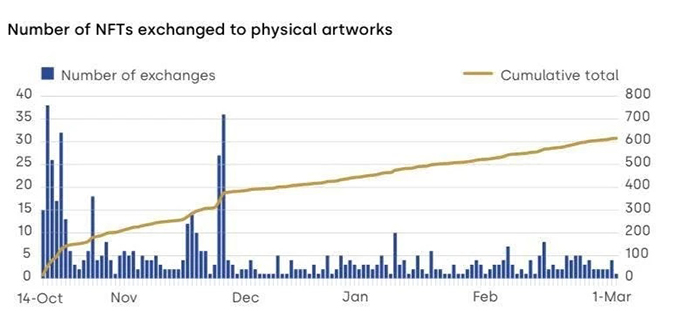

The graph is a bit painful to look at but bear with me.

When I look at it now, I think: “If only I’d sold at the peak so I could buy back in and own 6 pieces…”

But this is the thing with The Currency – it’s a lot of fun, and it consumes your thoughts. Unusually, it’s an artwork that wants you to judge it on its monetary worth; its value is not a reflection of quality but rather how people have interacted with it.

The Currency doesn’t lend itself to PFPs other than as a background. It is, however, often compared to the Blue-Chip NFTs, which are all PFPs. This has kept it from being fully embraced by the current NFT collectors.

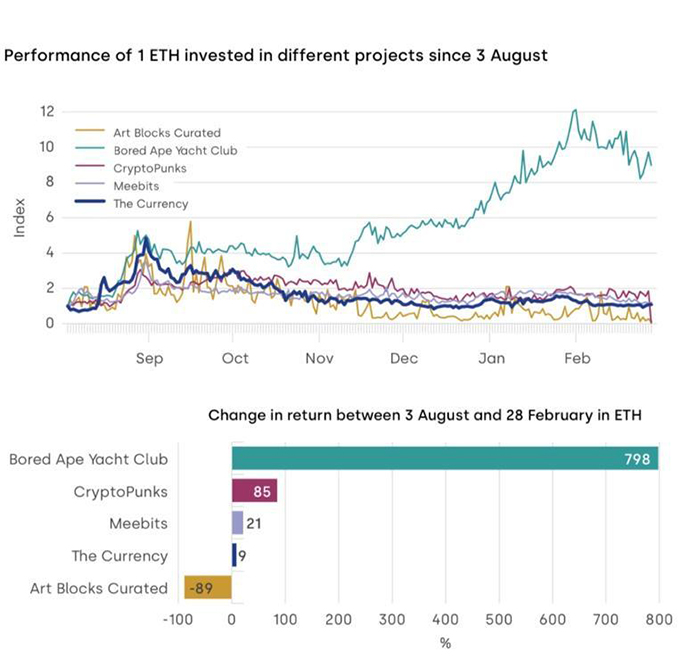

Performance

Many stats would clearly suggest avoiding it, and when I discuss it I find I sometimes contradict myself or have conflicting thoughts. That said, I do not doubt that one day an art historian will look back at the larger Currency artwork as occupying an extremely important place in the history of art, and the stats simply don’t illustrate that.

The physical and the NFT

As the Web3 space arrives and grows, will traditional fine art collectors confidently enter it? If they do, I have no doubt they’ll find The Currency the best genesis NFT artwork.

However, they are not here yet, and the price to own a piece from The Currency reflects that.

The opposite is also true. The stats reflect the PFP and Beeple crowds’ feelings towards it but fail to illuminate its unique selling points or the fact that it’s a sleeping giant.

At present, the physical painting and the NFT are tethered until the exchange deadline; this situation does not seem to help either fly. It gives a ‘false feeling’ to the batch numbers of each, as only 600 NFTs have been exchanged for physicals so far, meaning there are still currently 9,400 NFTs.

The physical is a one-off Hirst painting, hand-signed by the artist and with a unique title. This is clearly worth more than 10,000 USD and, in the future, when it’s not seen as a ‘spot painting’ but rather, as a part of a larger infamous and landmark artwork The Currency, the value has the potential to really soar.

The NFT was released on the Ethereum side chain Palm. This, too, has held back the price but also helps us work out the intentions of other owners.

For someone used to handling Crypto, bridging the NFT from Palm to Ethereum is fairly simple and means it can then be listed on a bigger marketplace like OpenSea, where pieces are consistently sold for slightly higher prices in Ether. The Palm floor seems to keep the Ethereum floor from shooting up.

How are people reacting to it?

There are some savvy traders out there: buying at the HENI Gallery floor price, bridging to OpenSea, listing it at their floor price, taking 10 percent profit and repeating.

Generally, the buyers on OpenSea seem to be buying to hold. However, there’s an ever-dwindling supply and opportunity on the HENI marketplace before the floor shoots up (at the time of writing, it’s about 20 NFTs away from a 20,000 USD floor).

I assume the people who are still on Palm and haven’t listed will probably exchange for the physical, as that can only be done on the Palm side chain through the HENI website. I think there’s a large group of owners who only ever planned to keep the painting since they’d be getting an original Damien Hirst for just 2,000 USD.

And there have been airdrops for the NFT owners, which is why it makes sense that even if the owners are planning to keep the physical painting and never sell it, they’re waiting for the exchange in case there’s a third airdrop before the deadline.

Why it’s so unique

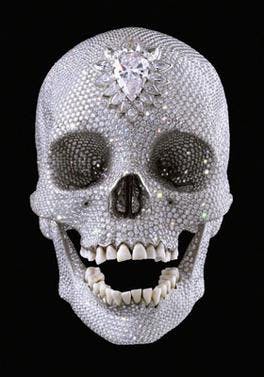

There are no other NFTs by a Blue Chip artist with an auction history and exhibition history that compare in any way to Hirst. No other NFT compares to The Currency in terms of the workload put into its creation.

With the NFT, you download a very high-res digital image, both front and back (with the latter showing where the spots bleed through the handmade, hand-torn paper). This makes it impossible to replicate identically the paper, tears, drips and drops as well as how the paper and the paints react to each other.

Further security measures on the back include a watermark, hologram and microdot. This really highlights the sheer industry and genius put into making this artwork. It’s the first NFT by an artist of Hirst’s stature and the first from a gallery of HENI’s reputation.

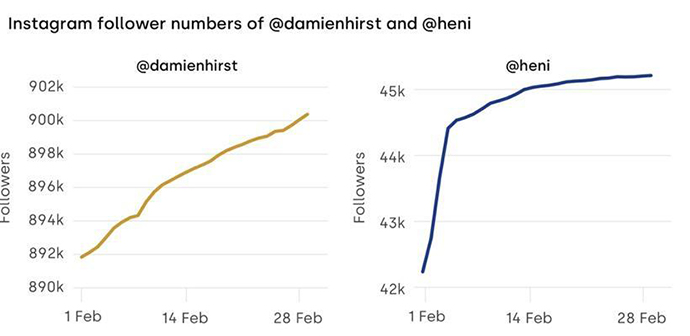

The gallery HENI seems to be moving hard into this space, bringing artists from the traditional art world into it and (hopefully) more and more collectors. Their Discord is very friendly and has moderators working 24/7 to keep it safe and – most importantly – to help people new to the space work through it.

Overall, the quality of the operation around the Currency is simply unrivalled and I’ll bet that as the NFT art world grows, so will HENI’s stature and reputation for being the best.

So it’s a case of fascinating artwork, made to the highest quality: the inaugural NFT from a genuine Blue-Chip fine artist, backed by a great gallery. Ignoring the price (I know, it’s called The Currency), this is clearly the best-made NFT available, and it’s still early days for this exciting and emerging new discipline.

My View on the Currency

Why the physical appeals to me:

The big argument in favor of the physical is that it’s a unique oil painting in a series of 600 and counting. This is part of the legacy of a series of paintings Hirst won the Turner prize for.

These Currency spot paintings, being a tangible slice of the larger Currency artwork, perfectly portray the status quo in which they’ve been made: reflecting the fissure in the art market, caused by NFTs, and the intensified fiscal lens through which people are viewing art right now.

The thing that keeps nagging at me is I’m not sure The Currency NFT is an artwork from the spot painting series, rather than the digital part of the larger Currency conceptual artwork (and I apologize, I’m about to get a bit arty farty…!).

I do believe NFTs are a new art medium equally valid to any other media like bronze or paint. In fact, I’d say today they perfectly reflect our time.

Yet, while a Punk or an Ape is computer-generated art in harmony with their medium, Currency NFTs are images created from one-off, handmade physical art pieces, like a poster of a painting in a blockchain.

The second thing which nags at me (and I’m sure no one else) is that the reason the spot paintings won the Turner prize goes back to a problem in the history of painting. Bear with me, and I’ll give you a really quick and flippant version of it:

Art writer Clemence Greenberg theorised that painting should be a celebration of paint, not paint being used to create illusions of material things. This led to new movements in painting, such as abstract expressionism or action art.

However, as each movement tried to become purer than the previous in its use of paint, a metaphorical wall was hit by the most minimalist artists. Things reached a total dead-end.

That’s until the spot and spin paintings.

These found a way to continue these painting discourses whilst remaining true to the theories behind them and perfectly reflecting the time in which they were made.

“Damien Hirst has pretty much brought the possibilities of the two main branches of abstract painting to a conclusion.” – Peter Blake, Art World magazine issue 2 December 2007”

So, the larger conceptual artwork The Currency adds context to the individual Currency spot paintings, taking them and the history of painting seamlessly into this decade, whereas the NFT isn’t paint; it’s a digital illusion of a painting.

Unlike the physical, the NFT is not necessarily a continuation of the spot paintings (at least in terms of why they won the Turner prize, and are so highly thought of).

Honestly, looking at the situation purely in lieu of Eth and dollars… none of that matters. Which is how I’m meant to be looking at… but I always end up in this headspace.

Why the NFT appeals to me:

I’ll admit it, I’m greedy. I plan to sell whichever I keep (if I don’t sell before the exchange deadline).

The NFT seems to me to have a higher ceiling, and they are much more liquid and available to be traded on HENI, OpenSea, Nifty, LooksRare, and rumoured to be on Coinbase soon too.

The press around The Burn event will likely be huge, similar to The Skull and the 2008 Sotheby’s auction, as he burns tens of millions of pounds worth of his own paintings.

Out of the 10,000 currency paintings, Damien Hirst owns 1,000 and won’t touch them for 5 years.

Anyone who has followed Hirst’s career knows that he always seems to win. He’s already air dropped the Great Expectations NFT, and I assume he is planning more airdrops/utilities after The Burn to hold engagement with buyers and manipulate the price for the brave investors/collectors who opt for the NFT.

I honestly believe that in 5 years’ time, he will have found ways to make sure his 1000 are worth a lot more than they are today.

Why you should invest

I’m bullish in recommending you get yourself a Currency, not just because it’s been a fun journey so far, but because buying right now means you’ll get in at the dip.

With all the press due, there’s a good chance it will increase in price towards the exchange period, and if it doesn’t, then at best, you can exchange it for a physical slice of a significant artwork in art history and at worst, a unique Damien Hirst spot painting for 10,000 USD.

Of course, if you are a higher-risk investor, you could aim for the moon and hold the NFT for a few years.

I could make an argument for every different potential outcome in this artwork, but the main one is still the exchange: the risk is very low due to being able to take the physical, and the rewards could be large.

Beyond the exchange, holding the NFT becomes high risk… But it is the best NFT around (IMHO) and if NFT Art rather than PFP becomes a big thing, then it’s the first proper Blue-Chip NFT fine art artwork.

To put it simply – if you are comfortable with the high-risk, volatile, Blue-Chip NFT market, I could not recommend enough that you buy in this dip as a long-term hold.

So, what will I do?

Honestly, I don’t know. I’m going to wait as long as I can to choose.

Can I really choose the digital, conceptual artwork in a metaphysical medium over a spot painting which continues the painting discourse into this decade and is also part of the larger Currency artwork? If I take the physical, I will also reach the end of the road on this journey I’ve enjoyed so much.

I think I want to keep going and see where it takes me, even though I know I’m giving up a Blue Chip painting to do so. (Hang on… that seems mad! Oh, I don’t know… If only I had six, then it would be much easier to choose…).

Ultimately, all I can say is that if, like me, you love getting into markets and collectibles, then I recommend you get involved – even if it’s just for six months. You’ll have a blast.