New here? Read up on our past Startups issues to get the most from this post.

Jun 23, 2022 | ± 6 minutes

HIGHLIGHTS:

- It’s a tough market if you’re raising, but a great market if you’re investing

- Do you like marijuana or virtual showrooms? Dig into our deals analysis

- What to expect in the future & what to do with this info

Note: We don’t talk about rounds raised or other similar vanity stuff. This post is all about the startups market and how you can make money.

Let’s go!

Table of Contents

Startups in 2022

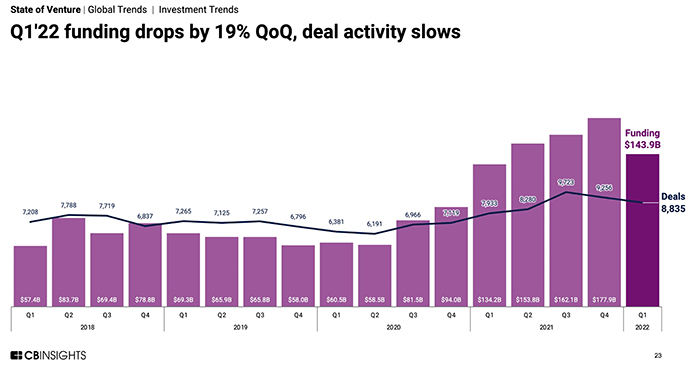

It’s no secret funding rounds have dried up over the last 30 days or so, and late-stage tech company valuations have plummeted along with the broader public markets (and crypto).

This is is a dual-edged sword for investors in start-ups.

One one hand, they’ll need to slash book values for many of their existing investments – possibly up to 60%.

On the other hand, those brave enough to get in the market now can find high-quality companies raising rounds at 1/3 the valuation they would have commanded just a few months ago.

Startups last week

Just how bad is the startups investment market? It’s hard to say, because deals getting announced today have been in the works for months – there’s going to be a lag.

But we’re already seeing a significant decrease in the number of deals done and their valuations, and it’s accelerating. It’s also affecting black founders more than their white counterparts.

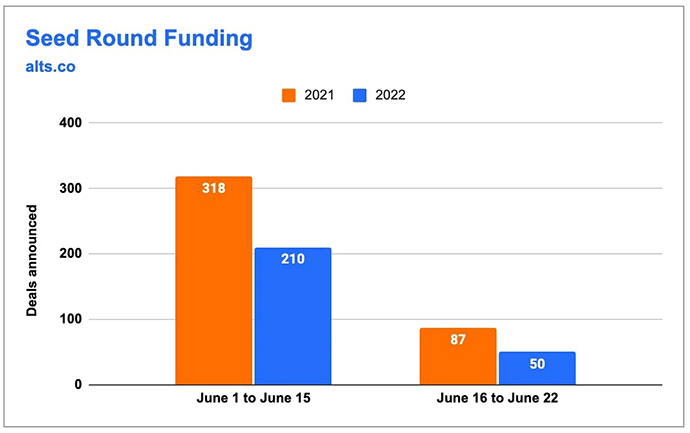

I crunched the numbers (data via Crunchbase) on seed stage deals done so far in June compared to 2021 as well as deals done over the last seven days compared to the same time period in 2021. Why seed stage companies? Because that’s what we are, and it’s what I care about.

For the first two weeks of June, the number of deals done was down 34%. For the last seven days? Down a whopping 43%.

Remember this is all on a lag, so I expect the numbers to get worse as we go on.

But worse is relative, right? If you’re an investor now — especially an institution willing to lead a round, it’s a great time to be investing.

[Side note – if you’re an institutional investor looking to lead a round in a groundbreaking fintech startup, hit me up]

Startups you can invest in today

The rules

Each startups will be scored from 1 to 10 (10 is highest) so they’re apples-apples as much as possible.

This is what each will be rated by:

1️⃣ Opportunity size

2️⃣ Problem

3️⃣ Solution

4️⃣ Team

5️⃣ Business model

6️⃣ Competition

7️⃣ Traction / unfair advantage

8️⃣ Product

9️⃣ Likelihood of getting to the next raise

🔟 Valuation

Anything above 70 is probably worth looking at more closely.

Now that this has been cleared up, let’s check out three startups featured on Republic:

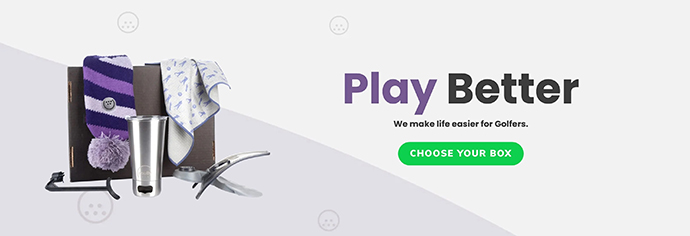

MullyBox

MullyBox is a retail service that sells Golf Subscriptions on a monthly or quarterly basis.

In simple terms, it’s like a golf dollar-shave club – a pro-shop delivered to your door every month, that replenishes your essentials and sends new gifts that up your game. Products can range from clothing, equipment, gear, props, supplies, and more. They have been featured in GolfDigest, Urban Tastebud, Popsugar, and more.

- Round: Seed

- Terms: Raising $1.07M @ $8M Pre-Money Valuation Cap.

- Traction: 2k+ subscribers, $1M+ in 2021 Revenues, 2x YoY Revenue Growth.

- Co-Investors: The company has been bootstrapped up until now.

All3D

AII3D is a B2B software company that provides self-service 3D solutions for retail companies to create hyper-realistic, low-cost and re-usable product images, virtual spaces and tours for better visualization and more beautiful brands.

Their mission is to disrupt the “physical-first” culture in the product design & manufacturing industry. They have been featured in Forbes, PRNewsWire, Business of Home, FurnitureToday, Apartment Therapy, and more.

- Round: Seed

- Terms: Raising $1.07M @ $15M Pre-Money Valuation Cap.

- Traction: 22X Revenue Growth in 2021; Customers include The Home Depot, Skyline Furniture MFG., Butler Specialty Company, Buildlane, and more; 64% Gross Margins

- Co-Investors: WXR Fund

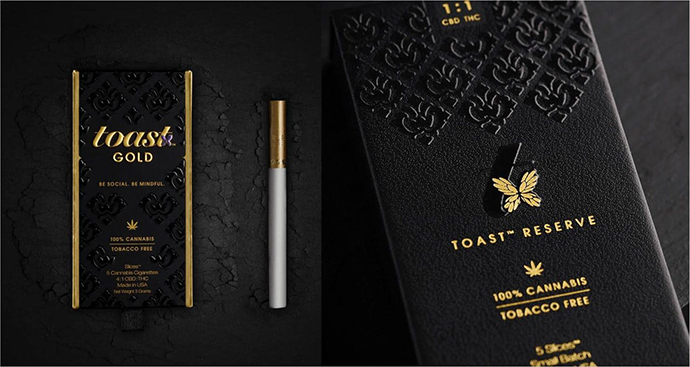

Toast

Toast is a luxury cannabis company that grows and sells full spectrum Hemp products for both B2B and D2C.

Their CBD products are full spectrum and sourced in small batches to ensure the potency is precise. Their product offerings include cookies, chocolates, oils, and CBD/THC cigarettes. They have been featured in the Business Insider, New York Post, DailyMail, Forbes, and more.

- Round: Series A

- Terms: Raising $1M @ $20M Pre-Money Valuation Cap.

- Traction: ~120% YoY Revenue Growth, 50%+ Gross Margins, $1.5k – $3k Average Order Size

- Co-Investors: Yaax Capital, Former COO of Citadel Group, Former Global CMO of Anheuser-Busch InBev

That’s all for this Startups Insider.

Cheers,

Wyatt