Welcome to the Fractional Trading & Index Update for 17th January 2022 – FREE edition.

This is one tight email with all the analysis and insight you need to make informed decisions on the fractional secondary markets:

- The Fractional Index

- Our weekly picks

Table of Contents

What is the Fractional Index?

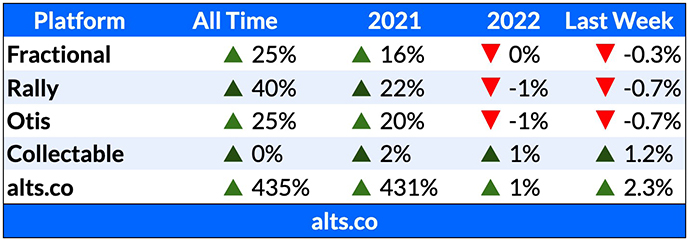

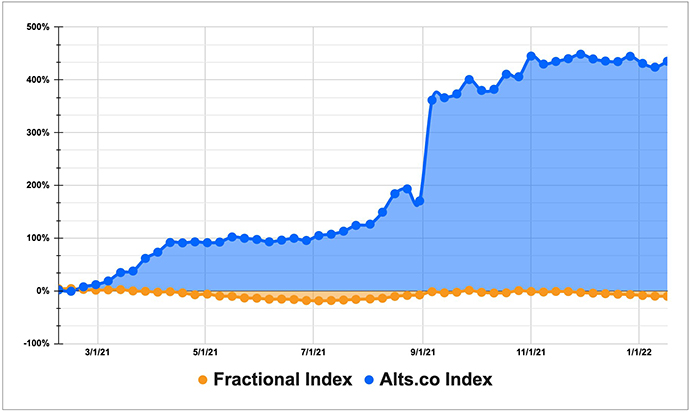

This is the world’s first index that tracks the performance of all IPOs across Rally, Collectable, and Otis since inception, and gives individual results for each platform.

And it’s exclusive to Alts.co subscribers.

Fractional Index for January 17, 2022

While the fractional market was slightly down last week, both Collectable and our picks were up.

You know that with your Insider subscription you have access to our analysis of every fractional IPO, giving each one a Yes or No vote.

Based on those picks, we also launched the Alts Index.

The good news: Since February 1st 2021, we’re up 435%

If you’d like to see our current picks, click below.

Last week’s changes to our picks

Last week we bought:

Last week we sold:

This was a short-term play based on auction results.

A QUICK NOTE: Time permitting, there will be significant changes to our Alts.co picks next week. Our picks are less-concentrated than we’d like, and our metrics don’t yet reflect Q42021 performance. We’ve currently got 46 buys active, and I hope to whittle that down to perhaps 30. You’ll also see an update to our insider scores that will reflect both Q4 performance and increased liquidity on Rally.

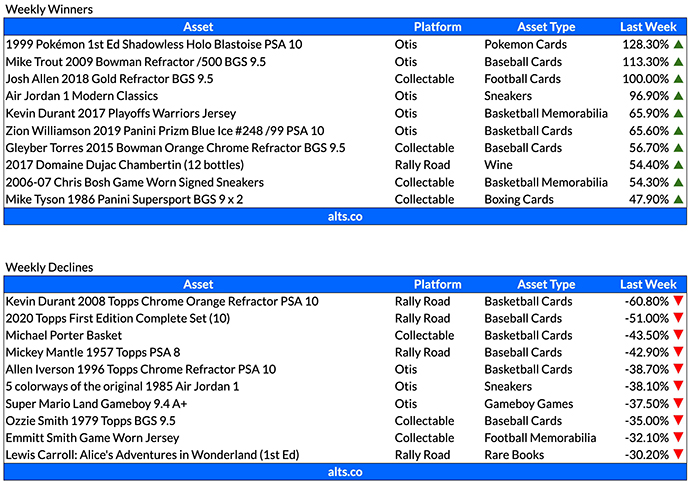

Weekly Winners and Losers

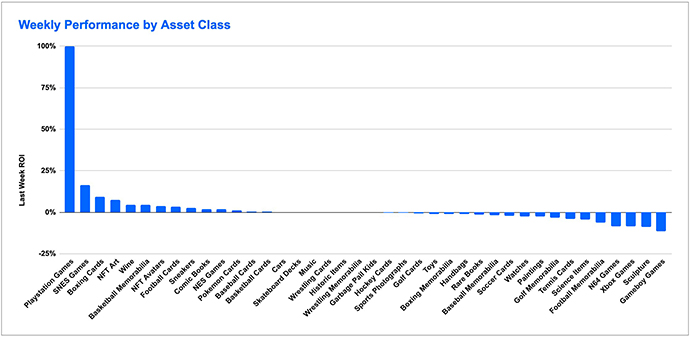

Performance by Asset Class

Look what happens when you’ve got an asset class with only one asset and that asset’s been down big time two weeks in a row. 100% gains!

NFTs continue to be low-key very stable and productive.

Trading this week

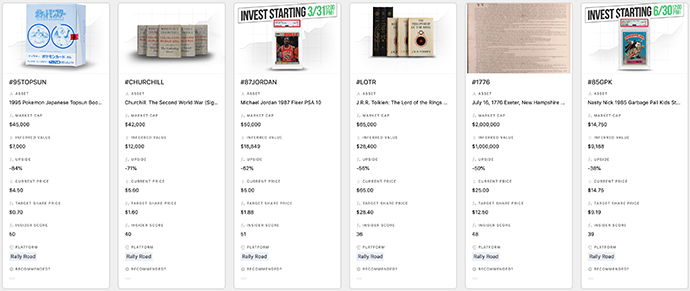

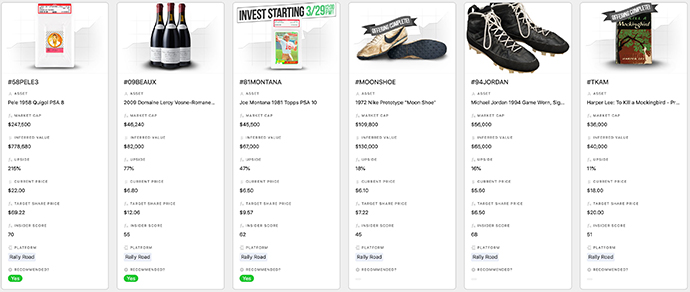

Twenty new assets are open for real-time trading this week on Rally. Nothing new yet from Otis or Collectable.

Disclosure: I own shares of the Domaine Leroy and will buy shares of Pele if it stays anywhere near where it is now.

I’ve also created a link to all assets currently trading on Rally + our inferred values. Check out the discord if you’d like access.

Assets we think are undervalued

Assets that may be overpriced