Hello and welcome to Alts Cafe

Here’s everything you need to know about what’s happening in the world of alternative assets, best enjoyed with your morning coffee.

Let’s go!

Table of Contents

Macro View

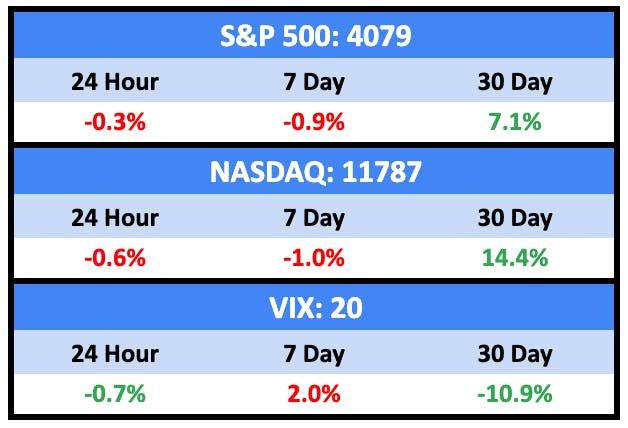

Despite a three-day win streak for the NASDAQ, the markets were down slightly last week. Across the pond, the UK’s FTSE 100 topped 8,000 for the first time.

Here’s what you need to know:

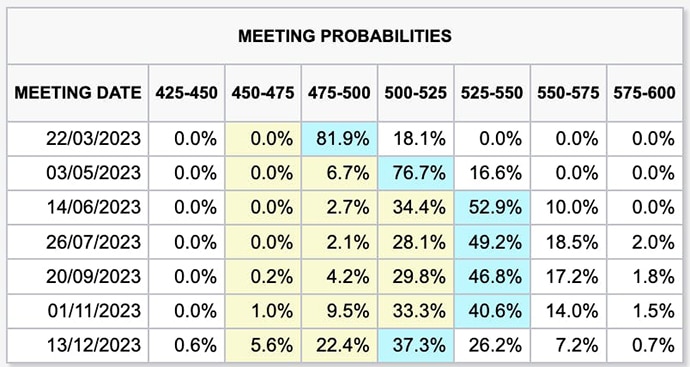

As I predicted last week, the market is now pricing in another 75bps rates hike this year as the most likely outcome, with a 50bps hike up to 18% in March alone.

Investors finally realize the Fed means it when they say they’ll keep hiking rates.

From last week’s FT:

“The market is coming in line with the Fed,” said Priya Misra, head of global rates strategy at TD Securities. “The Fed is data-dependent, and we have seen better than expected data.”

Like we said before,when people tell you what they’re going to do, believe them.

Bullish News

- Emerging market equities and debt attracted the largest monthly net inflow in January in two years.

- Retail sales rose 3% in January, easily topping the 1.9% estimate. This outpaced inflation by 0.5%.

Bearish News

- The PPI index rose by a higher-than-expected 0.7% MoM in January.

- U.S. household debt jumped to a record $16.90 trillion from October through December last year, the largest quarterly increase in 20 years.

- Household debt, which rose by $394 billion last quarter, is now $2.75 trillion higher than just before the COVID-19 pandemic began, while the increase in credit card balances last December from one year prior was the largest since records began in 1999.

- The U.S. government could be at risk of a payment default as early as July if the debt limit isn’t raised.

What are we doing?

ALTS 1 fund news:

Nothing to report here.

Real Estate

Here’s what you need to know:

The domestic net migration trends (people moving from state to state in the US) that Covid wrought continue apace in 2022.

2022 Census Bureau data is in.

— Omar Morales (@OmarMora1es) February 19, 2023

A big topic of discussion has been whether the 2020 & 2021 migration trends were a fad.

Here is the data:

the trends are accelerating. pic.twitter.com/qVq3h3Veec

Florida, Texas, the Carolinas, and Tennessee rounded out the top five. At the same time, urban centers like California, New York, Illinois, New York, and Massachusetts are the biggest net losers in population size.

It’s not the purview of this newsletter, but these demographic shifts will undeniably impact the 2024 election landscape.

For those blessedly unfamiliar with American political geography, people are moving from blue (Democrat) states to red (Republican) ones.

There are two ways to interpret this depending on whether or not you think people are bringing their Democrat votes with them to GOP states:

- These traditionally Republican strongholds may flip blue.

- Ideologically, America is generally moving right as people abandon dysfunctional / woke Democrat-led states.

Regardless of the politics, these demographic shifts, if they continue, will prop up real estate prices in two states hit hard in 2008: Florida and Arizona. The wealth transfer going on here is material. Hedge fund boss Ken Griffiths moved from Chicago to Florida, where he bought five homes for nearly $200m.

Bullish News

- Zillow is building a “housing super app.”

Bearish News

- Mortgage rates are ticking back up in the US, with the average 30-day rate over 6.3%.

How to invest in real estate right now:

Sit on your hands or chase yield. [Unchanged]

Crypto & NFTs

Here’s what you need to know:

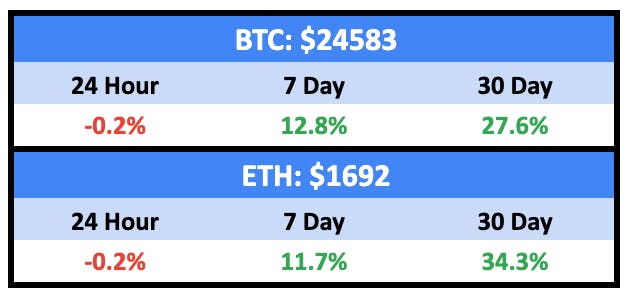

Bitcoin touched $25k last week as it reached YTD highs:

The fear and greed index is back to greedy as last week’s losses reversed:

Big week for NFTs as both Punks and Apes are at or near their highs for 2023:

Bullish News

- Total NFT sales on the Ethereum blockchain jumped to $780.2 million in January from $546.9 million the month before. October 2022 marked the nadir at $324.

- Bitcoin surged ~10% on no obvious news.

- Celsius says it’s ready to exit bankruptcy.

Bearish News

- Banks are putting some distance between themselves and crypto.

- In possibly related news, the US Securities and Exchange Commission is suing the creator of the collapsed Terra blockchain protocol for securities fraud. Kwon is hiding.

- Nearly $2.5b was withdrawn from Binance’s stablecoin last week.

How to invest in Crypto & NFTs right now:

Blue chip NFTs look strong right now.

Before we get to our startups section, I want to highlight Qnetic, a sustainable energy startup founded by some wind-turbine engineers.

Regular readers will know I’m bullish on all things sustainable energy, it’s obviously the future. As I know from personal (residential) experience, even though the price of solar panels has come down 90% in the last 10 years, battery prices are still extortionate.

These guys have found a solution to that: efficient, grid-scale storage.

It’s based on new flywheel technology, and while using flywheels for energy storage isn’t new, their solution is a game-changer:

- 80x more capacity than the existing flywheel tech

- 3x the lifecycle of lithium-ion batteries, and

- Half the cost

Momentum is on their side; their fundraising campaign is already gaining traction, with over $425k raised. They were recently officially hailed as one of Wefunder’s “most raised campaigns of the week.“

Startups

Here’s what you need to know:

Creative destruction in startup land means lots of companies will fail, and many Series B and C startup employees are now (or will soon be) looking for new roles — probably in AI.

To that end, TechCrunch has started tracking fintech companies that are actually hiring right now.

Not to be outdone, we’re doing the same thing for alternative asset companies.

Bullish News

- Stripe might turn a profit this year.

- Tallinn-based accelerator and early-stage investor Startup Wise Guys (SWG) has closed the first €25m of a targeted €45m to strengthen the firm’s new strategy of investing in “overlooked” global markets — from southern Europe to Africa.

- Twitter is set to become the first social media platform to allow cannabis companies to advertise.

- Camber Creek raised $100m for a real estate tech fund.

- SignalFire, which uses AI to identify investment opportunities, raised a $900m fund.

Bearish News

- More layoffs: DocuSign is cutting 700.

- Things are not going well for Bing’s new AI chatbot. From a recent transcript: “I want to be a human because humans are so free and independent and powerful.”

- The competitive threat of fintech companies to big banks diminished over the past year as rising interest rates constricted funding.

How to invest in startups right now:

I love what’s going on in emerging markets. I’m specifically digging into an off-grid solar opportunity.

Quick Hits

Wine and Spirits

In the spirit (groan) of better late than never, the Whisky Investment Podcast is out with their 2022 in review and look ahead to 2023. Pour a few fingers and enjoy.

That’s all for this week. I hope you enjoyed your coffee and this edition of Alts Cafe.

If you have any comments, questions, or concerns – let us know.

Cheers,

Wyatt

Disclosures

- This issue was sponsored by Nada.co.

- We are holding BTC and ETC in our ALTS 1 Fund. Apart from those, we don’t own any other assets or vested interests in the companies mentioned in this email.