Hello and welcome to Alts Cafe

Here’s everything you need to know about what’s happening in the world of alternative assets, best enjoyed with your morning coffee.

Let’s go!

Table of Contents

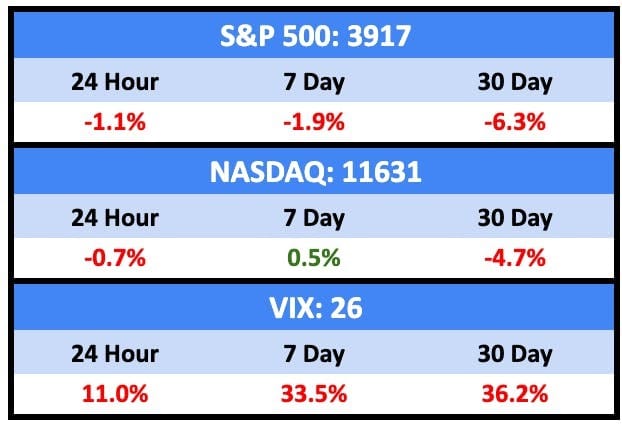

Macro View

What a mess. Banks are dropping like flies as 2023 aims to prove that every year can indeed be worse than the one before it.

Bullish News

- Markets are predicting a 50/50 chance the Fed will raise rates by 25bps at its meeting this week. A lot can change between now and Wednesday, though.

- US inflation came in at 6% in February, the smallest annual gain since September 2021.

Bearish News

- Argentina’s annual inflation surpassed 100% last month.

- The European Central Bank on Thursday announced a further rate hike of 50 basis points.

- Credit Suisse collapsed and was bought by rival UBS for pennies on the dollar.

- Banks took an all-time high $152.9 billion from the Fed’s discount window as of Wednesday while also taking $11.9 billion in loans from the Fed’s newly created Bank Term Lending Program.

- This month, the six largest Wall Street banks have lost almost $165bn in market capitalization.

What are we doing?

ALTS 1 fund news:

No news.

Real Estate

Bullish News

- Faithful Alts Cafe readers took my (not financial) advice last week, with mortgage applications climbing 6.5% while mortgage rates briefly plummeted.

- There could be a temporary housing price decline in tech-y areas like SF, Seattle, and Austin, which are impacted by SVB’s total mismanagement.

- Housing starts in February rose to 1.45 million, versus the consensus estimate of 1.31 million.

Bearish News

- The latest National Association of Home Builders (NAHB) report indicated an unexpected rise in the US Housing Market Index (HMI) to 44.0 in March, beating expectations.

- Nearly half of new home sellers offered concessions or price cuts during the beginning of the year.

- More than 5m American families are behind on rent. The average due is over $2k.

- Housing prices continu to decline.

How to invest in real estate right now:

I’m still out of the real estate market [no change].

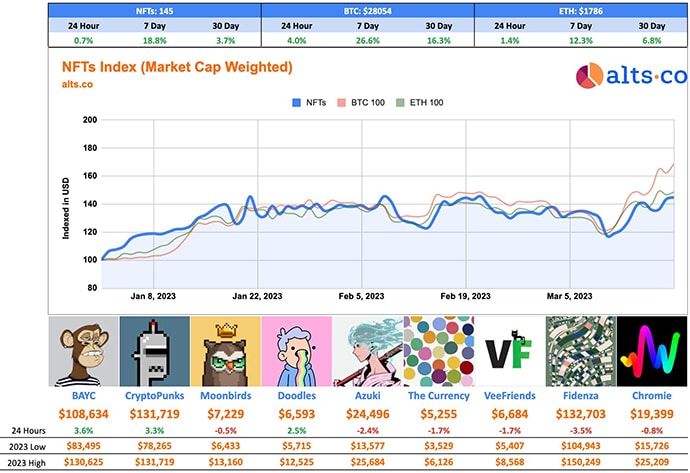

Crypto & NFTs

Here’s what you need to know:

Bitcoin ripped last week up over 26%. Ethereum had a pretty good week too.

The fear and greed index is firmly in greed territory for the first time in a year.

It was a decent week for blue-chip NFTs as well. They were up nearly 19% overall.

Bullish News

- Bitcoin surged past $28k for the first time since June 2022.

Bearish News

- Crypto investors pulled around $3 billion overall from the stablecoin USDC in three days last week.

- Binance halted deposits and withdrawals for customers in the UK.

- Meta (Facebook + Insta) is giving up on NFTs.

- Euler Finance was hit by a flash-loan attack that resulted in a loss of $197 million. The perpetrator returned 3,000 ETH a few days later for some reason. Flash loans let borrowers access large amounts of funds without providing collateral.

How to invest in Crypto & NFTs right now:

This is going to be an eventful week. Further turmoil could continue to drive up the price of crypto and NFTs. Stay tuned.

Startups

Bullish News

- Stripe got its $6.5b raise but had to take a 50% haircut to do it.

- PWC has introduced a chatbot to help its 4,000 legal associates get more work done in less time.

Bearish News

- Tiger Global marked down the value of its investments in private companies by about 33% across its venture-capital funds in 2022. That’s $23b.

- Silicon Valley startup accelerator Y Combinator won’t raise another continuity fund, which backs mature private tech companies.

- Naspers has wound down its $100m South African focussed VC fund.

- Crypto VCs say half their token bets are sidelined with no launch date in sight.

How to invest in startups right now:

Macro is dominating the news cycle(s) right now, and I probably wouldn’t make any big bets until that shakes out.

Quick Hits

Collectibles

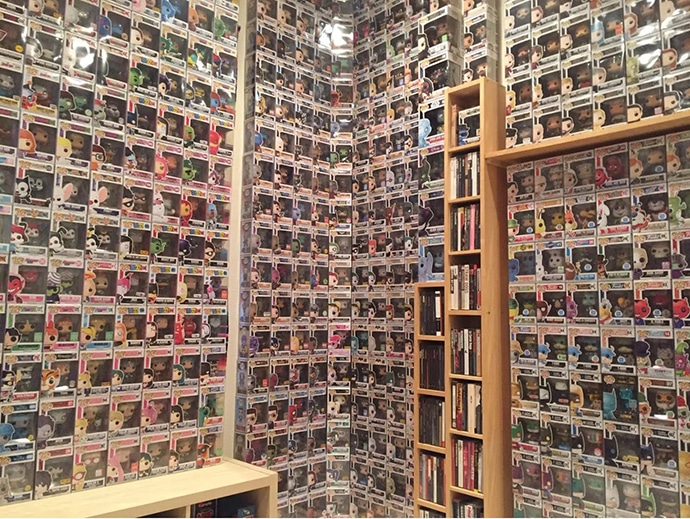

Remember last July when we said there’s a Funko Pops oversupply problem, and the only ones worth investing in are the super rare items?

No? You don’t? You bought 25 copies of the Mrs. Potts & Chip Funko Pop? And now you’re regretting this particular and possibly a great many more life choice(s)?

Anyway, it’s time to reap what we’ve sown, and the Funko Lords have so many pops in their warehouses that they’ve run out of space. Sometime soon, they’re going to dump $36m worth of superfluous product into a giant hole somewhere.

Anyone who gets a heads up on the location, hit me up. I’ll be there completing my Live Action Beauty and the Beast Funko pop set.

In other collectibles news, a pair of Michael Jordan game-worn sneakers from game two of his sixth championship series is going up for auction at Sotheby’s. They’re expected to fetch $2m to $4m.

That’s all for this week. I hope you enjoyed your coffee and this edition of Alts Cafe.

If you have any comments, questions, or concerns – let us know. Cheers, Wyatt

Disclosures

- This issue was sponsored by our friends at Invest with Roots and House of RARE

- We bought six barrels of House of RARE’s Spring Collection tequila for our ALTS 1 fund. Yum.

- We are holding BTC and ETC in our ALTS 1 Fund. Apart from those, we don’t own any other assets or vested interests in the companies mentioned in this email.

- I personally own a couple Funko Pops. What you gonna do.