October 3, 2022

Read time: ± 6 minutes

Hello and welcome to Alts Cafe!

This is everything you need to know about what’s going on in the world of alternative assets, best enjoyed with your morning coffee.

Table of Contents

The Big Picture

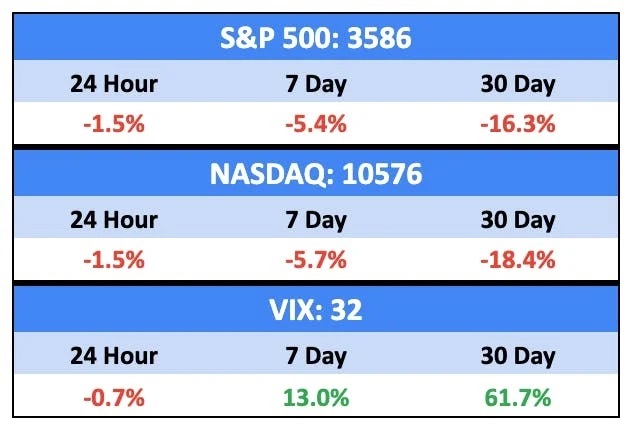

The S&P 500 closed September down -9.34% on the month and is now down -25.25% YTD. In real (CPI-adjusted) terms, it’s back below the pre-pandemic highs. History suggests there’s another 20% to 30% more to go.

The median Price-to-Sales Ratio across the Nasdaq 100 has almost halved vs. the peak (but it’s still nearly double what it was a decade ago).

Things in the UK continue to take center stage for all the wrong reasons. The Government had a look at the polls over the weekend and has U-turned on their tax breaks for the 1%. There’s speculation that PM Liz Truss is set to sack Chancellor Kwasi Kwarteng over the nightmare.

In Brazil, the most-watched presidential campaign in some time has gone to a run-off as neither Lula nor Bolsonaro secured 50% of the vote. The result here has global implications, as Brazil continues to play a key role in international trade, the environment, and the very nature of democracy itself.

Bullish News

- China’s factory activity rose for the first time in three months.

Bearish News

- Megabanks Credit Suisse and Deutsche bank are at risk of collapsing. With over $2.8 trillion in assets, their insolvencies could plunge the global economy into a deep depression. Shares of CS are off 10% in early trading.

- The Russian invasion of Ukraine looks set to rumble on for some time after Vladimir Putin illegally annexed four Ukrainian regions. Moreover, the annexation of the Ukrainian regions brings them under Russia’s nuclear umbrella, potentially changing the strategic calculations of the conflict.

- The largest US bond fund, the $500 Billion Vanguard total bond market index is down nearly 15% this year. It’s the worst year ever for the combined bond and equity markets.

What are we doing?

Fractional Alts picks:

No changes here.

ALTS 1 fund news:

No changes here.

Crypto

Here’s what you need to know:

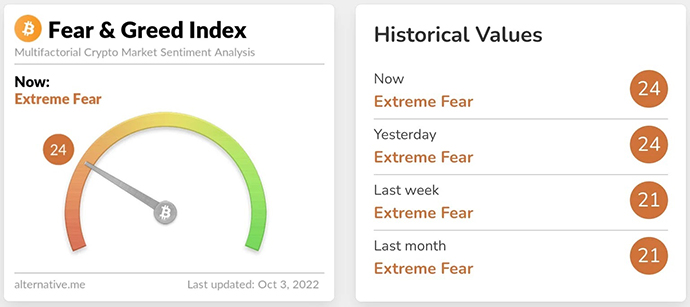

Bitcoin and Ethereum are mostly on the sidelines right now with not much going on –

Sentiment ticked up slightly last week, though the market is moving sideways for the most part –

Bullish News

- Bitcoin Could ‘Double in Price’ Under CFTC Regulation, Chairman Behnam Says.

Bearish News

- Interpol has issued a red notice for Do Kwon.

- Ex-CEO of bankrupt crypto lender Celsius withdrew $10M weeks before the company froze customer accounts.

- Indian crypto exchange WazirX lays off 40% of its employees.

What to do with that info:

If you think crypto has begun to decouple from the broader market as institutional money flows out, now could be a good time to start dipping your toes into BTC and ETH.

Real Estate

Here’s what you need to know:

Everyone has finally come around to the fact that the US housing market is in trouble, but things are worse than they appear, according to Zillow co-founder Spencer Rascoff.

Bullish News

- Foreign investment in British real estate is booming due to the falling pound.

- While residential real estate in China is struggling, commercial properties have been left relatively unscathed.

Bearish News

- The Case-Schiller index was off over 2% in July, which is the biggest slowdown on record.

- Homebuilder sentiment fell three points in September, the lowest level since May 2014.

- The 30-year fixed rate mortgage is now over 7%.

- In related news, mortgage refinancing dropped to a 22-year low.

- A record number of UK mortgage deals were pulled in one day.

- Things are getting bad in Australia.

- Median home price as a percentage of income is up 46% since the start of the pandemic.

What to do with that info:

I’m sitting on my hands right now, though I don’t think it’s too late to short this market. There’s more blood to come.

NFTs

Here’s what you need to know:

NFTs had a better September than the equity markets, which is weird.

Both Azuki and The Currency (we own both a physical and NFT copy in our ALTS 1 fund) were actually up

Bullish News

- Funko is releasing Game of Thrones NFTs.

- Christie’s has launched a fully on-chain NFT marketplace.

- A series of Banksy pieces will be released as NFTs on MakersPlace.

Bearish News

- Alexey Pertsev, a Tornado Cash developer who was arrested in August by Dutch authorities over allegations of facilitating money laundering, is to stay in jail for at least another two months after his appeal was rejected.

What to do with that info:

Punks and Apes look cheap now if you can hold a multi-year horizon.

Startups

Here’s what you need to know:

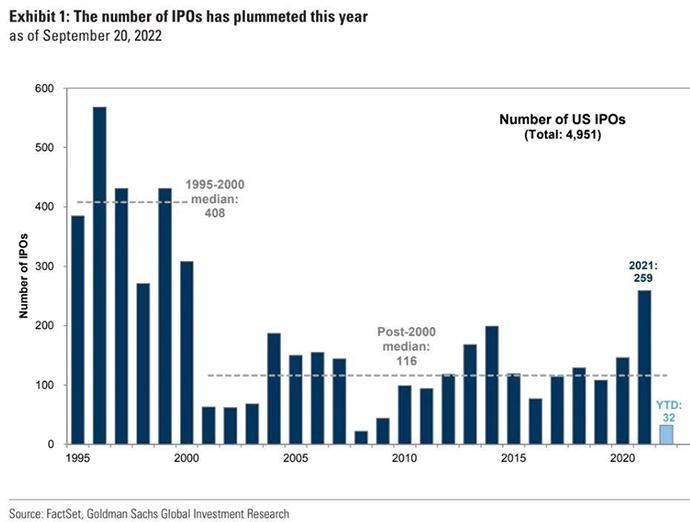

So far this year, there have been 32 IPOs, which puts us on pace for around 40 for the year.

In 2021, there were 259, while the recent median is 116 per annum. But hey, at least it’s more than 2008, right?

Bullish News

- 87% of the fintech roles advertised by this year’s LinkedIn Top Startups list are remote.

- TripActions has reportedly filed for IPO at a $12B valuation, up from its most recent valuation of $7.25B.

- Investment app Public.com has fully integrated its recent acquisition, Otis, which means its 3m members can now invest in alternative assets like Pokemon cards, a Harry Potter 1st edition, and sneakers.

- Chase and DoorDash announced plans to launch the “first-ever” DoorDash credit card, with Mastercard as the exclusive payment network for the new card.

- In Q2 2022, SpaceX launched 4.5 times more satellites than all other providers put together.

Bearish News

- Divvy Homes, a property tech startup backed by Andreessen Horowitz and Tiger Global Management, laid off about 12% of its staff Tuesday.

What to do with that info:

Valuations of companies that planned to IPO in 2022 are through the floor.

This could be an opportunity to pick them up cheap (relatively), ahead of IPOs in 2023.

That’s all for this week. Hope you enjoyed your coffee and this edition of Alts Cafe.

Any comments, questions or concerns – let us know. Cheers,

Wyatt